articles by Scott Shuttleworth

-

A potential opportunity?

Scott Shuttleworth

May 13, 2015

Last week we attended the 17th Annual Macquarie Conference in Sydney. One business firm that looked particularly appealing was CSG Limited (ASX: CSV). Unfortunately the stock is a bit on the small side for our funds but a brief analysis is an interesting exercise. Continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 5 Comments

- save this article

- 5

- POSTED IN Companies, Insightful Insights.

-

TPG ups it’s bid for iiNet

Scott Shuttleworth

May 7, 2015

We mentioned in a blog the other day our view that the market would be likely see TPG Telecom Limited (ASX: TPM) return with a new bid for iiNet Limited (ASX: IIN) – and yesterday morning they did. Continue…

by Scott Shuttleworth Posted in Insightful Insights, Technology & Telecommunications.

-

Australia’s home construction market (5/05/2015)

Scott Shuttleworth

May 5, 2015

by Scott Shuttleworth Posted in Video Insights.

- watch video

- save this article

- POSTED IN Video Insights.

-

Not getting schooled

Scott Shuttleworth

May 1, 2015

As an update to our blog on Monday, we noted on Tuesday the unfortunate outcome experienced by the shareholders of Ashley Services Group (ASX: ASH). Risk is one thing to write about yet another thing to see its effects. Continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- save this article

- POSTED IN Companies, Insightful Insights.

-

Not Getting Schooled Part 1

Scott Shuttleworth

April 27, 2015

Telecommunications, healthcare, technology, financials. These are all common themes in a Montgomery portfolio, yet what about education? Continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 3 Comments

- save this article

- 3

- POSTED IN Companies, Insightful Insights.

-

Own Telco stocks? Read this.

Scott Shuttleworth

April 21, 2015

As reported in the Sydney Morning Herald, iiNet (ASX: IIN) customers have reportedly experienced internet speed slowdowns from the later afternoon into the evening post the release of its Netflix offering. Note, watching Netflix doesn’t use up any of the users monthly data allowance. Continue…

by Scott Shuttleworth Posted in Insightful Insights, Technology & Telecommunications.

-

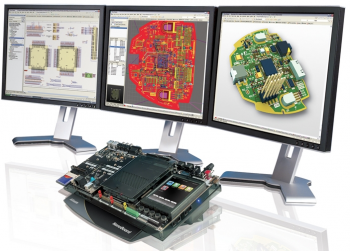

Altium continues its run

Scott Shuttleworth

April 16, 2015

On Friday, Altium Limited (ASX: ALU) reported results from the third quarter and its stock enjoyed a swift ride north to $5.00 shortly after. Continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 3 Comments

- save this article

- 3

- POSTED IN Companies, Insightful Insights.

-

Dodo… the share price that flies

Scott Shuttleworth

April 1, 2015

M2 Group Limited (ASX: MTU) has been a holding in our funds since the second half of the 2014 calendar year. Purchases were first made around August-September at approximately $7.50 with further purchases made in the beginning of 2015. As per the below chart, it seems we have done well for our investors. Continue…

by Scott Shuttleworth Posted in Insightful Insights, Technology & Telecommunications.

-

TPG – Ringing up growth

Scott Shuttleworth

March 27, 2015

Heathcare, telecommunications and financial services are three of only a handful of sectors enjoying tailwinds in the otherwise lacklustre Australian economy. TPG, the telephone and internet service provider we owe some thanks to for bidding for our iiNet shares, has just reported their results. Continue…

by Scott Shuttleworth Posted in Insightful Insights, Technology & Telecommunications.

-

Does Burson offer great value?

Scott Shuttleworth

March 24, 2015

As readers of our blog will know, the funds of Montgomery Investment Management have held shares in Burson Group Limited (ASX: BAP) since its initial public offering (IPO) in early 2014. Since that time Burson has delivered stellar returns (circa 50 per cent in a year) and it’s interesting to contrast our reasons for entering the position with our thoughts now. Continue…

by Scott Shuttleworth Posted in Consumer discretionary, Insightful Insights.