Companies

-

February 2024 reporting season calendar

Roger Montgomery

January 30, 2024

As we delve into the February reporting season, investor focus shifts to company profits and identifies sectors and companies anticipating earnings growth. This period can be marked by volatility in share prices, contingent upon whether companies exceed or fall short of expectations. continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies

-

Could deflation be the next surprise?

Roger Montgomery

December 7, 2023

After the well-documented U.S. money printing spree of 2020-21, something interesting happened in the U.S.: Inflation started picking up in 2021-2022. Just as it takes time for water to fill a bucket, it took time for inflation to emerge, but when it did, annualised inflation averaged 7.7 per cent for 18 months from January 2021 to July 2022 (Figure 1). continue…

by Roger Montgomery Posted in Companies, Global markets, Market commentary.

-

Navigating success: Inside Seven Group Holdings

Dominic Rose

December 1, 2023

In this week’s video insight, David Buckland and I discuss Seven Group Holdings (ASX: SVW), an Australian operating and investment group in the media, mining and construction industry in which the Montgomery Small Companies Fund holds a substantial stake. We spotlight the remarkable alignment between the Stokes family’s leadership and investors’ interests, emphasizing Seven Group’s astute counter-cyclical investment strategy. Additionally, we explore their recent strategic acquisition of Boral (ASX: BLD), shedding light on their concerted efforts to enhance operational efficiencies and bolster margins. Catch the full discussion here. continue…

by Dominic Rose Posted in Companies, Stocks We Like, Video Insights.

-

Temple & Webster’s share price soars following its AGM update

Roger Montgomery

November 30, 2023

As we monitor the behavior of the Australian consumer, it’s crucial to acknowledge that consumption constitutes approximately 50 per cent of Australia’s GDP, significantly influencing decisions related to interest rates. The robust trading update presented during the annual general meeting (AGM) by Temple & Webster Group (ASX: TPW), an online retailer specialising in furniture and homewares, prompts thoughtful consideration. continue…

by Roger Montgomery Posted in Companies, Market commentary.

- save this article

- POSTED IN Companies, Market commentary

-

Why I believe REA Group is one of Australia’s highest quality businesses

Roger Montgomery

November 28, 2023

I believe REA Group (ASX:REA), is one of Australia’s highest-quality businesses. REA Group’s online portal – realestate.com.au – is the go-to destination for people wanting to buy, sell or rent property. Price rises in all property related areas have led to substantial revenue and earnings growth and have turbo-charged REA Group’s share price. continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Property, Stocks We Like.

- 5 Comments

- save this article

- POSTED IN Companies, Editor's Pick, Property, Stocks We Like

-

Alliance Aviation Services – A beacon amidst small cap volatility

Gary Rollo

November 15, 2023

In this video insight, David Buckland and Gary Rollo discuss the underperformance of small-cap stocks compared to large-cap stocks since the beginning of 2022. Gary explains that economic uncertainty has contributed to the recent underperformance, as investors tend to shift from small, less liquid investments to larger ones during such periods. However, he views this as a temporary condition, anticipating that once economic uncertainty diminishes, the longer-term performance characteristics of small caps may come into play. continue…

by Gary Rollo Posted in Companies, Stocks We Like, Video Insights.

-

Rationalisation of the Australian commercial radio industry

David Buckland

November 14, 2023

In this week’s video insight, I delve into the events of mid-October, specifically focusing on the collaborative proposal by ARN Media and Anchorage Capital Partners for a non-binding, indicative acquisition of Southern Cross Media. The merger sparked concerns about market dominance, particularly in the commercial radio sector in metropolitan Australia, leading to scrutiny from the ACCC. Notably, over the weekend, Kerry Stokes’ Seven West Media strategically acquired a 20 per cent stake in ARN Media, raising questions about his broader interests across Australia. The developments add layers of intrigue to the future of Australia’s commercial radio sector, making it a captivating subject to observe. continue…

by David Buckland Posted in Companies, Market commentary, Media Companies, Video Insights.

-

MEDIA

Ausbiz – The market’s ‘weighty’ overreaction…

Roger Montgomery

November 13, 2023

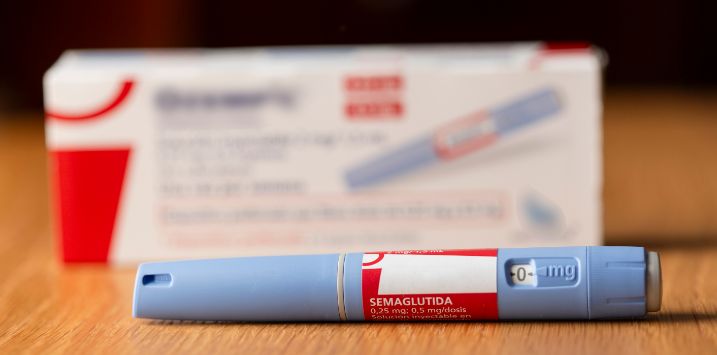

In last week’s Ausbiz interview, I explored investor sentiment surrounding the latest GLP-1 medications, specifically on Ozempic and its implications for companies like CSL (ASX: CSL) and ResMed (ASX: RMD). While the drop in CSL’s share value suggests market concerns about competing Ozempic-style drugs, I argue that these anxieties may be unfounded. My perspective rests on the belief that such medications might not be as transformative in addressing the weight of the U.S. population as investors might anticipate and the affordability surrounding it. Watch the full interview here. Ausbiz – The market’s ‘weighty’ overreaction… continue…

by Roger Montgomery Posted in Companies, Market commentary, TV Appearances.

- save this article

- POSTED IN Companies, Market commentary, TV Appearances

-

The market’s “weighty” overreaction

Roger Montgomery

November 8, 2023

Markets often resemble their participants, and the stock market is particularly vulnerable to the human psyche, prone to bouts of elation and despondency with each new trend. The recent euphoria surrounding a novel class of weight-loss and diabetes management drugs is a textbook example of this phenomenon. continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Health Care, Market commentary.

- save this article

- POSTED IN Companies, Editor's Pick, Health Care, Market commentary

-

MEDIA

ABC The Business – Insights into Wesptac’s performance, RBA meeting, and Newcrest mining takeover

Roger Montgomery

November 7, 2023

During my recent interview on ABC’s The Business with Kirsten Aiken, I delved into several key topics. We explored Westpac’s (ASX: WBC) recent financial results, highlighting an overall improvement for the year, albeit with a slight decline from their first-half results. Additionally, we discussed the outlook in the context of the Reserve Bank of Australia’s (RBA) meeting and the consensus regarding potential rate increases. Furthermore, we touched upon the noteworthy takeover of Newcrest Mining by Newmont. continue…

by Roger Montgomery Posted in Companies, Market commentary, TV Appearances.

- save this article

- POSTED IN Companies, Market commentary, TV Appearances