On 1 March, Harley sent me an email. Right in the guts of reporting season with up to 93 companies reporting in a single day, I have to confess to prioritising our work for the fund. But Harley put a lot of thought into his letter to me about Allmine Group and I would hate to see it not receive some feedback from the wider community. The price hasn’t changed so one suspects the arguments he puts forward remain unchanged also. Here’s Harley’s letter(s) in full. Remember Harley is not providing any advice nor are we. For those interested in researching the company and referring it to their advisor, you can find Allmine’s latest investor briefing Allmine March2012 Investor Presentation.

Hi Roger,

I have followed the blog virtually since inception and have written to you a few times (about NST when it was 42c and ZGL when it was 32c – Emails are below as proof. Just thought I’d point that out! :P)

I’ve said it before but thanks again for how open you are with what you practice and for being willing to teach those that are willing to learn. It is much appreciated and has made a significant impact on my own development both as an investor and in what I aim to do as a career.

In this email I just wanted to point out an interesting little stock. I have done a lot of homework on this one (and I promise it isn’t a stock ramp!) but I thought it was worth letting you know about it and writing my view, even though it is likely you are already aware of the company.

The company is called Allmine Group, (ASX:AZG), and is composed of three divisions: Arccon which is in mining services, Construction Industries Australia and Allmine maintenance. I apologise if this email becomes too long but the company has a very interesting story and I believe it is incredibly cheap.

Firstly, just looking at the numbers, the company reaffirmed its 2012 profit numbers of around $16.5m which puts it on a fully diluted EPS of around 5.5c. The SP is currently sitting at 15c. On my numbers, the per share value of Net Receivables, Net Cash and tangible assets for FY12 is 14c. The company is most certainly cheap on a number of metrics, and when using the formula from Value.able it becomes even more attractive.

The issue the market had with the company, and one that I believe is being resolved, is cashflow. The Sep quarter 4C showed OCF was negative and the company appeared to be relying on the banks to keep running. The obvious assumption was that a capital raising was on its way, something I didn’t agree with but believed still needed to be considered. Around that time I actually gave the company a call and spoke to Scott Walkem, CEO, about their CF situation. He basically said that the company was “essentially cash flow positive” and that short term negative CF was a result of the huge step change in the business, which I’ll expand upon in a moment.

I tried to gauge when he saw CF turning positive and his exact words were “I see no reason why we won’t be in a net cash position by June 2012.” While encouraged by this I didn’t want to act solely upon his words and so have waited until recently to take a position in the company (and am looking to buy more after the company reports). More encouraging was the fact that weeks after I spoke to Walkem he purchased $50k in shares, adding more skin in the game.

What I find most important is the fact that in the latest 4C the company was OCF positive. They were also able to establish a number of new contracts across all divisions and secured a new bank facility last December. So while I am not overly bullish on mining services as a whole in the short term, I am of the view that the value in AZG is enough to warrant an interest.

Even more interesting is the qualitative side of AZG. AZG acquired Arccon, a company founded by Robert Wilde and John McGowan, two highly successful and well respected men in the industry. Arccon was the brain child of these two men, and Construction Industries Australia (CIA) was born out of Arccon and these two companies have significant relationships with two of the Chinese giants in mining – MCC and China Non Ferrous Metals.

Basically what happened was that Robert Wilde went to MCC and told them he could promise substantial savings on their Sino Iron project. He ended up saving them $100m+ (according to Scott Walkem) and out of this CIA was born. As a result the two companies have strong relationships with MCC and its sister company China Non Ferrous Metals. As a result of this relationship Arccon and CIA are able to not only have access to some of the projects MCC and China Non Ferrous are working on (evident in recent contract announcements), but also have access to cheap project financing via the Chinese banks. In the meantime the Allmine maintenance division announced a new contract with Downer EDI worth $10m p.a. which is a substantial amount based on the $30m odd revenue of the previous year.

Since following the blog I have learnt so much and been given so many investment opportunities and ideas, that if possible, hopefully I can return the favour! AZG in my view is worth a look. It appears to me to be very cheap, has only recently become OCF positive and I believe there is minimal risk of a capital raising. Obviously one must consider some of the risks: slowdown in China, weakness in the Chinese banks impairing the relationship with MCC and NFC, commodity prices falling. In my view in an ironic way, thanks to the relationship with MCC and NFC Allmine is less exposed to a slowdown in China than other mining services companies. The Chinese desire for resources is not a short term play and without further lengthening this email I do not see Chinese exploration/acquisitions of resource projects slowing in the event of a commodity price fall, in fact I expect the opposite as they see cheap assets as an opportunity.

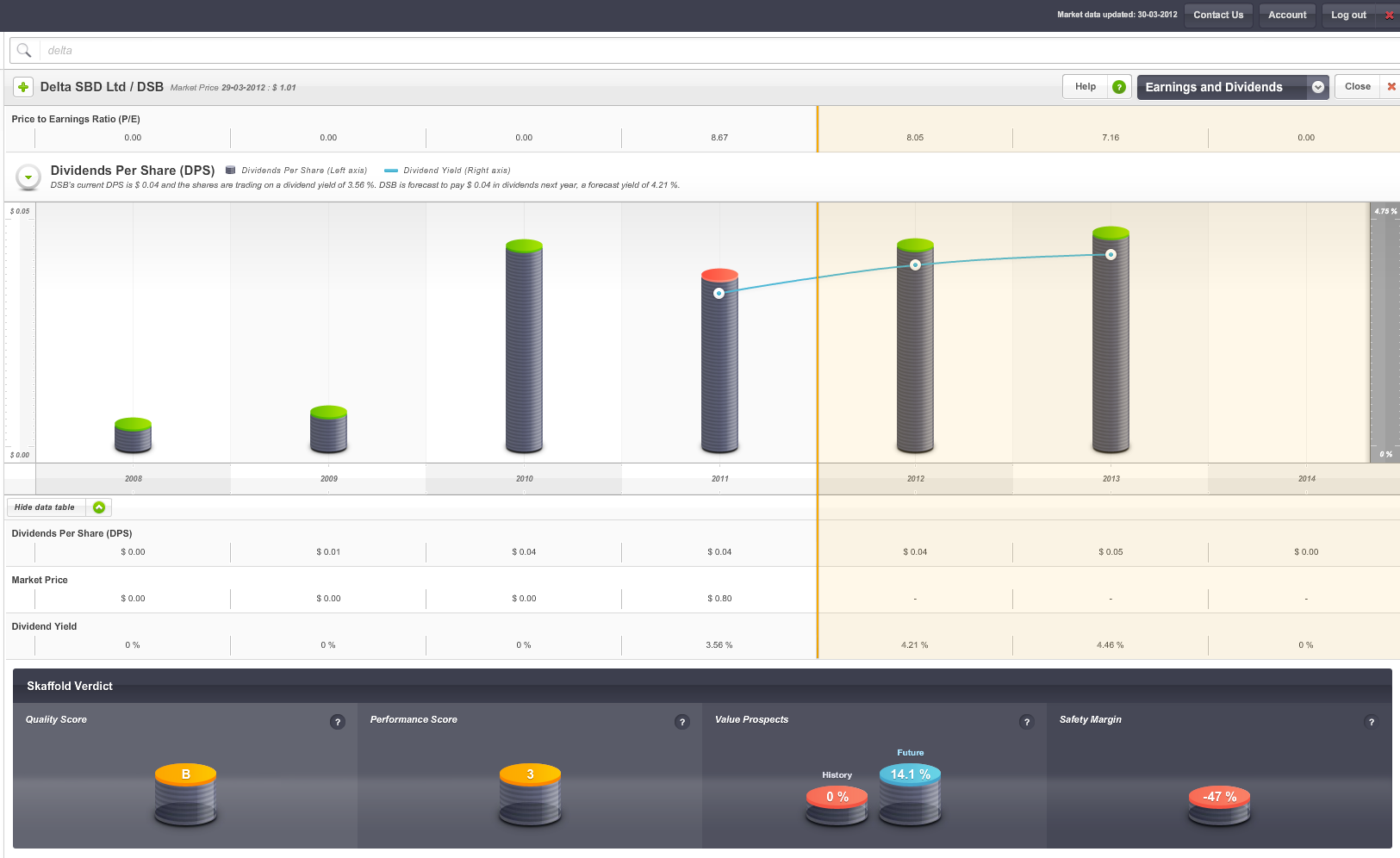

In terms of catalysts for SP appreciation if Allmine can reconfirm a $16.5m profit this month and put it on a PE of 3 I think that will be a shock to the market. The latest report will reveal a substantially different company to that shown in the previous report with the 100% acqusitions of both Arccon and CIA now being fully accounted for, and Skaffold will likely rerate the company too if I am correct!

Thanks again Roger.

Regards,

Harley

…Seperately Harley also wrote the following about the company…

Overview

Allmine Group provides a life of mine service to its clients via three divisions: engineering, construction and fixed and mobile maintenance services. The company is comprised of Allmine Maintenance, Arccon and Construction Industries Australia (CIA). But there is much more to Allmine Group than meets the eye. At first glance it is just another mining services company, but the story behind this company is an exciting one and one that completely changes your view of the company when you begin to understand it.

When AZG listed in March of 2011 they were entirely a maintenance services company. I remember looking at the prospectus when they listed at 20c and thinking it was an ok company but nothing outstanding. Since that time Allmine have made two significant acquisitions that have substantially changed the nature, growth profile and outlook of the group.

Firstly, Allmine bought Arccon Mining Services, an EPC/EPCM contractor for a maximum consideration of $22.8. The acquisition will be paid for in two tranches. The first tranche has been paid and involved an equity deal of 75 million shares at 20c/share, a total consideration of $15 million. The second tranche is performance and loyalty based, whereby Arccon must achieve NPAT of $5.55m in 2012. If the target is achieved another $7.8m worth of shares will be issued at the 5 day VWAP at June 30 2012. For the Arccon shareholders to receive this payment they will have to hold 75% of the shares issued to them in Allmine.

The second acquisition was for Allmine to purchase the remainder of Construction Industries Australia (CIA), which was 50% owned by Arccon and 50% by the original founders. The total consideration paid was $3m paid in shares at 20c strike price. In 2011 CIA achieved $10.5m NPAT. Yes, you read that correctly.

Now at first glance it seems impossible that such acquisitions could be made so cheaply, to good to be true in fact. The truth is that the initial payments being made do not fully reflect the price that will ultimately be paid for these companies. Instead, the rest of these payments will come through in the performance incentives program which provides for substantial benefits for management and original Arccon shareholders should they achieve key objectives. The details of the performance incentive plan are quite complex and are explored in depth later in this report.

Background

I took a closer look at this company around September last year. At the time it was very cheap based on its forecast earnings, but its operating cashflow (OCF) was negative. There was fear of an imminent capital raising as it appeared upon looking at the financial statements that the company was relying on the banks for survival. But that wasn’t the case.

What the market was missing was the company was essentially cash flow positive, but that cash flow timing issues were causing OCF to come out negative. I looked into the company and thought it’s story (which I will get into in a moment) was one of a company with incredible opportunity and its current share price was ridiculously cheap. So I got in contact with the company and, luckily enough, was able to speak to the CEO, Scott Walkem, over the phone. Much of the story that follows is direct from the CEO himself.

Allmine Group’s Story: Not Your Everyday Mining Services Company

When AZG bought Arccon and CIA they substantially changed the makeup of the company. Arccon and CIA have two significant competitive advantages: access to cheap project financing from Chinese banks and management with a proven track record.

Arccon was founded in 2003 by Robert Wilde and John McCowan, the two founders of the hugely successful Minproc Engineers which was taken over by AMEC plc., the UK mining services giant. These guys have a proven track record in growing a successful company, and they have significant ownership in AZG as well as performance related incentives. And shareholders can be more or less assured that they will remain at the company for at least the next three years, as the details of the acquisition state they must do so to receive their performance and loyalty bonuses.

It is their experience, as well as their connections to the Chinese companies China Metallurgical Group Corporation (MCC) and China Non-Ferrous Metal Industry’s Foreign Engineering Construction Co. Ltd (NFC), and as a result their access to cheap project financing from the Chinese banks, that presents a fantastic opportunity.

The story goes like this. Robert Wilde, then working at Arccon, got in contact with MCC and told them he could help them achieve sizable savings on the Sino Iron Ore project in the Pilbara (which MCC owns 20% and which AZG works on to this day). They agreed and in the end Arccon was able to save MCC $100m USD on the project. From this demonstration of ability CIA was born, and the company was introduced to MCC’s sister company, NFC.

MCC and NFC are big companies. They work on big projects around the world with Tier 2 (or below) mining companies. They are able anywhere between 70-100% of the project requirements through the Chinese banks at relatively cheap rates. Arccon now has a “significant pipeline of work across next the 1-4 year time horizon” (most recent Half Yearly Report) as a result of this relationship, while CIA is currently undertaking projects on a lump sum and cost recovery basis with MCC. Many of these big contracts involve financing arrangements through Chinese banks, something no other Western mining services company can offer their clients.

Allmine Group now has two clear competitive advantages:

1) Management with a proven track record.

2) Key relationships with MCC and NFC allowing large projects to be financed via the Chinese banks.

These two factors, particularly the latter, in my mind represent something the market may just latch onto when it realises how significant these competitive advantages are. I encourage you during the process of researching this company to look closely at some of the projects AZG has lined up as a result of these arrangements as they are indeed quite large and begin coming through in Q4 of this year.

Of course the maintenance division, while not as attractive as Arccon and CIA, is still a strong business. It is experiencing labour shortages, as Walkem said “the business could be twice as large tomorrow if we could find the people.” The company announced it had initiated an in-house training program to help alleviate this issue and that first signs were encouraging.

CIA is in the process of diversifying its client base away from MCC to reduce the reliance on the Chinese company, with positive news coming from its contract win with UGL. At the moment CIA is heavily dependent on contracts at the Sino Iron Ore Project, which as many of you will know has had its fair share of negative press, so any diversification can only be positive.

The Allmine Advantage

The main difference between Allmine and competitors is indeed the connection to the Chinese companies and through them the cheap financing of the Chinese banks. Firstly, mining companies will be attracted to the prospect of cheap financing on offer from MCC and NFC. In the past, and in recent news, Australian companies have not been satisfied with the performance of MCC, as was made clear when CITIC Pacific complained about the cost blow-outs on the Sino Iron Ore Project. It is therefore in the interests of MCC and NFC to have Arccon (and CIA) covering some of their contract requirements in Australia, as projects need to be completed to Australian standards. If MCC were to lose their relation with Arccon they would greatly reduce their chance of future contract wins (and therefore opportunities to secure resources) in Australia. The Chinese company relationship is very important to Allmine Group, but don’t think it’s a one way street as MCC and NFC benefit too.

From a client’s perspective working with MCC/NFC and Allmine Group offers project financing, access to cheaper Chinese materials and work completed according to Australian standards. To demonstrate this competitive advantage in action, read the following from an announcement by Reed Resources:

“The involvement of both NFC and Arccon in the EPC consortium enables Reed to access the cost benefits of a Chinese contractor, whilst retaining appropriate Australian expertise and experience, to ensure Australian standards and work practices are adhered to and construction of the Project can be executed smoothly.” (Nov 11 2010)

As has been demonstrated the management of Allmine clearly have a few things to show the big Chinese engineering companies when it comes to efficiency and cost management. For a small to mid tier company looking to go from explorer to producer, in an environment like today where the future of potential project financing seems uncertain (whether true or not), this is an attractive option.

It is also important to note that the projects Arccon tenders for via their relationship with MCC and NFC are not limited to Australia. In fact some of their biggest projects are overseas with two examples being the Yandera project in Papua New Guinea and the Citronen project in Greenland.

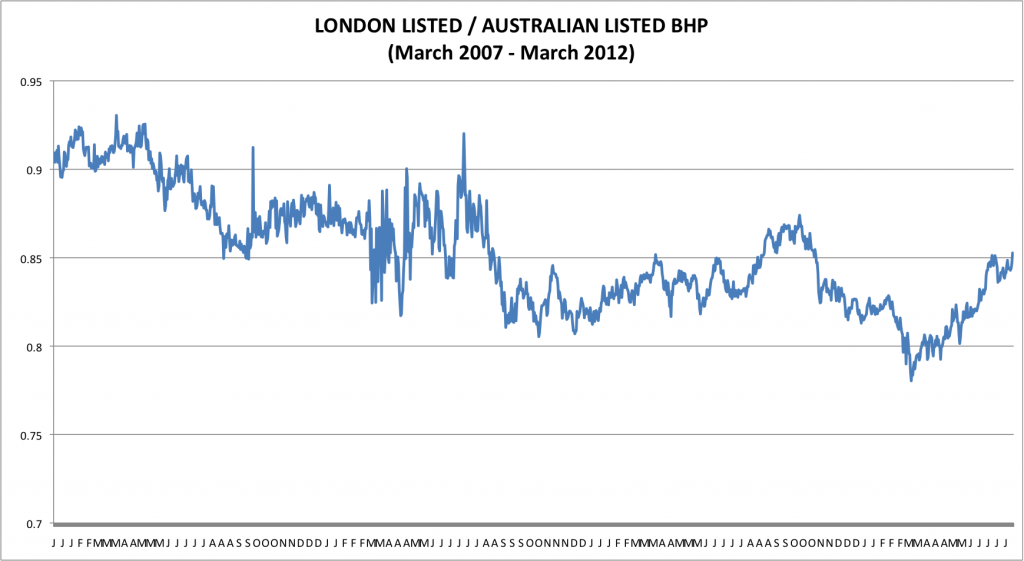

The goal of the Chinese is to eventually source half its imports of iron ore from owned or co-owned mines by 2015. They want to diversify away from their reliance on BHP, RIO and Vale, for obvious reasons. For this to occur the Chinese will need to continue to invest money into iron ore and other commodity projects worldwide, and to do so by buying/financing projects. If this is to occur, as I expect it will since the Chinese have made it a priority, then Allmine is well positioned to benefit from increased Chinese investment into iron ore and related commodity projects. Remember the Chinese will need more than just iron ore. Zinc, vanadium, copper, molybdenum, all are resources the Chinese need to secure. I expect to see more stories along the lines of small-medium sized Australian companies partnering up with companies like MCC to secure project financing while MCC (or other Chinese companies) take large stakes in the projects/companies themselves.

Then of course you have the proven track record of Wilde and McCowan, which should translate into further contract wins for Arccon and CIA outside of MCC and NFC. Continued diversification is a positive and it seems a focus of Allmine management.

The maintenance division, while smaller, should not be forgotten. If labour issues can be kept under control the business should stay relatively profitable. On top of this the synergies will only increase as the volume of work for Arccon and CIA picks up.

Cashflow Turnaround

Cash flow is key for this business. As it stands the balance sheet is not strong enough to withstand a significant shock should something unexpected occur. When OCF was negative last year, Scott Walkem insisted there was no need for a capital raising saying the company is essentially cash flow positive and backing it up by purchasing shares for his own account. He said that the company was undergoing a step change in growth and the changes in working capital were temporary and beneficial long term.

In the latest 4C he was proven right when OCF was reported as positive, albeit by only $2m. At December 31 2011 AZG had $2.5m cash at bank but had drawn down their bank overdraft to the tune of $7.7m. While they have plenty of room to draw down this facility under normal operating circumstances, should something unforeseen occur then the company will have little room to move.

Negating these risks somewhat are three key factors. The first is that the CEO is purchasing shares. He purchased $50k last year and another $100k earlier this year. Insider buying is always a good sign. The second is that the potential for cash flow to turn around, and to do so quickly, is certainly there. Around $36m in cash is coming in each quarter, and that is expected to increase in future. In the most recent quarters the company experienced significant growth, increasing total engineers from 5 to 50 as well as a significant jump in total employees.

And finally, the company has forecast for working capital needs to normalize in the fourth quarter of FY12 and for cash to start building up on the balance sheet. They still maintain their forecast of $17m cash by the end of FY12.

Is There An Issue With Dilution?

If you are going to invest in Allmine you need to be aware of the almost inevitable increase in total shares on issue. It is true that the total share count will likely increase substantially. What is not correct is the idea that this is a net negative for shareholder value.

While a number of new shares will likely be issued it will not cause a significant reduction in the value of this company so long as current performance is maintained. Today there are 280m shares on issue. There are 40m options at 20c, 2.5m at 25c and 2.5m at 30c. Each represents a price that is above current equity per share! Thus if these options were to be exercised it would actually be value accretive! As I write this the 20c options are at the money while the rest are out of the money and thus are unlikely to be exercised before a substantial share price rise.

One must keep in mind that if options were to be exercised it would inject over $8m into the company, which would entirely remove the negative cash flow position of the company. Options being exercised is actually a net benefit to the value of the shares!

The next issue of possible dilution relates to the second tranche of payment for the Arccon acquisition. Should Arccon achieve NPAT of $5.55m in FY 2012 $7.8m of shares will be issued at the 5 day VWAP as at 30/6/12. It is difficult to determine how many new shares will be issued because it depends on what the share price is at the time the VWAP is calculated. If the company can continue its strong performance it is entirely possible that the share price is substantially higher by June than it is today. But at the same time it could be cut in half tomorrow! It really is anyone’s guess. So for now let us assume the 5 day VWAP at 30/6/12 is near enough the current share price, or 20c. At 20c 39m shares will be issued, taking the fully diluted share count to 360m. Remember the total number of shares to be issued in this second tranche payment for the Arccon acquisition is highly sensitive to the share price in the 5 trading days prior to 30/6/12.

The final source of dilution relates to the performance incentives to be paid out to management and the CEO. In a moment we will look more closely at this, but for now take it that the maximum number of shares on issue for FY12 will be 400m. Provided the $16.5m NPAT is achieved, EPS will come to 4.1c and the current share price represents a PE of 4.8.

Performance Incentives For Key Management

On face value the total considerations paid for Arccon and CIA are ridiculously low, especially considering the calibre of management. The truth is that these acquisitions will be paid for over time and provided Robert Wilde and John McCowan achieve key objectives for the company. Personally I prefer this approach to simply overpaying upfront for a company, as at least this way any shareholder dilution is a trade off for increased performance.

The CEO, Scott Walkem, has his incentives tied to total market cap. According to the plan he receives no performance incentive if market cap is below $60m, $1.8m between $60 and $80m, $2.4 between $80m and $100m. If market cap is over $100m Walkem receives $3m plus 1% of the total market cap up to $200m. Again the payment is made in shares at the 5 day VWAP as of June 30 2012. Currently the market cap sits at $56m, but it I would not be surprised if options were exercised if the market cap does not break the $60m mark between now and then.

Robert Wilde is rewarded according to the NPAT achieved by Arccon in FY12. He receives $2.474m if NPAT is between $7m and $12m; and $4.2m if NPAT if it is above $12m. Again it is tied to the 5 day VWAP at 30/6/12. Unlike the shares to be issued upon exercise of options these shares will not result in any cash being injected into the company.

So let’s now calculate the maximum total of shares to be issued. We will assume the 5 day VWAP at the relevant time is equal to the current share price, or 20c.

45m shares can be issued through exercise of options, 39m shares will be issued for the second tranche payment for Arccon, the maximum realistic payout to Scott Walkem is 9m shares (since the CEO is rewarded based on market cap his bonus relies on the share price increasing, which would ultimately increase the VWAP used and thus reduce the total new shares to be issued.) and the maximum payout to Robert Wilde is 21m. This brings the maximum realistic total to 394m shares.

It is difficult to forecast the total shares to be issued, simply because no one can forecast the share price. But even assuming 394m shares are on issue by the end of this year, it would mean profit came in near guidance, or around $16.5m, which still puts the company on a PE in the 4’s. There are risks to this company but provided the profit numbers are hit dilution is not one of them.

Risks

As with any company there are some key risks one should consider. They are as follows:

Cashflow: This risk has been covered above. Some may avoid this company as cash flow in the recent past has been weak, which admittedly makes them vulnerable to key project risk. If this is you, consider waiting for the next few cash flow reports before investing.

Key Project Risk: This is in my view the biggest risk for Allmine. They are strengthening their balance sheet but are not in a solid enough position to withstand a number of key projects being delayed or cancelled. They have had one major project delayed due to weak vanadium prices already, which is something to keep an eye on. (In regards to this project the company is still in informal negotiations with Arccon and the project will likely go ahead. In what form will be revealed in April.) Because the big key projects don’t start coming through until FY13 the FY12 profit number is still uncertain and reliant on timing of projects. It is my view that this risk is negated by those big projects in the pipeline, but it does not prevent the possibility of a project delay causing the FY12 profit forecast to be missed.

Chinese Connection: While a significant strength, the risk of losing the relationship with MCC and NFC is indeed a risk and would damage the billions of dollars worth of projects in the pipeline. However, it is important to remember that the benefits are mutual, and MCC/NFC do indeed benefit from working with Arccon and CIA.

Profit Guidance Being Missed: As with any company the risk exists that profit falls short of guidance. This is true with Allmine. However, the margin of safety on offer reduces this risk. The company made clear they expect the second half of FY12 to be stronger than the first. If we consider the possibility that this doesn’t occur, and instead profit continues at the same pace as the first half then NPAT will come in around the $12-$13m mark, the increase in the second half being due to the profits from CIA having a full 6 months to come through, unlike in the first half. In this case, and assuming the maximum possible share dilution occurs EPS will come in at around 3.2c and if you were to purchase today you would still be paying a PE of only 6, which isn’t too bad for a downside scenario.

The Financials And A Valuation

Ok, here is where it gets really interesting. When I first noticed this company it had announced earnings guidance of $16.5m. As I have made clear if this were to be achieved the company is currently very cheap, which reflects its doubling in price since then.

In the latest half yearly report AZG reported NPAT around $5m in the half, but the key to the report was the reaffirmed earnings guidance. They stuck with the original $150m revenue and$16.5m NPAT but separated the guidance into two key parts. The company announced $13m from construction and maintenance services, with an additional $4-$8m in ‘at risk’ income due to uncertainty regarding timing of contracts. $13m NPAT for 2012 would represent a continued rate of performance over the first half, as the acquisition of CIA comes through to the bottom line. And there is now potential for upside as according to the company there is the possibility that NPAT comes in as high as $21m.

Forecasting profit for an EPC/EPCM services company is very difficult, and for the sake of company valuation I would rather be conservative and right than optimistic and wrong. So when valuing this company I have decided to assume NPAT of $15m, which would mean falling short of guidance by 10%. For me this takes into account the recent project delay as well as any other unforeseen risks. It also assumes $150m revenue comes through but that margins fall from historical levels, which is not impossible considering the labour issues currently present in the industry. The numbers that follow are in my opinion quite conservative. Suffice to say that if the upside of profit is achieved this company is ridiculously cheap, so in using conservative numbers I hope to demonstrate that even in such a case the company still presents value.

So assuming $15m NPAT let’s forecast equity per share. Equity was $54.4m at December 2011. Since no dividend will be paid retained earnings would increase by $9.8m. We will assume that the 40m options at 20c are converted, which is likely if the share price rallies going into reporting season. If this were to occur it would inject $8m into equity. Equity would now be equal to $73.6m and equity per share on a fully diluted basis (394m shares) would come to 18.6c. This means that if $15m NPAT is achieved (which would mean they are short on guidance, upside exists) that on a fully diluted basis the book value of the company is near the current share price. Average ROE would come to 23.4% and would be likely to remain stable or increase in future years as the larger projects with MCC and NFC start to come online. EPS will be 3.8c putting the current share price on a PE of 5.25.

So what does this mean for the value of the company?

Using these numbers and based on an average of three valuation models, I value Allmine Group at 40c.

Thanks Harley …As always be sure to conduct your own research and do not engage in any securities transactions of any description without seeking and taking personal professional advice.