Insightful Insights

-

Leighton’s Failures Could Savage Balance Sheet

Roger Montgomery

August 13, 2012

Leighton’s half yearly results grabbed headlines when they reported a 66 per cent drop in interim net profit to $114.6 million, at the low end of guidance.

For 24 months, we have been warning investors about the company’s difficulties in collecting receivables in the Middle East and the likely writedowns of the Desal Plant in Victoria and the Brisbane Airport Link. And now a string of results are revealing that these issues are savaging the company’s profits which for the most recent half, were down from $340 million in Leighton’s previous first half, the six months to December 31, 2011.

But the problems may not be over. The early traffic numbers out of Airport Link are much worse than expected – even though the opening of the link has allowed drivers on the road for free – the project may go bust like other toll roads before it. We believe Leighton’s have a deferred equity contribution requirement of $200 million that may still be required to be paid.

In the Middle East, Leighton’s has not been paid for a number of projects and they aren’t small. Imagine building an equestrian centre (see image) and failing to be paid. It would send most companies bust.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 4 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

You wouldn’t believe it…

Roger Montgomery

August 9, 2012

Many believe that understanding economics is the key to being able to predict the stock market. Curiously the Chinese economy is growing the fastest of all economies and is variously described as the global growth engine. And the Chinese ripples positively impact many peripheral economies too, as my recent visits to Singapore have shown me.

Many believe that understanding economics is the key to being able to predict the stock market. Curiously the Chinese economy is growing the fastest of all economies and is variously described as the global growth engine. And the Chinese ripples positively impact many peripheral economies too, as my recent visits to Singapore have shown me.Meanwhile the US economy is in the doldrums, threatening to fall into another recession with anemic growth, stubbornly high unemployment and continued weakness in housing.

And yet the Chinese market as measured by the Shanghai Stock Exchange A Share index remains 65% below its high of 6391.98 in October 2007. Perhaps ironically the S&P500 made its high of $1565.42 on October 10, 2007 and today it sits just 11% below that. If the Total Return index is taken into account, its sits level or just above its 2007 highs.

So all that chatter about recessions, depressions, unemployment and the like counts for very little. How many children are suffering needlessly because the money spent on economists isn’t directed to the kids?

What we do know is that investors should be looking at individual companies. Or talking to people on the ground. In China, balance sheets are deteriorating as receivables blow out while in the US, of the 411 companies listed on the S&P 500 that have reported earnings so far this quarter, 297 have exceeded analysts’ estimates, while less than 110 have missed their forecasts. And as many of our travelling clients have informed us, things seem to be swimming along in the US.

Keep an eye on individual companies and you’ll go far. So don’t worry about whether you should say Go Australia or not. We say Go ARB, Go WOW, Go CCP, Go COH and Go CSL!

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation.

-

Results to 30 June 2012

Roger Montgomery

August 8, 2012

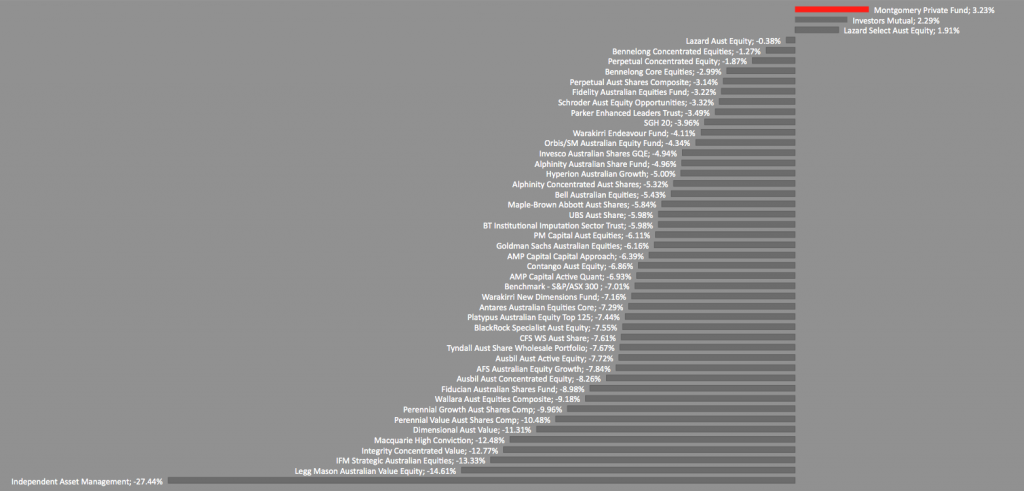

On behalf of the Montgomery Investment Management Team, I am delighted to display the full year results for the Montgomery [Private] Fund as measured and ranked against the 98 funds surveyed by Mercers.If you would like to discuss an investment in The Montgomery [Private] Fund please contact The Office by email at Office@montinvest.com or call (02) 9692 5700.Alternatively, if you would like to pre-register to be contacted when the fund re-opens to investment visit www.montinvest.com and select Apply to Invest.

Fig 1. Selected Australian Long Only Equity Funds as reported by Mercers and compared to The Montgomery [Private] Fund.

NB. The Montgomery Private Fund was not included in the Mercer Survey however the below chart reveals the fund’s comparative performance as if it were.by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Reporting Season – it won’t be much of a celebration!

Roger Montgomery

August 3, 2012

Over the next 20 business days, approximately 1,250 ASX listed companies will be reporting their full year (or interim) results to 30 June, 2012.

Twelve months ago, the consensus forecast for the year to 30 June 2012, was for 20% growth in earnings per share.

Over the past twelve months that number has been progressively downgraded to nil, nought, nothing.

For the year to 30 June 2013, the consensus forecast currently stands at 15% growth in earnings per share.

Insights from the outlook statements will be interesting and it wouldn’t surprise us to see consensus earnings per share growth forecasts for the year to June 2013 to follow the same downtrend as those for the year to June 2012.

At Montgomery, we will be using our proprietary fact-based investment process to analyse the results.

We hope this reporting season will alert us to some new companies which own extraordinary businesses trading at a discount to their estimated intrinsic value.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation.

-

The mining boom IS over

Roger Montgomery

August 2, 2012

Roger Montgomery discusses how the latest data reveals that the mining boom has ended, and he discusses the implications of this on mining stocks with Ticky fullerton on ABc1’s The Business. Watch here.

This program was broadcast 1 August 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Manufacturing, Value.able.

- save this article

- POSTED IN Companies, Insightful Insights, Manufacturing, Value.able

-

China Rongsheng Heavy Industries – the good, the bad and the ugly, part 2

Roger Montgomery

August 2, 2012

We had a wry smile this morning after reading Macquarie Equities daily newsletter.

China Rongsheng Heavy Industries’ net earnings have been downgraded by 37% in 2012, 68% in 2013 and an astonishing 79% in 2014. Forecast 2014 profitability is now one-sixth of the the level recorded in 2011.

A significant factor which had come to light is the fact that Rongsheng has provided highly attractive pre-delivery finance to customers to win market share.

As Rongsheng has had operational (and credibility) issues, it has had to increase its working capital and gearing to meet expenses during during the shipbuilding construction period. With the fast decline in their order book, from US$6.6 billion in 2011 to an estimated US$3.6 billion in 2014, cash flows are under pressure.

The extraordinary rise and fall of Rongsheng and the outlook for the Chinese shipbuilding industry lends support to Montgomery’s caution with respect to the materials industry.

We will become more positive on materials stocks when the outlook from the Chinese steelmaking, cement and shipbuilding industries is less pessimistic.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Manufacturing, Value.able.

-

MEDIA

What are Roger’s insights into the Banking sector?

Roger Montgomery

August 1, 2012

Do Newcrest Mining (NCM), Breville Group (BRG), Commonweath Bank (CBA), Westpac (WBC), Wotif.com (WTF) and CSL (CSL) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 1 August 2012 to find out, and also learn Roger’s current insights into the Mining Services sector. Watch here

by Roger Montgomery Posted in Companies, Insightful Insights, Intrinsic Value, TV Appearances.

-

MEDIA

Running out of puff

Roger Montgomery

August 1, 2012

In his August 2012 Money Magazine article Roger discusses how company weighting in Australian market indices distort the overall performance. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Intrinsic Value.

-

China Rongsheng Heavy Industries – the good, the bad and the ugly…

Roger Montgomery

August 1, 2012

Earlier this year we had the opportunity to visit China Rongsheng Heavy Industries, one of China’s leading shipbuilding companies. Rhongsheng was founded in 2005 and floated in November 2010 on the back of winning an enormous order from Vale to build twelve ore carrier vessels each 360 metres long, 65 metres wide and 30.4 metres deep with a deadweight tonnage of 400,000. The ambitious founder, 46% shareholder and Chairman, Zhang Zhi Rong, was desperate to challenge the global leaders, South Korean based, Hyundai Heavy Industries and Daewoo Shipbuilding & Marine.

Back in 2008, Rongsheng represented all that is good and bad in China. With Government support, Chinese corporate support, recently announced offshore diversification and the cost of shipping dry goods such as grain, coal and iron-ore at US$55,000 per day, the outlook was superb.

Let’s fast forward to July 2012 and the price of Rhongsheng’ shares have declined from HK$8 to HK$1. For the six months to June 2012, China’s 1,536 shipyards have announced a combined 50% decline in orders. The cost of shipping dry goods has crashed to sub US$10,000 per day (-82%), and Rhongsheng is experiencing a number of operational and credibility issues.

With the global slump in ship orders caused by a glut of vessels, Rongsheng is trying to diversify from shipbuilding and earlier this year they won a contract to build an offshore support vessel for CNOOC, one of China’s largest government controlled oil production and exploration companies.

Last week CNOOC announced a US$15 billion offer to acquire Nexen, a US listed Canadian based oil company. Nexen rose 52% on the announcement. The US Securities and Exchange Commission (SEC) just announced various traders had stockpiled shares of Nexen in the days leading up to the takeover bid. The SEC has claimed US$13m of illegal profit was realized and the finger is being firmly pointed to a Hong Kong based company controlled by none other than Zhang Zhi Rong.

The development of China has seen some extraordinary national champions in industries like ship building, however we wonder how many of these companies will ultimately become global champions. With several front page newspaper disasters associated with misfeasance, we continue to be wary of China’s corporate governance record.

In the meantime we believe a lot of companies in commoditized industries like shipbuilding, steelmaking and cement production are likely use their upcoming results presentation as an avenue to downgrade their outlook.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Manufacturing.

-

Deflation of fresh produce masks volume growth from Woolies and Coles

Roger Montgomery

July 31, 2012

The Woolworths Food and Liquor Division reported 3.8% sales growth to $37.5 billion for the year to June 2012. Same store sales growth increased by 1.3% for the year. For the June Quarter, sales growth was 3.8%, year on year, while same stores sales grew by 1.3%.

In comparison, Coles reported sales growth of 6.1% to $33.7b and same store sales growth of 3.7%. For the June Quarter, sales growth was 4.6%, year on year, while same store sales grew by 3.0%.

Both organisations reported price deflation of approximately 4% in fresh produce, and this masked both their strong volume growth and the increasing consolidation of the Australian supermarket industry.

The Montgomery (Private) Fund is a shareholder in Woolworths, and likes its 26% average return on equity.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights.