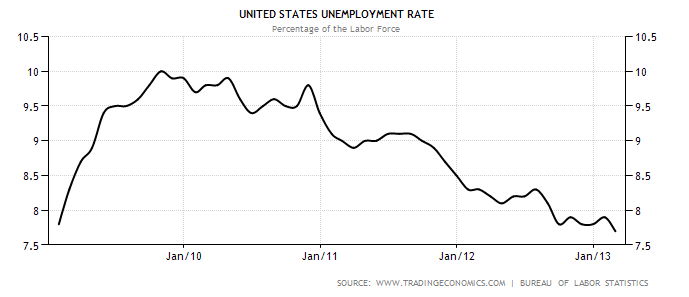

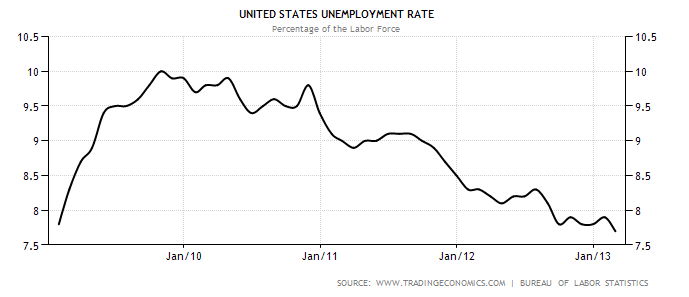

US Unemployment hits a four year low

The number of Americans filing new claims for unemployment benefits declined as the US economy added 236,000 jobs in February 2013. The unemployment rate hit a four year low of 7.7 per cent.

While this is good news some commentators are pointing to two areas of concern. The participation rate, or percentage of the eligible population employed at 63.5 percent, is at a low for the current cycle. Meanwhile 47.7m Americans or 15 percent of the population are recipients of the Food Stamp Program, now known as the Supplemental Nutritional Assistance Program (SNAP). In Fiscal 2012 this came at a cost of US$74.6 billion.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 30 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Scott W

:

As my business is exporting Aussie food all around the globe I have over the years developed a feeling for when an economy is doing well, or doing poorly.

When an economy is doing well I tend to receive a large number of unsolicited approaches from all type of traders wanting to get a range of Aussie products. Remember that this is prior to getting a price quote so it is not heavily impacted by the exchange rate until the next stage.

The last 6 months I can really feel the US economy is turning and they are open for business. The US retailers and distributors, and importers and now taking a more positive view of their economy, and the sense I get is that they are doing the groundwork for expansion.

Now we just need the US dollar to stage a little recovery to get the momentum going, and finally our over valued Aussie Dollar will lose it’s default status as a safe haven to park surplus funds.

Roger Montgomery

:

Than you Scott for sharing those insights from the front line. We have so many business owners and operators viewing the blog that I am sure your comments are reflecting their experiences too.