TV Appearances

-

MEDIA

What Value.able Insights does Roger have on Flight Centre?

Roger Montgomery

May 9, 2012

Do Indochine Mining (IDC), Silverlake Resources (SLR), Iluka Resources (ILU), Horizon Oil (HZN), Boart Longyear (BLY), Newcrest Mining (NCM), BHP Billiton (BHP), Rio Tinto (RIO), Think Smart (TSM), New Hope Coal (NHC), Ludowici (LDW), Alumina (AMC), Flight Centre (FLT), Hawkley Oil & Gas (HAG), M2 Communications (MTU), Northern Star (NST), Codan (CDA) or Onesteel (OST) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 9 May 2012 to find out. Watch here.

by Roger Montgomery Posted in Companies, Investing Education, Skaffold, TV Appearances, Value.able.

-

MEDIA

Uncovering the best value stocks

Roger Montgomery

May 2, 2012

In this 2 May 2012 ASX Investor Hour presentation, Roger explains that while many investors focus solely on price, he (like Warren Buffett) selects his stocks, to buy or to sell, by comparing their current price to the value he ascribes to them. Roger discusses about his value principles and the technology he uses to filter stocks (www.skaffold.com). Watch video here and view slides here.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Skaffold, TV Appearances.

-

MEDIA

Uncovering the best value stocks

Roger Montgomery

May 2, 2012

Join Roger as he discusses his Value.able approach to picking the best stocks for this ASX Investor Hour presentation delivered 2 May 2012. Watch here.

by Roger Montgomery Posted in Companies, Intrinsic Value, TV Appearances.

-

MEDIA

How will the interest rate cut affect Housing prices?

Roger Montgomery

May 2, 2012

Learn Roger Montgomery’s Value.able insights into the latest 50 basis point cut in the the base rate and how it may impact housing prices in this interview with ABC The Business’ Ticky Fullerton broadcast 2 May 2012. Watch here.

by Roger Montgomery Posted in Energy / Resources, Financial Services, Investing Education, TV Appearances.

-

MEDIA

What does the future hold for the Australian Car Industry?

Roger Montgomery

April 17, 2012

Roger Montgomery places context around the latest job losses at Toyota, and also discusses management and staff relations versus company performance at Leighton Holdings (LEI) with Ticky Fullerton on ABC’s ‘The Business’. Roger appears at 8:03. Watch the Inteview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- watch video

- save this article

- POSTED IN Media Room, TV Appearances

-

MEDIA

What are Roger Montgomery’s Value.able insights into Mining Services?

Roger Montgomery

April 14, 2012

Do New Hope Corporation (NHC), Northern Star Resources (NST), Mt Gibson Iron (MGX), Navarre Minerals (NMC), Allmine Group (AZG), Credit Corp Group (CCP), Matrix composites (MCE), Coffey International (COF), Data #3 (DTL), Breville Group (BRG), UGL (UGL), QR National (QRN) and Seymour Whyte (SWL) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 14 April 2012 to find out, and also learn Roger’s current insights into the Mining Services sector. Watch here.

by Roger Montgomery Posted in Companies, Energy / Resources, Intrinsic Value, Investing Education, TV Appearances, Value.able.

-

MEDIA

In April 2012 where does Russell Muldoon see good Value.able investments? (Part 2)

Roger Montgomery

April 10, 2012

Do Lonrho Mining (LOM), Integrated Research (IRI), Hawkley Oil and Gas (HOG), Boart Longyear (BLY), Forge (FGE) and Environmental CleanTechnologies (ESI) achieve Roger and coveted A1 grade? Watch Part 2 of Sky Business’ Your Money Your Call 10 April 2012 program now to find out. Watch here.

by Roger Montgomery Posted in Companies, Investing Education, TV Appearances, Value.able.

-

MEDIA

In April 2012 where does Russell Muldoon see good Value.able investments? (Part 1)

Roger Montgomery

April 10, 2012

Do Thorn Group (TGA), Maverick Drilling (MAD), Campbell Brothers (CPB) and Galaxy Resources (GXY) achieve Roger’s coveted A1 grade? Watch Part 1 of Sky Business’ Your Money Your Call 10 April 2012 program now to find. Watch here.

by Roger Montgomery Posted in Companies, Investing Education, TV Appearances.

-

MEDIA

Can Apple’s share price continue to climb?

Roger Montgomery

April 3, 2012

Roger Montgomery discusses with Ticky Fullerton on ABC1’s ‘The Business’ how the ever-increasing climb of Apple’s share price is likely to come under pressure. Watch here.

This edition of The Business was broadcast 4 April 2012.

by Roger Montgomery Posted in Consumer discretionary, Energy / Resources, Intrinsic Value, Investing Education, TV Appearances.

-

MEDIA

Value Investing ‘on air’.

Roger Montgomery

March 11, 2012

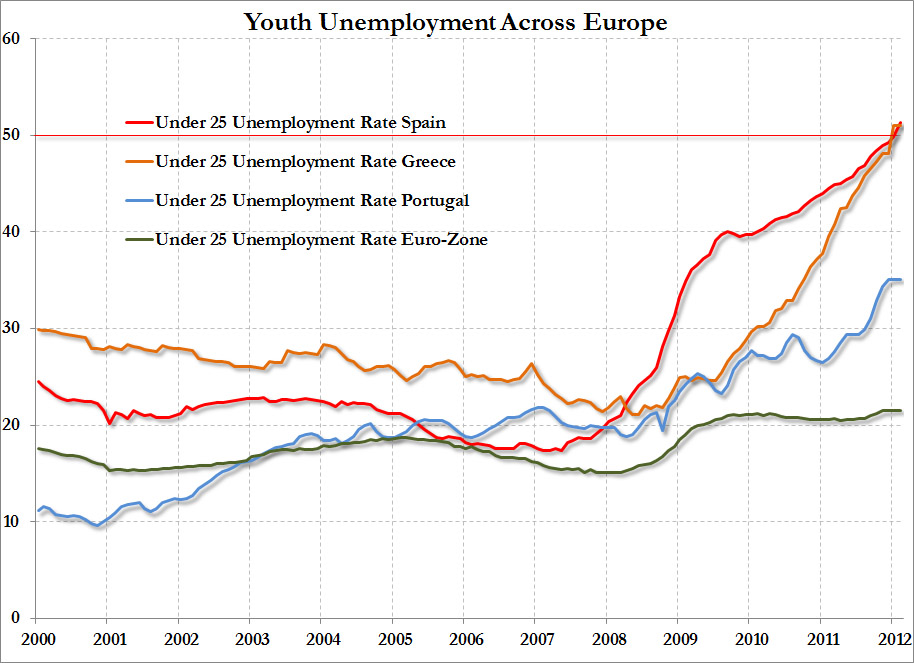

A busy week last week for value investing. Presenting in Perth for the ASX and in Melbourne as well as chatting to Ross Greenwood and Ticky Fullerton as I do regularly has cemented in my mind the idea that the case is building for a protracted de-leveraging (Click the European youth unemployment chart at left). I will bring you more about this de-leveraging vs recession idea soon as well as what I believe it means for share portfolios but for now I thought you might like a shortcut to some of the chats. And of course, all proudly brought to you by my very good friends at Skaffold.

A busy week last week for value investing. Presenting in Perth for the ASX and in Melbourne as well as chatting to Ross Greenwood and Ticky Fullerton as I do regularly has cemented in my mind the idea that the case is building for a protracted de-leveraging (Click the European youth unemployment chart at left). I will bring you more about this de-leveraging vs recession idea soon as well as what I believe it means for share portfolios but for now I thought you might like a shortcut to some of the chats. And of course, all proudly brought to you by my very good friends at Skaffold.The subject came up with Alan Kohler last weekend on the ABC’s Inside Business. You can watch it by clicking here

It also came up on the ABC’s The Business with Ticky Fullerton, which airs at 8.30pm and just after 11pm Monday to Thursday. You can watch it by clicking here

And finally, here is the talk I gave recently for the ASX Investor Hour. You can simply click on the video below to watch the seminar or click HERE to view the seminar with slides.

There’s plenty to think about and stay tuned to find out what stocks we have been buying in the most recent quarter. If you are looking for hot tips you are at the wrong blog, as we may have bought the stocks I mention as being worthy of careful study as many as three months ago. And sadly, we have already benefited greatly from someone spruiking some of these stocks online and I am told by one CEO that they have been reported to ASIC.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 11 March 2012.

by Roger Montgomery Posted in Market Valuation, TV Appearances.