RISK: Successful investing is all about managing risk and, as luck would have it, this is one of the things that we, as a species are not particularly good at.

It is demonstrably true that humans are terrible at evaluating the complex risks associated with modern environments. This is not new information and there are plenty of oft referred examples which you can probably bring to mind; how we assess the actual probability of death from road vehicles vs. the perceived risk of death from spiders, snakes, sharks and aircraft (1,414 deaths vs. 32 in Australia 2009), the detrimental health risks of nuclear power vs. the dangers of fossil fuels (for every nuclear power linked death, there are an estimated 4,000 coal related deaths. Both candles and wind power are linked to more deaths than nuclear energy), or the real risk of bacterial infection vs. swine flu or mad cow disease (septicaemia alone was responsible for 993 Australian deaths in 2009).

Even if we acknowledge this shortcoming and integrate this knowledge to inform our everyday decisions, humans are hardwired to act on perceived risk, and are thus influenced to varying degrees by emotion. This is an evolutionary thing, and was suitable during the times that most of our transition to the dominant species occurred, but far less so now. The data necessary to evaluate complex risk often requires computers to calculate, and gut feel just won’t cut it anymore. To make it worse, we (as an aggregated faceless mass of humanity) are more inclined to trust information that reinforces existing beliefs (a well established phenomena known as confirmation bias). In a world where prominent politicians (and others) oppose the use of vaccines responsible for the eradication of polio and smallpox, in direct contradiction of peer reviewed science, finding someone who will tell us that we are right about pretty much anything is not challenging.

In summary, our natural instinct is to assess risk using our perception rather than facts, our perception is very often wrong, and even if we go looking for facts, we are inclined to assign more validity to data that supports our predisposition rather than to conduct an objective assessment.

You want more? In an apparent contradiction, this inability to overestimate our abilities may even confer an evolutionary advantage. Unfortunately, this would work at a species level, rather than for the wealth of the individual, and is a complex topic for another day (more about it here van Veelen,M. and Nowak,M.A. (2011) Evolution: Selection for positive illusions. Nature, 477, 282-283)

So, why is this important, and how is it relevant to investment?

Investment, as we all know, is about accurately assessing risk, and requiring an appropriate return to compensate for these risks to our capital. The more accurately we can assess risk in our investments AND act accordingly, the more likely we are to maximize returns. Knowing that investment is about managing risk however, is VERY different, and a lot easier than doing the work that this understanding requires.

Risk is managed using facts and knowledge. There is no place for gut feel. The more relevant facts we have about an investment, and the more knowledge we have about how to integrate this mass of data, the more accurately we can ascertain risk. As investors, we are looking for opportunities where professionals, with millions of dollars allocated to data collection, and which have analysts with years of experience, have mispriced this risk.

It could be argued that this is not necessarily so, that we could accept the average rate of return, such as with an index ETF. In this case we are accepting the risk premium applied by the market, and the inferred risk premium is out of our control. Historically, the 10 year compound annual rate of return for the ASX is 2.4% (excluding dividends), and for 5 years -3.1%. Even going back 22 years to 1990 only gets you just over 4%. In my opinion, the reward over any of these time frames is clearly inadequate, even allowing for dividends. These returns are comparable or worse than much lower risk investments including cash (not accounting for tax).

This leaves us competing against experienced, well resourced professionals and, more dangerously, many not-so-great investors as we try to outperform the market. In this context a quick look at P/E ratios is unlikely to yield the stocks that will lead to suitable returns. We need to be able to value businesses, find those that are mispriced and, most importantly, identify and assess the risks inherent in our calculations.

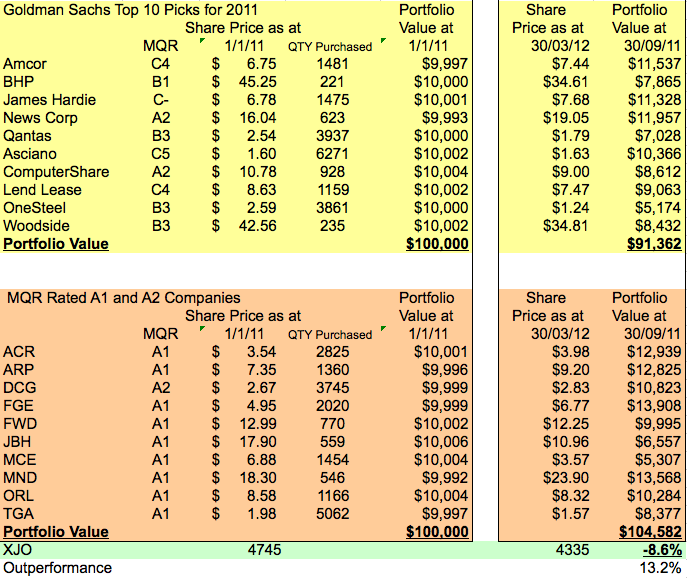

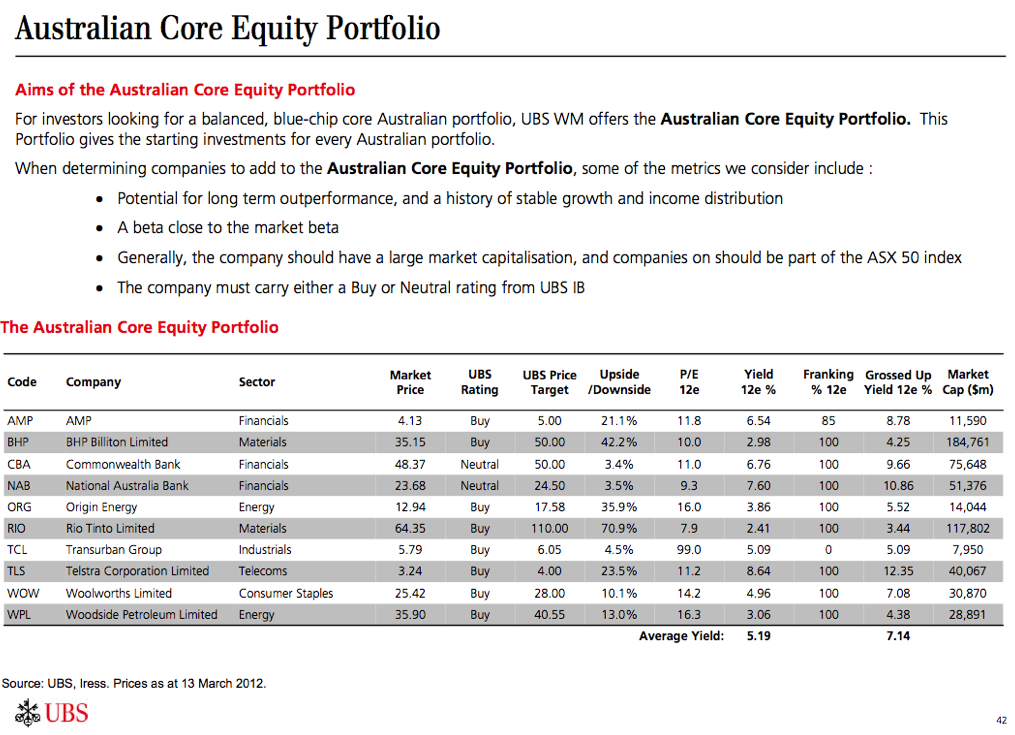

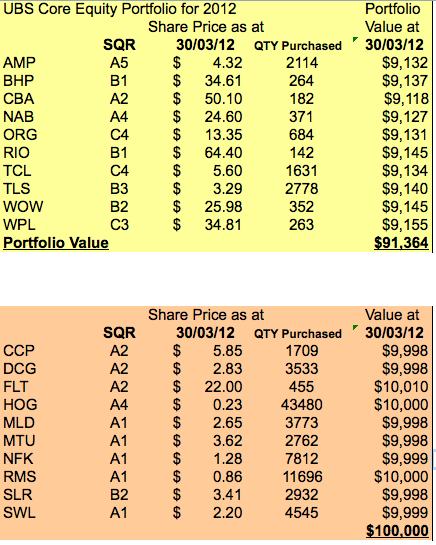

There are many tools for valuing businesses, such as the intrinsic value method described by James E Walter and explained much more accessibly in Valu.able, and even some for assessing risk (such as the Macquarie Quality Rating). The research necessary to even partially determine such metrics for all of the companies on the ASX (let alone internationally) with any accuracy is far beyond that available to the average retail investor, so historically we have had to only work on a handful of stocks recommended by professional researchers or investment publications, or use our gut as a first pass.

Like so many other things, the information age has turned this on its head. These days, a single service can value, and assess the quality of, the entire ASX, identifying companies worthy of further, thorough analysis. And this is exactly what products like Skaffold are useful for, and why they always come with a disclaimer.

When you make an investment, it is your cash, and your decision. You will reap the rewards if you get the risks right and pay the price if you do not. Tools like Skaffold (as an implementation of the MQR and intrinsic method) simply remove the noise, and allow you to find gold without having to pan too much gravel. When I first came across the MQR, both Forge Group and JB Hi-Fi were A1 and trading at a discount to estimated I.V. The decision to invest in the former and not the latter was not a function of luck, but an exercise in risk management.

The reason I invested in Forge was, that I know the industry, because I worked in it. I know the way high ROE is achieved in construction and mining services, the kind of businesses that can maintain it, and how such businesses generally grow. After carefully considering all of the available data and quantifying what I did not, or could not know, I felt I really did understand the risk and the potential reward, and as such made the investment.

In contrast, I did not understand how JB Hi-Fi would continue its level of growth, even in the medium term. I also work in the technology industry, and the threat to margins from online retailers was obvious, even two years ago. (This threat and the maturing nature of JBH was written about by Roger Montgomery some years ago) The discount to I.V was there, but the risk that ROE could not be maintained was too high for me. This is not a comment on the quality of JB Hi-Fi as a company, but on its valuation as a growth stock using historical ROE.

Generally, the more we know about managing businesses, the industries in which they operate and the products they are selling, the better we are at identifying and managing risks associated with these activities. If we were running the business we would be assessing strengths, weaknesses, opportunities and threats, barriers to entry, competitive advantage, brand awareness, and R&D just for starters. If we are considering about buying even a small part of a company, we should be doing the same.

In my opinion, I would rather have large investments in a smaller number of companies where I have control of the risk than rely on the brute force of diversification where I accept the risk premium of the market in general. I miss out on a lot of really good stories as a result (I don’t invest in mining exploration stocks for example) but at least I sleep well at night. My capital has been the result of far too much work for me to treat it cheaply.

There will be times when you can’t accurately assess risk, and times when no high quality stocks whose risks you understand are trading at a discount to their intrinsic value. It is times like this that it is hardest to hold your nerve. Remember, you don’t have to invest in the stock market, you can assess other asset classes, or alternatively you can follow Arnold Rothstein’s advice to Nucky Thompson (Boardwalk Empire – I recommend it if you haven’t seen it) for when the path forward isn’t immediately clear or the risks too great.

Do nothing.

Postscript:

- What is more common in Australia, suicide or homicide

- Motor vehicles are the most common cause of deaths attributable to “external causes”, what are the next 3 most likely

- What is the more common cancer in Australian women? Respiratory, digestive or breast?

Answers

- Suicide represents 24% of all deaths by “external causes” compare to 2.4% for deaths attributable to assault. While this probably didn’t surprise you suicide is also far more common in the USA.

- In order; Suicide, Falls and Accidental Poisoning (Snakes, spiders, jellyfish and crocs hardly rate a mention. There were not deaths attributable to snakes on a plane).

- In order; Digestive (4,917), Respiratory (3,080) and Breast (2,722)

Data from ABS census 2009

http://abs.gov.au/AUSSTATS/abs@.nsf/mf/3303.0/

1. van Veelen,M. and Nowak,M.A. (2011) Evolution: Selection for positive illusions. Nature, 477, 282-283, 10.1038/477282a. Available at: http://www.ncbi.nlm.nih.gov/pubmed/21921904 [Accessed September 15, 2011].

“Dividend policies and common stock prices” James E Walter

Author: Dennis Gascoigne is, or has at some time been; a Civil Engineer, Application Developer, Molecular Biologist, Management Executive and Professional Musician. He has held senior management roles in international Australian construction companies, has founded successful businesses in both civil engineering and information technology, and more importantly, played at the Big Day Out. These days he splits his time between genome research, and working on his cattle farm at Tenterfield in the NSW tablelands.