Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).

Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).

Buffett (or was it Todd Combs?) topped up Berkshire’s holdings in the world’s 24th biggest bank by 9.7 million shares in the three months to June 2011 (we don’t have more recent information because Berkshire requested and was granted permission to withhold stock specific information). Between 1 March and 30 June – the three months during which the stake was increased – Wells Fargo traded as high as $33 and as low as $27.

WFC currently trades at $25.65 and its book value is $26.10 per share. Paying a small discount to book value for a bank that earns a return of 11.86 per cent on that book value doesn’t seem like a fantastic bargain and paying a premium to book value is perhaps less so. But the fact remains one of the best investors of our generation, reckons it is ok to be selectively buying US banks. Is Buffett going to make off with a bank fortune the way Butch Cassidy did or will he be caught red handed this time? Should you be doing the same as Buffett with Australian Banks?

Wells Fargo is the biggest U.S. home lender (think Commonwealth Bank) and Berkshire is its biggest shareholder. Given Berkshire’s interest in Wells Fargo and Bank of America should be taking a look at our own Banks?

I know there are conflicting and well-articulated opinions here at the blog about the banks, so feel free to add your own thoughts.

Here are mine.

Broadly, the local banking system is in a relatively strong position compared to peers globally. The funding, capital and liquidity position of the major banks has been strengthened and those who fear a housing collapse in Australia should be mindful that such an event would impact consumer confidence and credit growth more than the immediate profits of the banks, who have insured their exposure.

From a funding perspective, bank deposit growth has outstripped lending growth and while further increases in wholesale funding costs could reasonably be expected, the banks are ahead of schedule in raising term wholesale funding that is said to provide 6 months grace. Of course if deposits continue to grow faster than loans, the gap that is funded from overseas wholesale markets diminishes.

As I have previously noted, high levels of leverage at the consumer, company and country level simply take time to pay off. You just don’t go off spending aggressively again until you feel your debt is under control. As a result, it is reasonable to expect bank balance sheet expansion will be muted over the next year or two at least. Some of you may think even longer or permanently…

Globally, the banking picture is at the very least, interesting to watch. The five biggest US banks excluding bank of America posted 8 per cent profit growth, while in the UK the five majors posted H1’11 profits that were half of those reported the year before. Predictably this has resulted in announcements of an intended five billion Sterling cost cutting drive by 2014. In Europe, the largest ten banks saw profits fall less than 8 per cent. Curiously some observers suggest that the present problems befalling sovereigns will have less of an impact on banks than the GFC because sovereign debt is less complex than credit default swaps on collateralized debt obligations and stress testing has been completed and widely reported. With little exposure to European debt and strong growth domestically, Asian banks (with the exception of Japan) are the one bright spot.

Globally, banks are targeting cost to income ratios of less than 40 per cent despite the higher costs associated with reengineering systems and procedures to meet a heightened regulatory environment.

Locally, our major banks have posted more than acceptable profits considering global financial conditions and local consumer and business sentiment, which has remained muted

Growth has been achieved at least partly by the reduction in the provision for bad and doubtful debts. Additionally, the reduction in the aggregate loan impairment charge was 37%; from $8.4 billion to $5.3 billion.

While significant reductions in loan impairment charges can be seen as a positive, future growth in profits – in the absence of a recovery in consumer and business confidence – will have to come from cost cutting.

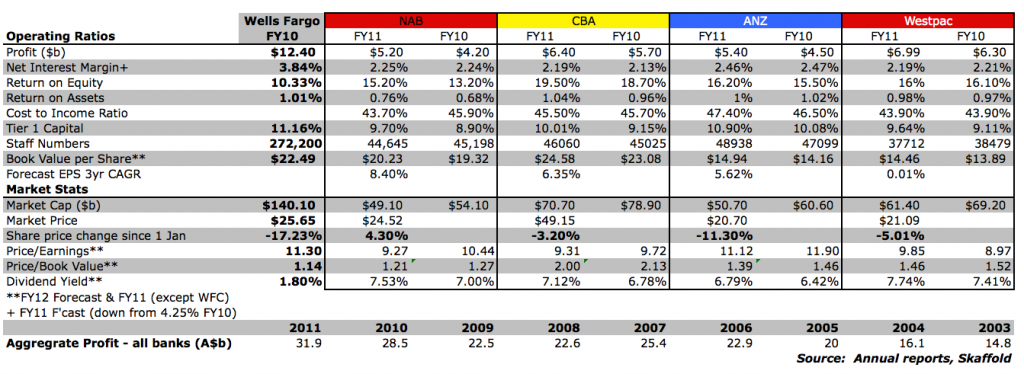

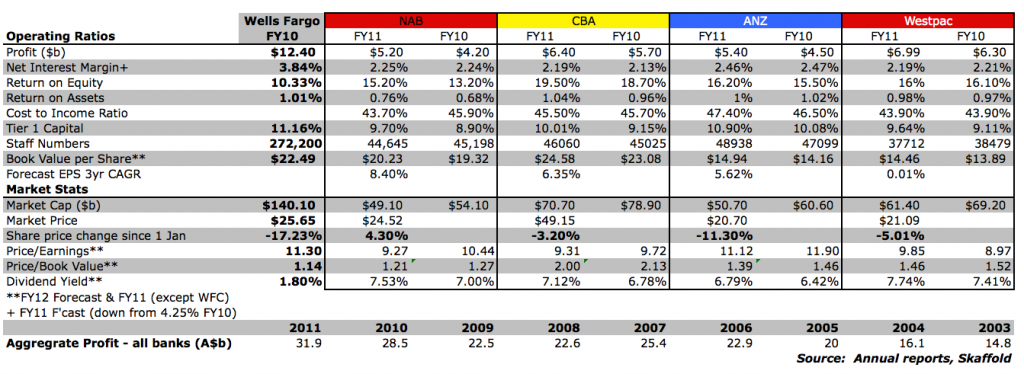

Collectively, cost cutting is being reflected in some results – cost to income ratios improved for the CBA and NAB and less so for the ANZ and Westpac. Further improvements should be expected and I have been reliably informed to expect significant retrenchments – in the thousands – in the financial services sector, even though full time employees increased at the ANZ and CBA last year. The changes in cost to income ratios should also be seen in the light of the dramatic reductions achieved since the early nineties when cost to income ratios were; ANZ 74%, WBC 68%, CBA 67% and NAB 57%.

Net interest margins – the net margin earned or the difference between interest paid on deposits and interest earned on loans – were broadly unchanged and while the CBA recorded an improvement, this has not been widely reported elsewhere as being materially due to an accounting reclassification of net swap costs. Competition for retail deposits and higher-cost, post-GFC funding as well as regulatory changes forcing an increase in liquid assets put pressure on margins. A broad maintenance of margins is therefore laudable.

The banking industry’s preferred measure of profit is Cash Profit (after tax), which removes the impact of discontinued operations, adjustments for acquisitions, Treasury shares and fair value adjustments.

On this measure, all the banks posted healthy increases.

The ANZ increased profits from $5.1 to $5.6, the CBA $6.1 to $6.8, NAB $4.6 to $5.5 and Westpac from $5.9 to $6.3.

Non-interest income, which includes trading, fees & commissions and Wealth management & insurance (which includes life insurance, superannuation and investment management products), declined in aggregate. Fees & commissions across the major banks were largely steady at just under $12 billion due to a drop in lending offset by an increase in corporate M&A. Wealth management profits fell for all the banks bar Westpac (BT). Profits here are largely a function of equity market performance given the big brand’s focus on index hugging and fund inflows/outflows. Funds under management and administration grew only for the CBA.

The outlook for Australian banks will remain mired by the general ‘funk’ Australian consumers and business are in. Our one-cylinder economy is not going to spur rapid balance sheet expansion (read credit growth) for the banks in the near term. With property prices and volumes in some areas also depressed the number of mortgages and the size of a loan on any individual property is necessarily lower. Banks love mortgages the most because their perceived lower risk means the banks have to provision less for each one they write. You are welcome to discuss your views about the direction of property in Australia in the comments below and I would welcome your thoughts. I think that we shouldn’t expect any immediate recovery in property activity to spur bank balance sheet expansion.

With the details broadly out of the way what are the current estimated valuations and prospects for intrinsic value growth for each of the banks? Keep in mind the intrinsic value expectations for the next three years are based on earnings growth and equity figures as stated in the table included with this column.

Skaffold’s (www.Skaffold.com) current estimated intrinsic values for the banks are: WBC $22.12, ANZ $24.49, CBA $51.54 and NAB $27.69. Of course these will change over the next weeks and months as estimates are updated and the banks make announcements about prospects, acquisitions or capital raisings etc. and I may not update those details here at the Insights Blog.

The bank displaying the greatest estimated margin of safety currently is ANZ, which at the current price, is displaying an estimated safety margin of 16%. Of the others NAB appears to be next, with an estimated margin of safety of 11%, WBC 5% and CBA 3%.

Despite being second on this list, the NAB has produced the lowest returns on equity and assets but also the lowest cost to income ratio, second highest Net interest margin and the highest forecast earnings per share growth for the next three years.

In aggregate the opportunity to buy at either very large discounts or smaller discounts but with solid growth potential does not appear to be available. An investor requiring meaningful margins of safety, would demand lower prices before being seriously interested. I will leave that decision to you after taking personal professional advice of course – from Buffett or your advisor. Growth doesn’t have to be sensational to make attractive returns but in such cases, one should require a large margin of safety to be more certain of a reasonable return.

What are you thoughts about the banks? Have I missed an angle that you would like to add? For example do you think the economic growth prospects are bright for the US compared to Australia? What are your estimates for earnings growth and what are your expectations for the residential, agricultural or commercial property market? I would be delighted to facilitate a discussion on these subjects.

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 November 2011.