Industries most affected by the East Coast drought

The drought currently impacting much of eastern Australia is already having significant impacts on numerous businesses and industries. With the Australian Bureau of Meteorology forecasting drier than average conditions for the second half of November and December, it’s worth considering which industries could feel the most pain.

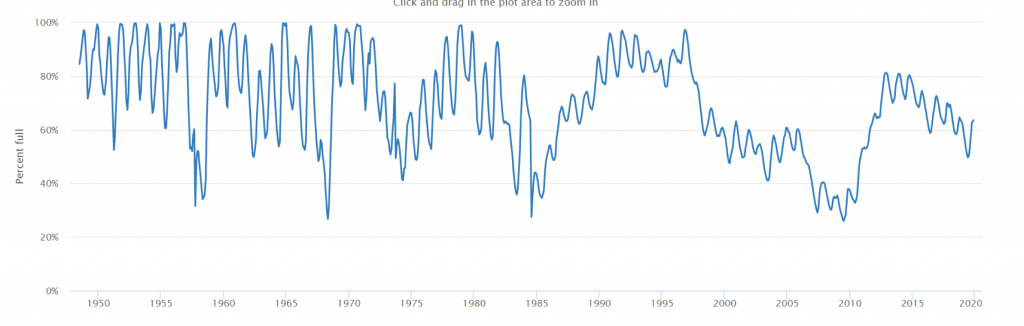

Quantifying the severity of the drought is tricky as there are many different measures but we can look at the level of water storage in dams serving the major cities:

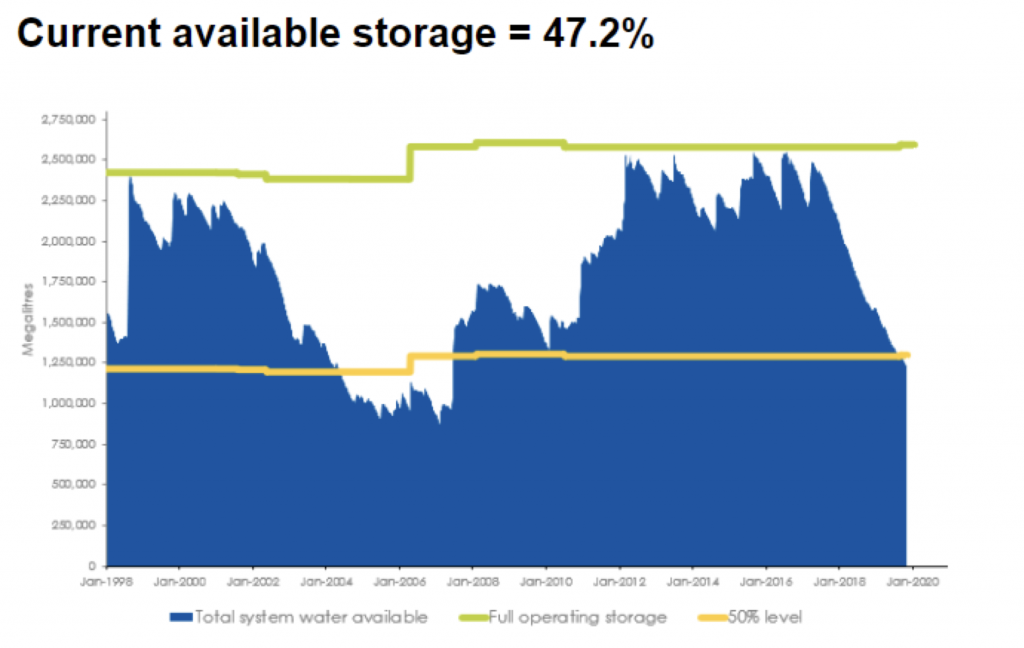

- For Sydney, we can see that the current level of 47.2 per cent full is the lowest since late 2007 and that they rate of depletion is steeper than 2000’s Millennium drought.

- The situation is not as bad for Melbourne at 63.6 per cent but this is also towards the historical lower end.

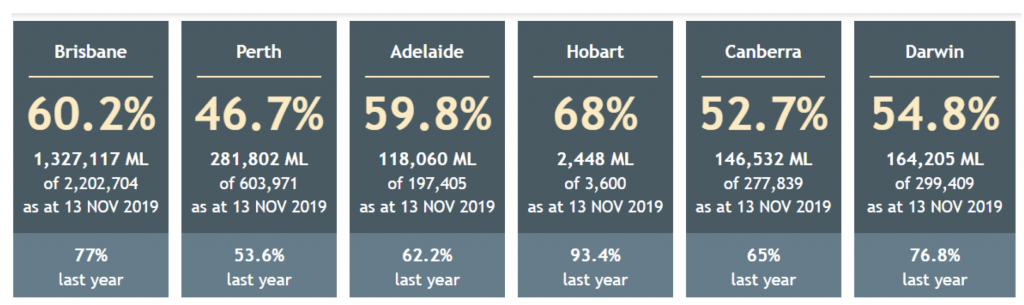

- The situation is similar in other capital and we can see that each capital has (in some cases significantly) lower storage levels than last year.

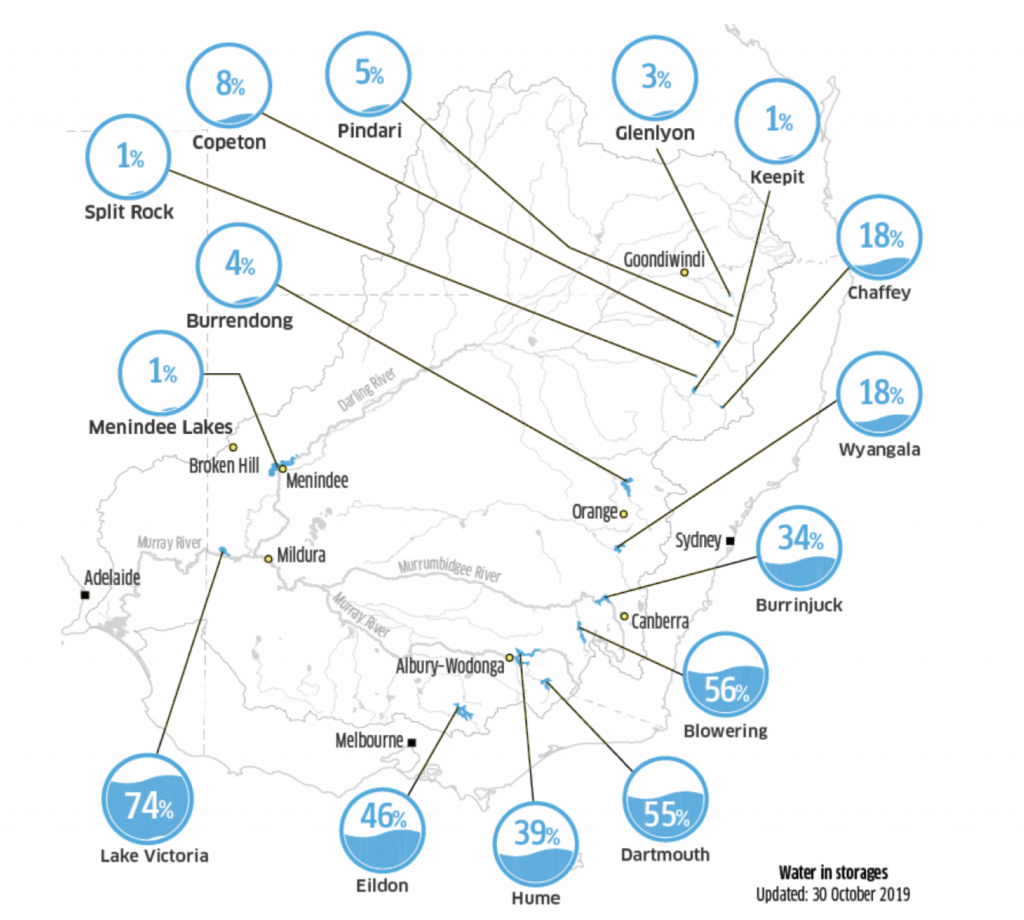

The situation in the Murray-Darling basin, the food bowl of Australia, is no better with total water storage levels down to 34 per cent and in particular the northern basin being down to 8 per cent dam levels.

This situation caused me to think about possible investment implications that investors should keep in mind if the situation does not improve.

If we start with the most obvious ones:

- Adverse growing conditions for agriculture will negatively impact companies that are directly involved in food production as their output will likely be lower. Supply/demand will likely result in higher prices so some offset will be had from this but overall, adverse growing conditions is a clear negative for a primary producer of agricultural products be it wheat or other grains or fruit and vegetables or animal products.

- Companies that are not primary producers but are one step down the value chain in refining and selling agricultural products are also likely to be negatively impacted.

- Diminished profitability for primary producers will likely lead to adverse trading conditions for suppliers to agriculture like fertiliser and machinery producers/distributors.

- Higher prices will likely eventually feed through to consumers and if consumers are spending more on food, they will have less to spend on other more discretionary products so it is a negative for discretionary retailers.

If we think a bit further, there are a number of other industries that could be impacted:

- Mining uses a lot of water for a variety of uses including dust control, fire hazard reduction, equipment maintenance as well as ore processing. Mines can recycle quite a bit of the water they use but certain uses require freshwater and mines account for about 10 per cent of the water extracted from the Great Artesian Basin each year. If the drought continues and further water restrictions are enforced, companies with mines in drought affected areas could well see production limitations.

- Suppliers to mining companies would then also be impacted in a similar way to suppliers in agriculture.

- Coal seam gas production also uses a lot of water and could come under production pressure.

- If the situation were to continue for a long time and some of the major cities run out of water, it could have much more wide-ranging implications on the overall economy as it would likely lead to steep falls in property values like we saw in Cape Town during 2018 when they ran out of water and had to impose very strict water restrictions.

However, there are though some sectors/companies that could be positively impacted:

- Producers that have operations in areas not affected by the drought are likely to benefit as lack of overall supply is likely to result in higher prices that they can sell their products into.

- Increased prices of certain goods are likely to lead to substitution into other products that are not affected by the drought. An example of this is aquaculture where most fish farming does not rely on access to fresh water and if the cost of land based protein increases, the demand for fish might increase as consumers change their consumption pattern.

Regarding how to invest, traditionally it is said that the time to buy cyclical sectors like agriculture is when conditions are tough, earnings are under pressure and share prices depressed, while you wait for the situation and sentiment to improve.

If we look at companies like Graincorp, Costa Group (see Joseph’s video here), Nufarm (see Stuart’s post here) Australian Agriculture Co, Inghams and Bega Cheese, most share prices are down a lot since their highs and it is probably fair to say that expectations are very low at this point.

Investing into those companies does though entail significant risk as if the drought continues for a long time, operating conditions are likely to continue to deteriorate. Investing in companies that can potentially benefit from the drought include seafood producers Tassel and Huon which is probably a less risky proposition but an investor is wise to remember that these companies remain primary producers who are still subjects to the whims of nature.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Another possibility for investment is in agricultural commodities if the Australian drought is significant enough to influence a particular commodity’s global price eg grains and livestock?

With regard to Duxton Water, I think that Max’s concerns over future price movements of water rights are valid. It is hard to see water prices moving significantly higher – remember that rights are to available water – if there is no water then the allocation is reduced even for High Security entitlements., Water prices can move lower and quite sharply, if the drought breaks.

Websters is another agricultural company that holds significant water rights as well as run an agricultural enterprise.

Hi Andreas

One Business that stands to gain in the short term from the drought is Duxton Water (ASX Code – “D2O”) which holds significant amounts of Water Rights which are leased to Primary Producers . Current share price is trading well below NTA. A buy back is in place suggesting Management sees value in buying back it’s own shares. The only problem I can see is whether the NTA will hold up when the drought breaks as the price of water rights will fall. It looks attractive in the current drought situation but may prove to be a trap over the long term and there could also be political risk if water trading rules change.

Hi Max,

Yes Duxton Water is definitely a company that can benefit from the drought. It is a bit small for us to invest in unfortunately.