Are debt deferrals a ticking time bomb for the economy?

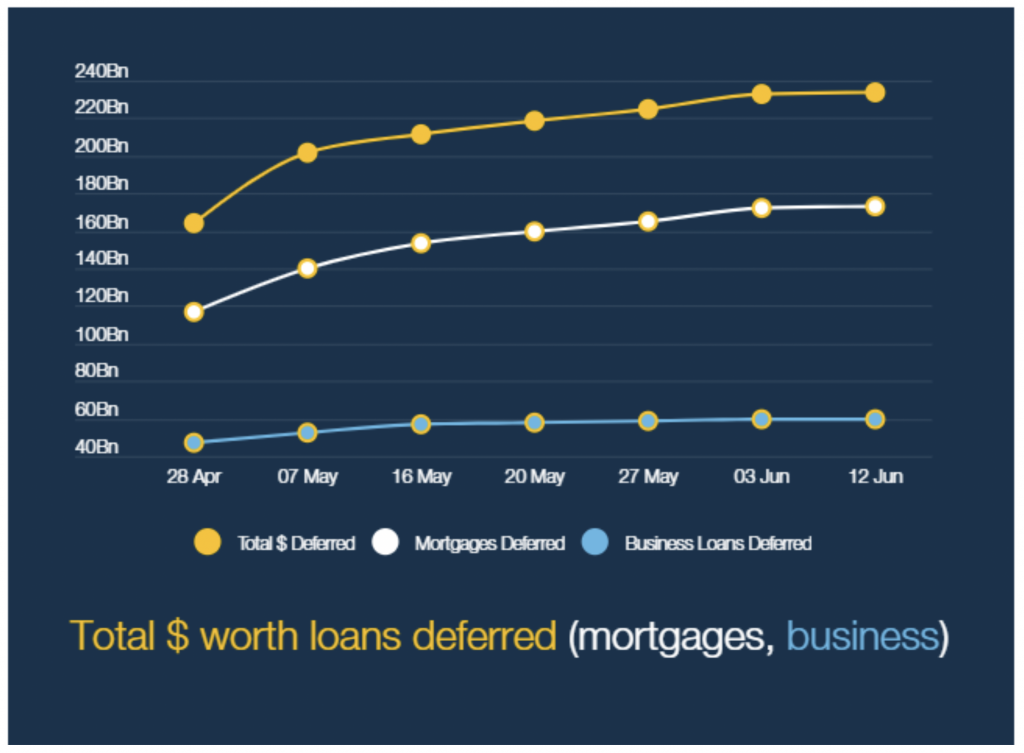

Last week, the Australian Banking Association (ABA) updated the market on the number of mortgages and business loans deferred due to impacts from the COVID-19 crisis. In all, loans totalling $234 billion are not being repaid. The question is: what proportion of these borrowers will be able to resume repaying the banks once the other COVID-19 stimulus measures end?

Just to recap, the banking sector – through the ABA – devised a policy where individuals, households and businesses can self-report to their bank that they are impacted by the crisis and receive a six-month deferral on interest and principal repayments.

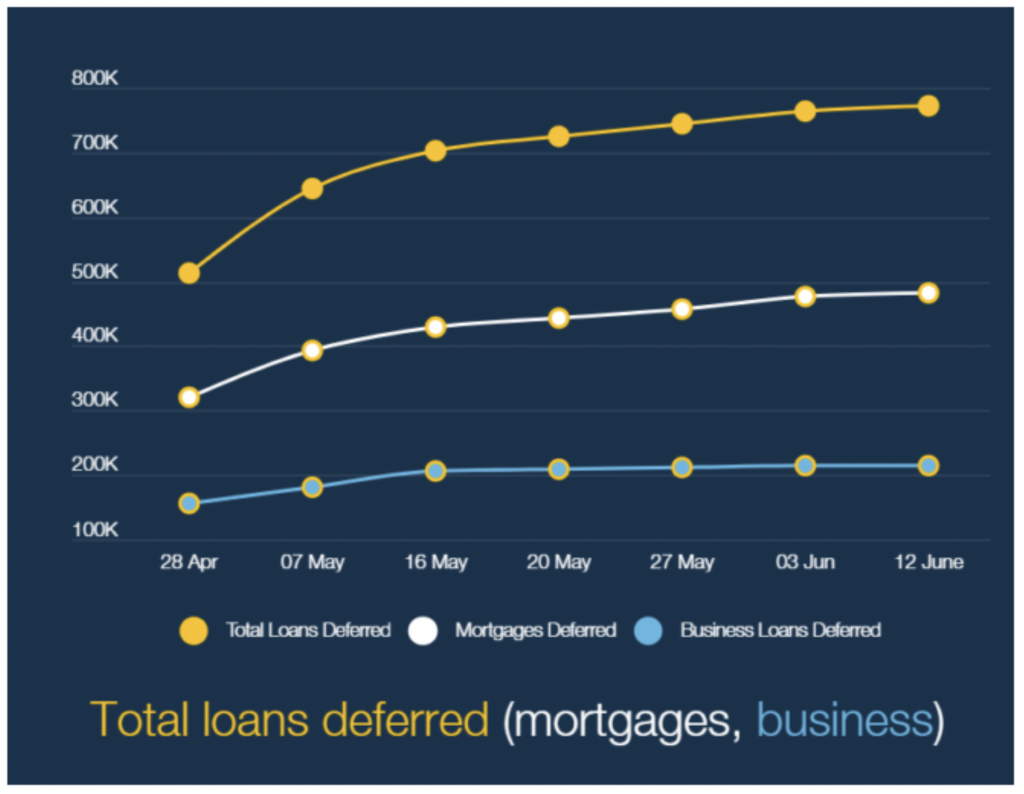

In total, 772,600 loans have been deferred and this includes 480,700 mortgages with the remaining being mostly personal credit.

This means that around 1 in 14 mortgage holders have had their interest and principal payments deferred.

If we look at the amount of money that has been deferred, it is in total $234 billion of outstanding loans that are currently not being repaid including $173.5 billion of mortgages.

Now, a loan deferral is very different from a loan forgiveness or an interest free period. These loans will need to be repaid and, even though interest is not currently payable, it still accrues and is added to the principal of the loan ($8.5 billion of interest payments have so far been added to the loans that are deferred).

This support policy is supposed to end in September after having been in place for six months and this raises a number of interesting questions/issues:

- Given this policy is running in parallel with the other stimulus packages like JobKeeper etc., what will happen to households and businesses’ ability to start paying their debt again once the cash inflows from the other stimulus packages go away? I note that the government has been clear that there will not be an extension to JobKeeper so we are at risk of seeing welfare payments decline substantially at the same time as debt repayments resume.

- There are of course a number of people and businesses (maybe even a substantial number) that have applied for the deferral out of an abundance of caution and did not really need it but reasoned that with interest rates at this very low level, a couple of extra months paying off your mortgage 10-30 years into the future does not make that much of a difference.

- I note that the combined equity capital in the 4 big banks is $251 billion and if all of these were loans were to be classified as impaired, it would wipe out 75 per cent of the combined equity of the big 4 banks (assuming their share of these loans are similar to their overall 80 per cent share of the Australian debt market. Now, this is not how accounting works as these loans will not be deemed impaired due to this deferral (banks are actually able to count the deferred interest as current income even through it is not actually paid… oh the wonders and logic of accounting rules…) and also hopefully a very substantial portion of the households and businesses will be able to start paying of their debts again but it is interesting to see the scale of the policy.

We have recently seen positive retail spending numbers and it will be interesting to see if some of that strength in spending is indeed coming from the savings from people not repaying their mortgage (which is indeed what the policy is designed to do) and if indeed both the income boosting payments packages and the debt deferral policies can be unwound at the same time without leading to a significant contraction in economic activity.

You can find other articles on this topic here, here and here.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY