To visit the February 2026 reporting season calendar Click here .

-

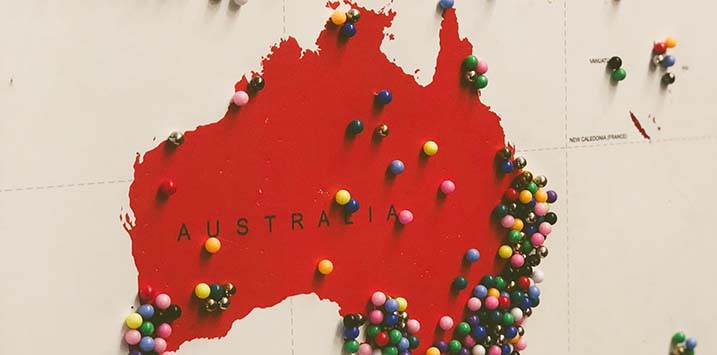

Are foreign students really a $40bn export industry?

Andreas Lundberg

May 6, 2021

The education industry is fond of stating that foreign students studying in Australia represent a $40 billion export industry.* And it’s using this ‘export’ benefit to push for an early re-opening of our national borders for foreign students. I’m not denying that education is a sizeable export, but is this $40 billion figure actually correct? Continue…

by Andreas Lundberg Posted in Tourism.

- 4 Comments

- save this article

- 4

- POSTED IN Tourism.

-

Universal Store continues to grow sales

Stuart Jackson

May 5, 2021

Universal Store (ASX: UNI) is a youth-focused retailer of trend-led and casual fashion, shoes, accessories, lifestyle and ‘gifting’. It only listed last November, but has managed to surprise market estimates to the upside three times since then with impressive and accelerating rates of organic growth. Clearly, it’s a great story, and I like the firm’s short to medium term prospects. Continue…

by Stuart Jackson Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.

-

For the Australian economy, it’s full steam ahead!

Roger Montgomery

May 4, 2021

Compared to most other major economies, Australia is now in a sweet spot. After breezing through the COVID-19 pandemic, economic growth is above expectations, unemployment is low, and the outlook for business is incredibly positive. If you add low rates and ongoing government support to the mix, it all adds up to a rosy near-term outlook. Continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary.

- 1 Comments

- save this article

- 1

- POSTED IN Editor's Pick, Market commentary.

-

Finding opportunities in small companies

Gary Rollo

May 4, 2021

There are over 2,000 companies listed on the ASX and most of them are small caps presenting huge investment opportunities in ASX small cap stocks, but how do you know which ones to invest in? We look for exposure to high-quality businesses that exhibit considerable growth and will come out of the pandemic in a stronger competitive position.

by Gary Rollo Posted in Companies, Investing Education.

- watch video

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Investing Education.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

More strong Quarterly results, particularly from Facebook and Amazon

David Buckland

May 3, 2021

Facebook’s March 2021 Quarter revenue increased 48 per cent to $26.2 billion from $17.7 billion with strong demand for advertising from the social network’s 2.85 billion monthly active users, across its Facebook, Instagram and WhatsApp platforms, up 10 per cent. Net income in the March quarter jumped 94 per cent from $4.9 billion to $9.5 billion, easily exceeding analysts’ expectations. Continue…

by David Buckland Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.

-

How to estimate intrinsic value

Roger Montgomery

April 30, 2021

In this educational video Roger shares the steps for estimating intrinsic value using the formula from his book Value.able. Back in February 2011 when he applied the formula to Woolworths Roger arrived at an intrinsic value of $23.36. Today, he share with you the steps to update the estimated intrinsic value of Woolworths keeping in mind the biggest change over the last 10 years – a significant decline in interest rates. Continue…

by Roger Montgomery Posted in Editor's Pick, Investing Education, Video Insights.

-

Is Megaport at an inflection point?

Tim Kelley

April 29, 2021

Network as a Service provider (NaaS), Megaport (ASX:MP1) is a company we follow with interest, and one that we have commented on in several previous articles. Continue…

by Tim Kelley Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.

-

Polen Capital Global Growth Fund’s holdings and the bumper March Quarter results

David Buckland

April 28, 2021

In terms of the weighting of the Polen Capital Global Growth portfolio, each of Microsoft, Alphabet and Starbucks produced bumper March 2021 Quarterly results and a summary follows. Continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like.