Who is in front of the reporting season avalanche?

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.

TLS was a clear disappointment, as it has been since it listed. I have been on the front foot for a long time saying that this is a company to avoid, I hope you took notice. My valuation has fallen now from $3.00 to almost $2.50. If anyone can turn it around however I think Thodey can.

Qantas should have come as no surprise. A $300 million cash loss and I wouldn’t be surprised to see another raising of capital or debt.

Personally though I am not interested at all in TLS or QAN as investment candidates. I am only interested in the highest quality best performing businesses available – it’s here that intrinsic value can be created rather than destroyed and with reporting season just about to kick into top gear from this week, to find them, I put each company through the same rigorous process.

My initial screening process is a vital part of the investment process as it allows me to determine those companies that deserve to retain their place in the short list and it also highlights new opportunities as they arise. But to do this for some 2,000 listed Australian companies can be a very burdensome task unless you have a systematic way of analysing and comparing results in a consistent manner.

For me, it involves pulling out some 50-70 profit and loss, balance sheet and cash flow data fields from each annual report to populate my five models. All of these models employ industry specific metrics to calculate my quality and performance scores. This allows me to rank all companies from A1 – C5 to sort the wheat from the chaff.

For those not familiar with my ranking system, A1s are the simply the best businesses and the safest to own, while C5s are the poorest performers and the least safe.

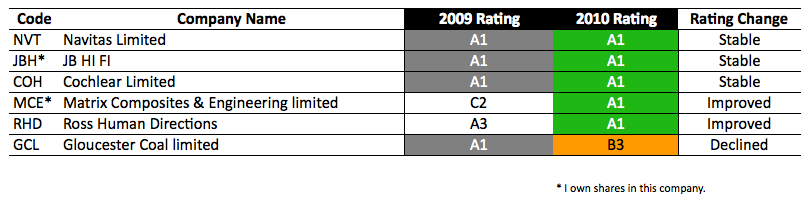

Out of the 80 companies that have reported, only 5 have achieved my coveted A1 status – around 6.25% (the best of the rest).

NVT, JBH and COH had my A1 rating last year and retained it this year and there are 2 new entrants in MCE and RHD, with GCL (it was an A1 last year) having a dramatic rating decline. I tend to shy away from resource companies for obvious reasons.

On my blog I have previously spoken about NVT, JBH and COH and also mentioned ITX, so please revisit those thoughts. itX is under takeover and Navitas, it was recently reported, had been approached some time ago by Kaplan – a company I have done some consulting work for and a subsidiary of Warren Buffett’s Washington Post company – so a big tick for the A1 to C5 Rating system!

That only leaves MCE, an engineering business that currently generates most of its returns from the manufacture of riser buoyancy modules for deep-sea oil rigs. Its order book is already underwriting a doubling of revenue for 2011. The 2010 result revealed profits had almost tripled and significantly exceeded prospectus forecasts and it is producing returns on equity of 49% – a rate that is unavailable generally elsewhere. Borrowings amount to about $8 million compared to equity of about $60 million (of which a little over 10% is capitalised development and goodwill intangibles). Best of all, the share price over the last week is a long way below my estimate of its intrinsic value.

If you have seen me on TV or heard me on radio in the last week or so you would have heard me mention that I had bought something, MCE is it. Please be mindful that if you act rashly and go and push the share price up, you will be helping me perhaps more than yourself. Also remember that I am not recommending the stock to you and that I cannot forecast the share price direction (although I am pleased with its performance since my purchase). The share price, I warn you, could halve, for example if there is a recession and or the oil price plunges – delaying expenditure of the construction of oil rigs globally. I simply am not recommending it to you.

Also remember that I am under no obligation to keep you informed of when I buy or sell nor answer any specific questions, which means 1) you have to do your own research and 2) you have to be responsible for your own decisions. Seek and take personal professional advice BEFORE you do anything.

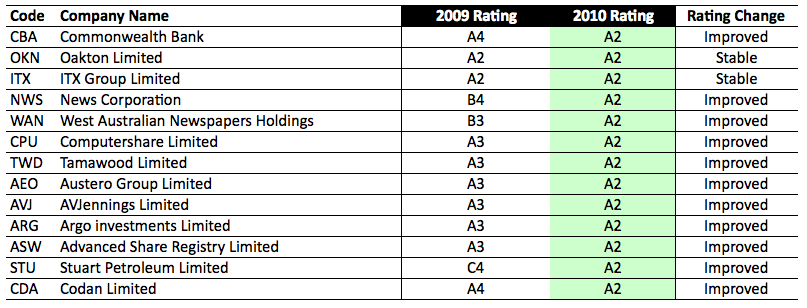

Moving on, another 13 companies have achieved my second highest rating of A2. They are listed below with their prior years rating so you can compare.

Noteworthy in this list is the excellent performance of the Commonwealth Bank (which I continue to hold in my Eureka Report Value Line portfolio, along with JBH and COH) and those companies I generally classify as being in the Information Technology sector including OKN, ITX, CPU and ASW. Both sectors appear to be doing well in aggregate.

While focus should always be placed on the A1’s (the top 5-7% of the market) at any one point in time, A2’s are still very high quality businesses. The use of the two lists in tandem will therefore provide you with an excellent starting point in isolating those who have reported high quality financials and performance levels above the average business. An important first step in the Value.able Montgomery brand of investing.

It is from here that I will select candidates worthy of further analysis (qualitative and quantitative) and possibly meet with company management, if I have not already done so. Once again I have taken you to the river I fish in, you have my fishing rods and tackle box. Now up to you to catch the right priced fish.

Please use these two lists as a starting point to conduct your own research and use Value.able as a guide to estimate your own valuations. If you don’t yet have a copy you can order one at www.rogermontgomery.com so you too can do your own valuations. Remember to always focus on the highest quality and best performing business available.

If you focus on the best when they are cheap and simply forget the rest, you should avoid more (if not all) of the disasters and should be able to build a portfolio that will give you a greater chance of out-performing the market.

Happy reporting season!

To be continued… Read Part II.

Post by Roger Montgomery, 17 August 2010.

Hi again Roger

If I want to do future IV values where can I get forecasted shareholder equity from?

Hi Deb,

You have to approximate it. I have laid out the steps in a previous blog post or comment.

Hi Roger,

Love the methodology set out in your book.

As a cosequence, I undertook an analysis of WAN Holdings using 2010 outturns and 2011 estimated financial projections..Roe was 143% and 82.6% respectfully.Adopting ROE selected of 60% and RR of 10% on the basis of 100% payout in 2011 I calculated an intrinsic value of $9.74

This calculation turned out to be about $1.30 higher than the 2010 calculation.

From your assesment of WAN would these assumptions be in the ballpark?

Hi Ron,

I get $5.54 for 2011, $5.76 for 2012 and $5.71 for 2013. Sounds like it just comes down to the discount rate you have adopted.

Hi again Roger, Being a newbie to (sensible!) investing, it is great to have your book as a resource to guide the process. You said recently that you’ve been trawling thru all the recently released company accounts. Isn’t there a computer program where you can tick all the boxes of the data you want and it will bring up all the companies that meet your criteria? I’m not familiar with any of them, but have seen talk of Metastock for example.

Also, it seems that even if we set up a table to find IV from the inputs, there are still some variables that we have to take into account that may determine whether we buy the share or not; I have seen examples in the comments on other pages; like abnormals (whatever they are), your talk on MMS’ recent acquisition affecting its future performance; how does a newbie take these extra things into account?

It is so great to have a forum where one can ask such questions and know you will get an answer and you won’t be scoffed at.

Many thanks for the opportunity.

Regards

Toni

Hi Toni,

There are many cases where nothing can replace experience. It simply takes time to see enough to know what to look for. That comes from self-protection because many years ago, I pulled the trigger without checking what was beyond the obvious target and missed things. The reality is we will continue to make mistakes and I am sure that by the time I am done, I will have made every one there is to make. Mistakes are refining and so you need to be prepared to accept there will be some. Don’t bet the farm and be conservative. More importantly, try to know what it is that you don’t know – establish your circle of competence.

Good morning Roger,

Fleetwood (FWD) was in the A1 gruop several months ago. The company has since made an acquistion of a Pre-fab manufacturing company. Has little debt and large amount of cash. Going by the figures that I can see, and information available. You have not mentioned this company for some time. Is it still in the A1 group?

Regards

Peter

Hi Peter,

I will give an update in the next few days. I do think that it is a little expensive at the moment but the upgrades to earnings have seen that valuation estimates rise.

Hi Roger

What is your current valuation for Telstra? Your last intrinsic value was $3.00.

Hi Nachi,

$2.30 now. Good question.

Hi Roger,

Based on the recent 4 corners program, would it be wise to wait for another market correction to get a price advantage? I noted that you quite correctly predicted when to re-enter the mkt just after the GFC. And, accordingly you advised every one.

Cheers

Peter

Hi Peter,

When those opportunities are available, it is really obvious. That is not the case now although I am not advising anyone of anything. There are a few good quality businesses that are cheap. I am no good at forecasting whether the market will rise or fall but when it appears to be really cheap I will share my thoughts.

Hi Roger,

Love the books and the articles. Is it too much to ask, in future, for you to add a column to your above tables to include IV?

This would give us the chance to mull over our worksheets and figure out where we may be going right or wrong.

Great stuff.

Thanks

Rob

Thanks Rob.

OK.

LLoyd, I just love your blogs,

“deleterious” is not a word I have heard for some time but your choice of words are supreme.

You enlighten us with your knowledge of the oil & gas sector.

Keep posting

Thanks Ashley,

Both you and Lloyd have emerged as Value.able contributors here. Please keep it up and many more investors will be saved from mistakes that have been repeated by those who don’t know about this blog.

Ashley/Roger,

Thanks for the kind assessment of my contribution.

The CVN 2010 results, released after my post, were pretty deleterious for shareholders in every way…that is to say in a polite way avoiding profanity that the result was *^#@ing awful. Every controllable factor headed south, minimal exploration write off, cash outgoings exceeding cash generation, equity/assets rising 22% for 38% less oil production and ROE collapsing to around 17.5% ( down from 48% in 2009) on the significantly increased capital base. This was 20% below analyst expectation at the end of FY 2010!

Now plug all that into the IV calc and you get IV falling to $0.33/share in 2010. This 58% less than the IV based on 2010 analysts forecasts of $0.57/share, just days before the results announcement.

But hey, never mind, according to the analysts the profit will rebound 67% in 2011 giving an 2011 IV of $0.66 cents making it appear yet again a bargain at a current share price of $0.33/share. Yeah right! I smell a rat in the analysts forecast for this company.

BIG MESSAGE : Please use IV calculations with great caution when seeking to evaluate and value oil and gas companies.

Regards

Lloyd

Thanks Lloyd,

I am doing EXACTLY that! And I trust Ashley is too.

Thanks Roger/LLoyd,

I actually don’t even bother doing an IV calculation on these types of stocks.

As you often say Roger there is much much more to investing than the formula alone.

Buffet always says he wants predicable future earnings.

Neither I nor analysts have the skills to predict earnings in these type of stocks

Roger,

Based upon MMS’s results released around the 17th August I now have an intrinsic value for them of around $9. That is using a 12% RR, forecasted ROR of approx 35% and a divdend payout ration of 54%. That said, should it be a red flag that their debt to equity is now at 158%? I notice that long term debt has gone from practically zero to $134million. I am assuming this debt is related to the aquisition of Interleasing?

I’d appreciate your feedback.

Cheers

sorry, i meant ROE of 35%.

Hi David,

The debt is indeed a red flag. I flagged it here when the acquisition was made and also mentioned that it would result in a lowering from A1 status. It does make me think of JB Hi-Fi in the earlier years when its debt was significant. Since then of course it has been paying it down. I think it is necessary to see evidence of strong cash flow from the acquisition, assisting in the repayment of the debt. This will also assist in the assessment of whether or not the profits have been boosted by manipulation of items such as payables, which can be obscured by acquisitions.

Hi,

From the recent Oakton (OKN) report, I have them valued reasonably more than my calculated value and 2001 forecasts seem positive. Currently priced around $3, small amount of debt that they’re looking to clear this year.

regards, Matt

Thanks for your thoughts Matt,

Does anyone else have any thoughts or insights into Oakton?

I have their IV declining in 2011 probably due to the higher Payout Ratio in 2011. It goes up again slightly in 2012. They are currently trading above my IV, therefore I will not be looking at them any closer until the price drops. I selected a ROE of 22.5 & my RR of 12.

Good stuff Pat.

Just read a comment regarding wesfarmers from a highly respected financial institution. Not to quote them verbatim but it went something like this.

it is obvious that WES paid far too much for Coles as return on capitial has fallen dramaticially and write downs are enevitable. This should not be a concern for investors as debt level are low and write downs of goodwill will not adversely effect gearing ratios..

Well escuse me.

Write downs of goodwill may not effect gearing ratios but they do effect shareholders wealth.

The destruction of shareholders wealth has allready happened it is just not reflected in the share price at the moment

Hi Ashley,

Sounds like they read part of the book but not all of it!

Hi Roger,

Loved the book. When you get chance could you have a look at Carnarvon Petroleum Limited (CVN)? Good ROE, retains all earnings, no debt. Seems to be trading well below my intrinsic valuation especially based upon 2012 forecasts. Would be interested to get your view.

Cheers

Hi David,

Thanks for the suggestion. You are right. I just had a quick look. Good ROE, no debt and trading at a discount to intrinsic value. Started with 78 million shares ten years ago and now have almost 700 million shares on issue. Only started making a profit in the last couple of years and thats forecast to increase – as is intrinsic value. Gets an A2 on my quality scoring. Perhaps Lloyd or someone else with up-close-and-personal insights might like to chime in about this one?

Roger,

You may have a different view, but I suggest that he IV valuation method utilizing the Montgomery tables is not really applicable to the oil and gas sector, particularly small, single producing asset companies like CVN.

Oil and gas companies produce a finite reserve from any field on a declining annual production basis. They have to continually re-invest via successful exploration to replace production. Exploration success is not guaranteed and the re-investment is usually at higher unit cost each round of the re-investment cycle. Moreover, oil prices can fluctuate by a factor of 0.5 to 2, year over year, producing huge swings in profitability and ROE. The assumption of a degree of continuity of the underlying economic efficiency (ROE) of an oil and gas company (which underpins Rogers multiplier tables) is at best problematic. To compound this, oil and gas accounting under Australian standards is subject to all sorts of financial engineering to overstate profitability, the key lever being the capitalization of exploration expenditure on an area of interest, rather than successful efforts basis (the latter being the US SEC standard). The net result is that many Australian oil and gas companies produce accounts that overstate short term profitability and thus ROE.

As to CVN, I have no specific knowledge other than the generalization that it has had a checkered performance history and is producing from a field in Thailand under very different fiscal terms to those that prevail in Australia.

The ten fold increase in shares on issue over the decade is a bad sign, with deleterious consequences for shareholder value.

The 2009 Income Statement reveals no exploration write-off in the last two years, suggesting a high capitalization rate and indicating the potential for overstated profitability.

The company’s accounts don’t break out exploration expenditure from development expenditure, which always rings a few bells of caution with me.

In 2009 the company produced NPAT $36 million, yet spent $36 million on exploration and development (with no write-off of any exploration expenditure). The performance of the last year based on reserves and production growth doesn’t look too shabby, but is it sustainable? The company is trading on and Enterprise Value (EV) of A$13.20/BBL while producing A$26.89/BBL earnings (NPAT). However, before you get too excited much of the remaining reserve will be produced 5-10 years out and with further capital expenditure required, thus requiring a major discount to be applied to the earning/BBL figure in the context of the value of future years production. Remember that oil fields always deliver the highest rate, lowest cost production in earlier years and unit production costs rise as production declines.

Now to the matter of IV. Using a 10% RRR the CVN IV was A$0.83/share in 2009 falling to A$0.57/share in 2010 (based on consensus EPS). This translates to EV/BBL of A$31.98/BBL falling to A$21.53/BBL in 2010. Compare this to the 2009 NPAT/BBL figure of A$26.89/BBL and it is clear that the IV methodology is delivering an outcome that overstates the worth of the company in this case i.e. with the calculated IV you potentially pay more than the the undiscounted profit per barrel produced by the company.

An accurate assessment would require detailed analysis of the CVN Thailand producing asset, its production, operating and and capital costs profiles together with an evaluation of the exploration program and exposure to drilling commitments, plus a view on 10 year oil prices, etc. etc. etc.

In my view CVN is not quite the bargain that the IV approach suggests.

Regards

Lloyd

Great Stuff Lloyd,

And you haven’t even begun to talk about the difficulty of predicting the price of the commodity itself! Further, the approach is doing its job if it is telling you that IV is declining. Stay away.

Firstly, thank-you Roger for your time and effort in producing Value.able and the insights on this blog.

Regarding CSL IV fluctuations mentioned above. With 10% RR and using 2yr avg equity, I have for 2010 an actual ROE 22.34% = IV $21.82. Or using estimated ROEs –

22.5% ROE = $26.24

25.00% ROE = $30.98.

I find that when buybacks, aquisitions etc occur it’s more about looking at past ROEs. Is this reasonable or is there a more methodical approach?

Hi Matt,

There are many ways of thinking about future returns on equity. Each year’s return on equity is not independent of the last so it is not a completely foolish place to start. As I mention in my book, I like to think about the implied growth rate that my ROE and POR combination produces. Of course the real work is in identifying the competitive advantage and its sustainability. Very few are truly sustainable in Australia, but if you can find them and then approach the valuation conservatively – and the shares are STILL below intrinsic value – then you probably have something.

Roger

I’m now glad I resisted the temptation to sell MMS in the Henry-driven downturn.

I wonder if you could use MMS’ 2010 results to cover the topic of ‘normalisation’ which often appears in results commentary when a co. has made a purchase or sale in the year. How should we adjust our calculations in such circumstances – should we just take the normalised numbers on trust?

No you shouldn’t Paul. Sometimes normalisation is not normal. Its a topic for a future blog and I would be delighted to cover it.

When I hear the term ‘normalised’, it makes me wonder what was ‘un-normal’ about the numbers in the first place. :) (like “hey, here’s a number that’s out of the ordinary, but if we mean / median it, it all becomes ‘more normal’ and gets massaged into the average).

If a number is ‘right’ in terms of accounts, it does not need to be made ‘more right’. A good profit etc. should just stand up by itself.

Hi Chris,

Good point. If abnormal profits occur more than once – they’re normal.

Just for my 2 cents on Kathmandu…

I believe that there are a LOT of similar retailers in Australia.

I can only speak for Melbourne and Adelaide, but there are at least half a dozen ‘outdoor’ stores all located in the city, selling the outdoor/camping gear. I think margins will not be strong for these businesses in the future as they will mostly be competing on price. down jackets and tents are, for the most part, a commodity product.

Further, based on my camping/hiking knowledge, I would classify Kathmandu as a relatively inferior product. I shop at Paddy Pallin because it is a retailer that only stocks the best ‘technical’ gear and I am happy to willingly pay more for it there than buy Kathmandus similar but ultimately inferior product. Kathmandu is not a great quality product like, for instance, ARB.

Kathmandu is just ‘another general retailer’ and I see nothing to suggest it will earn outsized returns on incremental capital. I am certain that competition will see to that.

Couple that with an overleveraged australian consumer and I would be very unwilling to invest in Kathmandu.

cheers

Justin

Thanks Justin. Really appreciate your contribution to the discussion.

Hi Roger,

Congrats on the book. Just finished reading it. Very funny how you make mention a couple of times to your lecture this year at Sydney Uni. I was actually present that day and had a great time.

I have just been looking at the numbers on Kathmandu and it appears to be trading at a significant discount to the intrinsic value after the profit downgrade. I know that it doesn’t tick all of your boxes (no debt, long track record of high returns on equity). But it is definately the undisputed leader in its field and has virtually no competitors in Australia (Except for Paddy Pallin – which only has a few stores).

I have valued it at $1.65 with ROE of 12%.

Did I also mention that it has James Strong as chairman!!

My only major concern is whether the outdoor adventure market is big enough in Australia to sustain the growth. It’s definately growing but by how much??

Regards,

Ben

Hi Ben,

Thanks for your kind words and I trust you had a fun time at my lecture.. I am not sure about your comment that competition is lacking. There’s BCF, North Face, Paddy Pallin, Rebel Sports etc etc…Perhaps not all direct competitors but certainly share of mind. I am very interested in what other readers know about the Adventure/Camping retail sector? Lets see if anyone with some retailing insights can make a comment Ben.

I recall Kathmandu Founder Jan Cameron stating in an article last year, prior to the new private equity owners floating the chain, that Kathmandu is incredibly vulnerable and that she has intentions to launch another outdoor-wear chain.

On a related, retail competition matter.

Jan Cameron also now owns the well established Tasmanian discount chain Chickenfeed, with intentions of taking it nationwide. Given her calibre it would be prudent to keep a close eye on TRS’ numbers if/when she does ramp things up. She donates all profits from this business to charity.

Thanks Gavin.

Hi Roger, given that some FY10 numbers are now historical, is it more appropriate to use the FY11 forecast numbers when determining a margin of safety?

I would think that given the businesses most accurately represent FY10 numbers currently that FY10 numbers may be more appropriate, but then the question becomes when to “roll forward” valuations to FY11 numbers?

Hi James,

The answer is a resounding yes.

Roger

Would you please comment on the CSL share buyback.

Thanks

DC

Hi David,

I have had a few requests for this one and I am looking at it presently. WIll be included in the next post.

Roger,

Thanks for your book which I have just finished for the second time. As a great beliver in the saying that ‘we learn by our mistakes’ I wonder if at some time you could share with us some of the ‘wrong-uns’ – those companies that you purchased shares in using ‘valuable’ methods that didn’t work out, and what went wrong.

Regards.

Hi Peter,

I am delighted to say that there has been one. Its on the public record. As you know I use a completely new and original approach to valuations now.

Hi Roger

I noticed you rated Argo Investments – Given that it’s a listed company which is made up of various equity investments. How did you come to the A2 rating?

Michael

Hi Mike,

Its all about stability and performance. You should find some discussion elsewhere in the comments on my blog about the A1-C5 “Montgomery Quality Scores”.

Hi Roger,

I thought you had previously written something on RFG, but a search didn’t reveal anything. Could you please add it to your list? I’ve calculated what I believe to be the IV, but I’d be interested in your thoughts on it’s quality rating. Thanks Roger.

Regards,

Craig.

Will do Craig. Thanks for the suggestion!

Roger,

I’m a bit surprised that MCE and RHD go straight to A1 after a good result. Don’t you feel that there is a risk that managmement haven’t proved themselves yet? I like to see at least a 3 year consecutive record of low debt and high ROE as a listed company before I feel confident to buy. Is it the case that if you see a company like MCE that is below your valuation then you are prepared to take a calculated risk?

Hi Damian,

MCE was established in 1982. They have taken decades to get where they are now and it only in the last couple of years (and next year) that the hard work has started to pay off. A little digging will reveal this is a family business that is one of just four in the world (and one might be going bust). They have a reputation for quality and some of the biggest companies in the world are their customers. So I don’t need Aaron or Max to prove themselves to me any. There is a lot more to the decision to buy than just the valuation. Its all in the book of course, so don’t skip straight to Chapter 11!

Hi Roger,

New to blogging, so not sure if this is the place to ask…

Has COU registered on your radar? Seems to have a high ROE and low debt. They have a high dividend payout ratio which i know from reading your book is not ideal.

Regards,

Kyle

Hi Kyle,

I will have a look for you and welcome to the blog!

Hi Roger,

What did you make of CSL’s FY2010 results announced today? Another share buy-back announced.

I read something interesting from the Business Spectator regarding the CSL result and buy-back:

“After last year’s massive buy-back, CSL has shareholders’ funds of $4.2 billion. It is about to embark on another $900 million buy-back. At this rate, in perhaps three years, it may not have any stated equity base left at all – and would have a return on equity approaching the infinitesimal! That would have the analysts and regulators scratching their heads.”

What do you make of this.

Thanks.

Hi Shaun,

A couple of requests for this one, so I will work through the numbers and the impact.

Hi Roger

For MCE, with payout ratio 17%, ROE 40% and RR 12%, IV is $7.56.

Any thoughts?

(Even if I’m out, you still must have got bargin!)

Cheers

Brad

Hi Brad,

You aren’t far from my numbers, just a bit higher. Don’t assume the payout ratio will stay at 17%.

Hi Roger,

Thank you for these two lists. I was wondering about Monadelphous (MND). It’s just reported a 57% ROE (62.5% when I put it through the Value.Able calcs) and is trading just (2%) below my calculation of I.V. at 10% RR. Any thoughts on that one?

Hi John,

Will get to it. The busiest time of the year for me. Will put it up on the next Blog Post. Thank you for the suggestion!

Hi Roger,

Even though you are probably sick of hearing this….thanks for the book. It is no doubt the most useful tool I have ever got my hands on.

Using your methods of obtaining intrinsic values I reach a valuation of $4.01 for servcorp (SRV) and $1.72 for Thorne Group (TGA). I was wondering how your valuations compare?

regards,

Chris

Hi Chris, Not sick of hearing that people appreciate the book and am delighted it is having such a positive impact on the way everyone here is investing.

Hi Roger,

I am a buy-and-hold investor. Have been having a lot of fun using your IV technique on my existing portfolio and wondering how to interpret the 2011 IV as companies announce 2010 results and analysts update forecasts.

My spreadsheet goes back more than 10 years. I have inserted IVs for the last 10 years (its v quick using the VLOOKUP function) and for 2011 and 2012.

Reviewing the results, what jumps out is the big swings in IV from one year to another (good examples are CBA, CSL and WPL).

Do you think IV would be more useful (as a buy indicator and a sell indicator) if ROE were to be averaged over 2 years?

Hi Martin,

You are not trying to smooth historical valuations. If the valuations jump around, it means the business performance also jumps around (that could be due to a whole bunch of factors). If it upsets you, you need to find those that are more stable. Thats what I do.

hi roger,

regarding forge again. currently they have ROE of at least 35% – 40%. would you use that to work out their current value or would you say that since they have no track record as of yet of producing these returns consistently, then we shall use say 25% ROE to work out their value? is that how you would go about it?

thanks.

Hi Ron, Always be conservative. You may miss opportunities but thats a lower cost than losing money (most of the time).

Hi Roger,

Great article, plenty of fodder for my newly acquired Value.able valuation skills.

In regards to FGE’s interim report, I am pleased to see another year of exponential growth, and it seems their order book is already full enough to beat 2010’s earnings (though as you suggest, their ROE may begin to slow).

What caught my attention was management signalling their intention to use their strong cash position to fund acquisitions. It seams they are loathe to go into debt, so I doubt we’ll be seeing large value destroying takeovers, but I wonder how this will play out and what it will do for FGE’s intrinsic value?

Hi Chris,

yes. And the reference to earnings “accretive” acquisitions is a worry too.

McMillan Shakespeare – Very happy i increased this position to very over-weight in my portfolio once the Henry tax news got cleared back on May 3. The run up to now was the easiest and safest money I have ever made I believe. And still, the current price is quite reasonable but I would not be comfortable being even more ‘concentrated’.

Curious to know if you have any personal rules on how big a single position can be Roger? I have been doing a lot of thinking in this area so would be interested to hear your thoughts.

Vishnal

The main reason these guys get taken out at below Intrinsic Value (based on Rogers Calcs) is that they generally get valued based on their size (‘small and risky’) as opposed to their quality (consistent high returns on capital). Most corporate advisers and independent experts often don’t recognise the latter, but for maybe adding a small premium to their valuations.

Hi Vishal,

Keep an eye on the borrowings Vishal and any dramatic changes in working capital! Check the balance sheet very closely. Yes I do have upper limits as rules for positions.

Hi Roger

It is interesting to see ARG in your list of A2 companies. I have looked at a few LIC’s as I only have a relatively small amount of capital to invest so thought they may be my best option. Can you let me know your general opinion on them as I’d have thought if the value of there holdings are generally expensive so will the LIC. You could buy wen they are trading to a discount to NTA to make up for this but they seem to be trading at a premium since the GFC.

FGE is one company that seems to have dropped off your list of companies in the top tier. I have a valuation of $4.68 so I’m happy to keep holding at the moment. The only thing in there report that concerned me was the forward orders for 2011 only being equal to 2010 so I’m hoping fr some new contracts soon. Like you said previous it looks as if current ROE is unsustainable. Any reason it’s no longer an A1 or A2?

Hi Andrew,

Forge hadn’t reported when I put the list together. Its still in the list. On ARG, I cannot give you any advice but generally, you can see over time that its performance mimics the aggregates.

Hi Roger,

Must say, it’s exciting reading a company report and actually understanding what it is I’m looking at. With that said, was most impressed with the 2010 results of FGE. To me, its one of those companies that as you like to coin – “Ticks all the boxes.” Based on 2010 results and rounding down to 30% ROE, I have an intrinsic value of $7.98 for 2010. I note you gave an intrinsic value of $4.62 which I had as well for 2009. Does your value for 2010 match mine?

Hi Mani,

The intrinsic value of Forge is rising. Just keep an eye on what acquisitions they make. They said the phrase “earnings accretive” which always worries me because its not based on returns.

Hi Roger

thanks for sharing your thoughts on MCE.

I got interested in this company a couple of months ago and thought it had the hall marks of an undervalued A1, my calculations were a long way from the current price but I still questioned whether I was right about this one. Your post has confirmed that what I have learnt from your book and blog is working. I have an efficient valuation spreadsheet now and greater confidence in my decisions.

Hi Craig,

It takes time be confident in your valuations. Nothing can replace the benefit of trial and error. Glad to hear you have an “efficient spreadsheet” working. Well done. I am delighted the book is having a positive and profound impact on your investing.

Hi Roger,

Thanks so much for these great insights. I appreciate the fact that you have shared these companies with us including one you have taken an interest in yourself. It certainly helps to narrow down the candidates for further research. In regards to MCE, using the ‘Montgomery Value.Able method’ (or at least attempting to) I came up with a very conservative (in my opinion) valuation of around $5.60 – and a much less conservative one of close to $9.00. What do you think about that and is it close to your own estimate?

Steve

Hi Steve,

I won’t go and check your work or try to establish the source of any difference. A I say in the book, the point is that real bargains are obvious. Of course that doesn’t mean the share price cannot halve. I cannot predict the short term direction of share price.

Hi Roger

First off I must compliment you on a great book.

There is 1 part that I am having trouble understanding. In the worksheet Step B how did you come up with the “Reported Dividends” figure?

Do you multiply the number of shares by the dividends paid per share?

Hi Daryl,

Go to the annual report and look at the notes for the balance sheet item “retained earnings”. Its all there. Its often around note 23 or 24. You may also find it right after the balance sheet on a page called “Changes in Equity”.

Hi Roger,

Monadelphous (MND) did not make your list ? did it miss your publishing cutoff ?

Regards,

Paul

WIll have to check that Paul. Thanks for bringing it to my attention.

Hi Roger,

I’ve notice in my relatively short history of investing in the stock market that many of these smaller higher quality companies (such as ITX, RHD and FGE) tend to become takeover targets and the price paid for them is not necessarily adequate to compensate shareholders for:

1) their current intrinsic value

2) their future rate of growth in intrinsic value

Alas for many of these smaller star performers we are left having to accept a lowish takeover price and not get the full benefit of the upside so to speak. Any thoughts on this subject?

P.S Thank you so much for your book. I am extremely grateful for the knowledge it has provided me.

Regards,

Vishal

Hi Vishal,

YOu are right. It is frustrating and I don’t think shareholders are getting a great deal especially when the acquirer debt funds the acquisition and you end up with their stock!

Roger,

I nearly fell out of my chair when I saw A V Jennings on your list of A2 companies. I have always regarded them as something of a basket case, and a highly risky investment. It seems I was wrong ?

Hi Ken,

Big improvement in cash flow in the last 12 months. Note the drop in borrowings and increase in cash. Significant drop therefore in probability of ‘default event’.

G’day Roger,

Congratulations on the popularity of your book; it was easy to read and understand.

The main thing I got out of it (apart from the valuation tools) was a clearer idea of what to look for in annual reports and profit results. All of a sudden things like debt levels and ROE are sticking out like the proverbial dog’s and I can see why I shouldn’t have been holding ‘popular’ stocks like WDC and TTS, to name just a couple. It is also now clear to me that small caps can’t all be bundled into the speculative basket.

Like many others I’ve been ‘playing’ with different stocks’ numbers since reading Value.able. Today’s FGE numbers gave me an IV that I’m finding hard to believe is correct. I’ll have to re-run it a few times to make sure.

Thanks for all of your effort in schooling investors like me. Of course the learning never ends in this subject, but it’s nice to get a leg up every now and then. Adding words like ‘didactic’ to the vocabulary – possibly a side-benefit.

Cheers.

Thanks Adam,

As I have said to so many investors, I am delighted that my book is having such a positive impact – vocab expansion notwithstanding.

Hey Roger,

Clearly exactly how you rank companies into your various A1 to C5 categories is something you probably don’t want to disclose to everyone, however are there any notable investors or authors/ researchers etc. that you would recommend reading about to help in assessing the bankruptcy risk side of the equation and the aspects of probability that you have briefly mentioned as being added to your formula, or are these insights things that you have developed yourself through observations etc.

Cheers,

Nick

Hi Nick,

Its not a failure per se that I am watching for but rather chances of a ‘default event’. Capital raisings, covenant breech, underwritten DRPs are all included in my definition of ‘default events’. I am delighted to announce that experience has played no part in it. That means that anyone can pick it up.

i meant for the latest 2010 results. cheers.

hi roger,

been looking at forge group. i have current valuation range of $8.65 – $11.91

does that seem ballpark or am i way off? thanks

Hi Ron,

I have $4.62, so yes, it does seem like you are being a little optimistic somewhere there. Mind you I am not using the current ROE to project forward because I don’t think that is sustainable. So your numbers may indeed be right, if you believe the company can keep generating those ROEs.

Hi Ron,

I’ve got FGE’s current valuation based on their actual 2010 results at $10.66 assuming an 11% IRR and at $13.42 for 2011. Based on Roger’s IV, it looks like my numbers may be wayward as well but I’ve checked them against FGE’s 30/6/10 preliminary final report and still come up with the same answers. Input from others would be most welcome in case I’ve missed something.

Perhaps the RR is a bit low guys.

Hi Roger,

How do you classify a stock as an A1? What specific attributes do you use?

What’s the difference between an A1 and B1?

Thanks

Hi Mike,

Thanks for your question. Unable to answer it at this time. I hope you are finding the ratings helpful in your analysis though.

Love your book Roger, but I must be one dumb guy, because I can’t get your numbers to match up. For example, WOW reported dividends are $1174.3, exactly the same as the 2009 Cash Flow Statement, but FGL is $524.6 and the 2009 Cash Flow Statement shows $476.2. If I can’t get the right numbers in, I can’t get a meaningful result!

Hi Ron,

Go and take a look at the notes to the retained earnings in the annual report. The section number will be next to retained earnings in the last section of the balance sheet.

Roger,

You mentioned that the 13 A2 companies are “listed below” but I can’t see them ?

Hi Ken,

Try refreshing your page. It worked for me.