Companies

-

Shipping firms profit from the supply chain crisis

Andreas Lundberg

April 6, 2022

The global supply chain crisis caused by COVID-19 has significantly increased the cost and time it takes to ship goods. This has been bad news for some businesses – particularly those that find it difficult to pass on rising costs. But the crisis hasn’t been bad for everyone. For the world’s major container shipping companies and freight forwarders, it’s meant rising profits and soaring share prices. continue…

by Andreas Lundberg Posted in Companies, Consumer discretionary.

- save this article

- POSTED IN Companies, Consumer discretionary

-

Hey Big Super – will there be more offers for Uniti Wireless?

Gary Rollo

April 5, 2022

There is an auction process (of sorts) happening for Uniti Wireless (ASX:UWL), and it appears contested with two interested parties emerging to date. Should there be more? continue…

by Gary Rollo Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

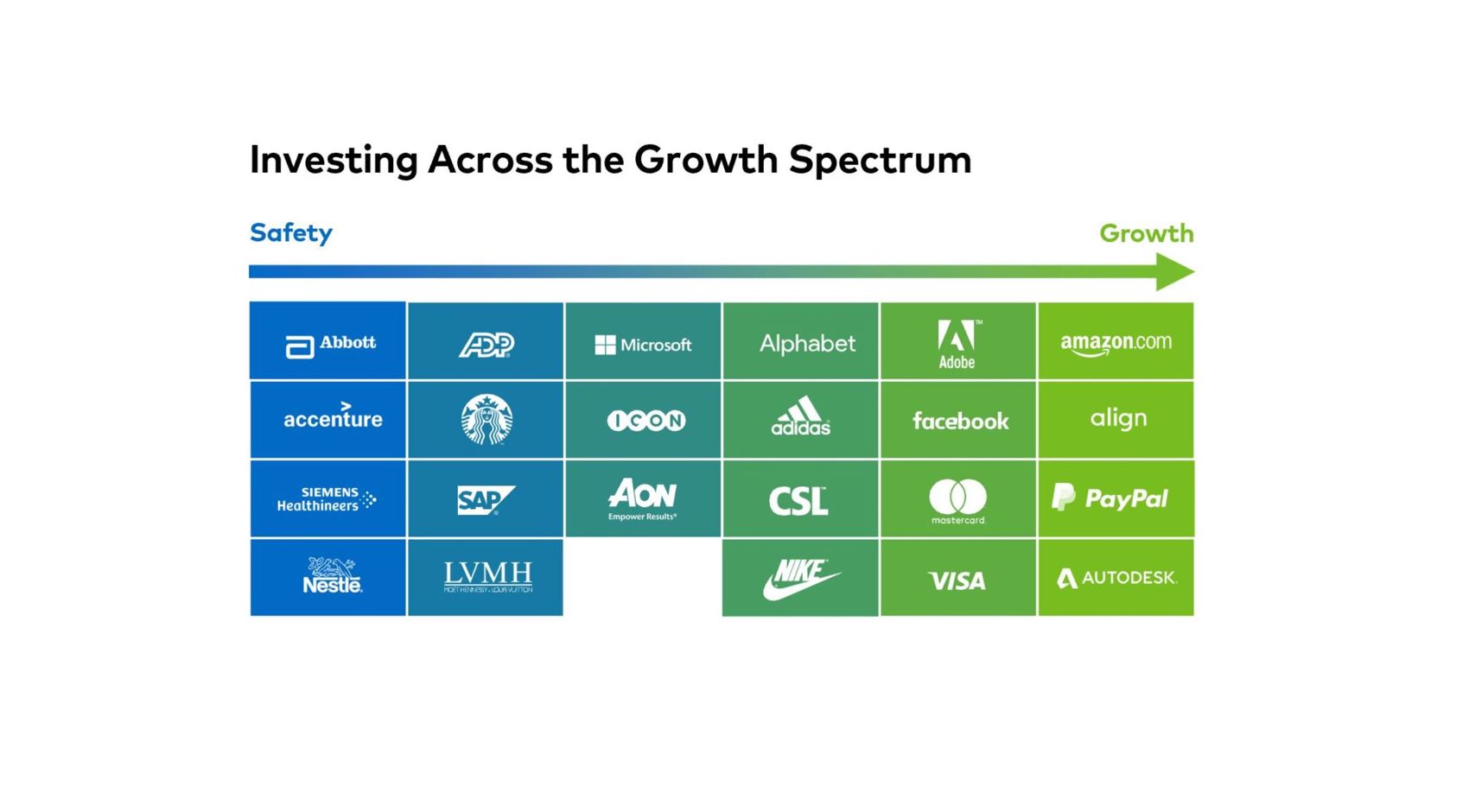

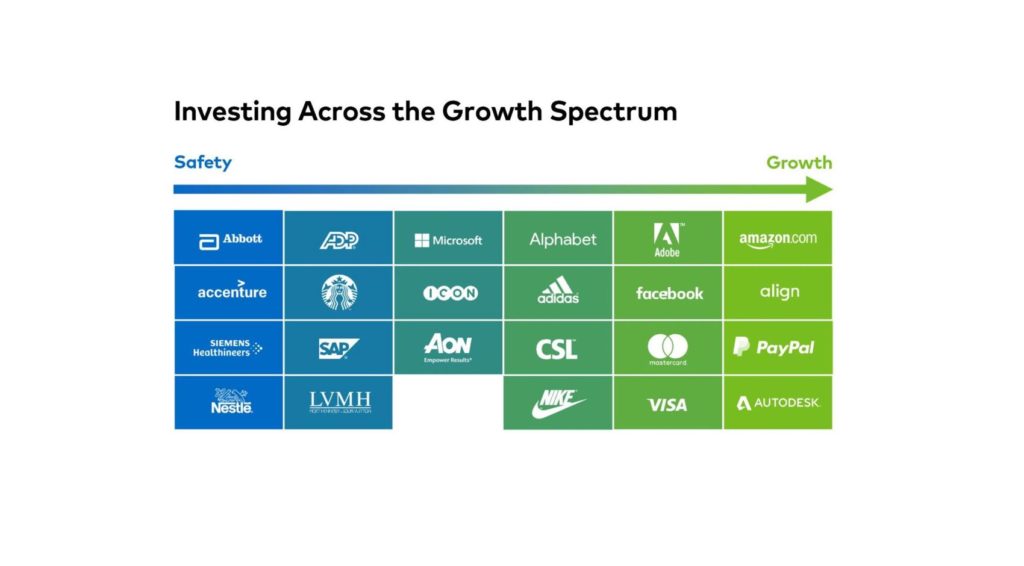

How Polen Capital invest across the growth spectrum

Polen Capital

April 4, 2022

In this video extract from our recent webinar, Polen Capital’s Damon Ficklin shares how the Polen Capital team construct their portfolios using the strategy of investing across the growth spectrum. To achieve a mid-teens earnings per share growth target, they look at a range of different types of growth companies across this spectrum. Damon shares two examples of companies in the Polen Capital Global Growth Fund including Adobe and Siemens Healthineers and their investment thesis. continue…

by Polen Capital Posted in Companies.

- watch video

- save this article

- POSTED IN Companies

-

Earnings growth is becoming a priority

Roger Montgomery

April 1, 2022

Over the years I have often sat alongside guests on a TV or radio panel and heard them conclude the easy gains have been made. For the first time in many years I agree. continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Market commentary, Stocks We Like.

-

Opposing forces currently affecting the share-market

David Buckland

March 30, 2022

In this week’s video insight David discusses how the current confusing market conditions have most investors sitting on their hands watching it play out, although domestic and international super-funds, infrastructure funds and private equity groups will be using this market confusion to make proposals and takeovers bids for more interesting relatively secure cashflow plays. David discusses the current take-over proposals for Uniti Group and why we see the business in a beneficial position. continue…

by David Buckland Posted in Companies, Stocks We Like, Video Insights.

-

The stocks set to fly as travel takes off again

Dominic Rose

March 28, 2022

With COVID-19 travel restrictions beginning to ease, the Montgomery Small Companies Fund has been adding to its investments in ASX listed travel businesses. In particular, we like the look of Alliance Aviation Services, Corporate Travel Management, Flight Centre and Webjet, which should all do well as travel rebounds. continue…

by Dominic Rose Posted in Companies, Editor's Pick, Stocks We Like, Tourism.

- 4 Comments

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like, Tourism

-

Two companies Polen Capital like

David Buckland

March 24, 2022

We have just hosted the team from Polen Capital in Sydney and Rob Forker, Portfolio Manager of the Polen Capital Global Small and Mid Cap Fund, selected two companies to highlight. While it’s been a challenging start for the Fund from a unit price perspective, the portfolio companies are performing well at an operational level. continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like

-

Uniti Group goes from hunter to hunted

David Buckland

March 16, 2022

Over the years, the team at Uniti Wireless (ASX:UWL) has proven incredibly adept at growing through acquisition – before becoming a take-over target – and handsomely rewarding investors along the way. They did it with M2 Group, and now they’re doing it again with Uniti. The recently announced $4.50 per share bid by Morrison & Co is a far cry from UWL’s 25 cent listing price in February 2019. continue…

by David Buckland Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

Despite global concerns, we still like Aristocrat Leisure

Stuart Jackson

March 14, 2022

Global leader in gaming content and technology Aristocrat Leisure (ASX:ALL) has suffered a savage sell-off since November. The share price has dropped around 25 per cent as geopolitical issues weighed heavily on investors’ minds. But a recent roundtable presentation for investors should ease any concerns, and the company looks set to ride out the turmoil. continue…

by Stuart Jackson Posted in Companies, Editor's Pick, Stocks We Like.

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like

-

Is it a fad? Yes, always

Roger Montgomery

March 9, 2022

Is this a fad? This is one of the questions an investor must always ask themselves, no matter what company they are investigating. And when the company in question is fitness related, the answer is it usually is a fad. continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies