Companies

-

Not getting schooled

Scott Shuttleworth

May 1, 2015

As an update to our blog on Monday, we noted on Tuesday the unfortunate outcome experienced by the shareholders of Ashley Services Group (ASX: ASH). Risk is one thing to write about yet another thing to see its effects. continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- save this article

- POSTED IN Companies, Insightful Insights

-

An audacious bid for iiNet?

David Buckland

April 29, 2015

I have always admired Vaughan Bowen, the founder of M2 Telecommunications (ASX: MTU). In the ten and a half years since listing at $0.25 per share, M2 has paid out a total of $1.23 in dividends and its share price has grown 44 fold to $11.00, making it one of the best performing companies in the ASX. In 2011, twelve years after founding M2, Vaughan stepped down as CEO, passing the baton to Geoff Horth, and fortunately for the business he remained an Executive Director with a focus on acquisitions. continue…

by David Buckland Posted in Companies, Insightful Insights, Technology & Telecommunications.

-

Should you take a byte out of the market?

Roger Montgomery

April 28, 2015

Shares in US pop culture and technology company Apple are on the cusp of producing a market capitalisation of A$1 trillion. As the Nasdaq technology index closed at a record high last week – above the pre Tech Wreck highs for the first time – you might be interested in some bullish and bearish perspectives currently occupying the minds of more learned observers than us. continue…

by Roger Montgomery Posted in Companies, Insightful Insights, Technology & Telecommunications.

-

Not Getting Schooled Part 1

Scott Shuttleworth

April 27, 2015

Telecommunications, healthcare, technology, financials. These are all common themes in a Montgomery portfolio, yet what about education? continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 3 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Wow, that’s cheap!

Ben MacNevin

April 17, 2015

In a follow-up to Russell’s popular blog post on the threat of Aldi to Woolworths and Coles, we are starting to see competitive responses from the incumbents – and whether they’re working. continue…

by Ben MacNevin Posted in Companies, Consumer discretionary.

-

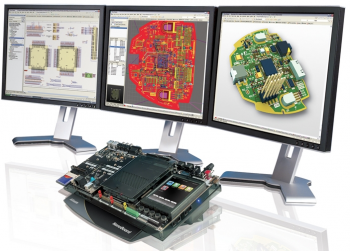

Altium continues its run

Scott Shuttleworth

April 16, 2015

On Friday, Altium Limited (ASX: ALU) reported results from the third quarter and its stock enjoyed a swift ride north to $5.00 shortly after. continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 3 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

No more Chinese junk

Roger Montgomery

March 30, 2015

Recently, senior Montgomery analyst Andrew Macken explained how dangerous it is for anyone to invest in any Chinese company listed on the ASX, or even an exchange in the US. continue…

by Roger Montgomery Posted in Companies, Insightful Insights.

- 2 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Should you be looking at potential takeover targets?

Tim Kelley

March 26, 2015

After a subdued period following the GFC, merger and acquisition (M&A) activity appears to again be coming into fashion. According to Thomson Reuters, worldwide M&A was up 47 per cent in 2014, making it the strongest year for worldwide deal-making since 2007. continue…

by Tim Kelley Posted in Companies, Insightful Insights, Takeovers.

- save this article

- POSTED IN Companies, Insightful Insights, Takeovers

-

Don’t yield to income!

Russell Muldoon

March 12, 2015

In recent times the market has been captivated by the ‘chase for yield.’ This phrase simply represents the symptom of the repressive money printing acting on interest rates globally. As a result of these low interest rates, funds are being ripped out of the safety of cash and poured into riskier assets in the pursuit of higher returns. continue…

by Russell Muldoon Posted in Companies, Insightful Insights, Market Valuation.

-

One stock we had to get our hands on

Ben MacNevin

March 10, 2015

During reporting season, we were quick to build a new position in a company after seeing a much stronger result than we had forecast in our research. A large cash holding allows Montgomery Investment Management to be nimble when opportunities present themselves. continue…

by Ben MacNevin Posted in Companies, Consumer discretionary.