The 3 words that tell me this property boom is over for now

The key driver for the short and medium-term direction of the Australian property market can be boiled down to just three words: access to credit. And, right now, the conditions for credit access are getting tighter. To my mind, it all points to a property market that is about to lose its froth.

I like to think we’ve been a helpful source of information about the likely direction for the property market over the years. Back in 2015 and 2016 we explained the market would decline and it did.

The slide

In 2015 we wrote “Glenn Stevens stated recently that he views some developments in the Sydney property market as “crazy” and “acutely concerning.” Adding “mortgage approvals pulled back 7 per cent in May relative to April. This could signal that APRA’s message is starting to be heeded.”

Doubling down on our view of the property market, in early 2017 we wrote here:

“…when the RBA says the issue with housing affordability is ‘supply’ they ignore the data produced by Prosper.org and others that show, for example, there are 80,000 vacant apartments already in Victoria alone. Negative rental growth also suggests supply is not an issue. According to CoreLogic’s asking rental price series, Australian rental annual growth turned negative in 2016 while the ABS’s established rent series shows rents have slowed to the slowest pace since the early 1990s recession, which itself was the worst economic downturn since WWII. What is an issue is speculative fervor and speculative fervor only.”

The property market bottomed, amid a collective sigh of relief, when the Liberal National party won the 2019 Federal Election. And since then the property market has been off to the races. More recently, another shot in the arm for property investors was to arrive in the form of the Term Funding Facility (TFF), which allowed banks to borrow at rates close to zero, and targeting of the yield on the April 2024 bond by the RBA – both providing banks with the fuel to offer sub-two-percent fixed rate mortgages over three and four years.

The boom

We wrote here last year: “If you think residential real estate in our major cities is already too expensive, then hang onto your hat. Because I think the conditions are right for home prices to explode.”

Since then of course real estate agents around the country have reported “insane” behavior at auctions where vendor reserve prices were smashed by millions and buyers agents describe “…crazy, stupid money forcing prices up.”

While agents try to explain the conditions as a function of a shortage of supply, or lockdowns, or a pre-Christmas rush, the reality is that there is one indicator that explains it all.

We don’t have a crystal ball but we do believe all of these factors fall under the umbrella provided by an indicator that explains the majority of short and medium-term movements in property prices in Australia.

Some years ago, we explained the direction of the property market can be explained by access to credit. Whether it’s the TFF, yield curve targeting, first home buyers grants, APRA restrictions on investment and interest-only loans, or some other macro-prudential measure, it all falls under access to credit.

Loosen access to credit and house prices rise. Tighten or restrict access to credit, by any measure, and all of a sudden properties are being passed in at auction and real estate agents are scrambling to explain what’s going on.

The boom is over (for now)

The conditions for credit access are changing. In early October APRA announced an increase in the minimum interest rate ‘buffer’ it requires banks to employ when assessing serviceability for new home loan applications. The buffer was increased from 2.5 per cent to three per cent above the rate offered on the product.

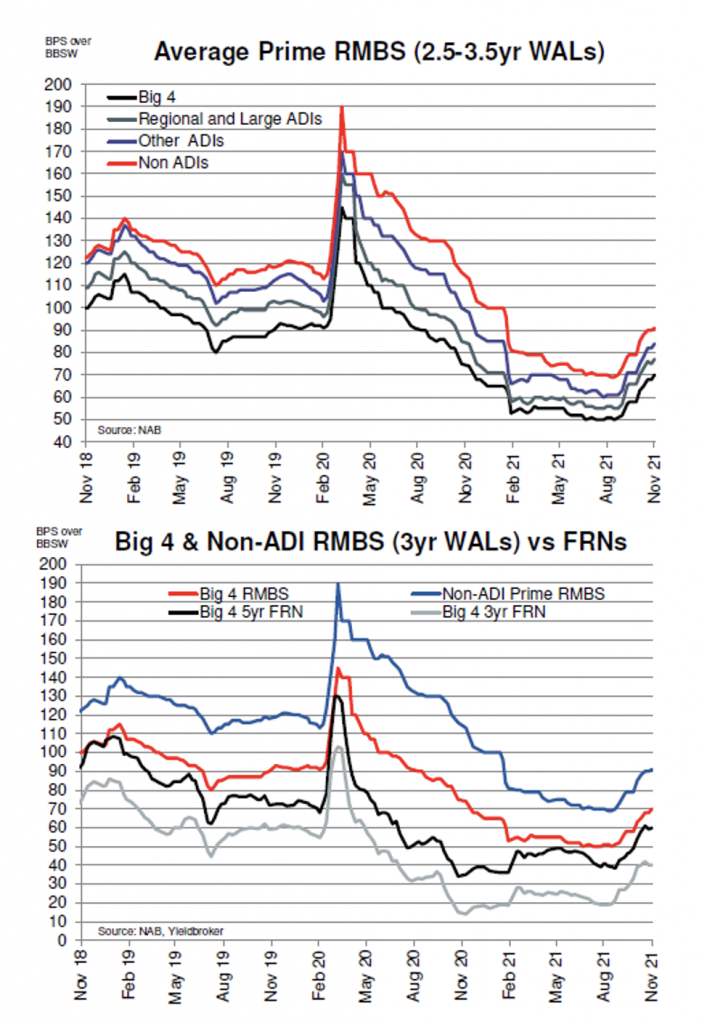

Additionally, the cost of access is rising. As Figure 1., below reveals, the cost of bank funding is rising.

It all points to a property market cooling. Stay tuned, by subscribing to our blog, and find out what happens next. We’ll keep you up to date.

Figure 1. Bank funding costs bouncing off all time lows

Source: NAB

You can read my previous articles here:

2015: Will APRA remove some of the fuel from the housing fire?

2017: We could be wrong about the property bubble (but we don’t think we are)

“The key driver for the short and medium-term direction of the Australian property market can be boiled down to just three words: access to credit. And, right now, the conditions for credit access are getting tighter. To my mind, it all points to a property market that is about to lose its froth.”

Yes, that is true but interestingly enough there has never been a period (in New Zealand at least) where if you took a 10-year sliding scale, that property prices were cheaper at the end compared to the beginning. In other words, like stocks, things go up and down but over the long term, they go up.

And in particular, in places like I live, which is the beautiful town of Whanganui, New Zealand, there is a supply issue. There are lots of buyers and not enough sellers. You can see local property listings here https://www.whanganuimansions.co.nz/ and there are only a couple of hundred in a town of about 48,000. But interest rates are going up and we have a lot more properties on the market now than we did a month ago so maybe things are starting to cool…

Thanks Steve,

agree with that.

Yes, prices may drop. But let assume property prices drops 10%, with so many borrowers, you can be sure of one thing. The reserve bank, federal government, and retail banking section will jump in with measures to keep prices stable or growing. History has proven this over and over again. I bet you in 10 years time prices will be more than today. Please correct me if I am wrong.

Thats been our view for a long time Wade. I wrote about it in the Australian last year:

Residential property dominates the assets held by Australia’s household sector, residential mortgages account for 62.8 per cent of the debt held by households and the construction industry is the third-largest employer in Australia.

Consequently, the one thing the government, regulators and the Reserve Bank does not want is a full-blown housing collapse. And for that reason, the probability of experiencing one is very low.

Property bears should also remember that thousands of property owners have been lured by the government into becoming property owners through incentives such as first-home buyers’ grants, mortgage guarantee schemes and, most recently, the HomeBuilder scheme.

In 2018, I reported that as much as 50 per cent of all loans written in 2014 and 2015 were interest-only. These were due to mature in 2019 and 2020, but only after a 30 per cent cap was placed on the proportion of “new” mortgages banks could write as interest-only. The combination meant that, despite rising arrears and mortgage stress, a large proportion of people who borrowed on interest-only terms in 2014 and 2015 would be forced on to unaffordable “principal and interest” loans in 2019 and 2020, sending the property market crashing via a wave of forced sales.

To prevent that cataclysm, protect the banks and stabilise the financial system, the regulator — the Australian Prudential Regulation Authority — simply changed the rules.

It redefined what a “new loan” was and prevented a tsunami of interest-only borrowers being forced onto principle-and-interest loans.

Crisis averted

As investors, we watch rental vacancies and employment, auction clearance rates, interest rates and policy settings as well as rent-to-mortgage comparisons, household debt and a raft of other things.

But I believe that there are far fewer signals investors have to consider. In the very long term, migration is the determinant for property prices. Commencing in 2007 with Kevin Rudd’s Big Australia policy, Australia has witnessed a net migration increase from 100,000 people per year prior to 2007 to about 240,000 per year more recently.

While many pundits lamented the COVID-inspired cauterising of migration in Australia, they forgot to include the 385,000 expats with secure jobs — who therefore have an ability to access credit and leverage — looking to return to Australia to live. This will drive demand for high-end homes as well as holiday homes.

And property investors should remember that the top-end homes — often referred to as trophy homes — will always work like a call option over the success of any industry. Whether individuals succeed in retail, finance, mining, energy, property development, IT or biotechnology, success fuels the desire to own a trophy home. In the absence of a depression, owners of such homes will always be able to sell to someone who has also been successful, ensuring suburb records will continue to be broken if not smashed over one’s lifetime.

And of course, business success has been sustained by 37 years of declining interest rates.

So, while migration is arguably one of the most important determinants for property prices long term, in the shorter term it is simply the availability of credit that will influence residential real estate prices.

On that front, there has been some important and arguably very bullish news. On September 25, the government proposed legislation to remove the responsible lending obligations from the National Consumer Credit Protection Act 2009. The change is aimed at reducing the time and cost of credit assessments for consumers and businesses and speed up lending by banks that had become almost scared to lend after the Financial System Enquiry and subsequent royal commission.

Josh Frydenberg said the government was seeking to remove a one-size-fits-all approach, noting that: “Responsible lending has become restrictive lending.”

Loosening the reins on lending by banks, lowering bank funding costs or supporting mortgage funding directly is either directly or indirectly supportive for property prices — and especially when four-year fixed rates are already at 1.98 per cent.

All up, property owners are a protected species.

There is one caveat however, and that is that the government’s plan to lessen the protections of responsible lending requirements faces an arduous journey in the Senate. Labor has heard the cries and petitions of victims of past poor bank behaviour and is working to retain the credit rules. Labor’s financial services spokesman, Stephen Jones, acknowledged there were serious issues relating to the flow of credit, but added that rolling back consumer protection was a “no-go zone”.

Nevertheless, and on balance, the influences for property prices are overwhelmingly positive.

To the main fundamental drivers of property prices, such as interest rates, wage growth, access to credit and migration, you must also add the desire by the banks, the regulators and the government to protect the wealth of Australians and the financial system by pulling all stops to avert a property collapse. Add to all of that record low interest rates and you have all the ingredients for a boom, backstopped of course by state and federal governments and a central bank and regulator incentivised to keep the property market supported but not frenzied.

Roger Montgomery is the founder and chief investment officer at montinvest.com