Not getting schooled

As an update to our blog on Monday, we noted on Tuesday the unfortunate outcome experienced by the shareholders of Ashley Services Group (ASX: ASH). Risk is one thing to write about yet another thing to see its effects.

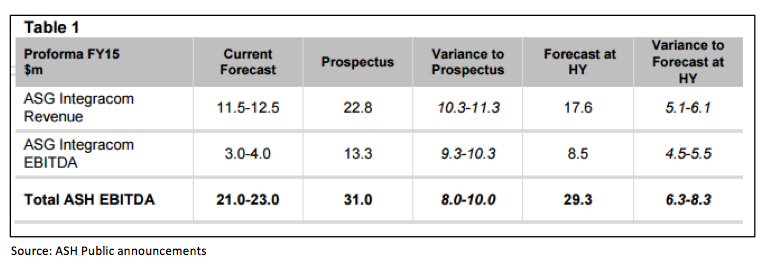

The tables and graphs below provide an overview of the points we found the most interesting:

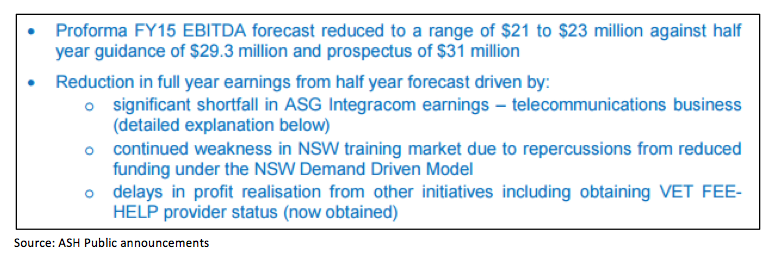

This is the second earnings downgrade that Ashley Services Group has issued since listing on the ASX last August.

I thought it may be worthwhile to draw attention to the second point (a statement from the company on these events can be found here). On the 1st of January 2015, the NSW government implemented the “Smart and Skilled” scheme, a demand driven model which would direct the future flows of government subsidies and funding. Ashley Services Group notes in its announcement:

“At the half year, ASH assumed a $1M improvement in revenue from H1 to H2 in NSW, on the basis of TAFE subcontracting agreement being secured and corporate initiatives that would eventuate. While TAFE subcontracting has been secured and other corporate initiatives are underway, timing of these revenues has been later than anticipated and it is now expected that NSW training revenue in H2 will be below H1.”

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY