Insightful Insights

-

Burying your head in the mineral sand…

Roger Montgomery

March 25, 2013

Last week, The Australian Financial Review’s Angus Grigg and Jamie Feed wrote a neat summary of the growing cries of concerns around China’s economy.

We summarise as follows:

– Dong Tao, Chief Regional Economist at Credit Suisse says there is “no good news to report on China…the Chinese economy is struggling”

– Greg Lilleyman, RIO’s President of Pilbara Iron Ore Operations says “additional exports and a slowing in steel demand growth would hurt the price in tens second half of the year”

– Andy Xie says “This is not good news for Australia” and “the Australian housing market and dollar were vulnerable to slowing growth in CHina, which could fall as low as 5 per cent in coming years”

continue…by Roger Montgomery Posted in Economics, Energy / Resources, Insightful Insights.

-

The NEW NORMAL from the horse’s mouth.

Roger Montgomery

March 23, 2013

Jeremy Grantham is a Co-founder and Chief Investment Strategist of Grantham Mayo Van Otterloo also known as (GMO). He has 44 years experience and is also the founder of one of the first index funds in the 1970’s. With about US $100 billion in funds under management, he is also the founder of one of the world’s biggest if not the biggest managers.

He is a contrarian and just last week was quoted as saying: “I bought more long-term Treasuries in the last month than I’ve bought in four years. I am a fan of Treasuries now. I wasn’t a fan of Treasuries in July.”He believes in and indeed coined the term, The New Normal – lower rates of growth for the US permanently.

continue…by Roger Montgomery Posted in Economics, Insightful Insights.

- 5 Comments

- save this article

- POSTED IN Economics, Insightful Insights

-

Put not your trust in money, but put your money in trust. -Oliver Wendell Holmes

Roger Montgomery

March 22, 2013

If you have been following the Montgomery story for some years, you will know that here at Montgomery we are focused value investors. If you have been also following the Skaffold journey you will know it is the online investing platform through which anyone can adopt and implement a value investing approach.

It is encouraging then, for all value investors, to observe that the approach we have adopted, and which we try our best to share is working.

continue…by Roger Montgomery Posted in Insightful Insights, Investing Education.

-

Cyprus and the proposed “deposit tax”

David Buckland

March 21, 2013

Cyprus’s parliament rejected an unprecedented levy on bank deposits, dealing a blow to European plans to force depositors to shoulder part of the Country’s rescue in a standoff that risks renewed tumult in the Euro area. The deal sought to raise E5.8b by drawing funds from Cyprus bank accounts (known as a deposit tax) in return for E10b in external aid.

Of the 17 countries in the Euro, the Cypress economy with GDP of E16b, ranks number 15, ahead of Estonia (E13b) and Malta (E5b) and accounts for less than 0.2 per cent of the Euro E9.4 trillion economy.

continue…by David Buckland Posted in Economics, Insightful Insights.

- 1 Comments

- save this article

- POSTED IN Economics, Insightful Insights

-

The irrational “Mr Market”

Ben MacNevin

March 20, 2013

Charlie Munger is one the most influential investors in the world today. As a founding partner of Berkshire Hathaway with Warren Buffett, Munger is known for his ability to logically process a number of steps in quick succession by employing about 90 relatively simple mental ‘models’.

You may be interested in the link below – to a speech that Charlie Munger presented and in which he discusses many of these models. The speech is well worth a read if you seek to improve your ability to make logical investment decisions (indeed, many of our blog posts reference these models in some way).

continue…by Ben MacNevin Posted in Companies, Insightful Insights, Investing Education, Market Valuation.

-

What is a game changer?

Roger Montgomery

March 20, 2013

Last night I received an unsolicited text message from Vodafone informing that Samsung had just released their Galaxy 4S. Vodafone cooed “it looks like a game changer”. Last week it was Dominos Pizza who insisted that new toppings (toppings others already had) and a square base (competitors already have those too) were ‘game changers’.

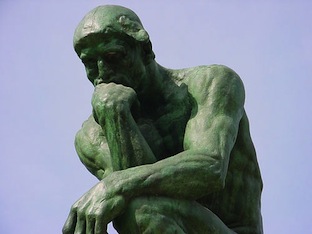

The noun Game Changer is being used a little too liberally at the moment, and lest it creep into our vernacular to such a degree that university students use it to describe skipping the train and catching the bus instead, I thought I’d attempt to use photographs to illustrate my understanding of game changers:-

continue…by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Technology & Telecommunications.

-

US Unemployment hits a four year low

David Buckland

March 19, 2013

The number of Americans filing new claims for unemployment benefits declined as the US economy added 236,000 jobs in February 2013. The unemployment rate hit a four year low of 7.7 per cent.

While this is good news some commentators are pointing to two areas of concern. The participation rate, or percentage of the eligible population employed at 63.5 percent, is at a low for the current cycle. Meanwhile 47.7m Americans or 15 percent of the population are recipients of the Food Stamp Program, now known as the Supplemental Nutritional Assistance Program (SNAP). In Fiscal 2012 this came at a cost of US$74.6 billion.

continue…by David Buckland Posted in Economics, Insightful Insights.

- 2 Comments

- save this article

- POSTED IN Economics, Insightful Insights

-

Wrestling with Resources

Tim Kelley

March 18, 2013

I noted with interest Anton Tagliaferro’s comments in today’s AFR, lamenting the apparent lack of shareholder focus shown by boards of directors in the resources and energy sectors. Reading these comments, it struck me that the boards of these companies are no doubt plagued by the same issues that confound value investors looking at these types of businesses.

As value investors, we aim to acquire an interest in a business when we can see that the value of the business is greater than the price we need to pay to own it. At Montgomery, we are concerned also with quality and a host of other factors, but let’s focus for the moment on value.

continue…by Tim Kelley Posted in Energy / Resources, Insightful Insights, Investing Education.

-

Listen Up

Roger Montgomery

March 18, 2013

As you know we have long been short Iron Ore. That was clever! “…long been short…”?

Jokes aside, many investors are still buying mining and mining services companies. Their reasoning is that they have underperformed the financials and non resource cyclicals. The rationale is that because they have under performed it is time for them to catch up. Well as you know, I think that is a bit like entering a Formula 1 race with a billy kart and a couple of friends to give you a push. Just because the billy-kart has lost the last 1000 races doesn’t mean its time for it to win. An F1 car accelerates from zero to 150kmh in 1.4 seconds. No matter how hard your friends push, your billy cart simply isn’t going to match it.

continue…by Roger Montgomery Posted in Energy / Resources, Insightful Insights.

-

The slow demise of Australian manufacturing?

David Buckland

March 15, 2013

In 1983, 19 per cent of the Australian workforce was in the manufacturing sector. This year, that figure stands at just 9 per cent.

This decline is a common trend across the western world.

So what’s happening to Australian manufacturing and where’s it going?

continue…by David Buckland Posted in Insightful Insights, Manufacturing.