Is the market rally built to last? WATCH THE LATEST VIDEO INSIGHT HERE.

-

A small cap embedded in a multi-year growth opportunity

Roger Montgomery

September 7, 2021

Macquarie Telecom (ASX:MAQ) is a data centre owner/operator with facilities in Sydney’s CBD, Macquarie Park in Sydney’s north, and Canberra. MAQ’s cloud services generated 46 per cent of the company’s revenues in FY21, while telecom services, in which it competes with Telstra, Optus, TPG and Vocus, and includes data, voice, mobile and colocation generated 47 per cent of revenues. The remaining revenue (6- 7 per cent) comes from data centre services for wholesale customers.

by Roger Montgomery Posted in Companies, Stocks We Like.

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Stocks We Like.

-

Two high growth retailers with global expansion strategies

David Buckland

September 6, 2021

In this week’s video insight David interviews portfolio manager of the Montgomery Small Companies Fund Dominic Rose to discuss two high growth Australian retailers with significant global expansion strategies. City Chic (ASX: CCX) and Lovisa (ASX:LOV) make up around 5 per cent of the Montgomery Small Companies Fund portfolio and Dominic identifies why their key prospects are looking better as key markets including the US and UK open back up post COVID-19 lockdowns. Continue…

by David Buckland Posted in Companies, Consumer discretionary, Editor's Pick, Stocks We Like, Video Insights.

-

Lockdowns help steer auto businesses to a bumper year

Roger Montgomery

September 6, 2021

FY21 was a great year for companies in the automotive industry. With overseas travel ruled out, we took to the roads. And recent results announcements from Motorcycle Holdings and Apollo Tourism & Leisure indicate that the good times could continue into 2022, even though Peter Warren Automotive is less optimistic. Continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies.

-

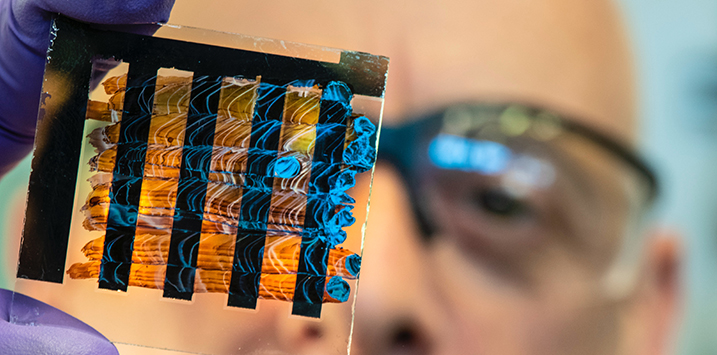

Science that benefits people

David Buckland

September 3, 2021

Strong investor sentiment and positive macroeconomic conditions saw the volume of initial public offerings (IPOs) rise to 61 in the first half of 2021. One of those listings was small-cap Trajan Group, who raised $90 million in June at $1.70 per share. Continue…

by David Buckland Posted in Companies, Editor's Pick.

- save this article

- POSTED IN Companies, Editor's Pick.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Ramsay Health Care set to benefit as the world opens up

Andreas Lundberg

September 2, 2021

The COVID-19 pandemic has dented the profits of Ramsay Health Care (ASX: RHC), Australia’s multinational healthcare provider and hospital network. The good news is that earnings are growing again across key regions as lockdowns and restrictions start to ease. And an increased final dividend signals that the company expects a better year ahead. Continue…

by Andreas Lundberg Posted in Companies, Health Care, Stocks We Like.

- 3 Comments

- save this article

- 3

- POSTED IN Companies, Health Care, Stocks We Like.

-

What’s in a global equity benchmark?

Scott Phillips

September 1, 2021

The MSCI (Morgan Stanley Capital International) organisation is arguably the best know provider of global equity indexes and provide an excellent insight into the investable equity markets around the world. The MSCI indexes are market cap-weighted indexes, which means stocks are weighted according to their market capitalisation—calculated as stock price multiplied by the total number of shares outstanding. Continue…

by Scott Phillips Posted in Global markets, Polen Capital.

- save this article

- POSTED IN Global markets, Polen Capital.

-

Why unfettered capitalism is failing us

Roger Montgomery

August 31, 2021

One of the seemingly inevitable consequences of capitalism is the increasing concentration of market power in the hands of fewer and fewer large corporations. This issue was raised in a recent speech by ACCC Chair, Rod Sims, who noted the many ways in which increasing market power is adversely impacting Australian society. In his speech, Mr Sims also stated what I have long been advocating: governments need to do something about it. Continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- 1 Comments

- save this article

- 1

- POSTED IN Global markets, Market commentary.

-

Why Polen Capital expect mid to high-teens EPS growth from Mastercard

Roger Montgomery

August 30, 2021

Mastercard (NYSE:MA) is the second largest processor of debit and credit transactions globally behind Visa. It has a market capitalisation of US$354 billion and is a top 10 holding in the Polen Capital Global Growth Fund. Continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Editor's Pick, Polen Capital, Stocks We Like.