What did the August 2019 reporting season tell us?

Phew! So much anticipation. So much data to digest. One early conclusion to draw from reporting season is that consumer spending isn’t very healthy. Taking a look at the sector breakdown, consumer discretionary and consumer staples were the worst off.

Before the reporting season kicked off, I published a blog post on valuations and expectations going into the results with the help of data from a JP Morgan report.

The conclusion of that post was that outside the materials sector, the Australian market was very expensive and fundamentals were deteriorating with earnings revisions on a negative path.

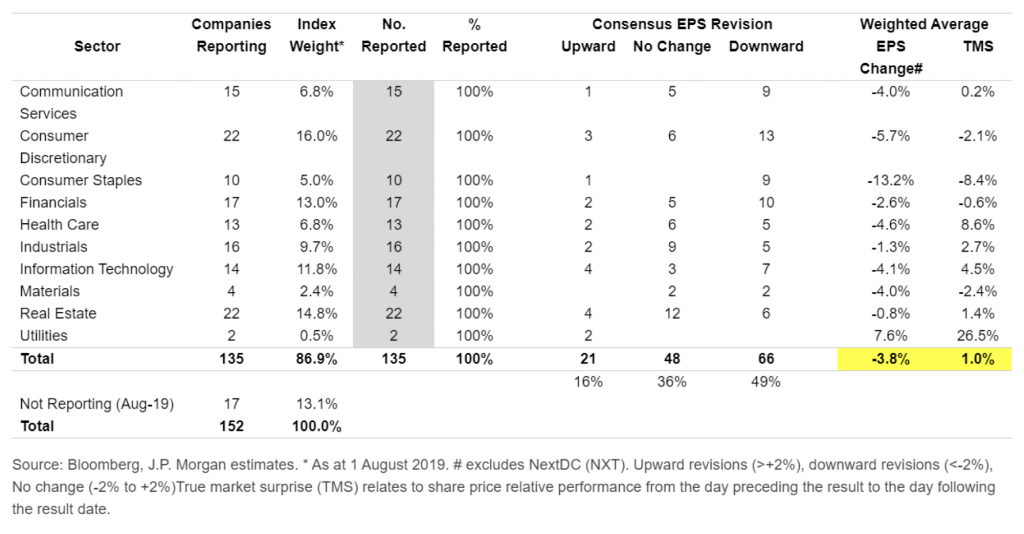

Today, almost all companies in Australia have reported and let’s look at what actually happened. To this extent, we again look at a report from JP Morgan which looks at how many companies have seen positive or negative earnings revisions following their report announcements.

The highlight is that out of 135 companies in the ASX Small Industrial Index that reported in July/August:

- 21 companies or 16 per cent had upwards revisions (more than 2 per cent positive change on next year’s eps)

- 66 companies or 49 per cent had downwards revisions (more than 2 per cent negative change on next year’s eps)

- 48 companies or 36 per cent had no major revisions (less than 2 per cent change on next year’s eps)

If we look at the sector breakdown, we can see that the trends were similar across most sectors, but that consumer discretionary and consumer staples were the sectors with the worst negative revisions, as well as the most number of companies seeing negative revisions, which indicates that consumer spending is not very healthy.

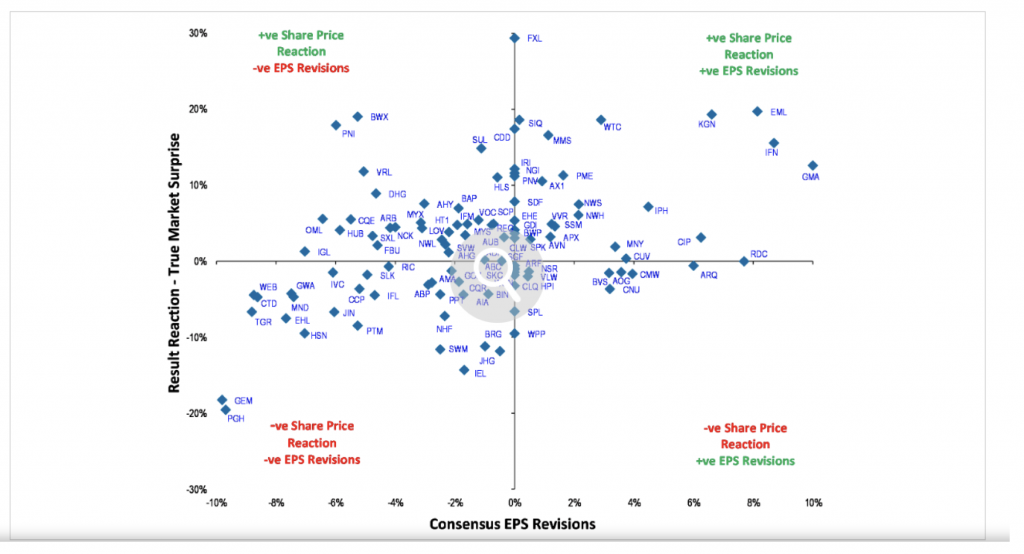

It is also interesting to look at the scatter chart below showing the revisions compared to the share price reaction of the day of the result. Normally, markets function so that earnings expectations drive share prices and we can see from the chart below that this is generally the case but that there are always some exceptions to this.

The main explanation to the exceptions is that published earnings estimates are not always accurately reflective of what the market really expects or, in other words, there is a mismatch between what sell-side analysts who publish their forecasts and investors who do not are forecasting.

There can of course be some other reasons for exceptions like corporate activity (i.e. announcement of take overs, share buy-backs and management changes etc.). Overall, I would say that the relationship between earnings revisions and share price performance held up pretty well during this reporting season and the ASX Small Industrial Accumulation Index was down by 3.0per cent during August reflecting the worse than expected earnings and outlook that the companies as a whole presented to investors.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY