Companies

-

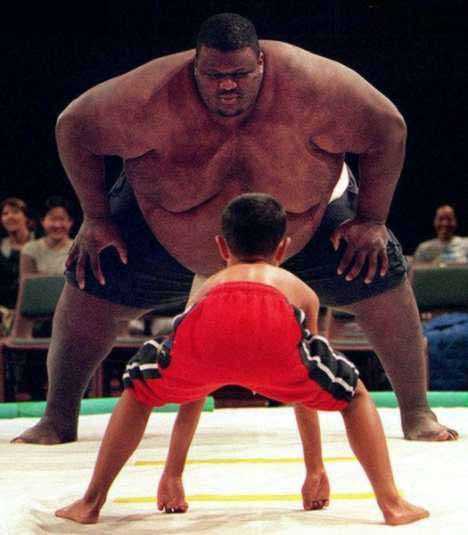

Will David beat Goliath?

Roger Montgomery

April 6, 2011

I am deviating from my regular style of post, handing over the stage to Value.able Graduate Scott T. Scott T has taken up a fight with conventional investing by tracking the performance of a typical and published ‘institutional-style’ portfolio against a portfolio of companies that receive my highest Montgomery Quality Ratings. I reckon in the long run the A1/A2 portfolio will win, but let’s not get ahead of ourselves.

I am deviating from my regular style of post, handing over the stage to Value.able Graduate Scott T. Scott T has taken up a fight with conventional investing by tracking the performance of a typical and published ‘institutional-style’ portfolio against a portfolio of companies that receive my highest Montgomery Quality Ratings. I reckon in the long run the A1/A2 portfolio will win, but let’s not get ahead of ourselves.Over to you Scott T…

In December 2010, a large international institution released their “Top 10 stockpicks for 2011”. Click here to read the original story.

I thought it would be interesting to compare the performance of these suggestions against an A1 and A2 Montgomery portfolio.

So I imagined this scenario…

Twin brothers in there 30’s each inherited $100,000 from their parent’s estate. One was a conservative middle manager in the public service; he had little interest in the stock market or super funds and the like, so he decided to go to an internationally renowned, well-credentialed and highly respected firm to gain specific advice. Goldman Sachs advised him of their top ten stocks for 2011, so he decided to achieve diversification by investing $10,000 in each of the ten stocks he had been told about.

His twin had a small accounting practice in a regional Queensland and was a keen stock market investor. Specifically he was a student of the Value Investing method, and liked to think of himself as a Value.able Graduate. He too thought diversification would be a suitable strategy so decided to invest $10,000 in each of 10 stocks that were A1 or A2 MQR businesses and that were selling for as big a discount to his estimate of Value.able intrinsic value as he could find.

For this 12-month exercise, running for a calendar year, we shall assume that neither brother is able to trade their position. One brother has no inclination to, and his regional twin is fully invested, and more inclined to hold long anyway.

For the companies who have declared dividends in this quarter, most are now trading ex-dividend, but only 2 or 3 have actually paid. Dividends will be picked up in Q2 and Q4 of this study.

Now after just 3 months let’s look at the how the two portfolios have performed…

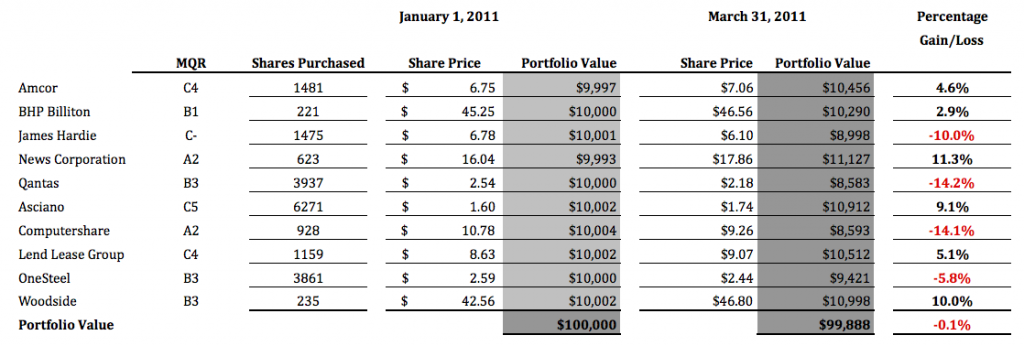

Institutional Bank Top 10 Picks for 2011

Montgomery Quality Rated (MQR) A1 and A2 Companies

We will visit the brothers again in 3 months on 30/6/2011 to see how they are fairing.

All the best

Scott T

How has your Value.able portfolio performed compared to the ASX 200 All Ords?

Posted by Roger Montgomery, author and fund manager, 6 April 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Why idolise the iPad2?

Roger Montgomery

March 29, 2011

It’s an amazing story… Man creates computer. Man overcomplicates computer. Man strips back computer and creates a brand that has revolutionised the way we are entertained.

It’s an amazing story… Man creates computer. Man overcomplicates computer. Man strips back computer and creates a brand that has revolutionised the way we are entertained.Did you know Apple has sold over 300 million iPods and iPhones over the past decade? That’s 300,000,000 products. According to the World Bank, in 2009 the world’s population stood at 6,775,235,741. The World Bank also notes that 80 per cent of the world’s population lives on less than $10 per day. Of the remainder, every 4th man, woman and child has purchased an Apple products in the last decade. Not a bad competitive advantage, (postscript: but perhaps not a sustainable one?)

Apple is also infiltrating the way we work. The Montgomery office is all Mac (and for your information, we have never had to call an IT professional to fix anything). Our iPhones are synced with our iMacs and our MacBooks synced with our iPhones.

You have heard the stories of Apple fans setting up camp on the footpath outside Apple’s flagship store on Sydney’s George Street. Australians don’t do that for coal or iron ore.

And don’t forget the accessories market. There’s no special concessions for development partners. Privately held companies that manufacture the sleeves, cases and connectivity devices that enhance our Apple experience don’t get hold of new devices until we do – on launch day.

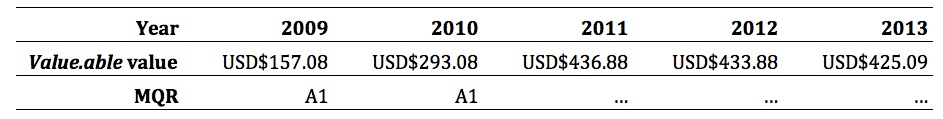

Apple has the X-factor. Its product is unique. Its experience is unique and there is an almost religious fervour toward the brand. Competitors don’t stand a chance. The result? High, durable rates of return on equity and a rising Value.able intrinsic valuation – an A1 business.

Return on Equity is just one of dozens of metrics I uses to produce the Montgomery Quality Rating (MQR). Re-read Chapter Eleven, Step C on page 188 of Value.able for the Value.able ROE calculation.

Who is the Aussie equivalent? The Australian market may be much smaller than the US, but there are a handful of extraordinary businesses, A1 businesses. And its worth finding tem. They may not be listed yet. They may not even have launched yet…

Posted by Roger Montgomery, author and fund manager, 29 March 2011.

Postscript: The data used to calculate intrinsic value is available here: https://www.apple.com/investor/

by Roger Montgomery Posted in Companies, Investing Education, Value.able.

-

Who makes your A1/A2 small cap list?

Roger Montgomery

March 25, 2011

Time was a rare commodity on Peter’s show last night. Whilst I managed to list a few A1 and A2 small cap stocks that I consider make the Value.able grade, there just wasn’t time for details. So, as promised, I have put together a quick precise of two stocks (in boring businesses) I listed last night.

Time was a rare commodity on Peter’s show last night. Whilst I managed to list a few A1 and A2 small cap stocks that I consider make the Value.able grade, there just wasn’t time for details. So, as promised, I have put together a quick precise of two stocks (in boring businesses) I listed last night.Remember: DO NOT rush out and buy shares in any company I discuss with Peter or any other media outlet (or here at the blog) without conducting appropriate research and seeking personal and professional advice FIRST!

These insights are not a solicitation to trade any security. I may own shares in the companies mentioned. I cannot predict share price directions – they could all fall by 80% or more after you buy. Finally, I am under no obligation to keep you updated with any change of my view, my estimate of the Value.able value of the company or my Montgomery Quality Ratings (MQRs).

Before I begin, here are the highlights from last night.

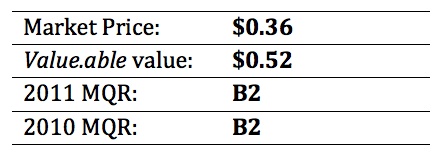

Zicom Group (ZGL)

In 2007, the first reported results after purchasing the Zicom Group, the company earned $6 million on equity of $21.6 million (ROE 27.7%). Since then another A$8 million has been raised from owners and profits have risen to A$8 million. Return on additional capital is 25%.

In the HY11 results, the company announced a profit A$7 million. Revenue grew from $47.75 million in the previous corresponding period to $71 million. A buyback of $4 million shares occurred in the half.

Company forecasts are for a full year profit of $12.9 million, which would representing a return on equity of 18%. Growth in equity is exceeding growth in profits, however the ‘growth’ has been through retained earnings.

Zicom has four divisions; Offshore Marine Oil & Gas (43% of revenue, makes winches and ROV’s/oil rig boom to help – think winches on ships that lift ROV’s off deck and into water), Construction Equipment (39%, concrete mixers/marginally profitable & foundation equipment), Precision Engineering & Automation (14% constructs automated production lines, ink cartridges for HP, semi conductor and medical devices and associated components) and Industrial and Mobile Hydraulics (4%).

ZGL’s order book stands at $83.2 million, up from $68.9 million. Cash flow was negative $10 million, however $5 million was spent seeding two start-ups and another $5 million was spent on acquisitions ($700k of PP&E and $4 million on buying back shares).

Click here to read Roger’s latest insights on Zicom, published 6 April 2011 in Alan Kohler’s Eureka Report.

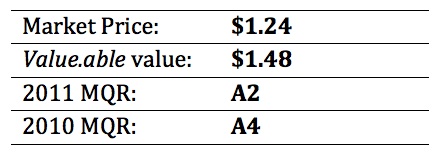

Codan Limited (CDA)

Codan Limited designs and manufactures a diversified products range for the international high-frequency radio, satellite and metal detection markets (think Minelab metal detectors).

Shares on issue are virtually unchanged from a decade ago and borrowings, which surged from $2 million in 2007 to $73 million in 2009, fell to $52 million last year and another million in the latest half year.

CDA’s 2007 profit of $11 million fell to $8 million in 2008, then rose to $24.4 million last year. The company forecasts profit of $20-$22 million in 2011 (optimistic analysts believe this figure will be higher, circa $24 million).

Since 2001, CDA’s profits have increased by 10.13 per cent per annum, from $10.268 million to $24.472 million

To generate this $14.2 million increase in profit, shareholders have put in equity of $21.859 million and left in earnings of $23.150 million (32%). The company has also borrowed $8.615 million net, in addition to the $43.483 million of debt held in 2001, resulting in current debt outstanding of $52.098 million and a net debt to equity ratio of 46.66 per cent.

Return on Equity is the best measure of economic performance, and CDA has averaged 31.02 per cent since 2001. Recently, CDA generated a return on equity of 37.94 per cent.

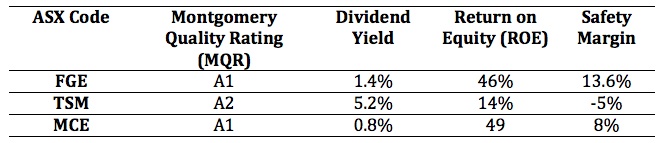

Finally, I also mentioned a small number of small cap stocks that are high quality and appear to be trading at a discount or close to my estimate of intrinsic value at the moment – Forger Group, ThinkSmart and Matrix Composites and Engineering. Here is my list:

Over at facebook.com/montgomeryroger Unc Dev’s list includes Thorn Group, Reckon, Iress, Nick Scali and Fleetwood. Shuo nominated PFL and Kristian proposed FSA, SWL & RQL. Which stocks make your A1/A2 small cap list?

Posted by Roger Montgomery, author and fund manager, 25 March 2011.

by Roger Montgomery Posted in Companies.

- 312 Comments

- save this article

- POSTED IN Companies

-

When to sell? Matrix and other adventures in Value.able Investing

Roger Montgomery

March 18, 2011

In August 2010 Matrix Composites & Engineering, when we first began commenting on the company, was trading around $2.90. Thirty days later the share price was at $4.48. Today MCE is trading at just over $9.00 and has a market capitalisation of more than half a billion dollars. It’s no longer just a little engineering business. Like the Perth industrial precinct of Malaga in which its headquarters are based, MCE is growing rapidly (according to Wikipedia there are currently 2409 businesses with a workforce of over 12,000 people in Malaga. The 2006 census listed only 28 people living in the suburb).

But has MCE’s share price risen beyond what the business is actually worth?

Stock market participants are very good at telling us what we should buy and when. When it comes to selling, it seems silence is the golden rule.

If you receive broker research, take out a report and turn to the very back page – the one beyond the analyst’s financial model. You will often find a table that lists every company covered by that broker’s research department. Now look to the right of each stock listed. What do you notice?

Buy… Buy… Hold… Buy… Buy… Accumulate… Hold…

What about sell?

There aren’t many companies in Australia worthy of a buy-and-hold-forever approach. And if you have invested in a company with a previous BUY recommendation, the luxury of a subsequent Ceasing Coverage announcement by the analyst is not helpful.

So then, when should you sell? It is a question I have been asked, to be honest, I can’t remember how many times. Because I have been asked so many times, it’s a question I answered in Chapter 13 of Value.able – a chapter entitled Getting Out.

Value.able Graduates will recognise a sell opportunity. Yes, it is an opportunity. Fail to sell shares and you could eventually lose money.

Of course, any selling must be conducted with a certain amount of trepidation, particularly when capital gains tax consequences are considered. But not selling simply because of tax consequences is unwise.

We pay tax on our capital gains because we make a gain. Yes, its difficult handing over part of our investment success to the Tax Man for seemingly no contribution, but without success our bank balance would remain stagnant forever.

When then should you sell? In Value.able I advocate five reasons. For now I would like to share with you a possible reason. Based on any of the other reasons I may be selling Matrix so make sure you understand this is a review based on one of five reasons.

Eventually share prices catch up to value. In some cases it can take ten years, but in the case of Matrix, it has taken far less time for the share price to approach intrinsic value.

One signal to sell any share is when the share prices rise well above intrinsic value.

There are no hard and fast rules around this. And don’t believe you can come up with a winning approach with a simple ‘sell when 20% above intrinsic value’ approach either.

What you MUST do is look at the future prospects. In particular, is the intrinsic value rising? I believe it is for Matrix (and I am not the only fund manager who does – you could ask my mate Chris too).

Here’s some of his observations: Risks associated with the timing of getting Matrix’s facility at Henderson up and running are mitigated by keeping Malaga open. And Malaga is producing more units now than it was only a few months ago. Matrix could also produce more units from Henderson than they have suggested (the plant is commissioned to produce 60 units per day) and I believe the cost savings will flow through much sooner than they say. Recall the company has indicated Henderson could save circa $13 million in labour, rent and transport costs (see below analyst comment). Excess build costs are now largely spent and if the company can ramp up to 70 units a day, HY12 revenue could double.

Why do I believe this? Because a recent site visit for analysts suggested it. As one analyst told me: “Production of macrospheres has started from Henderson with 7 of the 22 tumblers in operation. This is a good example of the labour savings to come as it’s now a largely automated process – there were only 3 people working v >20 on this process at Malaga.”

(Post Script: My own visit to WA at the weekend revealed a company capable of producing just over 100 units per day – Henderson + Malaga) Moreover, the sad events unfolding in Japan will force a rethink on Nuclear. If nuclear energy – recently hailed as a green solution to global warming – reverts to being a relic of an old world order, demand for oil will increase. Oil prices will rise. Deep sea drilling will be on everyone’s radar even more so.

And the risks? Well, one is pricing pressure from competitors. This is something that needs to be discussed with management, but preferably with customers!

Some Value.able Graduates may be reluctant to place too much emphasis on future valuations. Indeed I insist on a discount to current valuations. If it is your view that future valuations should be ignored, then you should sell.

Personally I believe one of my most important contributions to the principles of value investing is the idea of future valuations. Nobody was talking about them at the time I started mentioning 2011 and 2012 Value.able valuations and rates of growth. They are important because we want to buy businesses with bright prospects. And a company whose intrinsic value is rising “at a good clip” demonstrates those bright prospects.

If you have more faith and conviction that the business will be more valuable in one, two and three years time, you may be willing to hold on. On the basis of this ONE reason I am currently not rushing to sell Matrix (of course I may sell based on any of the other four reasons), however notwithstanding a change to our view (or one of the other four criteria for selling being met) I do hope for much lower prices (buy shares like you buy groceries…)

I cannot, and will not, tell you to sell or buy Matrix and I might ‘cease coverage’ at any time. As I have said many times here, do not use my comments to buy or sell shares. Do your own research and seek and take personal professional advice.

What I do want to encourage you to do is delve deeply into the company’s history, its management, their capabilities, recent announcements and any other valuable information you can acquire.

And in the spirit demonstrated by so many Value.able Graduates, feel free to share your findings here and build the value for all investors.

When the market values a company much more highly than its performance would warrant, it is time to reconsider your investment. Looking into the prospects for a business and its intrinsic value can help making premature decisions. Premature selling can have a very costly impact on portfolio performance not only because the share price may continue rising for a long time, but also because finding another cheap A1 to replace the one you have sold, is so difficult. At all times remember that my view could change tomorrow and I may not have time to report back here so do your own research and form your own opinions. Also keep in mind that we do not bet the farm on any one stock so even if MCE were to lose money for us (and we will get a few wrong) we won’t lose a lot.

Posted by Roger Montgomery, author and fund manager, 18 March 2011.

by Roger Montgomery Posted in Companies, Energy / Resources, Investing Education, Value.able.

-

Are relationships more important than cars?

Roger Montgomery

March 10, 2011

In last weekend’s Weekend Australian, Terry McCrann wrote an excellent piece explaining the possible nature and motivations behind the relationship between Murdoch, Stokes and Packer. ‘Hiatus after Packer’s bombshell’ was both enlightening and entertaining. continue…

In last weekend’s Weekend Australian, Terry McCrann wrote an excellent piece explaining the possible nature and motivations behind the relationship between Murdoch, Stokes and Packer. ‘Hiatus after Packer’s bombshell’ was both enlightening and entertaining. continue…by Roger Montgomery Posted in Companies, Media Companies.

- 95 Comments

- save this article

- POSTED IN Companies, Media Companies

-

Is UNV a diamond or destroyer of wealth?

Roger Montgomery

March 8, 2011

Last month on Your Money Your Call John asked for my insights on Universal Coal (ASX:UNV)l.

UNV is not currently investment grade. It is a business that would not receive an adequate MQR.

Section 3.13 of the Prospectus reads: “The directors… believe that they do not have a reasonable basis to forecast future earnings on the basis that the operations of the company are inherently uncertain”.

Given this statement by management, any investment in Universal Coal appears to be speculative.

Without confidence in the future of the business, estimating its Value.able valuation is nearly impossible and investing is risky.

Turn the stock market off, focus on extraordinary businesses (re-read Chapters 5 – 9 of Value.able), calculate what the business is truly worth and buy them for less than they’re worth. And if you haven’t already done so, pick up your copy of Value.able at my website, www.rogermontgomery.com (there aren’t many Second Edition copies left).

Sky Business Channel have been invited to appear on Your Money Your Call this Thursday, 10 March. Tune in from 8pm Sydney time.

Posted by Roger Montgomery, author and fund manager, 8 March 2011.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 17 Comments

- save this article

- POSTED IN Companies, Energy / Resources

-

Peter Switzer interviews Matrix CEO Aaron Begley

Roger Montgomery

March 4, 2011

Peter Switzer called me earlier this week. He was travelling to Perth and asked me to recommend a CEO to invite on his show. Matrix CEO Aaron Begley instantly came to mind.

Value.able graduates will recall I discovered Matrix a long time ago. It was the first business to achieve my coveted A1 Montgomery Quality Rating (MQR). I have written about Martix in Money magazine and here at the blog, and also shared my insights with Peter on the Sky Business Channel.

Here are the highlights of Peter’s recent interview with Aaron Begley.

I often meet with CEOs and advocate you do the same. Attend AGMs and EGMs, or better yet, call the company. If management isn’t willing to speak to shareholders, that’s a fairly good indication to me of what they think of their owners.

Aaron and the board of Matrix check all the boxes I seek in Value.able companies. Re-read Chapter 6 of Value.able for more of my thoughts. And to watch another CEO interview, click here.

Posted by Roger Montgomery, author and fund manager, 4 March 2011.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 143 Comments

- save this article

- POSTED IN Companies, Energy / Resources

-

Is CSL a master of share buy backs?

Roger Montgomery

March 1, 2011

When a company buys back its shares, the announcement is often accompanied by reports suggesting either 1) the company has no other growth options towards which it can employ equity capital or, 2) the company has great confidence in its future and other shareholders should be following its lead rather than selling out to the company itself.

Back in 1984, in his Chairman’s Letter to Shareholders (a source of information I have quoted frequently here and in Value.able), Warren Buffett observed:

“When companies with outstanding businesses and comfortable financial positions find their shares selling far below intrinsic value in the marketplace, no alternative action can benefit shareholders as surely as repurchases.”

Note to CFOs and CEOs: “shares selling far below intrinsic value in the marketplace.”

It is just as important for the CEO of a public company to be buying shares only when they are below intrinsic value, as it is for Value.able Graduates building a portfolio.

Buying shares above intrinsic value will destroy value as surely as buying high and selling low – something many Australian companies became all to expert at during the GFC as they issued shares in their millions at prices not only below intrinsic value, but below equity per share.

One question to ask is if companies are engaging in buy backs today, why weren’t they when their shares were much, much lower? The answer of course may be that they may not have had the capital back then. A recovery from the lows of the GFC has not only occurred in the prices of shares trading in the market place, but also in the cash-generating performance of the underlying businesses themselves.

Irrespective of the circumstances, a company now buying back shares that had previously issued them at the depths of the GFC is having a second crack at wealth destruction.

I am pleased to report that not all companies are following the crowd. Some larger companies, including BHP, RIO and Woolworths, have announced buy backs at or slightly below my estimate of their Value.able intrinsic values.

Webjet, Customers, Coventry Group and Charter Hall Retail REIT have all announced buy backs and Bendigo/Adelaide Bank is engaging in one to reverse the impact of shares issued through their DRP.

As I wrote yesterday (Is there any value around?), value is becoming much harder to find. Companies are expensive, even my A1s. Whilst any Value.able valuation is merely an estimate, the absence of a large Margin of Safety, combined with the announcements of buy backs, does not inspire my confidence.

In the US, share buy backs historically peak at market highs. Think back to the first half of 2007 and in 1999 and 2000 – two periods that investors may have wished they’d sold shares back to the companies – are also periods during which buy backs peaked.

Share buy backs are a very public demonstration of management’s capital allocation ability, or lack thereof.

Whilst Warren Buffett is regarded as the master of share buy backs, he has often sited another capital allocator as the real genius – the late Dr. Henry Singleton, the founder and CEO of Teledyne.

When the inflation-devastated stock market of the 1970s had pushed shares to the point that some suggested ‘equities were dead’, Henry Singleton bought back so many shares that by the mid 1980s there were 90% less Teledyne shares on issue. Here’s a para from the web: “In 1976, the company attempted, for the sixth time since 1972, to buy back its stock in order to eliminate the possibility of a takeover attempt by someone eager for the cash reserves the company had accumulated. Altogether, Teledyne spent $450 million buying back its stock, leaving $12 million outstanding, compared to $37.4 million at the close of 1972. With many of the company’s divisions showing stronger results and fewer shares outstanding, Teledyne’s stock increased from a low of $9.50 per share to $45 per share, becoming the largest gainer on the New York Stock Exchange.”

Who is Teledyne’s Australian equivalent?

One iconic Aussie business (it achieves my second highest MQR – A2) immediately springs to mind. In 2009 this business issued shares at a high price to fund a $A3.5 billion acquisition. But things didn’t quite go to plan… the US Federal Trade Commission intervened and the shares slumped. What did management do? They used the cash raised from the share issue to buy them back. Amazing!

Fast-forward twelve months and this business has nearly $1 billion in cash in the bank and no debt. If it keeps using its own cash and that being generated, and buying back shares at the present rate (and assuming the share price doesn’t change of course), it will have bought back all its shares in seven years. A Value.able business… what do you think?

Yes, if not for management’s decision to buy back shares ABOVE intrinsic value.

Unfortunately CSL’s share price may not be as high in seven years as it could have been, had management chosen to buy back its shares below intrinsic value.

If you own shares in a company engaging in a buy back, ask yourself whether value is being added to the company? Value is generated when the shares being purchased are available at prices below your estimate of its Value.able intrinsic value.

If management are overpaying, inappropriate capital allocation practices may be the only addition to the future prospects of the business.

Posted by Roger Montgomery, author and fund manager, 1 March 2011.

by Roger Montgomery Posted in Companies, Health Care, Investing Education.

-

Is there any value around?

Roger Montgomery

February 28, 2011

Two themes seem to be gaining traction amongst Value.able Graduates at the moment.

1. Value is becoming harder to find (yes, I agree), and

2. Questions related to share buybacks have increased remarkably

This afternoon I will address the growing problem of finding value (and save buybacks for another day).

As I scan the market for great quality businesses trading at large discounts to my estimate of their Value.able intrinsic value, I am finding fewer and fewer opportunities. And when it comes to ‘small caps’, the prospects are few and far between.

On Peter Switzer’s show last Thursday a caller asked me what was good value in the small cap space. I define ‘small cap’ as anything between $300 million and $2 billion (below that is micro caps and nano caps). The fact is, only four or five of my highest Montgomery Quality Rated (MQR) businesses (think A1, A2, etc) are cheap. And most of them you already know about.

Forge and Matrix Composite are still below rising intrinsic values (more on those soon), and Cabcharge and ARB Corporation are just below intrinsic value. The remaining value is in much smaller companies and of course, the risk when investing in this space can be much higher.

Many Value.able Graduates have commented that investing in these micro and nano cap stocks is akin to scraping the bottom of the barrel. Whilst I tend to agree, I also believe that when it comes to investing, little is more satisfying than discovering an extraordinary business beyond the reach of the managed funds that have self-imposed restraints and must only invest in the top 200 or 300 companies.

There is merit in the concept of investing in small businesses that have the potential to become large. And there are profits to accrue when they do. Before you dismiss this idea, keep in mind that many of the large companies dominating Australia’s competitive landscape today were once small. Admittedly, in many cases they were small while they were buried in private ownership or private equity ownership, but in some examples they were small and grew to be large whilst they were listed. Can you think of a few examples? The Value.able community has shared a few here at my blog.

Given Australia’s small population, the big businesses that dominate the investment landscape are mature and have to make smart decisions and continually reinvent themselves to continue to grow. Think about Harvey Norman. Its failing is not in the fact that the economy is slow or that consumers can buy cheaper goods overseas. Its failing is that it is a tired old concept that has lost its mojo. The company has failed to change and failed to reinvent itself. Its own failure has seen it fall victim to the JB Hi-Fi’s and the buy-online-from-overseas-cheaper.com merchants of the world.

So whilst scouring for smaller companies may seem like bottom-fishing, there is merit in catching the smaller fish. And for those investors who prefer to stay clear, patience, bank bills and term deposits are the solution.

Far better is it to be in the safety of cash than in inferior investments, such as companies trading at premiums to intrinsic value.

Forewarned is forearmed. And to be forewarned, don’t miss out on your copy of Value.able. As I told Peter last week, there aren’t too many Second Edition copies left.

Posted by Roger Montgomery, author and fund manager, 28 February 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

Will Iron Ore and Base Metals continue to drive BHP?

Roger Montgomery

February 24, 2011

It has been six months since my last BHP update. With so much smoke surrounding the half-year results, I thought it worth reviewing whether anything – particularly my Value.able valuation, had changed.

It has been six months since my last BHP update. With so much smoke surrounding the half-year results, I thought it worth reviewing whether anything – particularly my Value.able valuation, had changed.You may recall back on 31 August 2010 last year BHPs shares were trading at $42.30. At the time my Value.able intrinsic valuation for BHP was $45-$50 per share. As I write today the shares are trading at $46.09 (they have traded as high as $47.63). Gains of 8.2% over the past 6 months are satisfying, but not spectacular. Gains in MLD, MCE, FGE and DCG have been more impressive.

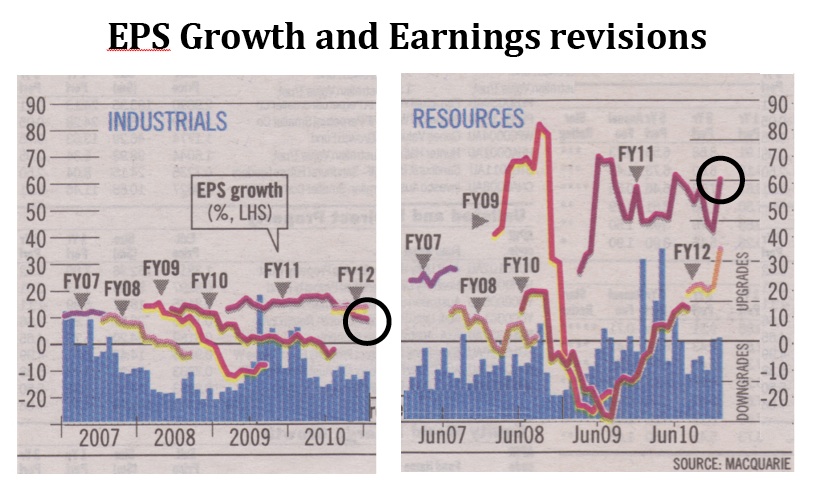

Since I shared my insights, BHP has of course announced their half-year results and exceeded all prior forecasts. Fifty seven per cent earnings growth was forecast for BHP and 50% per cent for the resource sector as a whole in 2011. This was eclipsed by 71.5 per cent earnings growth.

Booming commodities and record Iron Ore and base metal prices, which account for roughly half of the group’s revenue (see table below), has boosted their result. Having moved away from yearly pricing to a monthly pricing benchmark, BHP has been able to take full advantage of rapid commodity price appreciation.

BHP’s reported revenue from Iron Ore sales in FY11 was up 109.5 per cent. Given its largely fixed production costs, Iron Ore was also the largest contributor from an EBIT perspective, with a 177.90 per cent increase. This is the happy side of operating leverage, which I have discussed previously. And remember, Iron Ore is China’s second largest import, after crude oil.

With growth rates and margins of this magnitude, analysts have become even more bullish on our resource sector. Earnings growth for 2011 is now forecast to be 60 per cent (previously 50 per cent) – that’s a 20 per cent increase in just six months. Estimates for 2012 are 30-40 per cent.

Compare this to earnings growth forecasts for the Industrials Sector. The difference of 10 per cent clearly indicates where Australia’s economy will derive its strength.

But can it last? I have said many times that I have no predictive ability. I will leave that for others to determine.

I will however take onboard recent comments from Marius Kloppers, who stated that high Iron Ore pricing should continue for a further 6-9 months. Whilst the Iron Ore market remains in tight supply, I note the many expansion projects currently underway will swell supplies from 2014 onwards – an excellent example of how boom-time profits entice others to enter the market and compete – the very definition of a commodity.

Over the longer-term, BHP’s aggressive $80b growth plan suggests confidence in the markets in which it operates. More importantly, $80b should give investors in mining services businesses cause to celebrate!

With analysts becoming more bullish and being contrarian by nature, I’m more comfortable adopting a conservative approach when it comes to resource companies. So while others continue upgrading their numbers and forecasts based on current market pricing, I will retain my previous AUD $22b profit forecast (hopefully this is conservative enough) for 2011 and my Value.able valuation of AUD $45-$50.

As always, I will also further my conservative approach by seeking substantial margins of safety. There are some A1 opportunities available at present, however they are the exception rather than the rule.

Posted by Roger Montgomery, author and fund manager, 24 February 2011.

ON ANOTHER NOTE… The SMSF Review, along with Alan’s Eureka Report and my team, are delighted to announce an event where 100 per cent of the net proceeds will be donated to those affected by the recent spate of natural disasters. The SMSF Strategy Event – for charity, includes some of the country’s most respected Self Managed Superannuation Fund experts. Tickets are $77 and can be purchased online at www.thesmsfreview.com.au. Click here to view the full event brochure. If you are based in Sydney and manage your own super fund, I encourage you to join me at this very special event.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 119 Comments

- save this article

- POSTED IN Companies, Energy / Resources