To visit the February 2026 reporting season calendar Click here .

-

Scratching your head about the stock market rally? It makes perfect sense.

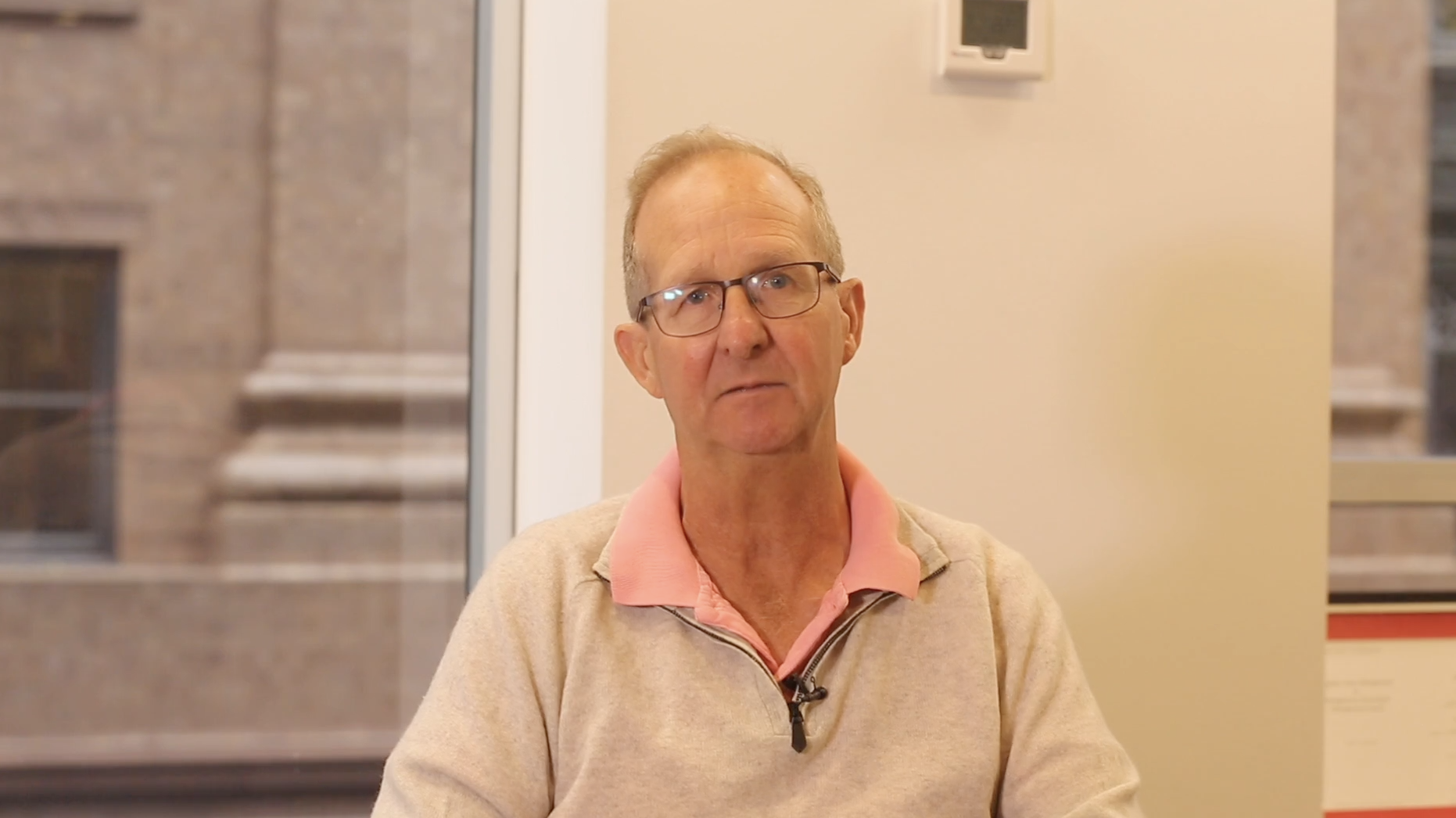

Roger Montgomery

May 12, 2025

With the U.S. economic picture deteriorating, you might be wondering why the market is rallying. It’s simple if you remember that hope springs eternal.

U.S. President Donald Trump’s first chaotic days in office have been economically disruptive, thanks to a whirlwind 143 executive orders, a tornado of declared emergencies, and tariffs heralding a trade war – particularly the 135 per cent levy on Chinese imports. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

Will the rally continue?

Roger Montgomery

May 9, 2025

The recent relief rally in the S&P 500 is welcome, but is it sustainable? The stock market’s vulnerability is a weakness in Trump’s arsenal against China, and it’s also a barometer of his popularity. Meanwhile, the market and the U.S. economy are heavily reliant on consumer spending, with personal consumption expenditures accounting for approximately 70 per cent of U.S. Gross Domestic Product (GDP), according to the Bureau of Economic Analysis. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

MEDIA

Will a pragmatic tariff-imposing Trump back down and create investment opportunities?

Roger Montgomery

May 8, 2025

The US stock market is rallying, defying the chaos of unknowable tariffs and a new barrage of grim economic indicators.

With President Donald Trump’s aggressive tariffs – most notably a 135 per cent levy on Chinese imports – triggering fears of stagflation, a looming recession and collapsing consumer confidence, you might wonder why shares are climbing.

This article was first published in The Australian on 02 May 2025. Continue…

by Roger Montgomery Posted in In the Press.

- READ

- save this article

- POSTED IN In the Press.

-

Labor’s big win and Buffett bows out – What investors need to know

Roger Montgomery

May 8, 2025

In this week’s video insight, I cover two major headlines that hit papers this week: Labor’s sweeping win in the federal election and Warren Buffett’s retirement as CEO of Berkshire Hathaway.

Labor’s second-term agenda is set to reshape sectors like transport, energy, healthcare, and housing. With budget plans and reform drawing the line between winners and losers. Continue…

by Roger Montgomery Posted in Video Insights.

- 1 Comments

- save this article

- 1

- POSTED IN Video Insights.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

U.S. recession risks for the regions

Roger Montgomery

May 7, 2025

The global economy faces a complex landscape as trade tensions between the United States and China persist, threatening economic stability. This week, Ric Deverell, the highly regarded Chief Economist at Macquarie, shared insights on the potential for a U.S. recession, the resilience of China’s economy, and the ripple effects on global markets, including Australia and Europe. Our interpretation of his comments follows, and where data is independently available, we have provided that data along with sources. Continue…

by Roger Montgomery Posted in Economics, Foreign Currency, Global markets, Market commentary.

-

Gold-plated billionaires

Roger Montgomery

May 7, 2025

For years I have abided by the idea that gold is useless. As Charles Munger noted; if you buy an ounce of gold today, at the end of eternity, you will still own an ounce of gold. With no industrial use and producing no income, Munger’s partner, Warren Buffett, noted gold is only good for doing two things: ‘looking and fondling’. They are right in the sense that, without any ability to compound or any commercial value, buying gold is a bet that others will subsequently buy gold at a higher price. In that sense, buying gold is speculation rather than investing.

I remain convinced, buying gold is, and will always be, a bet on fear. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

MEDIA

The Business: ABC Television news – Westpac half-year results and Australian election outcomes

Roger Montgomery

May 6, 2025

Last night, I appeared on ABC News to discuss Westpac’s (ASX:WBC) half-year financial results, where CEO Anthony Miller reported disappointing numbers. Continue…

by Roger Montgomery Posted in Market commentary, TV Appearances.

- save this article

- POSTED IN Market commentary, TV Appearances.

-

The end of an epoch. Warren Buffett retires.

Roger Montgomery

May 6, 2025

Australian investors, engrossed in the 2025 Federal Election, may have missed a seismic shift in the global financial landscape: Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, announced his retirement at the age of 94. On Saturday, during the company’s annual shareholder meeting in Omaha, Nebraska, Buffett revealed he would step down as CEO and chairman by the end of the year, handing the reins to Vice Chairman Greg Abel. Continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary.