articles by Tim Kelley

-

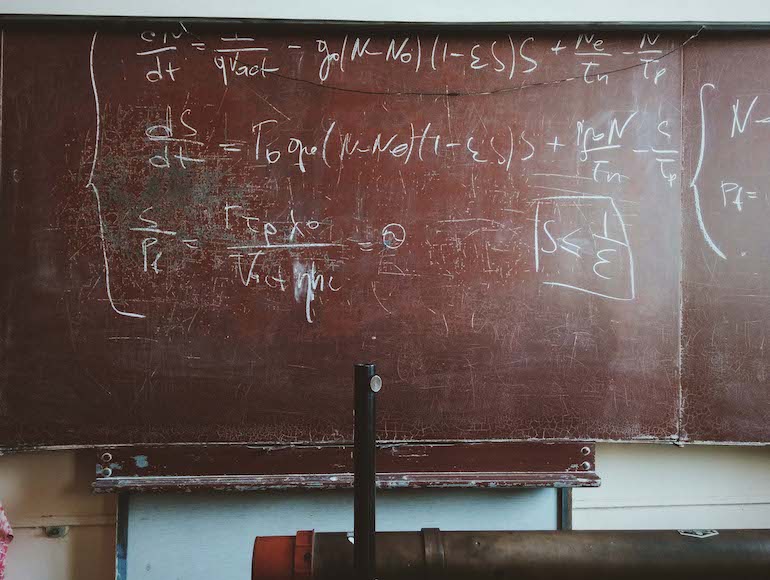

An odd period for quant in the Australian equity market

Tim Kelley

June 12, 2018

Many investment managers use quantitative screens to focus their attention on the investment opportunities that are most likely to reward close study, and we are certainly among them. Over the years we have built software tools that make it easy for us to analyse the historic performance of a wide range of fundamental and other data points in forecasting future investment performance. Continue…

by Tim Kelley Posted in Investing Education.

- 4 Comments

- save this article

- 4

- POSTED IN Investing Education.

-

Thinking about an Autonomous Future

Tim Kelley

May 30, 2018

Autonomous vehicles and the evolution of Transport as a Service (TaaS) are topics that we have spent a significant amount of time thinking (and writing) about in the past year or so. We see these developments as having a profound impact in many industries and have begun to remove from our portfolios businesses that we see as being on the wrong side of them. Continue…

by Tim Kelley Posted in Technology & Telecommunications.

-

Why we see value in Telstra

Tim Kelley

May 29, 2018

In this week’s video insight Tim discusses our view on Telstra. We have been reasonably critical of Telstra over the years, although given the extent of the share price decline we think Telstra has now reached a point in which it offers value upside.

by Tim Kelley Posted in Editor's Pick, Video Insights.

- 17 Comments

- save this article

- 17

- POSTED IN Editor's Pick, Video Insights.

-

What kind of investor are you?

Tim Kelley

May 23, 2018

One of the features of active equity investing is its zero-sum nature (in aggregate). By that, I mean that when an investor “beats” the market, some other investor must get beaten. Averages being what they are, there needs to be an equal representation of investors who deliver above average performance and investors who deliver below average performance. Continue…

by Tim Kelley Posted in Investing Education.

- 1 Comments

- save this article

- 1

- POSTED IN Investing Education.

-

Assessing the Healthscope Takeover Proposals

Tim Kelley

May 21, 2018

On 26 April, Healthscope Limited (ASX:HSO) received a non-binding indication of interest from a BGH-led consortium in relation to a proposal to acquire HSO for a price of $2.36 per share, which was a 16 per cent premium to the price prevailing before the approach. Continue…

by Tim Kelley Posted in Companies, Health Care.

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Health Care.

-

Is BT Investment Management suffering from style headwinds?

Tim Kelley

April 17, 2018

In this week’s video insight Tim discusses a position The Montgomery Fund recently took in BT Investment Management (ASX:BTT).

by Tim Kelley Posted in Video Insights.

- 2 Comments

- save this article

- 2

- POSTED IN Video Insights.

-

How Many Lines?

Tim Kelley

April 11, 2018

One of the cooler sites you can find on the interweb is David McCandless’ informationisbeautiful.net – a site aimed at using data visualisation and information design to convey interesting stories and ideas. Continue…

by Tim Kelley Posted in Insightful Insights.

- 1 Comments

- save this article

- 1

- POSTED IN Insightful Insights.

-

Is the Coles demerger a good idea?

Tim Kelley

March 22, 2018

Recently, Wesfarmers Limited (ASX: WES) announced its intention to demerge the Coles business into a separate ASX-listed company. While WES will retain up to a 20 per cent stake in Coles, the demerger effectively splits the company into two separate entities, with WES owning Bunnings, Kmart, Target, and Officeworks, as well as WES’ Industrials and “Other” divisions.

Continue…by Tim Kelley Posted in Companies.

- 3 Comments

- save this article

- 3

- POSTED IN Companies.

-

What does outstanding stock picking look like?

Tim Kelley

February 22, 2018

Many readers will have some familiarity with the sorts of returns a successful stock-picker might aim to produce. Often, a fund will have an explicit target of beating the market by an amount of, say, 5 per cent per annum over rolling 5-year periods. While it doesn’t sound dramatic, this sort of extra return can compound into a very dramatic difference to investor wealth over long periods of time, and so it is very valuable. Continue…

by Tim Kelley Posted in Investing Education.

- 3 Comments

- save this article

- 3

- POSTED IN Investing Education.

-

Why we aren’t concerned to see volatility rising

Tim Kelley

February 13, 2018

In this week’s video insight Tim gives you a perspective on how we’re thinking about the recent market moves and trying to position for a good long-run outcome for our investors.

by Tim Kelley Posted in Editor's Pick, Video Insights.

- save this article

- POSTED IN Editor's Pick, Video Insights.