Companies

-

What is your WOW Value.able valuation now Roger?

Roger Montgomery

February 14, 2011

With food prices on the way up and Woolies share price on the way down, I have received many requests for my updated valuation (my historical $26 valuation was released last year). Add to that Woolworths market announcement on 24 January 2011, and you will understand why I have taken slightly longer than usual to publish your blog comments.

With food prices on the way up and Woolies share price on the way down, I have received many requests for my updated valuation (my historical $26 valuation was released last year). Add to that Woolworths market announcement on 24 January 2011, and you will understand why I have taken slightly longer than usual to publish your blog comments.With Woolworths’ shares trading at the same level as four years ago (and having declined recently), I wonder whether your requests for a Montgomery Value.able valuation is the result of the many other analysts publishing much higher valuations than mine?

Given WOW’s share price has slipped towards my Value.able intrinsic value of circa $26, understandably many investors feel uncomfortable with other higher valuations (in some cases more than $10 higher),

Without knowing which valuation model other analysts use, I cannot offer any reasons for the large disparity. What I can tell you is that no one else uses the intrinsic valuation formula that I use.

So to further your training, and welcome more students to the Value.able Graduate class of 2011, I would like to share with you my most recent Value.able intrinsic valuation for WOW. Use my valuation as a benchmark to check your own work.

Based on management’s 24 January announcement, WOW shareholders can expect:

– Forecast NPAT growth for 2011 to be in the range of 5% to 8%

– EPS growth for 2011 to be in the range of 6% to 9%The downgraded forecasts are based on more thrifty consumers, increasing interest rates, the rising Australian dollar and incurring costs not covered by insurance, associated with the NZ earthquakes and Australian floods, cyclones and bush fires. The reason for the greater increase in EPS for 2011 than reported NPAT is due to the $700m buyback, which I also discussed last year.

Based on these assumptions and noting that WOW reported a Net Profit after Tax of $2,028.89m in 2010, NPAT for 2011 is likely to be in the range of $2,130.33 to $2,191.20. Also, based on the latest Appendix 3b (which takes into account the buyback), shares on issue are 1212.89m, down from 1231.14m from the full year.

If I use my preferred discount rate (Required Return) for Woolies of 10% (it has always deserved a low discount rate), I get a forecast 2011 valuation for Woolworths of $23.69, post the downgrade. This is $2.31 lower than my previous Value.able valuation of $26.

If I am slightly more bullish on my forecasts, I get a MAXIMUM valuation for WOW of $26.73, using the same 10% discount rate.

So there you have it. Using the method I set out in Value.able, my intrinsic valuation for WOW is $23.69 to a MAXIMUM $26.73.

Of course, I only get excited when a significant discount exists to the lower end of these valuations and until such a time, I will be sitting in cash.

Posted by Roger Montgomery, author and fund manager, 14 February 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education.

-

Is your stock market still turned off?

Roger Montgomery

February 3, 2011

At this time of year, well-meaning articles on the subject of how to invest in the year ahead abound. Indeed I have contributed to the pool of wisdom in my recent article for Equity magazine titled Is your stock market on or off?.

At this time of year, well-meaning articles on the subject of how to invest in the year ahead abound. Indeed I have contributed to the pool of wisdom in my recent article for Equity magazine titled Is your stock market on or off?.Value.able Graduates know to turn the stock market off and focus on just three simple steps. Even if you have read Value.able, or joined in the conversation at my blog, its not just me that believes they’re worth repeating. Ashley wrote about the article ‘More of the same stuff for the Value.able disciples but the more you read it the more you will practise it’ and from David ‘’twas a good refresher indeed!’.

Step 1

The first step of course is to understand how the stock market works. Once you understand this, turning it off is easy. And you do need to turn of its noisy distraction.

Step 2

The second step is to be able to recognise an extraordinary business (Go to Value.able Chapter 5, page 057).

I have come up with what are now commonly referred to by Value.able Graduates as Montgomery Quality Ratings, or MQR for short. Ranking companies from A1 to C5, my MQR gives each company a probability weighting in terms of its likelihood of experiencing a liquidity event.

Step 3

Finally, the third step is to estimate the intrinsic value of that business. Use Tables 11.1 and 11.2 in Value.able.

Three simple steps. If you get them right, you too can produce the sorts of extraordinary returns demonstrated and published, for example, in Money magazine.

The key is to buy extraordinary companies. To save you some time, I would like share a current list of companies that don’t meet my A1 rating. Indeed these are the companies that receive my C4 and C5 ratings, the worst possible. Avoiding these is just as important as picking the A1s because even diversification doesn’t work when your portfolio is filled with poor quality companies or those purchased with no margin of safety.

Whilst the eleven companies listed above are low quality businesses, they won’t necessarily blow up. This is not exhaustive, nor is it a list of companies whose share prices will go down. It is however a list of companies that I personally won’t be investing in.

If your first question is what are the chances of loss?’ then my C5 rating represents the highest risk. But of course risk is based on probability. And a probability is not a certainty. Nevertheless, I prefer A1s and A2s. More on those lists another time.

Posted by Roger Montgomery, author and fund manager, 3 February 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

Will your portfolio repeat its 2011 performance?

Roger Montgomery

February 2, 2011

If you are new to my stock market Insights blog, welcome. And to the Value.able community, thank you for your many comments and encouraging words. It gives me great encouragement and motivates me to hear how your investing and returns have improved as a result of reading Value.able and the collection of comments posted by Graduates here at my blog. Thank you also for spreading the word and purchasing additional copies for family and friends.

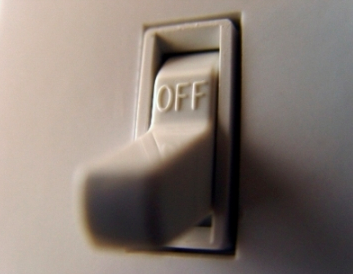

If you are new to my stock market Insights blog, welcome. And to the Value.able community, thank you for your many comments and encouraging words. It gives me great encouragement and motivates me to hear how your investing and returns have improved as a result of reading Value.able and the collection of comments posted by Graduates here at my blog. Thank you also for spreading the word and purchasing additional copies for family and friends.Taking a look back over the stocks we discussed last year, it appears the Value.able approach to investing in the highest quality businesses, with a true margin of safety, has been doing quite well.

In addition to the blog, I also wrote about many of the stocks that achieve an A1 Montgomery Quality Rating (MQG) in my Value.able stocks for Money magazine over the last six months of 2010.

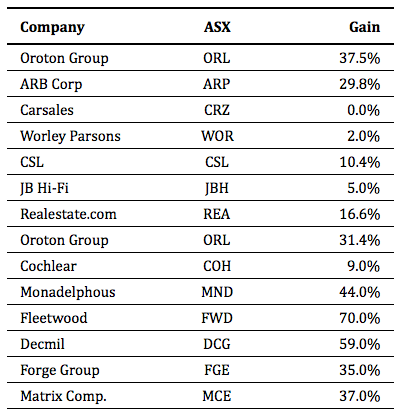

The stocks are listed in the table below. The column titled ‘Gain’ demonstrates you can do well without exposing yourself to lots of risk – for example the risk that is inherent in speculative stocks.

The returns exclude the dividends received, which would obviously boost results materially. The correct comparison therefore is the All Ords price index rather than the All Ordinaries Accumulation Index. Since 30 June 2010 the All Ordinaries has risen 12%. That is a stark contrast to many of the returns produced by the high quality businesses listed above.

The returns stand even higher above the Index when the selection is ranked by those that I regarded as offering the greatest margin of safety at the time the stock was mentioned: Oroton (up 37.5%), ARB Corporation (up 29.8%), JB Hi-Fi (bought and then sold the next month (up 5%), Monadelphous, Forge, Decmil and Matrix (up 44%, up 59%, up 35%, and up 37% respectively). The average, six month, price-only return of these businesses is 34.8%. And some of these A1 businesses, a margin of safety still exists.

If you are new to value investing you will, when searching around, find many commentators, portfolio managers and investors who may disparage value investing generally. They may question the method of calculating intrinsic value or even dismiss the valuations produced, but quite seriously, the proof is in the eating. And the returns offered have been nothing short of mouth watering.

But six months is NOT enough to hang your hat on, as Tony and Adam recently pointed out on my Facebook page. So if you have been an investor in any of these companies, following a conversation with your adviser of course, remember that the change in price over a year or two shouldn’t excite or concern you. It’s the change ahead in the Value.able intrinsic value of the company that matters.

If you haven’t already purchased your copy of Value.able, I commend it to you. It will change the way you think about investing in the stock market for the better, and as the many independent comments elsewhere here on the blog can attest, it may also materially improve your results. Value.able is available exclusively at www.rogermontgomery.com

Posted Roger Montgomery, author and fund manager, 2 February 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

What does my 2031 crystal ball predict?

Roger Montgomery

January 13, 2011

I’m going to kick off 2011 with two things that I will unlikely repeat. Rather than look at individual companies today – something I am hitherto always focused on (and always will be) – I would like to share my insights, ever so briefly, into what I think are the major and possibly predictable themes for the next twenty years. The second? A 1781 word blog post.

I’m going to kick off 2011 with two things that I will unlikely repeat. Rather than look at individual companies today – something I am hitherto always focused on (and always will be) – I would like to share my insights, ever so briefly, into what I think are the major and possibly predictable themes for the next twenty years. The second? A 1781 word blog post.A word of warning… my track record at correctly predicting market direction is lousy. Thankfully this inability hasn’t hindered my returns thus far and probably won’t in the future.

Having provided that requisite warning, I invite you to consider the following thematic predictions (and yes, they are predictions).

1. Higher Oil Prices

The International Energy Agency (IEA), Energy Information Administration (EIA) and Platts Oilgram News have ‘confirmed’ that peak oil (maximum daily global oil production) was reached in 2005/06. With this backdrop, any hint of Chinese demand increasing and drawing down on spare capacity can cause significant price surges. It is interesting that prior to the last oil price spike, and when oil traded at $90/barrel, US unemployment was about 4%. If someone back then had asked you what the oil price should be in 2011 if US unemployment was more than double – you would not guess ‘still $90’.

It strikes me that there is a lot of demand for oil supporting the price that is not contingent on a strong US economy. China is the first that comes to mind. Other analysis reveals the Middle East, driven by the desire to be a global leader in the manufacture of plastic, is using much more oil than in the past.

And as Jim Rogers has regularly noted; if the US and global economies strengthen, demand for oil will increase. What if they don’t? Rogers anticipates the US Federal Reserve will print more money and the price of commodities will go up.

2. Higher Coal and Uranium Prices

Of the 6.8 billion people on Earth, over 3.5 billion have little or no access to electricity. Irrespective of greenhouse gas concerns, rising demand for energy will see coal’s current share increase. China and India will lead the demand. China’s demand shifted the country to net importer status in 2009 and by 2015 will more than triple consumption from 1990 levels. According to some reports, China is commissioning a coal-fired power plant every week.

In India coal generates three quarters of the country’s electricity, yet over 400 million people have no access to electricity. Demand for coal has risen every year for the past ten years. Some expect India will triple its coal imports in the next… wait for it… two or three years. Democracy hinders the ability of the government to install decent transport infrastructure (it can take six or seven hours to travel just 250 kilometers) and one would expect the same issues will prevent any substantial increase in the domestic mining of coal.

Don’t be surprised if there are more takeovers of Aussie coal companies.

Uranium has recently bounced 50 percent from the lows, but remains half the level of 2007 highs.

If the price of coal and oil rises, then the political opposition to uranium that has resulted in underutilisation of this resource (and of course constrained supply) will cause the price to rise materially.

According to the World Nuclear Association (WNA), global demand for uranium is about 68.5 thousand metric tons. Supply from mines is 51 thousand. The Russian and US megatons-to-megawatts program fills the shortfall, but clearly that provides only a short-term band-aid. So there is already a shortfall; currently, nearly 60 reactors globally are under construction and nearly another 150 are on order.

Late last year China increased its nuclear power target for the end of the new decade by 11 times its current capacity. And China plans to build more plants in the next ten years than the US has, ever.

On the supply side, new mines can take more than a decade to go from permit to production and while Australia has the largest reserve in the world, government debate has barely begun.

3. Higher Rubber Prices

Less than 50 people per 1000 own a car in China, and the country already consumes a third of the world’s rubber! The numbers elsewhere are three times that per thousand. It doesn’t matter whether those cars are electric, hybrid, diesel or petrol – the Chinese will need rubber for their car tyres.

On the supply side, rubber comes from trees predominantly grown in Asia. They take many years to mature and recent catastrophic weather has dented supply.

4. Weather, Weather everywhere

Many years ago my wife gave me a copy of The Weather Makers. In it Tim Flannery predicted the south-east corner of Australia would dry up and the northern states would experience increased rainfall. Whilst it seemed farfetched at the time, it was sufficiently concerning for me to put the purchase of a rural property in the North East of Victoria on hold. The 2009 Black Saturday bushfires and now, the devastating floods being experienced by 75 per cent of Queensland, are enough to convince me that Flannery’s predictions were prescient. The rest of the world has not been spared – the closure of Heathrow and JFK airports are testament to the fact that, irrespective of whether humans are responsible, the climate is changing.

Expect the price of agricultural products and foods to strengthen. This never occurs in a straight line so there will be bumps along the way, but food prices are going to rise and 140 year highs in cotton, for example, may be just the beginning.

Jim Rogers reckons you will be rich if you buy rice, and I would have to agree. Global increases in demand, supply shortfalls and then disruptions due to more violent weather patterns (La Niña notwithstanding) should be expected to dramatically increases prices.

Floods in Thailand (the world’s rice bowl) will cut production, insufficient monsoonal floods will cut production in Vietnam (the world’s second most important rice bowl) and freak weather elsewhere has meant other producing countries now rely more on imports. Rice is the staple for half the world’s population. Riots in 2007, when the price of rice hit a long-term high, offers an insight into how important this food is.

And as Jeremy Grantham said on CNBC: “We’re running out of everything”.

5. Inflation and Interest Rates

With wheat, cotton, pork and oats rising more than 50% last year and copper, sugar, canola and coffee up more than 30%, the inflation train has left the station, so to speak. Then there is the US Federal Reserve’s perpetual printing press – driving yields down and causing a currency tidal wave to flow to emerging countries, like China. Once the funds get there, they seek assets to buy, pushing their prices higher and thus exporting inflation elsewhere.

Despite this, in the US at least, the trend has been to invest in bonds. After being beaten to within an inch of their lives in stocks and real estate, there has been a love affair with bonds. The ridiculously low yields in bonds and treasury notes does not reflect the US’ credit worthiness and has caused some observers -including US Congressman Ron Paul (overseer of the US Fed) in Fortune magazine – to describe US Bonds as being in a “bubble”.

The Fed’s policies are geared towards low interest rates. But artificially-set low rates don’t reflect genuine supply and demand of money – they perpetuate a recession or at best merely defer it. The low rates trigger long-term investment by businesses even though those low rates are not the result of an increase in the supply of savings. If savings are non-existent, then the long-term investment by businesses will produce low returns because customers don’t have the savings to purchase the products the businesses produce. But that is a side issue.

The US, for want of a better description, appears to be bankrupt. A country with the poorest of credit ratings and living off past victories will not forever be offered the ability to charge the lowest interest rates. And China won’t continue to allow itself to be the sponge that absorbs US dollars either. Indeed at the start of this year, China allowed its exporters – for the first time – to invest their foreign currency directly in the countries they were earned. No longer do they have to repatriate foreign funds and hand them to the Peoples Bank of China in return for Yuan. This is a solution that Nouriel Roubini didn’t consider in his article – how China may respond to inflows that inevitably drive up its exchange rate, published in the Financial Review late last year.

5a. Expect US interest rates to rise

Inflation in the US has been held down in the first instance, arguably, by some questionable number crunching, but also by the export of deflation by China to the US. Now the inflation train has left the station (coal, uranium, food, agriculture, rubber et. al., Chinese input costs will go up – because its currency hasn’t (to help its exporters remain competitive)) – and the ability of the US to continue to report benign inflation numbers becomes problematic.

If inflationary expectations rise, so will interest rates. Declining bond prices will again dent the investment performance of pension funds that have been pouring into treasury and municipal bonds (they’re another fascinating story – Subprime Mk II). In turn, the ageing US consumer will feel the double impact of poor present economic conditions and poor retirement prospects.

Over in China, even if the government tries and mitigate inflation by simply capping prices, suppliers won’t invest in additional capacity and the resultant restriction in supply will simply defer, but not prevent, even higher prices.

Tying it all together

It’s far easier to invest when the tide is rising and it is also easier to make profits in businesses when your pool of customers is expanding and becoming wealthier. Value.able investment opportunities (extraordinary businesses at big discounts to intrinsic value) will be found in companies that sell products and services to Asia and India (from financial to construction), as well as those that stand to benefit from the ongoing impact of rising demand for, and [climate] effects on, food and energy etc. These opportunities will dominate my thoughts this year and this decade and I believe they should guide yours too.

So now I ask you – the Value.able Graduate Class of 2010 and Undergraduate class of 2011. What are your views, predictions and suggestions? Which companies do you expect to benefit the most? Be sure to include your reasonings.

I will publish my Montgomery Quality Rating (MQRs) and Montgomery Value Estimate (MVE) for each business you nominate in my next post, later this month.

Posted by Roger Montgomery, 13 January 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

After some extra help with your holiday homework?

Roger Montgomery

January 6, 2011

Happy new year! I trust you had a safe, peaceful and Happy Christmas.

Happy new year! I trust you had a safe, peaceful and Happy Christmas.To the Value.able Graduates, thank you for sharing your knowledge and taking the time to help the Undergrads with their holiday homework.

If you are seeking a little extra guidance, this Masterclass video I recorded for Alan’s Eureka Report may just do the trick. Think of it as Value.able‘s Chapter 11, Steps A-D and Steps 1-4, live.

If you have not already secured your copy of Value.able and want to kick 2011 off the Value.able way, go to www.RogerMontgomery.com. The First Edition sold out in just 14 weeks and with so many private and professional investors now buying multiple copies for friends and family, the Second Edition is set to sell out just as quickly. Don’t waste another minute!

Posted by Roger Montgomery, 6 January 2011.

by Roger Montgomery Posted in Companies, Investing Education, Value.able.

-

Have you done your homework?

Roger Montgomery

December 22, 2010

As my last official day at the office draws near, I am delighted with the results we have achieved from combining my approach to quality (The Montgomery Quality Ratings “MQRs”) with Value.able‘s method of calculating intrinsic value. There will always be conjecture and disagreement with these, but that doesn’t matter to me and it shouldn’t bother you either. The market is wide enough and deep enough to cater for us all.

As my last official day at the office draws near, I am delighted with the results we have achieved from combining my approach to quality (The Montgomery Quality Ratings “MQRs”) with Value.able‘s method of calculating intrinsic value. There will always be conjecture and disagreement with these, but that doesn’t matter to me and it shouldn’t bother you either. The market is wide enough and deep enough to cater for us all.I am very proud of how far you – the Value.able Graduate Class of 2010 – have come and encourage you to continue questioning and challenging the things you read and learn. It was Elbert Hubbard who said “The recipe for perpetual ignorance is: Be satisfied with your opinion and content with your knowledge.”

Some of the most memorable results of 2010 for me where the gains in Matrix, Decmil and Forge, as well as the gains in Acrux, Thorn, Fleetwood, MMS, Data#3, and Oroton. I was also delighted to have left QR National alone – missing out on an 11.8% return, but selecting MACA instead, which has produced a 70 per cent return.

Elsewhere, fund managers have reported good results. But as one Graduate noted via email, when some portfolios, filled with debt-laden, low ROE businesses, rise, it is generally a function of a rising tide rather than sound investing principles. Of course when investing the Value.able way, it matters not what anyone else is doing. All that matters is that your analysis is right and that you are consistent.

There have been plenty of questions about the Value.able valuation formula this year and perhaps even a little obsession over the source of, reason for and disagreement with the formula/tables. If that resonates with you, I urge you to re-read pages 193 and 194 and consider the following parallel; In the sport of mountain biking, some riders obsess with the weight of their bicycles. Many shop around for a ceramic or titanium rear derailleur pulley so that they might save as few as 5 grams! Paying thousands for their obsession, they fail to realise that the weight of their fettucini carbonara the night before, the water bottle they carry with them and the mud that sticks to their tyres is far greater than the savings they make and that strength, fitness, endurance and momentum are all far more important. Don’t become too obsessed by the math when its the competitive advantage that is more important and, in any case, value slaps you in the face when it is obvious.

There are very good reasons why my valuations have differed from those you have produced, and I explain a major source of the difference on pages 193 and 194.

Far more important is that you are now carrying out your own analysis and focusing your attention on high quality companies, sustainable competitive advantages and intrinsic value. I believe you will continue to do well – as so many of you have shared with our community – if you stick to the disciplines outlined in Value.able. And if you haven’t purchased your copy yet, do it now!

Before I leave for the annual Montgomery family holiday, I promised to give you some homework. There are three tasks with a total of two challenges. You can choose those you’d like to complete. You are under no pressure to complete them all. It is the holidays after all!

Challenge 1, Task 1

The first task is to print out the Notes to the Financial Statements: Contributed Equity for the number of shares on issue, Balance Sheet, Profit and Loss statement and Statement of Changes in Equity for The Reject Shop for 2010. Links to the statements are below:

Notes to the Financial Reports: Contributed Equity for the Number of Shares on Issue – click here

Balance Sheet – click here

Profit and Loss – click here

Statement of Change in Equity (Dividends) – click here

Using the numbers circled on each of the statements and a Required Return of 11%, try your hand at calculating The Reject Shop’s 2010 Value.able Intrinsic Value. Follow Steps A through D on page 195 of Value.able. Be sure to list your outputs for Equity per Share, Return on Equity and Payout Ratio. Click here to download my Value.able Valuation Worksheet. Ken has also provided a great list of guidelines – click here.

Challenge 1, Task 2

If you want to obtain extra marks you can have a go at also calculating the 2010 cash flow for The Reject Shop using the method I outline in Value.able on page 152.

If you haven’t purchased Value.able, don’t worry. My website will continue to accept your orders and my distribution house is working through the holiday season.

Challenge 1, Task 3

The final task involves completing one or both challenges on the Christmas Holiday Spreadsheet. The first challenge is for Value.able Undergrads. Use the worksheet to fill out the spreadsheet, then rank the companies by their Safety Margin. The spreadsheet will download automatically to your computer. When I return in late January I will publish my table and we can compare results.

Challenge 2

The second challenge is for the Value.able Graduate Class of 2010 (and any Undergrads that fancy a challenge). Your task is to calculate the historical change in intrinsic value and price over the last ten years.

Don’t worry. You don’t have to calculate ten intrinsic values, just two. Estimate the intrinsic value a decade ago (2001) and compare it to the 2011 intrinsic value. To make things a little less onerous, maintain the same RR for a company for the two years. You can then rank the five companies by their rate of change and you can use the following formula in excel if you like:

((IVn/IVn-10)^(1/10))-1

Where, IVn is Intrinsic value for 2011 and IVn-10 is Intrinsic Value for 2001 and ^(1/10) is ‘to the power of 1/10’.

I expect it will take a few weeks for you to get all the your submissions and I will consider some form of recognition for the winners. In the meantime enjoy a peaceful and Value.able Christmas and all the very best to you and your loved ones.

Posted by Roger Montgomery, 22 December 2010

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Who made the Value.able grade?

Roger Montgomery

December 16, 2010

The Value.able class of 2010 is indeed all class.

The Value.able class of 2010 is indeed all class.Your nominations for the A1 stocks to watch in 2011 are fine examples of the sorts of companies that I eagerly seek for my own portfolio (with the exception of the odd recalcitrant student who diverged from the lessons learned).

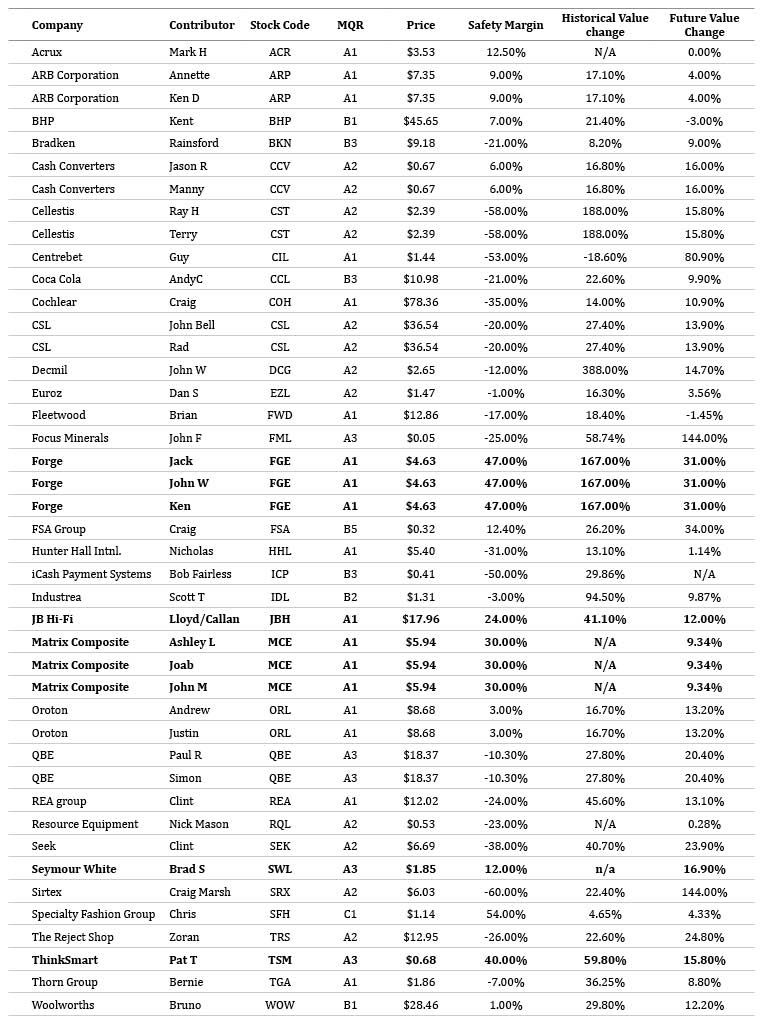

I haven’t yet decided which will be revealed on Sky’s Twelve Shares of Christmas special tonight at 7pm, although the shortlist may be obvious from the numbers presented in the table below.

If we presume that all A1s have equally bright prospects – they don’t – then the job of picking the top stock comes down to the one that offers the highest return when combining the discount to intrinsic value and the prospective change to intrinsic value over the next two or three years.

One difficulty with such a simplistic approach is that firstly, varying degrees of certainty about the future cloud the picture. I have also used consensus numbers to produce the valuation changes and these are notorious for being optimistic at precisely the wrong points in the business cycle.

To avoid this dilemma for the purposes of the exercise (but perhaps not for the purposes of investing), I could elect to go with the choice that received the most recommendations. The winner of that contest would be a tie between Matrix Composite & Engineering (MCE) and Forge Group (FGE) and the equal runners up would be Oroton (ORL), ARB Corp (ARP), Cash Convertors (CCV), Cellestis (CST) and CSL (CSL). The remaining contributions include Acrux (ACR), BHP (BHP), Bradken (BKN), Centrebet (CIL), Coca Cola (CCL), Decmil (DCG), Euroz (EZL), Fleetwood (FWD), Focus Minerals (FML), FSA Group (FSA), Hunter Hall (HHL), iCash Payment Systems (ICP), Industrea (IDL), JB Hi-Fi (JBH), QBE (QBE), REA Group (REA), Resource Equipment (RQL), Seek (SEK), Seymour White (SWL), Sirtex (SRX), Speciality Fashion Group (SFH), The Reject Shop (TRS), ThinkSmart (TSM), Thorn Group (TGA) and Woolworths (WOW).

Whilst I have identified a universe of A1 companies trading at discounts to intrinsic value that have slipped under your radar, the objective of the exercise was to ask for your picks and now that I have the list, choose a winner I must.

On tonight’s Summer Money program on Sky Business at 7pm I will reveal the ONE stock that you have selected as the relatively best prospect for 2011. It won’t be Roger Montgomery’s pick. It will be the top pick by the Insights Blog Community – the Value.able Graduate Class of 2010!

Posted by Roger Montgomery, 16 December 2010.

by Roger Montgomery Posted in Companies, Investing Education.

-

What are your Twelve Stocks of Christmas?

Roger Montgomery

December 9, 2010

I have an assignment for you.

Before we start, two things…

1. If you are looking for a gift that keeps on giving in 2011, give your loved ones a copy of Value.able. To guarantee your gift makes it into Santa’s sleigh, you must order before 5pm next Monday, 13 December.

2. Put Thursday 16 December @ 7pm in your diary. Sky Business has invited me to appear on their Summer Money program.

Within Summer Money, Sky is running a series called The Twelve Stocks of Christmas and I have been asked to present one of the twelve stocks. What I would like to do is let everyone on Sky Business know about you – the Value.able Graduate class of 2010!

You have been instrumental in contributing to the knowledge and awareness of value investing and I would like to say thank you by reviewing your suggestions on air.

So, what will it be? You can nominate one of the companies we have already discussed. More points can be earned by contributing a company of which you have industry-level knowledge. Think about your industry or business:

– Who is the strongest [listed] competitor in your industry?

– Who would you like to see out of business because they are an emerging threat?

– What are their competitive advantages, their opportunities for growth and why do you think they will sell more of their product or services in the future or at higher prices?

– Perhaps they are out of favour in the share market, but you believe it’s a case of a temporary set back being treated like a permanent impairment?

I encourage you all to post your contribution. There are just two rules:

1. One stock (your best pick) per Value.able Graduate. The more detailed your information, the better; and

2. Ideas must be submitted by Wednesday 15 December

Before the live show at 7pm next Thursday, 16 December, I will run my valuation eye over every suggestion and give each my Montgomery Quality Rating (MQR). But the list will be yours – a contribution from the Value.able Class of 2010.

Whilst only one stock will make it to the show, EVERY SINGLE STOCK contributed on this post with sufficient supporting detail will be subsequently listed in my final pre-Christmas post for 2010, complete with MQRs, current valuations and prospective valuations (I have decided to called these MVEs – see below).

Embrace this opportunity to practice what you have learned over the past twelve months, and get the official Montgomery Quality Rating (MQR) and Montgomery Value Estimate (MVE) for your favourite stock. You never know, your stock may just be the one I contribute on national television to The Twelve Stocks of Christmas.

Post your suggestion here at the blog by Wednesday 15 December 2010.

I look forward to reviewing your insights and hearing what you think of your classmates’ suggestions. Simply click the Leave a Comment button below.

Posted by Roger Montgomery, 9 December 2010.

Postscript: thank you for your kind words and birthday wishes. I’m thoroughly enjoying my time away and am very much looking forward to reading and replying to your comments when I return to the office next Monday.

Postscript #2: Steven posted his own Value.able 12 Days of Christmas at my Facebook page last Friday – brilliant!

On the twelfth day of Christmas,

My independent analyst’s blog gave to me

12 A1s humming

11 valuations piping

10 C5s a-sleeping

9 forecasts prancing

8 capital raisings milking

7 floats a-sinking

6 CEOs praying

5 golden A1s!!

4 C5 turds

3 emerging bubbles,

2 editions of Value.able

And a market leader with a high ROE!Here is Steven with his daughter Sophie.

Roger, you were good enough to sign my book…

“To Steven, Your guide to avoiding the dogs you told me you were so worried about, RM”.

Here I am reading Value.able to my little two year old Sophie at bedtime, holding her toy dogs. The moral of the story for Sophie? Roger shows dogs make fun toys and pets but must be avoided at all costs when investing in great businesses!”

Steven

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Has 2010 been a good year for Value.able investing?

Roger Montgomery

December 7, 2010

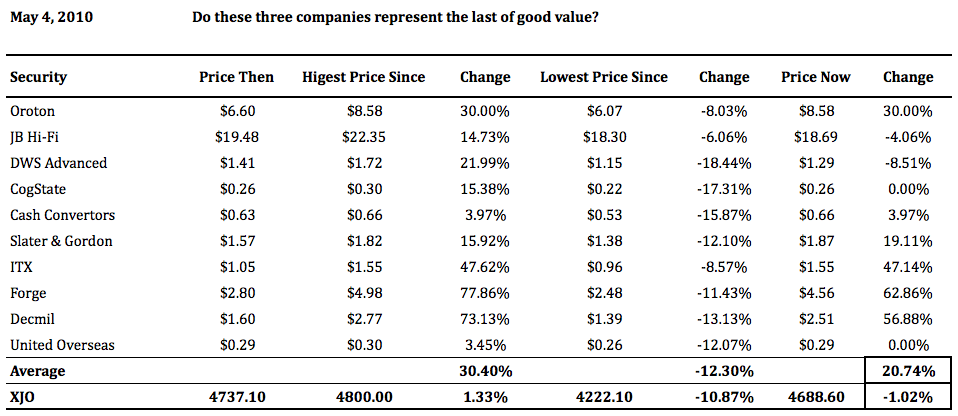

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.Does the Value.able approach to investing, as advocated some of the world’s leading investors, have merit?

First Edition Graduates may not be surprised by the results posted below. The higher quality businesses, those scoring A1 and A2 Montgomery Quality Ratings (MQRs), and those at larger discounts to intrinsic value have, in aggregate, beaten the index. Some have trounced it. And with the exception of QR National, the companies that were labeled as poor quality (C4 and C5 MQRs) and overpriced, have under-performed. Some of the maturing higher quality companies (think JB Hi-Fi) have indeed performed.

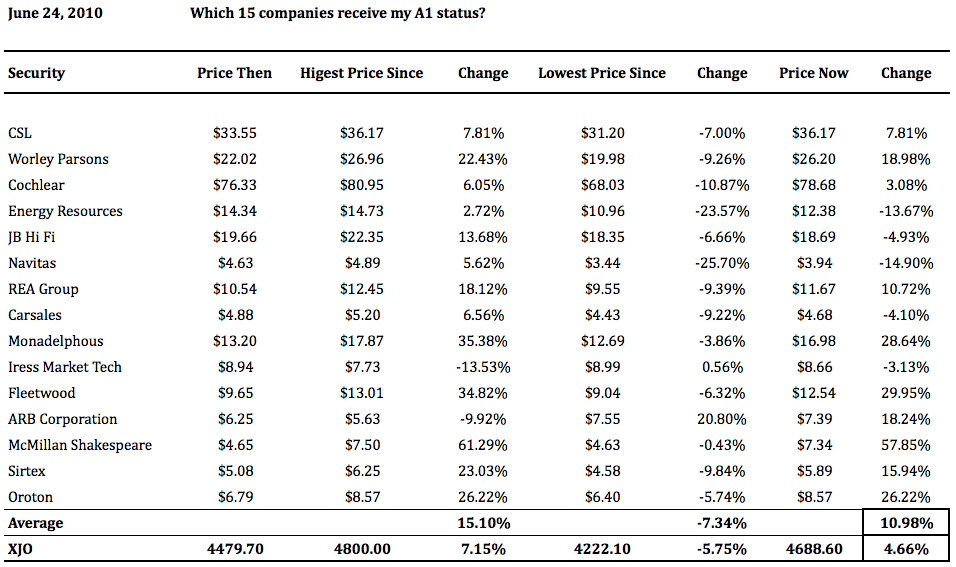

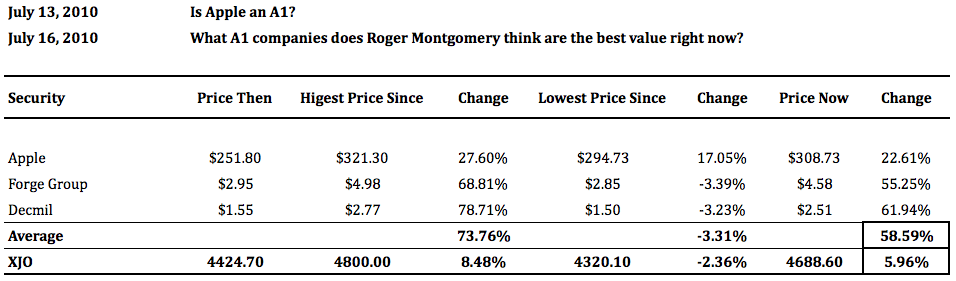

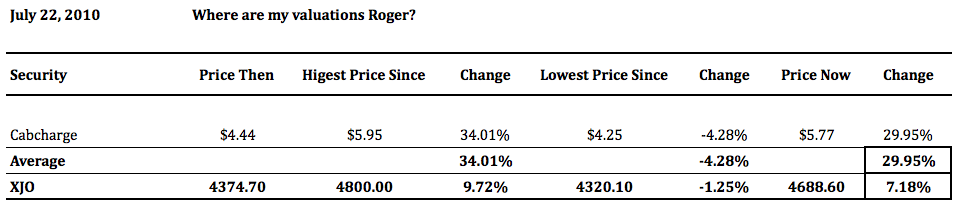

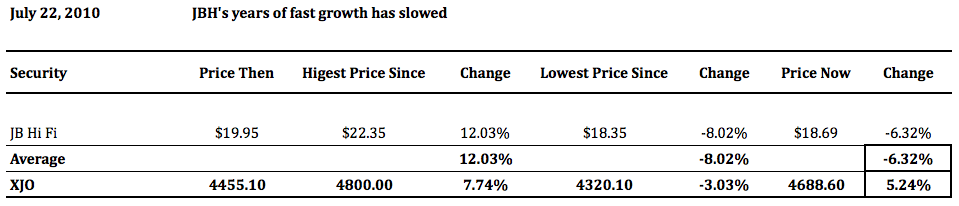

The following tables present some of the blog posts and the stocks that I have listed, mentioned or discussed in them. I have consistently suggested investigating an approach that seeks the highest quality businesses and prices that offer the biggest discounts to value.

Whilst the results are short-term (therefore nothing should be taken from them), they are nevertheless encouraging. The approach advocated in Value.able is worth investigating.

Many Value.able Graduates have suggested I start a newsletter or a stock market advice service. Thank you for the encouragement. I do enjoy the cross pollination of ideas and look forward to 2011 attracting even more investors to the patient and rational approach shared here at my blog.

Here are the tables (DO YOUR HOMEWORK AND RESEARCH. ENSURE YOU ARE COMPREHENSIVELY INFORMED. SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE).

Do these three companies represent the last of good value? Oroton, JB Hi-Fi, DWS, Cogstate, Cash Converters, Slater & Gordon, ITX, Forge, Decmil and United Overseas

Which 15 companies receive my A1 status? CSL, Worley Parsons, Cochlear, Energy Resources, JB Hi-Fi, Navitas, REA Group, Carsales, Mondaelphous, Iress, Fleetwood, ARB, McMillian Shakesphere, Sirtex, Oroton.

Is Apple an A1? What A1 companies does Roger Montgomery think are the best value right now? Apple, Forge and Decmil.

Where are my valuations Roger? Cabcharge.

JBH’s years of fast growth has slowed.

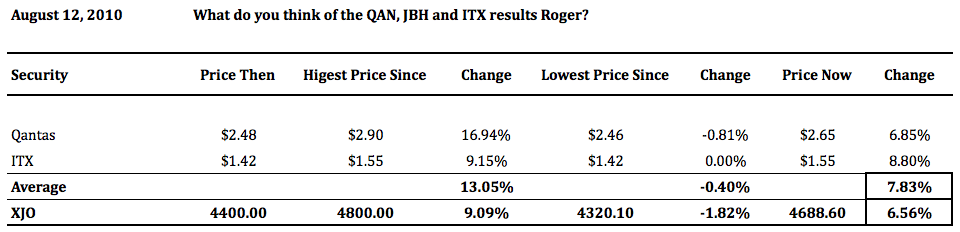

What do you think of the QAN, JBH and ITX results Roger? Qantas and ITX

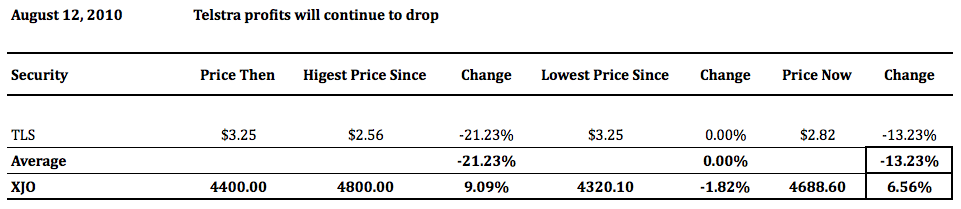

Telstra profits will continue to drop

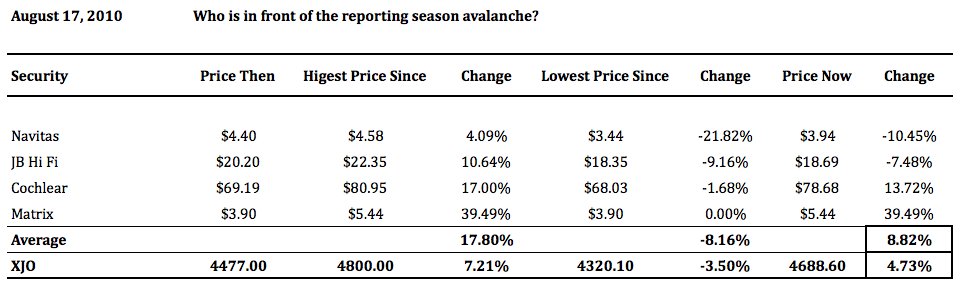

Who is in front of the reporting season avalanche? Navitas, JB Hi-Fi, Cochlear and Matrix.

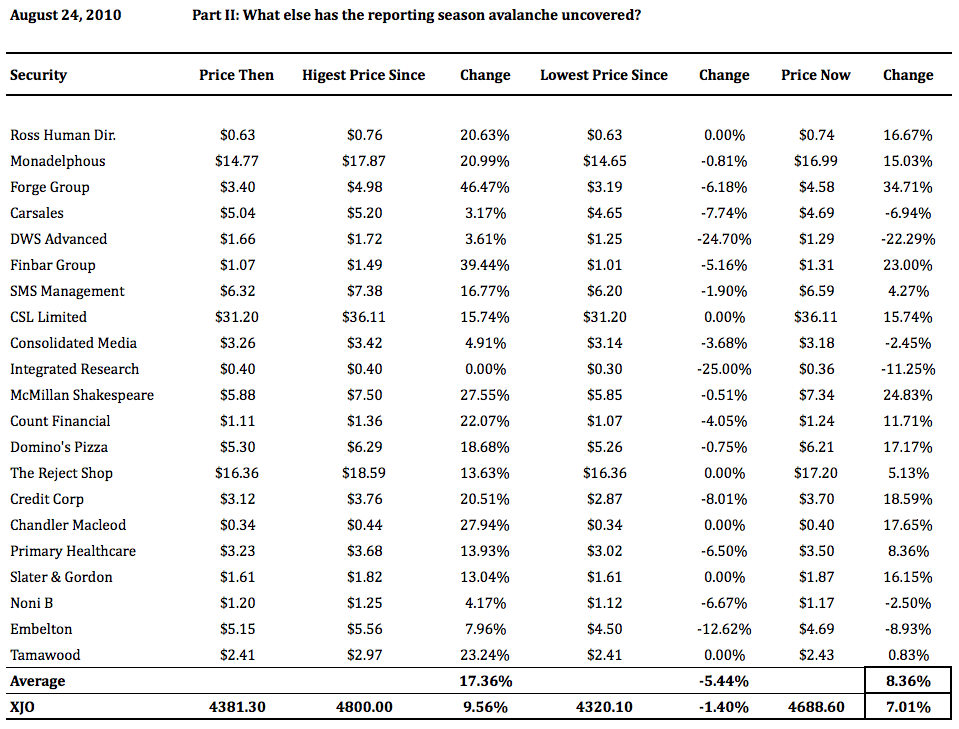

Part II: What else has the reporting season avalanche uncovered? Ross Human Directions, Monadelphous, Forge, Carsales, DWS, Finbar, SMS Management, CSL, Consolidated Media, Integrated Research, McMillian Shakesphere, Count Financial, Domino’s Pizza, The Reject Shop, Credit Corp, Chandler Macleod, Primary Healthcare, Slater & Gordon, Noni B, Embelton and Tamawood.

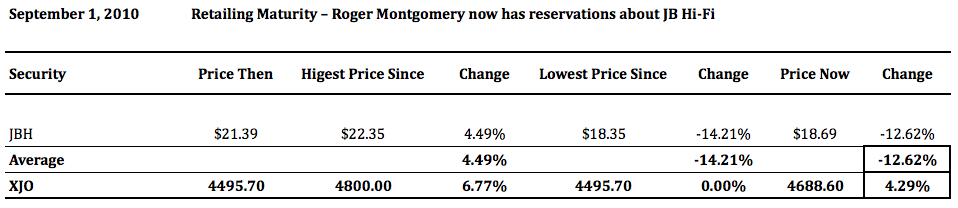

Retailing Maturity – Roger Montgomery now has reservations about JB Hi-Fi.

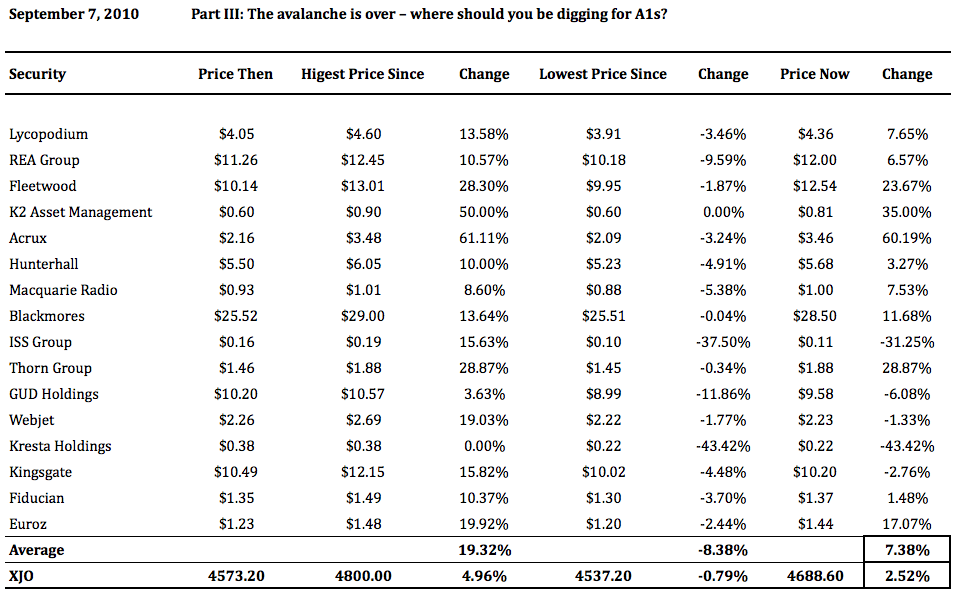

Part III: The avalanche is over – where should you be digging for A1s? Lycopodium, REA Group, Fleetwood, K2 Asset Management, Acrux, Hunterhall, Macquarie Radio, Blackmores, ISS Group, Thorn Group, GUD Holdings, Webjet, Kresta Holdings, Kingsgate, Fiducian and Euroz.

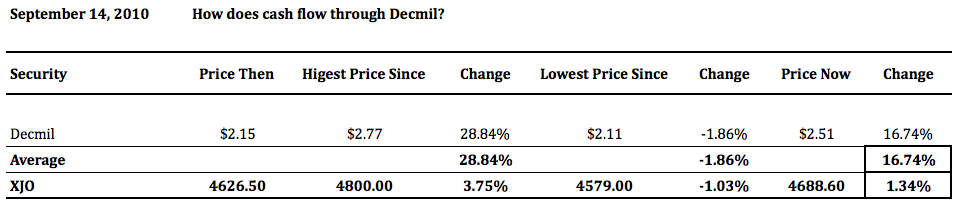

How does cash flow through Decmil?

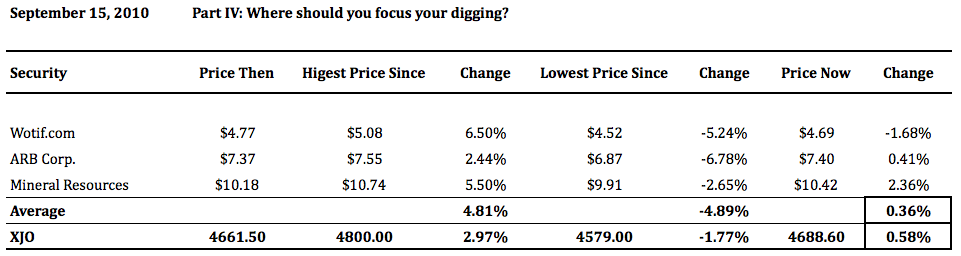

Part IV: Where should you focus your digging?

Will Roger Montgomery invest in QR National?

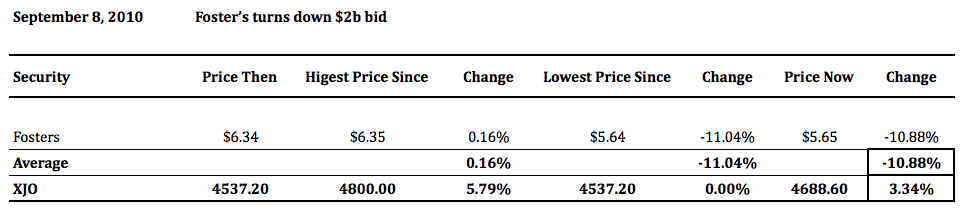

I thought the performance of Fosters after the wine bid was knocked back was interesting, but only another year or two will confirm whether the opportunity to add value was passed up. Some higher quality businesses also underperformed the market, thanks in part to deteriorating short-term prospects rather than deteriorating quality.

Remember to look for bright long-term prospects. Of course, in the short-term prospects will swing around – that is business, but longer-term prospects of businesses with true sustainable competitive advantages tend to win out.

Keep an eye on the blog before Christmas as I will be posting a couple of very handy lists (and possibly some homework) before the annual Montgomery Family Christmas break.

Posted by Roger Montgomery, 7 December 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

How many of your Chips are Blue?

Roger Montgomery

November 26, 2010

If you are new to the stock market, I believe it is possible that you have been lulled into a false sense of security. I say this because I regularly hear well-meaning advice that goes something like this; “just buy a portfolio of blue chips and hold for the long term”

If you are new to the stock market, I believe it is possible that you have been lulled into a false sense of security. I say this because I regularly hear well-meaning advice that goes something like this; “just buy a portfolio of blue chips and hold for the long term”But what is a blue chip? Here are some of the definitions I have found around the place:

“a common stock of a nationally-known company whose value and dividends are reliable; typically have high price and low yield; blue chips are usually safe investments”

“A blue chip stock is the stock of a well-established company having stable earnings and no extensive liabilities. Blue chip stocks pay regular dividends, even when business is faring worse than usual. …”

“A large company. Blue chip shares are generally lower risk. FTSE 100 constituents are generally considered blue chips”

“Shares of companies that are considered to be particularly solid and with a high capitalisation level. Their purchase is presumably associated with minor risk when the Stock Exchange falls”

And my new favourite definition;

“Blue Chip is the third album by Acoustic Alchemy, released under the MCA Master Series label in 1989, and again under GRP in 1996.”

Clearly there is only rough consensus around what a ‘blue chip’ actually is, but I get the distinct impression that a lack of understanding about what truly constitutes ‘high quality’ has meant the resultant definitions are clumsy at best. And if advisors can’t define quality/blue chip with some consensus, then its quite possible new investors are plunging into a blind-leading-the-blind situation.

Here at my Insights blog, I don’t talk about blue chips. Why? Because they don’t exist. There is no such thing.

I define quality through my A1-C5 Montgomery Quality Ratings (the MQRs) using a raft of measures and scenarios, combined with measures of the financial relationship a company has articulated over the years with its shareholders and its competitive position.

Warren Buffett once observed that time is the friend of the wonderful business but the enemy of a poor one. You don’t want to put the shares of a bad business, even if it’s a big one, in the bottom drawer and forget about them. Long term buy-and-hold investing then should only apply to the truly high quality companies – A1 companies.

To that end I would like to share with you an early Christmas gift (until Value.able arrives under your Christmas tree).

One of the definitions noted above and a commonly held one is that blue chips have to be large companies. Companies that inhabit the S&P/ASX 50, for example, may be considered Blue Chips. Putting aside for a moment the fact that there are plenty of large companies that have gone to the wall, it is possible to re-rank the so called Blue Chips – the large capitalisation companies – and find out if any are more blue than the rest.

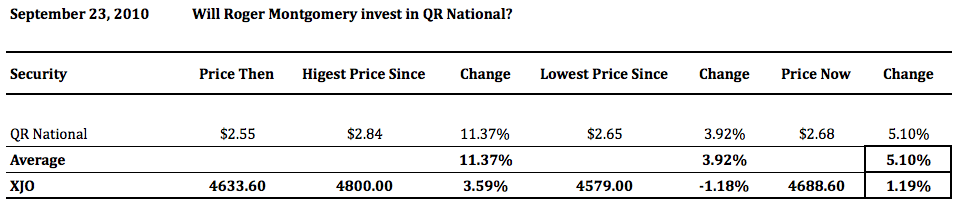

So in the pursuit of ‘blueness’, below you will find all companies with a current market capitalisation of more than $10 billion sorted by my MQR (followed by Safety Margin for good measure). I have also included my current expected (annual) rate of change in Value.able Intrinsic Value over the next three years and thrown in dividend yields because I know how adored they are.

Of course, all of this is purely didactic and not intended as advice. YOU MUST SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE. Also remember that I do not know what share prices are going to do, they could all halve or double and my MQRs andValue.able Intrinsic Values could all change tomorrow, possibly by a lot. They could go up or down and I am under no obligation to keep you updated. So please DO NOT RELY ON THE INFORMATION PROVIDED.

Having made that clear, and I am not joking about such serious matters, here is the list:

So its seems not all blue chips are entirely blue. As one of my friends – who likes to occasionally catch the amber light – says, “there’s still a bit of green left!”

Lumping all large companies into the ‘Blue Chip’ camp may not lead you to secure returns. Indeed, it could more likely see you merely lurch from one crisis to the next. If that is an experience you would like to change or avoid, then understanding the factors that indicate good quality is vital.

Value.able Graduates would have read the chapters about identifying extraordinary businesses in my book. If you haven’t yet secured your copy of Value.able you can do so at my website, www.rogermontgomery.com.

Posted by Roger Montgomery, 26 November 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Value.able.