To visit the February 2026 reporting season calendar Click here .

-

What we have seen from the first quarter

Roger Montgomery

April 4, 2023

In this week’s video insight Roger reviews what has happened during the first quarter, the performance of markets so far and what’s important looking forward. All eyes are on the short and long-term plausible paths for monetary policy. Despite this, Roger remains optimistic for investing in high-quality businesses generating double-digit earnings growth. Continue…

by Roger Montgomery Posted in Editor's Pick, Video Insights.

- watch video

- save this article

- POSTED IN Editor's Pick, Video Insights.

-

Money Me: from $2.20 to $0.08 in 15 months

David Buckland

April 3, 2023

One of the reasons our business partners, Australian Eagle Asset Management, Montgomery Lucent and Polen Capital, focus on higher quality companies with relatively strong and enduring cash-flow is they rarely suffer such crashes often requiring highly dilutionary capital raisings. Continue…

by David Buckland Posted in Companies.

- save this article

- POSTED IN Companies.

-

Aura Private Credit: Letter to investors 31 March 2023

Brett Craig

March 31, 2023

This week saw the release of two key economic indicators; the monthly indicator of the Consumer Price Index and Job Vacancies data. Both are displaying a slight softening in the economy, perhaps an early indication of the contractionary monetary policies explored last week, increases to the cash rate and quantitative tightening, beginning to take their intended effect. Continue…

by Brett Craig Posted in Aura Group.

- save this article

- POSTED IN Aura Group.

-

MEDIA

The importance of going for growth with Roger Montgomery

Roger Montgomery

March 31, 2023

In this interview with Ausbiz Roger discusses why it is important for investors to go for growth rather than yield, because the pursuit of growth will produce a better yield too. Watch the interview: The importance of going for growth with Roger Montgomery

by Roger Montgomery Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Why we should all be concerned about the coming AI revolution

Roger Montgomery

March 31, 2023

Since its launch in November last year, the transformative potential of ChatGPT has stunned the world. After seeing what it can do, Bill Gates said he had just seen the most important advance in technology since the graphical user interface. The trouble is, AI like ChatGPT has the power to obliterate many industries and occupations, and cause massive social dislocation. Little wonder many technologists are warning that it’s time to hit the pause button, before it’s too late. Continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary.

- 3 Comments

- save this article

- 3

- POSTED IN Editor's Pick, Market commentary.

-

Why you should avoid the siren call of high-dividend stocks

Roger Montgomery

March 31, 2023

We’ve been writing a lot about income, and recently I updated some analysis on the importance of investing in growth stocks rather than yield stocks because, over the long run, the pursuit of growth actually produces a better yield. Let me put forward some more reasons why you’re usually better off avoiding the siren call of high-dividend paying stocks. Continue…

by Roger Montgomery Posted in Editor's Pick, Investing Education.

- 11 Comments

- save this article

- 11

- POSTED IN Editor's Pick, Investing Education.

-

MEDIA

Crisis, contagion or QE? The bigger picture

Roger Montgomery

March 30, 2023

In this article for Firstlinks Roger discusses the current U.S. regional banking industry crisis. Many investors are concerned SVB and Credit Suisse are the 2023 equivalent of Bear Stearns and Lehman Brothers, the 2008 poster children of the GFC. However, fears of a repeat are misplaced for several reasons. Read the article: Crisis, contagion or QE? The bigger picture

by Roger Montgomery Posted in On the Internet.

- READ ONLINE

- save this article

- POSTED IN On the Internet.

-

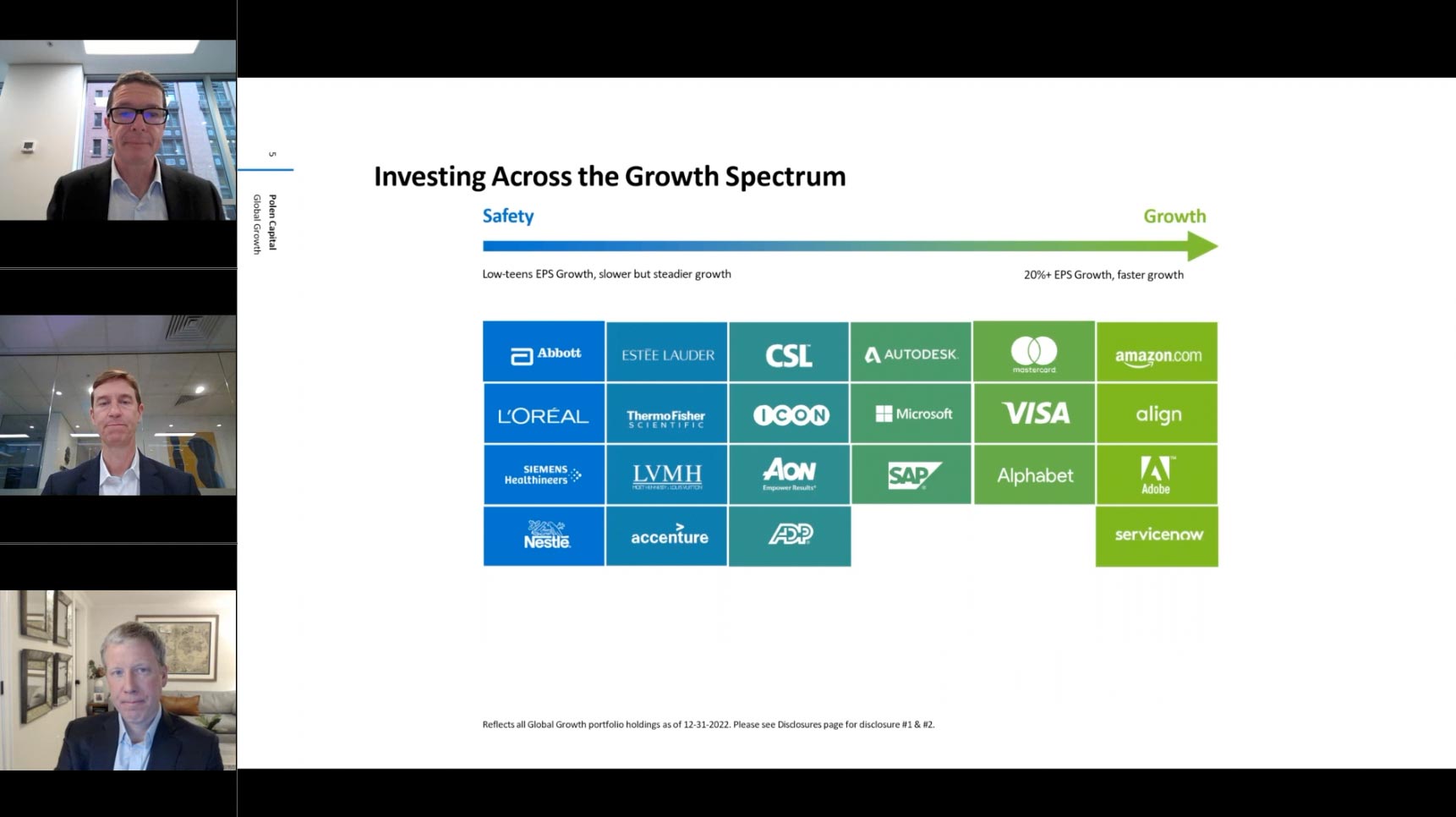

Why the Polen Capital Global Growth Fund portfolio is going to help investors win in the long run

Polen Capital

March 30, 2023

In this video Polen Capital’s Damon Ficklin joins Roger to discuss the portfolio characteristics of the businesses owned in the Polen Capital Global Growth Fund. The businesses Polen Capital invest in are truly advantaged and have the ability to weather the business cycle and continue to perform well in the current environment. Two examples of businesses delivering double-digit revenue growth include Align Technology and Visa. Continue…

by Polen Capital Posted in Polen Capital.

- watch video

- save this article

- POSTED IN Polen Capital.