Looking to: China Rongsheng Heavy Industries

We have written about China Rongsheng Heavy Industries, one of the largest shipbuilders in the world, on several occasions. (See our posts from August 2012, and July 2013).

Rongsheng has been added to the growing list of Chinese companies effectively in default. With their results out for the year ending December 2013, we find it interesting that the company’s auditors, PricewaterhouseCoopers, have finally issued a report citing “multiple uncertainties relating to going concern”.

Rongsheng reported a horrendous year – revenue was down 84 per cent to RMB1.3b (US$0.2b), which produced a loss of RMB8.7b (US$1.4b). Net debt stood at RMB22.8b (US$3.66b), which compares with equity of RMB6.2b (US$1.0b). Current liabilities exceeded current assets by RMB6.68b (US$1.07b) and the company’s ten banks have extended repayment and renewal terms on its debt, known as the “debt optimisation framework agreement”.

The company’s founder, Zhang Zhirong, has provided an unsecured interest-free loan of RMB3.0b (US$0.45b) for working capital purposes.

Industry improvement is unlikely to lift Rongsheng out of its financial mess and offshore investors, whom have acquired HK$2.4b (US$0.3b) of convertible bonds in August 2013 and January 2014, will be looking closely at the security of their paper.

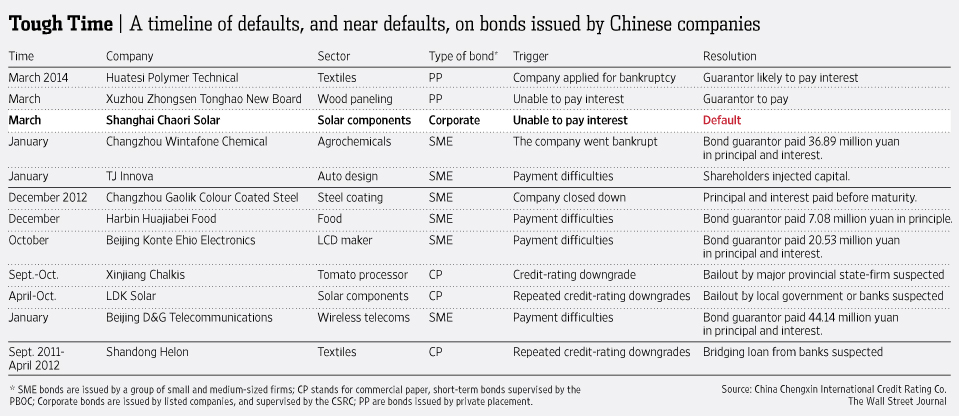

Also worth a look is this timeline of defaults and near-defaults on bonds issued by Chinese companies.

One must always apply due diligence when deciding to invest in any endeavour. China will have many stories like this as it grows and awakens from its economic slumber. It’s power to consume will gain a greater appetite and i believe we still have yet to see it even shift into a stable gear. Once it finds it’s pace, it will be an absolute powerhouse.

We tend to think in a short time frame in theses matters but China has a long way to go in this story of growth, there will be many distracting stories and there will be many events that will rock the economy. A long term view must be kept. It’s eventual returns on the economy must be considered.

As for companies going under or bankrupt, well China isn’t the only country with those problems. We only have to look at our own backyard and see the list of Resource companies chewing through cash and inevitable demise.

yes but isn’t the Chinese government awash with cash ( over 1 Trillion ),

so they will simply throw money at these companies rather than let them go under ?