Companies

-

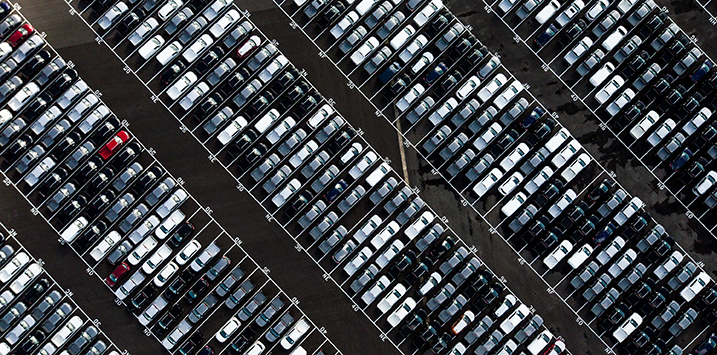

The headwinds facing Autosports Group

Roger Montgomery

March 1, 2022

Autosports Group (ASX:ASG) operates over 50 car sales outlets in Sydney, Melbourne, Brisbane and the Gold Coast. Its share price has been on a rollercoaster ride since floating in 2016 and currently sits below the $2.40 listing price. ASG is profitable and reasonably priced, but investors should be mindful of the threats facing its business model. continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies

-

A marriage of convenience or a marriage of necessity?

David Buckland

February 28, 2022

The tough conditions gripping the Buy Now, Pay Later sector has seen Zip Co Limited (ASX: Z1P) make an agreed takeover scrip bid for Sezzle Inc (ASX: SZL) using 0.98 Z1P shares for 1 SZL share. At Friday’s close of $2.21, this values each SZL share at $2.16, a 21 per cent premium to its closing price of $1.78. Despite recording a strong trajectory from a revenue perspective, both companies remain cashflow negative businesses, and it is hoped the merger and severe cost cutting accelerates the path to profitability. continue…

by David Buckland Posted in Companies.

- save this article

- POSTED IN Companies

-

Why we continue to like NZ’s Freightways

Andreas Lundberg

February 25, 2022

You may not be familiar with New Zealand’s Freightways Ltd (NZX:FRE), but it’s a company The Montgomery Fund has held for a long time. Freightways has been a strong performer for many years, and we’re attracted to the diversity of the business and entrepreneurial drive. The recently released interim results point to a company that is well positioned for further growth. continue…

by Andreas Lundberg Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

Consolidation of the BNPL Sector appears imminent

David Buckland

February 22, 2022

With the ZIP Co Limited (ASX:Z1P) share price declining 81 per cent from $13 to $2.50, and the Sezzle Inc (ASX:SZL) share price declining 84 per cent from $11.40 to $1.80, it seems increasingly likely the Buy Now Pay Later (BNPL) sector will consolidate with a ZIP – Sezzle Inc merger. continue…

by David Buckland Posted in Companies.

- save this article

- POSTED IN Companies

-

Goodman Group’s profit doubles

Roger Montgomery

February 18, 2022

Following on from material swings in the fortunes of property developers and managers including Dexus (ASX:DXS) and Vicinity Centres (ASX:VCX), Goodman Group (ASX:GMG) reported a doubling in profit for the first half of FY22. The Goodman Group result was very strong. continue…

by Roger Montgomery Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

GWA navigates the COVID-19 disruptions

Roger Montgomery

February 18, 2022

COVID-19 related labour shortages and supply chain disruptions are a constant theme this reporting season. And Brisbane-based GWA Group (ASX:GWA) – which imports and distributes bathroom and kitchen brands like Caroma, Dorf and Clark – was not immune. Despite these challenges, GWA was able to report a solid half-year result. continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies

-

Carsales continues to profit from a booming car market

Roger Montgomery

February 17, 2022

If you’ve been shopping for a new or used car over the last two years, you would have noticed that prices have rocketed. That’s been a major benefit to car retailers, like Eagers Automotive. It’s also boosted the revenues and share price of Carsales.com (ASX:CAR), the online automotive marketplace, which has just reported its half-year results. continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies

-

Should BHP pay big dividends, or buy back its shares?

Joseph Kim

February 16, 2022

After a bumper six months, BHP (ASX:BHP) is awash with cash. And it will soon be rewarding its shareholders. In its recent results announcement, the big Australian miner said it will pay a record interim dividend of US$1.50 per share. But are shareholders better off with a big dividend or a share buy-back? continue…

by Joseph Kim Posted in Companies, Energy / Resources.

- save this article

- POSTED IN Companies, Energy / Resources

-

Despite the share price fall, IDP Education’s future is looking bright

Roger Montgomery

February 14, 2022

IDP Education (ASX:IEL) has just reported its half-year results, which came in below market expectations, largely due to COVID-related restrictions. The initial market reaction was quite severe, pushing the share price well below its November 2021 high. IDP has a solid pipeline of leads and, with borders reopening, the future is looking bright. continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Stocks We Like.

- 2 Comments

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like

-

Why Polen Capital has pivoted from PayPal to SAP, Amazon and Netflix

David Buckland

February 11, 2022

Following PayPal’s change in business strategy, disappointing 2022 guidance and retreating from elements of their long-term thesis provided less than a year ago, the Polen Capital Global Growth Fund has exited its position in PayPal. continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like