To visit the February 2026 reporting season calendar Click here .

-

MEDIA

The Australian’s Money Cafe: why Aussie small cap stocks are ready to rebound

Roger Montgomery

April 28, 2023

Roger joined James Kirby on The Australian’s Money Cafe podcast to discuss a green light for small caps, the dangers of ‘over contributing’ to super, why the ASX is reasonable value just now and whether we should worry about US banks.

by Roger Montgomery Posted in On the Internet, Podcast Channel.

- READ ONLINE

- save this article

- POSTED IN On the Internet, Podcast Channel.

-

MEDIA

Ausbiz: Why Roger’s bullish on Transurban

Roger Montgomery

April 28, 2023

In this interview with Ausbiz Roger discusses two companies we believe have bright prospects ahead including Transurban (ASX:TCL) and Alliance Aviation services (ASX:AQZ). Roger emphasizes Transurban’s ability to secure substantial debt at very low rates, with 96.8 per cent of its debt book having interest hedging in place. Watch the interview: Why Roger’s bullish on Transurban

by Roger Montgomery Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

The Polen Capital Global Growth Fund receives a “Recommended” rating from Lonsec

Dean Curnow

April 28, 2023

We are pleased to announce that Lonsec, in their second year of coverage, has upgraded the Polen Capital Global Growth Fund (Class B Units[1]) to ‘Recommended’. This is the second highest rating available for strategies they research. Continue…

by Dean Curnow Posted in Polen Capital.

- save this article

- POSTED IN Polen Capital.

-

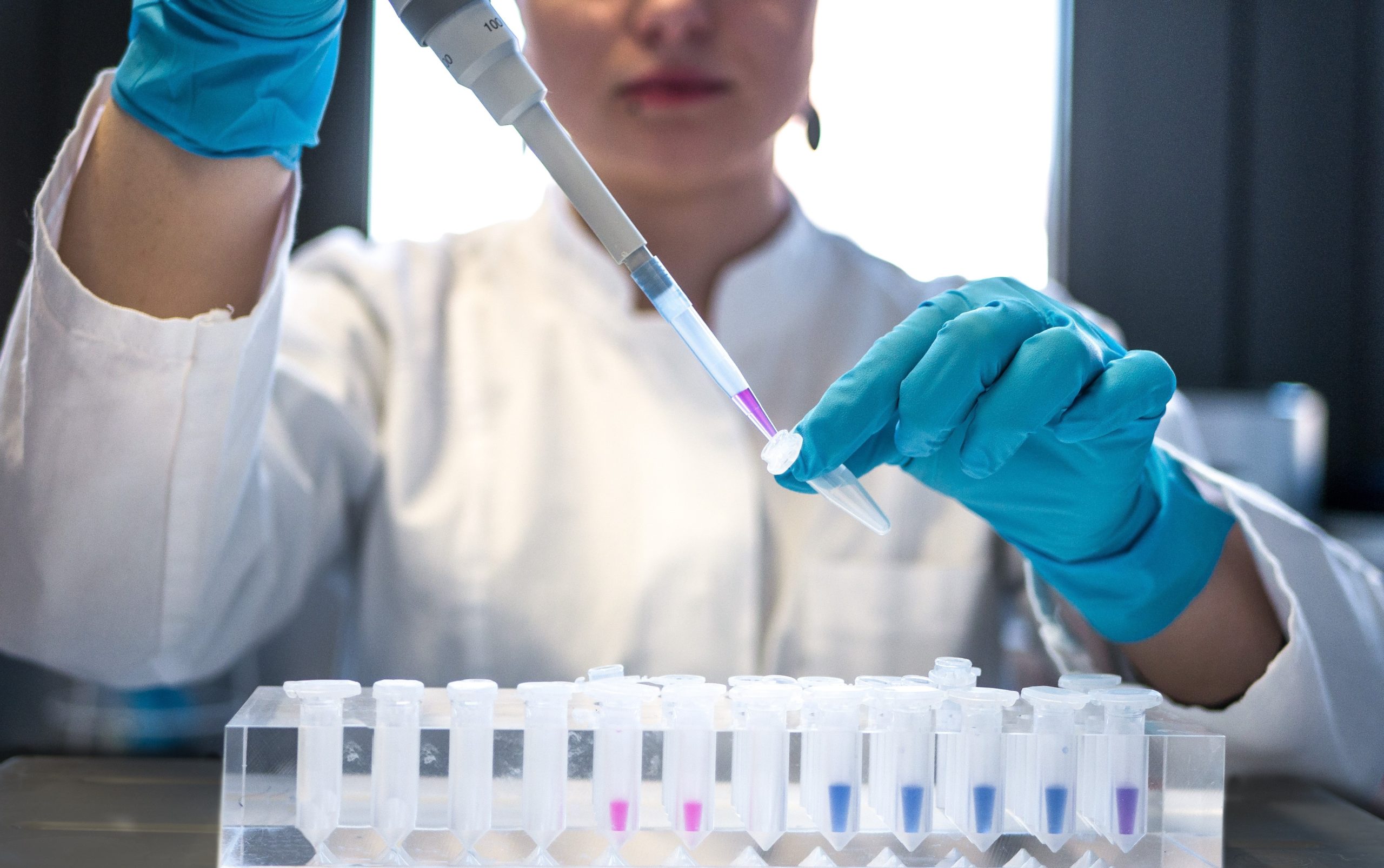

Why Australian Eagle believes CSL is a ‘dream company’

Sean Sequeira

April 27, 2023

CSL Ltd (ASX:CSL) – which labels itself as a multinational specialty biotechnology company – has long been one of the stars of the Australian market. Since listing in 1994, CSL has not missed a beat, with its share price soaring a massive 25,000 per cent. It’s a long-term holding in the Australian Eagle portfolio and, with great management and a solid growth outlook, we continue to like what we see.

by Sean Sequeira Posted in Companies, Editor's Pick, Health Care, Insightful Insights.

- 4 Comments

- save this article

- 4

- POSTED IN Companies, Editor's Pick, Health Care, Insightful Insights.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Significant contract win for Corporate Travel adds to strong momentum

David Buckland

April 26, 2023

This month Corporate Travel Management announced its largest ever contract win, worth around A$3 billion with the UK Home Office for Bridging accommodation and Travel Services. Under the contract, they will effectively be placing refugees and asylum seekers in accommodation. A record 45,000 migrants arrived in the UK on small boats in 2022, and PM Rishi Sunak has said finding a solution to this issue is a top priority. Continue…

by David Buckland Posted in Airlines, Companies.

- save this article

- POSTED IN Airlines, Companies.

-

Barrenjoey issues its economic outlook – and it’s all a bit grim

Roger Montgomery

April 24, 2023

Recently, our small-cap team listened to Barrenjoey Capital’s chief economist, Jo Masters, discuss the prospects for the Australian economy. In brief, Masters forecasts the economy to slow rapidly and unemployment to rise to five per cent, with a recession the most probable outcome. She also foresees persistent inflation, which will force the RBA to hold interest rates at the current level until May 2024. If she’s right, investors are in for interesting times ahead. Continue…

by Roger Montgomery Posted in Economics, Market commentary.

- save this article

- POSTED IN Economics, Market commentary.

-

Takeovers take the market stage

Michael Gollagher

April 21, 2023

In my blog post last month, ‘Volatility is the window to opportunity’ I discussed how recent market volatility may represent an opportunity for investors to take advantage of investing in quality long-term assets and distressed assets at significant discounts. Interestingly, it did not take market participants too long to recognise these opportunities and to act on them. Continue…

by Michael Gollagher Posted in Companies, Insightful Insights, Market commentary, Takeovers.

- save this article

- POSTED IN Companies, Insightful Insights, Market commentary, Takeovers.

-

How the Australian Eagle Trust Long Short Fund has achieved its outperformance*

David Buckland

April 20, 2023

Australian Eagle Asset Management, one of Montgomery’s four business partners, launched the Australian Eagle Trust Long Short Fund on 1 July 2016. It is effectively a 150/50 Fund, “long” its best 25-35 stocks with an average weight of around 4.5 per cent, and “short” 12-25 stocks with an average weight of around 2.5 per cent. The Fund is appropriate for investors with a “Very High” risk and return profile. Continue…

by David Buckland Posted in Companies, Editor's Pick, Market Valuation, Montgomery News and Updates.