To visit the February 2026 reporting season calendar Click here .

-

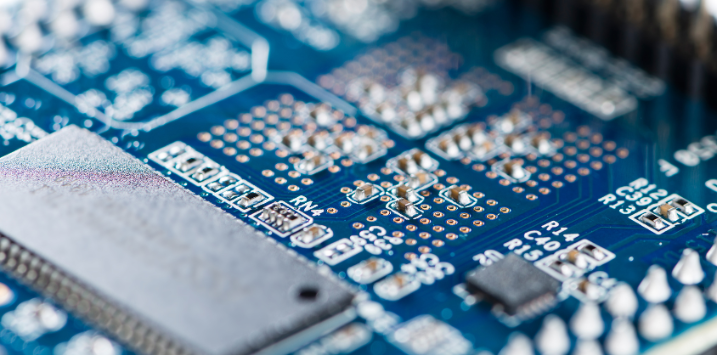

Altium: An extraordinary roller coaster over its 25-year listed history

David Buckland

February 23, 2024

In this weeks video insight, David takes us through Altium Limited’s (ASX:ALU) 25-year listed history, marked by a recent bid from Renesas Electronics Corporation valuing it at AU$9.1 billion. From highs of $6.70 per share in 2000 to a record low of $0.09 per share in 2011, Altium has experienced significant fluctuations. However, since fiscal 2012, there has been a turnaround with notable revenue growth and improved earnings before interest, taxes, depreciation, and amortisation (EBITDA) forecasts. Continue…

by David Buckland Posted in Companies, Stocks We Like, Video Insights.

- watch video

- save this article

- POSTED IN Companies, Stocks We Like, Video Insights.

-

The USA has had one budget surplus in 23 years. Is the debt to GDP path unsustainable?

David Buckland

February 22, 2024

In the past 23 years, the U.S. has produced one budget surplus (fiscal 2001) and 22 budget deficits. The past four budget deficits, from fiscal 2020 to fiscal 2023, inclusively have seen an aggregate budget deficit of $9.0 trillion and an average annual budget deficit of U.S.$2.25 trillion. Continue…

by David Buckland Posted in Editor's Pick, Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Editor's Pick, Market commentary.

-

MEDIA

ABC Nightlife – Forecasts for 2024 and reporting season updates

Roger Montgomery

February 21, 2024

In this week’s ABC Nightlife interview, I joined Phillip Clark to kick off the year and make some forecasts for 2024. We also discussed the latest news from this reporting season. You can listen to the full interview here: ABC Nightlife – Forecasts for 2024 and reporting season updates

by Roger Montgomery Posted in Radio.

- LISTEN

- save this article

- POSTED IN Radio.

-

Megaport half yearly: A solid, albeit pre-announced result

Roger Montgomery

February 21, 2024

Megaport (ASX:MP1) announced its half-yearly results on Tuesday. As the numbers were largely pre-reported at the company’s previous second-quarter announcement on 30 January, they were considered ‘in-line’ with expectations. Continue…

by Roger Montgomery Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Altium’s share price soars on take-over bid

David Buckland

February 21, 2024

Altium Limited (ASX:ALU) was floated on the ASX in August 1999 at $2.00 per share, and the market bought into the excitement by driving up the share price to $6.70 by March 2000. 11 years later, the company was going through enormous pain, and this saw the Altuim share price crash to $0.09 by mid-2011, down 98.7 per cent from its record high. Continue…

by David Buckland Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.

-

Deterra Royalties half-yearly result: stable performance and growth Initiatives

Roger Montgomery

February 20, 2024

Deterra Royalties (ASX:DRR) was established through a strategic demerger from Iluka Resources Ltd (ASX:ILU) in 2020. At the core of Deterra Royalties portfolio lies long-life, Mining Area C (MAC), a premier iron ore mining operation in the Pilbara region of Western Australia, operationally managed by BHP. This key asset is underpinned by a royalty agreement that ensures Deterra Royalties receives quarterly payments equivalent to 1.232 per cent of the revenue generated, alongside substantial one-off payments of A$1 million for each dry metric tonne increase in annual production capacity. Continue…

by Roger Montgomery Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.

-

Reporting season: my thoughts so far

Roger Montgomery

February 20, 2024

The domestic economic backdrop, characterised by 13 interest rate hikes, and consumer malaise brought on by the persistent inflation-induced cost of living pressures, had set the stage for modest, if not dour, expectations for reporting season. Continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies.

-

Investing in success: a look into ARB Corporation’s half-yearly results

Roger Montgomery

February 20, 2024

Investors in the Montgomery Small Companies Fund, take note; ARB Corporation Limited (ASX:ARB) has just released its half-yearly financial results for the period ending 31 December 2023, and there’s plenty of good news to unpack. As long-term fans and as shareholders in ARB, we’re keen to understand how the company is performing and what strategies it’s implementing for future growth. Continue…

by Roger Montgomery Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.