There was a lot of surfing on the Montgomery annual holiday so I thought I’d publish these thoughts on Billabong International for you. Happy new year and all the best for 2012.

There was a lot of surfing on the Montgomery annual holiday so I thought I’d publish these thoughts on Billabong International for you. Happy new year and all the best for 2012.

Billabong’s trading update in December attracted a great deal of attention – not only from shareholders who rushed the exits to sell their shares, but also from commentators who noted the result was a symptom of a cyclical and structural shift in the way retail goods, particularly fashion, is bought and sold in Australia.

That Billabong had downgraded its earnings guidance should not have come as a surprise: it is not the first time it has done this. In 2009-10, it announced a series of downgrades then failed to even meet the lowered figure in its full-year result. In 2010-11, it announced downgrades in October and December, then again in March 2011. Billabong is not a stranger to downgrades.

But downgrades aren’t the only reason I have never bought shares in this company. On a number of measures it has failed to live up to the high standards I set for a candidate to enter and remain in an A1 portfolio. On some of those measures it may be argued that Billabong has a “challenging road” ahead – a euphemism for the possibility of a serious structural change, which may include a capital raising, asset sales and/or write-downs.

Retailing in Australia has been doing it tough and I have written previously about the perfect storm facing conventional bricks and mortar retailers in this country.

Another retailer, JB Hi-Fi (ASX: JBH, SQR A3, $12.50), had been 5% of the Montgomery [Private] Fund portfolio until we sold out at $15.50. Our reasoning was simple: given present circumstances (the strong dollar and strong outbound tourism, and the consumer shift to online buying) and expectations for retailing (having spoken to many retailers recently), many retailers would have to revise their earlier outlook statements and this would produce lower future valuations.

Notwithstanding today’s speculation that the announced sale of Dick Smiths by Woolworths (ASX: WOW, Skaffold Quality Score B2, $24.45) will trigger a bid by the grocer for JB Hi-Fi, analysts’ forecasts are typically optimistic in the first half of the financial year (this year being no exception to that rule) and we should therefore be demanding much larger discounts and JB Hi-Fi’s shares were not offering that margin of safety.

I have also noted before that the deflation story – as explained by Gerry Harvey, who says selling plasma TVs for $399 last year means he has to sell three times the volume as last year to make the same money – would put pressure on profits because people already had enough plasma TVs.

Finally, we also believe ANZ’s reported profit growth last year, being dominated as it was by bad debt provisioning writebacks, meant that credit growth was non-existent. When you take away growth in credit card purchases that’s got to hurt discretionary retailers.

Billabong cannot be immune. And a long-winded, multipage analysis of the issues plaguing this company is not required because we’ve never suggested it as an investment.

Billabong reported that its first-half EBITDA in constant currency terms would be $4 million higher, but the company is a global retailer and its reported EBITDA is expected to be 20.8% to 26% lower. The company added that strong growth in constant currency terms in 2012 “is not expected”.

Tellingly, the company also noted that a full strategic review is required and a capital raising cannot be ruled out. The reason for this is simple: in light of deteriorating trading conditions the company has bitten off more than it can chew. This is best seen in the cash flow statement.

In 2010-11 Billabong reported profits of $119 million but cash flow from operations of just $24 million. Subtract dividends of $78 million (why pay dividends if you don’t have the cash?) and capex and investments of $266 million and you have a deficit that needs to be plugged with an equity raising or debt.

Turning to the balance sheet, you will find goodwill amounts to about $1.3 billion. That’s $1.3 billion of “oops-I-paid-too-much” and is more than half of the assets of the company. There’s also borrowings of $600 million and, despite the boost, the company is currently forecast to earn a return on equity of just 7%.

Given my bank is offering 90-day term deposits at 5.95%, I wonder how Billabong’s auditors can justify the carrying value of the goodwill on the balance sheet.

So there are two pretty good reasons you haven’t seen Billabong mentioned as a company to conduct more research on this year – or any year, for that matter.

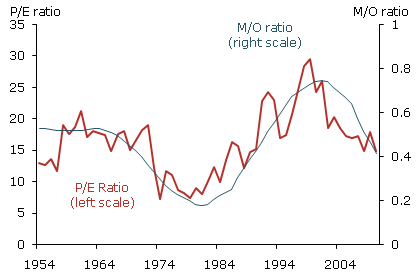

Investing in 2012 could be largely about avoiding losses. To do that, you will need to watch out for companies whose structures are weak, whose performance is undesirable or whose price is too high. Obviously any stock that harbours all three conditions does not require my comment here.

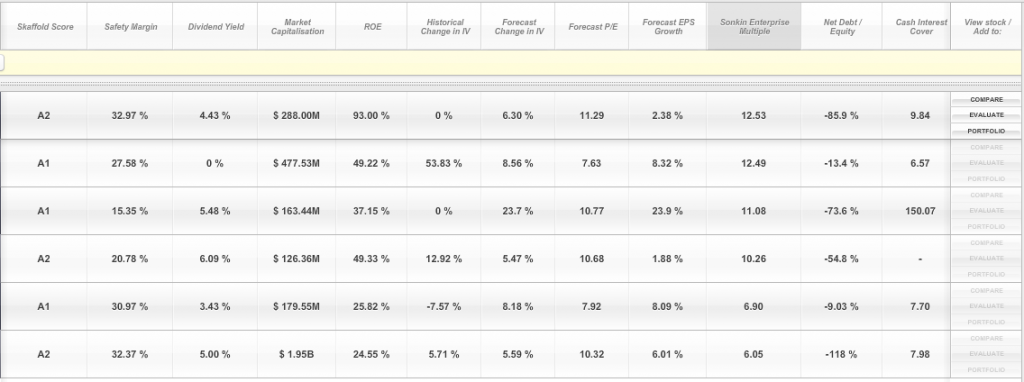

Billabong’s debt has been rising, its return on equity falling, its balance sheet weakening and as an A4 on Skaffold’s quality scale, it was not investment-grade.

Skaffold’s Quality Score History for Billabong

If you are thinking about investing in retail in the coming year, be sure you know what to look for, even if mouth-watering prices are being offered.

Finally, for Skaffold member’s I hope you enjoy update 1.1 you will be receiving today, making Skaffold even more powerful and user friendly. If you are not a member of Skaffold, what are you waiting for? Skaffold is the best way we know of to deal with the market’s main risks;

Don’t miss an opportunity – every stock is covered and updated daily and automatically.

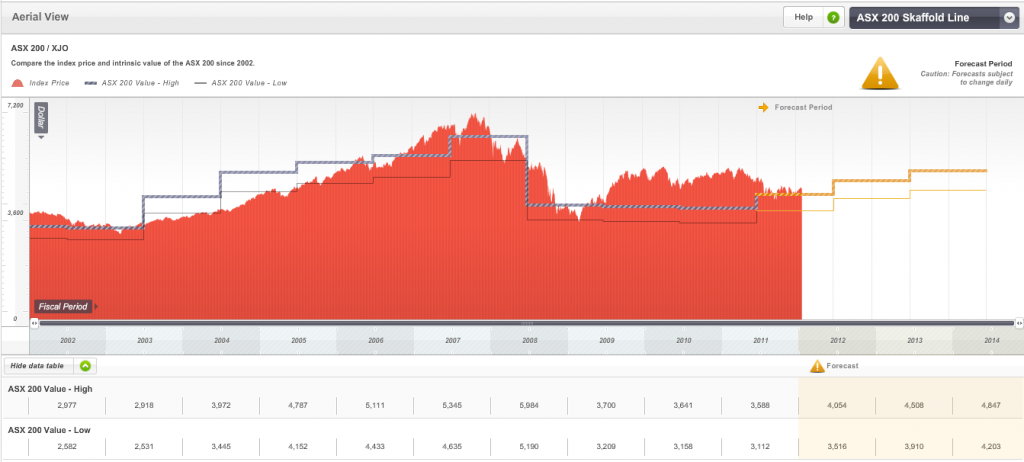

Reduce the risk of paying a high price for a stock – Skaffold’s intrinsic values ten years back and three years forward for every company.

Reduce the risk of buying the wrong company and suffering permanent capital loss – Skaffold’s Quality Scores, cash flow information and projected intrinisic values are updated in real time, keeping you abreast of vital changes to a company’s prospects as an investment candidate.

If you have been thinking about becoming a ‘Skaffolder’ there are few better times to get started than just before companies start releasing their important Half Year results. Skaffold’s intrinsic values are updated live and daily so as company’s prospects are upgraded (or downgraded!) during reporting season, you are likely to find a multitude of opportunities for investigation. Go to www.skaffold.com to get started just as reporting season takes off.

All the best for 2012.

Posted by Roger Montgomery, Value.able author and Fund Manager, 31 January 2012.