Stocks We Like

-

WHITEPAPERS

Hidden in plain sight: our quest for quality around the world

Polen Capital

August 31, 2023

Recently, we highlighted the attractive opportunity we see in international equities.¹ On the back of more than a decade of underperformance relative to the U.S., we believe international now has some notable winds at its back, including cheap absolute and relative valuations and moderating dollar strength. continue…

by Polen Capital Posted in Companies, Polen Capital, Stocks We Like, Whitepapers.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like, Whitepapers

-

Altium – A quality stock with excellent momentum

David Buckland

August 25, 2023

In this week’s video insight, David Buckland, CEO of Montgomery, and Sean Sequeira, Chief Investment Officer of Australian Eagle Asset Management, discuss the investment landscape surrounding Altium (ASX:ALU). The discussion delves into Altium’s historical performance, its emphasis on quality, and its ambitious growth aspirations. Through an exploration of Altium’s positioning, management consistency, and recent achievements, this discussion underscores the significance of these factors in evaluating the company’s investment potential. continue…

by David Buckland Posted in Companies, Stocks We Like, Video Insights.

-

Another high quality result – Breville

Roger Montgomery

August 23, 2023

Breville Group (ASX:BRG) is a company owned in the Montgomery Small Companies Fund and one we have written about extensively. Back on April 14, I wrote about Breville, its 40 per cent share price decline from August 2021 highs and the fact that it was trading on a price earnings (P/E) ratio typically reserved for retailers with store lease obligations and few runways for growth. continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Stocks We Like.

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like

-

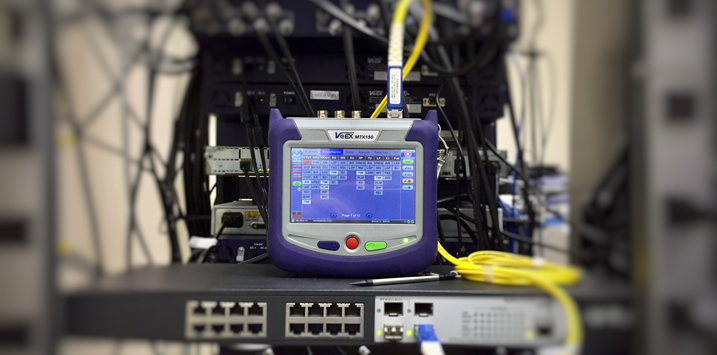

Megaport is seeing excellent momentum

David Buckland

August 23, 2023

After exceeding $21 per share in late-2021, Megaport Limited (ASX:MP1) experienced a very rough 17 months. The company now seems to have its mojo back from the trough in April 2023. Not only has the share price more than tripled to $12.15, but this has been accompanied by some very positive company announcements. continue…

by David Buckland Posted in Companies, Editor's Pick, Stocks We Like.

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like

-

Super Retail Group is still winning despite a challenging retail backdrop

Roger Montgomery

August 22, 2023

Another major retailer delivered its FY23 results providing a further data point for conditions in the consumer sector of the economy, which, it is worth remembering, represents a little over 50 per cent of the Australian economy. continue…

by Roger Montgomery Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

Two innovative companies the Polen Capital team like

David Buckland

August 22, 2023

Koh Young Technology, a world leader in 3D measurement and inspection technology and Tomra Systems, a Norwegian multinational corporation manufacturing collection and sorting products are two transformative players in the field of technology, both held in the Polen Capital Global Small and Mid Cap Fund. continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like

-

Two high-quality stocks we own in The Montgomery Funds’ portfolio

David Buckland

August 18, 2023

In this video insight, David Buckland, CEO of Montgomery, and Sean Sequeira, Chief Investment Officer of Australian Eagle Asset Management, discuss the positive impact of Australian Eagle’s partnership with Montgomery. They delve into recent company earnings reports, highlighting Cochlear’s (ASX:COH) return to growth as indicative of its strong business quality and long-term potential, independent of external factors. They also mention QBE’s (ASX:QBE) efforts to improve margins through enhanced risk management for better earnings quality, potentially leading to a higher market rating. continue…

by David Buckland Posted in Companies, Editor's Pick, Stocks We Like, Video Insights.

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like, Video Insights

-

Why we think Alliance Aviation has strong earnings growth potential

Gary Rollo

August 11, 2023

In this week’s video insight I joined Montgomery’s head of distribution Scott Phillips to discuss a current holding in the Montgomery Small Companies Fund, Alliance Aviation Services (ASX:AQZ). Alliance Aviation Services falls into the category of Aviation, although it is not a typical airline business. I identify why it is a holding in the Montgomery Small Companies Fund and what we expect in terms of its future earnings. continue…

by Gary Rollo Posted in Airlines, Companies, Editor's Pick, Stocks We Like, Video Insights.

-

Euronext and TMX Group: Two exchanges enjoying monopolistic connotations

David Buckland

August 8, 2023

Our global investment partner, Polen Capital, seeks to invest in high-quality companies that have strong growth potential and competitive advantages. In this article, I explore two global financial services organisations owned by the Polen Capital Small and Mid Cap Fund – Euronext and TMX Group. continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like

-

What can we expect from small caps this reporting season?

Michael Gollagher

August 7, 2023

As we enter reporting season, I thought it would be timely to take a moment and review four key sectors of the small companies market that will no doubt be front of mind for many investors. continue…

by Michael Gollagher Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like