Economics

-

Drip-Fed Economies Die

Roger Montgomery

November 6, 2014

It’s a bloody disgrace! It’s un-Australian and it’s nothing more than stealing from your own neighbour.

Finally, The Australian Financial Review, who received 28,000 pages of leaked tax information, forwarded it to ATO Commissioner Chris Jordan. The information reveals how 343 local and foreign companies used accounting firm PwC to slash their tax bills through total swap returns, royalty payments, hybrid debt structures and secret deals with tax havens like Luxembourg. continue…

by Roger Montgomery Posted in Economics, Insightful Insights.

- 12 Comments

- save this article

- POSTED IN Economics, Insightful Insights

-

Bubble Watch #15

Roger Montgomery

October 22, 2014

Businessweek reports: “Billionaire Stephen Schwarzman, who oversees the largest manager of alternative assets as Chief Executive Officer of Blackstone Group LP (NYSE: BX), said the recent declines in financial markets are an “overreaction.” continue…

by Roger Montgomery Posted in Economics, Market commentary.

- save this article

- POSTED IN Economics, Market commentary

-

RBA’s AUD expectations

Ben MacNevin

October 14, 2014

Guy Debelle, an Assistant Governor at the Reserve Bank of Australia, recently discussed the prospect of a violent sell-off in markets. His use of the word “violent” is bold, given the RBA is known for its nuanced language. It was his discussion regarding investor reactions which we found most interesting. continue…

by Ben MacNevin Posted in Economics, Insightful Insights.

- 2 Comments

- save this article

- POSTED IN Economics, Insightful Insights

-

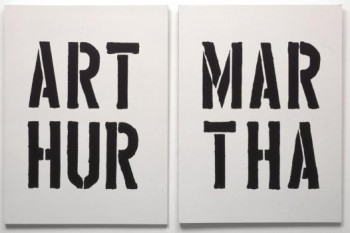

Arthur or Martha?

Roger Montgomery

October 8, 2014

In my morning news trawl, I came across an interesting article on Bloomberg this morning. I have copied an excerpt below, and should you be so inclined, you can read the full article here. continue…

by Roger Montgomery Posted in Economics, Market commentary.

- 2 Comments

- save this article

- POSTED IN Economics, Market commentary

-

Time frames and iron ore

Tim Kelley

September 17, 2014

So much of investing comes down to time and perspective.

In the short term, the market is awash with random noise – and one of the best things an investor can do is keep it away from their investment decision-making. continue…

by Tim Kelley Posted in Economics, Energy / Resources.

- 2 Comments

- save this article

- POSTED IN Economics, Energy / Resources

-

The US Labour Market: Inflation not dead and buried

David Buckland

September 9, 2014

With US ten-year bonds range trading between 1.5 per cent and 3.0 per cent over the past two years, there is a view that US inflationary expectations are dead and buried. continue…

by David Buckland Posted in Economics, Insightful Insights.

- 1 Comments

- save this article

- POSTED IN Economics, Insightful Insights

-

The Economic Scene, according to the RBA

Ben MacNevin

September 5, 2014

Following the September Board meeting, the Governor of the Reserve Bank of Australia (RBA) has provided a very thoughtful perspective of the Australian economy and the RBA’s view on asset prices. It’s well worth a read. continue…

by Ben MacNevin Posted in Economics, Insightful Insights, Value.able.

-

House prices to crash? Ask your barber!

Roger Montgomery

September 2, 2014

Writing for Finsia’s InFinance daily report, Robin Christie has quoted the Big Four banks’ head economists speaking at the AB+F Breakfast with the Economists event in Sydney late last week. continue…

by Roger Montgomery Posted in Economics, Financial Services, Insightful Insights.

-

Bubble watch #12 – we’re getting closer

Roger Montgomery

August 27, 2014

Journos are calling it a melt-up; economists are calling it a bubble. Here at Montgomery we’ve been writing since November last year that investors could expect rising asset prices (read: stocks and property) thanks to a regime shift at the US Federal Reserve under Janet Yellen. continue…

by Roger Montgomery Posted in Economics, Insightful Insights.

- 1 Comments

- save this article

- POSTED IN Economics, Insightful Insights

-

Is the Sky Falling?

Roger Montgomery

August 21, 2014

This morning, we read with interest the views of Chris Watling from Longview Economics, who believes the Fed is underestimating the strength of the US economy. continue…

by Roger Montgomery Posted in Economics, Foreign Currency, Insightful Insights.