articles by Tim Kelley

-

Does intellectual property have the value it once had?

Tim Kelley

April 10, 2013

A strong competitive “moat” is one of the features we value in a business. Moats can take many different forms, but one appealing type of moat is that provided by intellectual property, ideally protected by patents.

Companies like Cochlear, Resmed and Codan are good examples of businesses that owe part of their prosperity to technology that provides an edge over competitors. In many cases, this edge has been built and maintained over many years through substantial investments in R&D.

Continue…by Tim Kelley Posted in Consumer discretionary, Insightful Insights, Technology & Telecommunications.

-

Telstra’s Growth Conundrum

Tim Kelley

March 27, 2013

Today’s AFR reports on Telstra’s (TLS) capital investment plans, and states that the man in charge of those investment plans, Brendon Riley, believes that “the answer to the growth question is to keep investing.”

We don’t disagree with this in principal, but note that historically, TLS has not had much success in investing for growth. Continue…

by Tim Kelley Posted in Insightful Insights, Technology & Telecommunications.

-

Wrestling with Resources

Tim Kelley

March 18, 2013

I noted with interest Anton Tagliaferro’s comments in today’s AFR, lamenting the apparent lack of shareholder focus shown by boards of directors in the resources and energy sectors. Reading these comments, it struck me that the boards of these companies are no doubt plagued by the same issues that confound value investors looking at these types of businesses.

As value investors, we aim to acquire an interest in a business when we can see that the value of the business is greater than the price we need to pay to own it. At Montgomery, we are concerned also with quality and a host of other factors, but let’s focus for the moment on value.

Continue…by Tim Kelley Posted in Energy / Resources, Insightful Insights, Investing Education.

-

Reputation and Remuneration

Tim Kelley

March 7, 2013

I found myself with a bit of free time recently, and spent an enjoyable several days reading “Thinking, Fast and Slow”, which summarises the work of Daniel Kahneman, one of the world’s leading authorities on heuristics and biases which can influence decision making (and a winner of the Nobel Memorial Prize in Economic Sciences).

Continue…by Tim Kelley Posted in Economics.

- 3 Comments

- save this article

- 3

- POSTED IN Economics.

-

Forecasts and predictions

Tim Kelley

February 7, 2013

With the market having woken up in a good mood in January, we have recently seen a number of commentators revise upwards their forecasts for where the index may finish the year. Declaring 2013 to be a year for the bulls is very much in fashion. Admitting how wrong most of these forecasts were for 2012 is rather less fashionable.

To add some context, I thought it might be helpful to refer to some interesting research that has been done on the reliability of expert forecasts.

Continue…by Tim Kelley Posted in Insightful Insights, Investing Education.

-

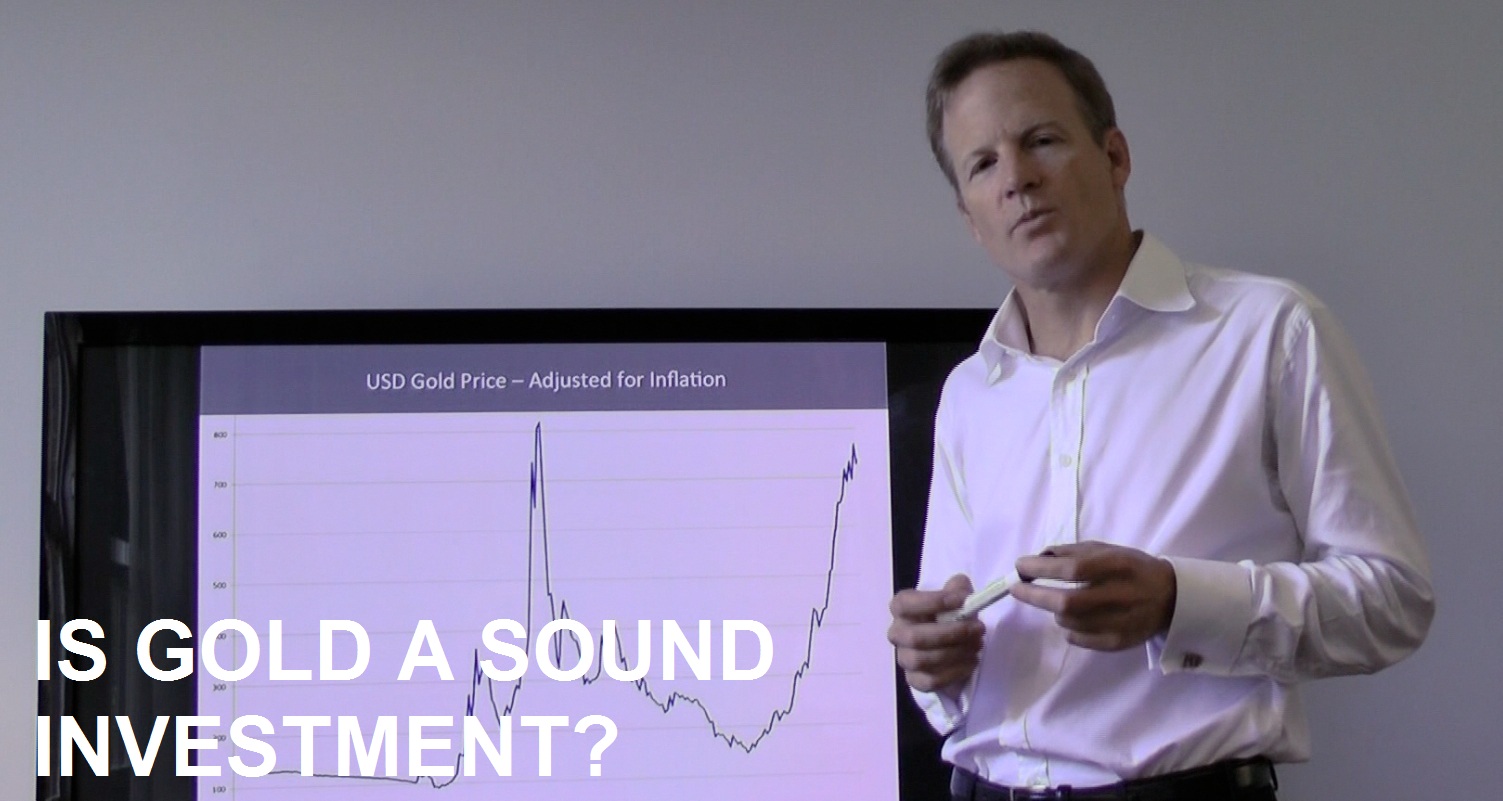

IS GOLD A SOUND INVESTMENT? (29/1/2013)

Tim Kelley

January 29, 2013

by Tim Kelley Posted in Video Insights.

- watch video

- 6 Comments

- save this article

- 6

- POSTED IN Video Insights.

-

Better times ahead for listed insurers?

Tim Kelley

January 23, 2013

After an extended run of disappointing performance from Australia’s largest non-life insurers, there have more recently been some positive signs. Over the past 12 months IAG’s share price has increased to around $5 from around $3 and, more recently, the QBE share price has risen from around $10 to over $12, partly on the back of press reports that cost reduction initiatives are planned. In light of these developments, it may be appropriate to consider whether these businesses face a brighter future.

Continue…by Tim Kelley Posted in Insightful Insights, Insurance.

- 1 Comments

- save this article

- 1

- POSTED IN Insightful Insights, Insurance.

-

Analyst Forecasts

Tim Kelley

January 17, 2013

In evaluating the future prospects for a business, one useful source of information is analyst earnings estimates. A good broking analyst who covers a particular company will often have a well-informed view of the factors that might influence earnings for that company in the years ahead.

At the same time, there are a number of biases and other issues with analysts’ forecasts. One interesting issue is that the forecasts can have a certain “inertia” to them, which means that changes may occur gradually over time. Because of this, it can be useful to look at the history of the forecasts, as well as the current level.

Continue…by Tim Kelley Posted in Insightful Insights, Investing Education.

-

Positioning for 2013 (15/1/2013)

Tim Kelley

January 15, 2013

by Tim Kelley Posted in Video Insights.

- watch video

- 4 Comments

- save this article

- 4

- POSTED IN Video Insights.

-

Value Investing

Tim Kelley

January 12, 2013

Value investing can be a laborious process. Properly understanding the many aspects that influence the value of a business is time-consuming, and in many cases the end result is to add one more company to the large pile of “No” decisions.

There are much quicker ways to arrive at investment decisions, one of which is to use trend-following systems. A large body of academic research has demonstrated that, historically, it has been possible to earn excess returns in a variety of markets over time by employing systematic trend-following methods (note that systematic trend following is something done by a computer employing back-tested statistical methods, not by an analyst casting their eye over a price chart).

by Tim Kelley Posted in Insightful Insights, Investing Education.