Aussie companies are now global standouts

According to JP Morgan, companies on the ASX have, on average, received some of the largest positive earnings per share revisions anywhere in the world. The reason is likely because our economy has been less impacted by COVID-19 than in most other nations. But this doesn’t mean our market is looking cheap.

Back in August 2019, I wrote an article looking at what happened in aggregate during the reporting season. The conclusion at the time was more than 3x the number of companies received future earnings per share downgrades than received upgrades and the average revision was a negative 3.8 per cent.

Today we are going to look at the recently concluded reporting season where the majority of the companies listed on the ASX reported first half results (some reported full year results) and it is a quite remarkable difference from 18 months ago.

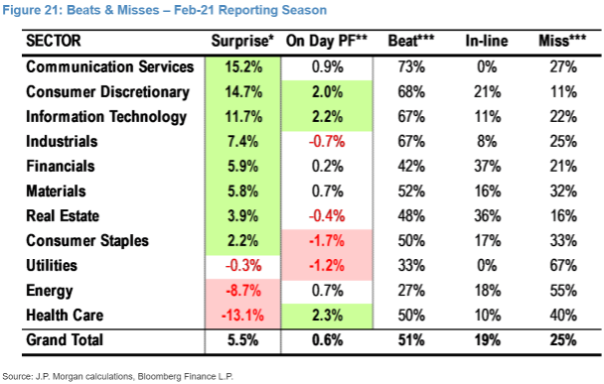

If we start by looking at how many companies beat vs missed the market’s earnings expectations, we can see that 51 per cent“beat” expectations and only 25 per cent “missed” as we can see from this table from JP Morgan:

We can also see that the strength was widespread across sectors with the exception of Utilities and Energy which were the only two sectors that saw more “misses” than “beats.”

There are a few observations I would like to make regarding this:

- We have generally seen an increase in the amount and frequency of information given to the market by companies but, at the same time, we have seen a lot of companies stop giving explicit guidance, which has had two effects:

- No explicit guidance has resulted in analysts (in general) taking a more cautious approach as they have a less concrete base on which to base their numbers.

- Given the uncertain times, companies have been more cautious in their information and have been emphasizing the potential downsides more than potential upside.

- We can also see a relatively low correlation between beating and missing to the share price performance which can be a bit surprising. The explanation for this is quite nuanced but what I think is going on is twofold:

- Firstly, we are seeing in particular long term interest rates starting to rise and this has a disproportional impact on companies with long duration (i.e. earnings a long time into the future) like IT and some of the discretionary consumer growth stories, which has led to their share prices being weaker than could be expected based on current operational performance.

- Secondly, given the COVID crisis has resulted in a lot of disruption and benefited and hurt different industries to different degrees, investors are now starting to anticipate what a “return to normal” will look like and hence do not care that much about what has happened during the last 12 months. This explains why consumer discretionary companies that have performed exceptionally well operationally have not seen as stellar share price performance while healthcare companies that surprised on the downside on average have seen better share price performance than the operational performance would indicate.

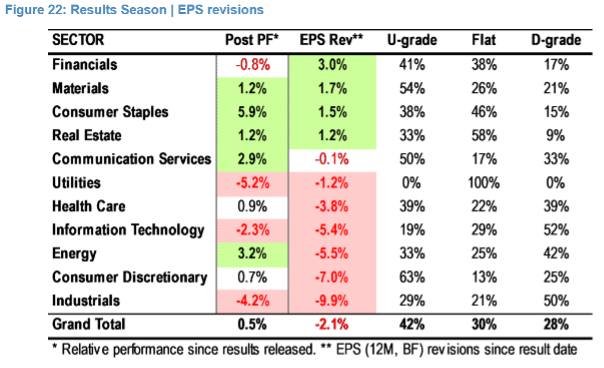

From the table below, we can also see that 42 per cent of companies have post the results seen upgrades to the future earnings forecasts while only 28 per cent have seen downgrades:

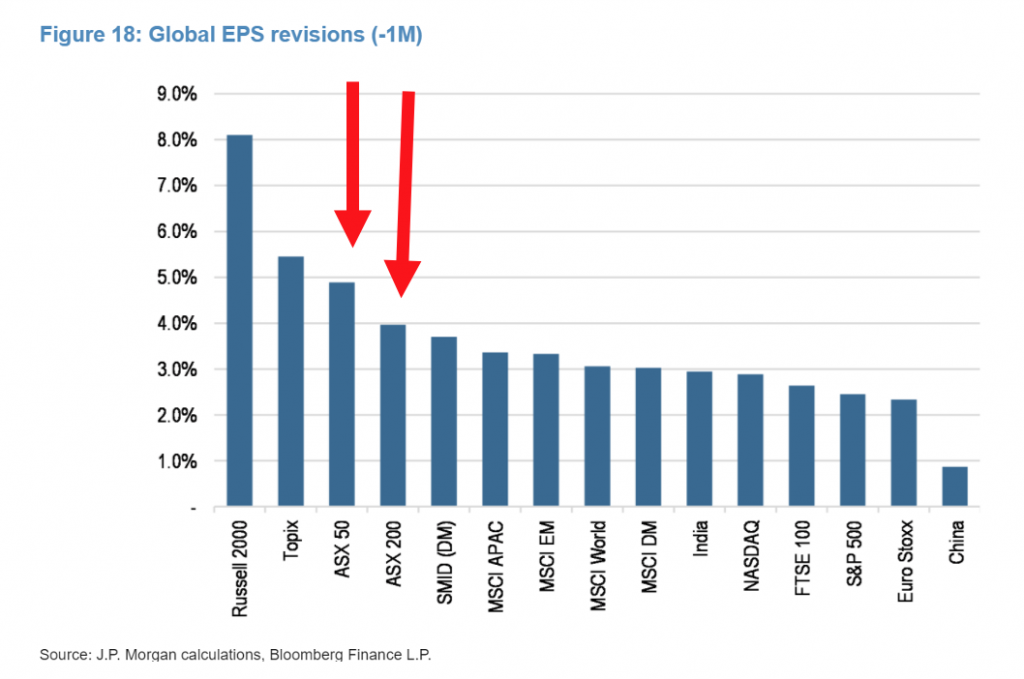

If we look at this in an international perspective, we can see that Australian companies on average have received some of the largest positive earnings per share revisions during the last month, as can be seen from this chart:

The reason for this is probably that the Australian economy has been less impacted than many other economies due to less severe lockdowns due to lower case numbers and at the same time significant government stimulus.

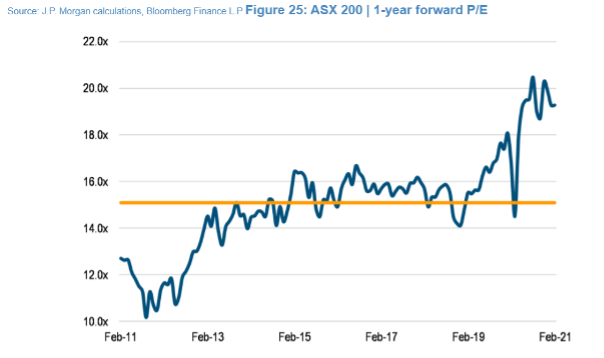

Despite these strong upwards earnings revisions, we have not seen a significant drop in the P/E of the market which continues to trade at very elevated levels:

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY