Monthly Archives: March 2011

Flights reduced, jobs cut at Qantas

Roger Montgomery

March 30, 2011

The head of Qantas says high fuel costs and a series of natural disasters means the company is facing its most serious challenge since the global financial crisis. Today the airline’s chief executive Alan Joyce announced the company will retire aircraft, reduce flights to Japan and New Zealand, and cut staff. Roger Montgomery said “If they keep going the way they’ve been going – with the amount of planes that they’ve got, the amount of staff that they’ve got, the routes that they’ve got and the prices that they’ve got – then yes they’ll have to keep increasing the amount of money that’s contributed to the business”. Read transcript.

by Roger Montgomery Posted in Media Room, TV Appearances.

- 29 Comments

- save this article

- 29

- POSTED IN Media Room, TV Appearances.

Qantas cuts staff, flights to counter fuel price hit

Roger Montgomery

March 30, 2011

Qantas shares closed 4 cents higher at $2.19 after the company announced it will reduce international and domestic capacity, retire aircraft, reduce management positions and maintain fuel surcharges in an effort to offset soaring fuel prices. Roger Montgomery of Montgomery Investment Management told ABC report Michael Janda the company’s share price is lower than a decade ago for good reason. Read article.

by Roger Montgomery Posted in In the Press, Media Room.

- READ

- 1 Comments

- save this article

- 1

- POSTED IN In the Press, Media Room.

ValueLine: Fifteen stocks to watch

Roger Montgomery

March 30, 2011

I have prepared a list of companies that achieve extremely high Montgomery Quality Ratings of A1, A2 or B1, with a market capitalisation of greater than $1 billion, returns on equity of more than 10% and historical and forecast intrinsic value increases of more than 10% per annum. I hope you find the list educational and are able to put it to good use. Read Roger’s article at www.eurekareport.com.au.

by Roger Montgomery Posted in Media Room, On the Internet.

- 81 Comments

- save this article

- 81

- POSTED IN Media Room, On the Internet.

Why idolise the iPad2?

Roger Montgomery

March 29, 2011

It’s an amazing story… Man creates computer. Man overcomplicates computer. Man strips back computer and creates a brand that has revolutionised the way we are entertained.

It’s an amazing story… Man creates computer. Man overcomplicates computer. Man strips back computer and creates a brand that has revolutionised the way we are entertained.

Did you know Apple has sold over 300 million iPods and iPhones over the past decade? That’s 300,000,000 products. According to the World Bank, in 2009 the world’s population stood at 6,775,235,741. The World Bank also notes that 80 per cent of the world’s population lives on less than $10 per day. Of the remainder, every 4th man, woman and child has purchased an Apple products in the last decade. Not a bad competitive advantage, (postscript: but perhaps not a sustainable one?)

Apple is also infiltrating the way we work. The Montgomery office is all Mac (and for your information, we have never had to call an IT professional to fix anything). Our iPhones are synced with our iMacs and our MacBooks synced with our iPhones.

You have heard the stories of Apple fans setting up camp on the footpath outside Apple’s flagship store on Sydney’s George Street. Australians don’t do that for coal or iron ore.

And don’t forget the accessories market. There’s no special concessions for development partners. Privately held companies that manufacture the sleeves, cases and connectivity devices that enhance our Apple experience don’t get hold of new devices until we do – on launch day.

Apple has the X-factor. Its product is unique. Its experience is unique and there is an almost religious fervour toward the brand. Competitors don’t stand a chance. The result? High, durable rates of return on equity and a rising Value.able intrinsic valuation – an A1 business.

Return on Equity is just one of dozens of metrics I uses to produce the Montgomery Quality Rating (MQR). Re-read Chapter Eleven, Step C on page 188 of Value.able for the Value.able ROE calculation.

Who is the Aussie equivalent? The Australian market may be much smaller than the US, but there are a handful of extraordinary businesses, A1 businesses. And its worth finding tem. They may not be listed yet. They may not even have launched yet…

Posted by Roger Montgomery, author and fund manager, 29 March 2011.

Postscript: The data used to calculate intrinsic value is available here: https://www.apple.com/investor/

by Roger Montgomery Posted in Companies, Investing Education, Value.able.

- 187 Comments

- save this article

- 187

- POSTED IN Companies, Investing Education, Value.able.

Who makes your A1/A2 small cap list?

Roger Montgomery

March 25, 2011

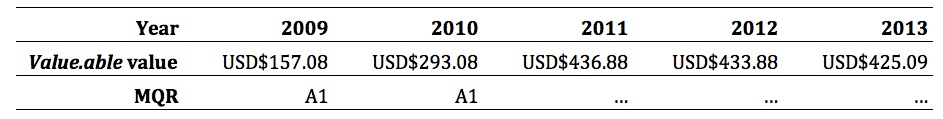

Time was a rare commodity on Peter’s show last night. Whilst I managed to list a few A1 and A2 small cap stocks that I consider make the Value.able grade, there just wasn’t time for details. So, as promised, I have put together a quick precise of two stocks (in boring businesses) I listed last night.

Time was a rare commodity on Peter’s show last night. Whilst I managed to list a few A1 and A2 small cap stocks that I consider make the Value.able grade, there just wasn’t time for details. So, as promised, I have put together a quick precise of two stocks (in boring businesses) I listed last night.

Remember: DO NOT rush out and buy shares in any company I discuss with Peter or any other media outlet (or here at the blog) without conducting appropriate research and seeking personal and professional advice FIRST!

These insights are not a solicitation to trade any security. I may own shares in the companies mentioned. I cannot predict share price directions – they could all fall by 80% or more after you buy. Finally, I am under no obligation to keep you updated with any change of my view, my estimate of the Value.able value of the company or my Montgomery Quality Ratings (MQRs).

Before I begin, here are the highlights from last night.

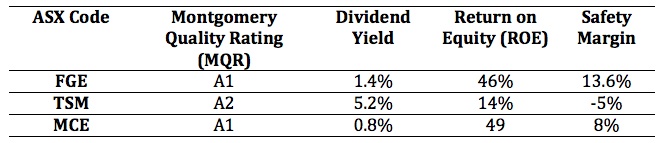

Zicom Group (ZGL)

In 2007, the first reported results after purchasing the Zicom Group, the company earned $6 million on equity of $21.6 million (ROE 27.7%). Since then another A$8 million has been raised from owners and profits have risen to A$8 million. Return on additional capital is 25%.

In the HY11 results, the company announced a profit A$7 million. Revenue grew from $47.75 million in the previous corresponding period to $71 million. A buyback of $4 million shares occurred in the half.

Company forecasts are for a full year profit of $12.9 million, which would representing a return on equity of 18%. Growth in equity is exceeding growth in profits, however the ‘growth’ has been through retained earnings.

Zicom has four divisions; Offshore Marine Oil & Gas (43% of revenue, makes winches and ROV’s/oil rig boom to help – think winches on ships that lift ROV’s off deck and into water), Construction Equipment (39%, concrete mixers/marginally profitable & foundation equipment), Precision Engineering & Automation (14% constructs automated production lines, ink cartridges for HP, semi conductor and medical devices and associated components) and Industrial and Mobile Hydraulics (4%).

ZGL’s order book stands at $83.2 million, up from $68.9 million. Cash flow was negative $10 million, however $5 million was spent seeding two start-ups and another $5 million was spent on acquisitions ($700k of PP&E and $4 million on buying back shares).

Click here to read Roger’s latest insights on Zicom, published 6 April 2011 in Alan Kohler’s Eureka Report.

Codan Limited (CDA)

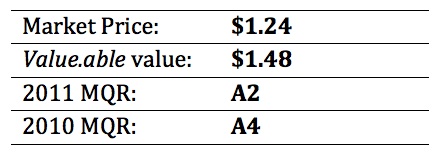

Codan Limited designs and manufactures a diversified products range for the international high-frequency radio, satellite and metal detection markets (think Minelab metal detectors).

Shares on issue are virtually unchanged from a decade ago and borrowings, which surged from $2 million in 2007 to $73 million in 2009, fell to $52 million last year and another million in the latest half year.

CDA’s 2007 profit of $11 million fell to $8 million in 2008, then rose to $24.4 million last year. The company forecasts profit of $20-$22 million in 2011 (optimistic analysts believe this figure will be higher, circa $24 million).

Since 2001, CDA’s profits have increased by 10.13 per cent per annum, from $10.268 million to $24.472 million

To generate this $14.2 million increase in profit, shareholders have put in equity of $21.859 million and left in earnings of $23.150 million (32%). The company has also borrowed $8.615 million net, in addition to the $43.483 million of debt held in 2001, resulting in current debt outstanding of $52.098 million and a net debt to equity ratio of 46.66 per cent.

Return on Equity is the best measure of economic performance, and CDA has averaged 31.02 per cent since 2001. Recently, CDA generated a return on equity of 37.94 per cent.

Finally, I also mentioned a small number of small cap stocks that are high quality and appear to be trading at a discount or close to my estimate of intrinsic value at the moment – Forger Group, ThinkSmart and Matrix Composites and Engineering. Here is my list:

Over at facebook.com/montgomeryroger Unc Dev’s list includes Thorn Group, Reckon, Iress, Nick Scali and Fleetwood. Shuo nominated PFL and Kristian proposed FSA, SWL & RQL. Which stocks make your A1/A2 small cap list?

Posted by Roger Montgomery, author and fund manager, 25 March 2011.

by Roger Montgomery Posted in Companies.

- 312 Comments

- save this article

- 312

- POSTED IN Companies.

Which small cap stocks have caught Roger Montgomery’s Value.able eye?

Roger Montgomery

March 24, 2011

Peter Switzer asked Roger Montgomery to reveal which small cap stocks achieve his A1 Montgomery Quality Rating (MQR). Forge Group (FGE), Matrix Composite (MCE) and Think Smart (TSM) have been on Roger’s list for a while. They all pass Roger’s Value.able criteria for extraordinary businesses – good quality, bright prospects, low debt, competitive advantage and rising intrinsic values. In this interview Roger reveals three new stocks that look set to make his A1 grade, plus his Value.able estimate of their intrinsic value. Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

ValueLine: Your retail form guide

Roger Montgomery

March 23, 2011

Entrants in Australia’s retail sector range from nippy thoroughbreds to tired donkeys… Harvey Norman, Oroton, Woolworths, Myer, Coles, Noni B, Kathmandu, JB Hi-Fi, Fantastic Furniture, Nick Scali, The Reject Shop and Billabong. Roger reveals his Montgomery Quality Rating (MQR), forecast change in Value.able intrinsic value over the next twelve months and the current safety margin for these well-known Australian retailers in his latest column for Alan’s Eureka Report. Read Roger’s article at www.eurekareport.com.au.

by Roger Montgomery Posted in Media Room, On the Internet.

- 58 Comments

- save this article

- 58

- POSTED IN Media Room, On the Internet.

Wesfarmers shareholders wait for return on takeover

Roger Montgomery

March 21, 2011

Wesfarmers’ $20 billion purchase of the Coles group is Australia’s biggest takeover, but Roger Montgomery says shareholder value has being destroyed. Read transcript.

by Roger Montgomery Posted in Media Room, TV Appearances.

- 47 Comments

- save this article

- 47

- POSTED IN Media Room, TV Appearances.

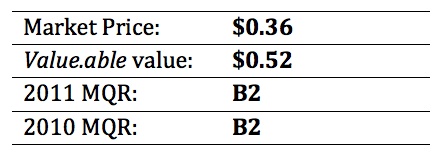

When to sell? Matrix and other adventures in Value.able Investing

Roger Montgomery

March 18, 2011

In August 2010 Matrix Composites & Engineering, when we first began commenting on the company, was trading around $2.90. Thirty days later the share price was at $4.48. Today MCE is trading at just over $9.00 and has a market capitalisation of more than half a billion dollars. It’s no longer just a little engineering business. Like the Perth industrial precinct of Malaga in which its headquarters are based, MCE is growing rapidly (according to Wikipedia there are currently 2409 businesses with a workforce of over 12,000 people in Malaga. The 2006 census listed only 28 people living in the suburb).

But has MCE’s share price risen beyond what the business is actually worth?

Stock market participants are very good at telling us what we should buy and when. When it comes to selling, it seems silence is the golden rule.

If you receive broker research, take out a report and turn to the very back page – the one beyond the analyst’s financial model. You will often find a table that lists every company covered by that broker’s research department. Now look to the right of each stock listed. What do you notice?

Buy… Buy… Hold… Buy… Buy… Accumulate… Hold…

What about sell?

There aren’t many companies in Australia worthy of a buy-and-hold-forever approach. And if you have invested in a company with a previous BUY recommendation, the luxury of a subsequent Ceasing Coverage announcement by the analyst is not helpful.

So then, when should you sell? It is a question I have been asked, to be honest, I can’t remember how many times. Because I have been asked so many times, it’s a question I answered in Chapter 13 of Value.able – a chapter entitled Getting Out.

Value.able Graduates will recognise a sell opportunity. Yes, it is an opportunity. Fail to sell shares and you could eventually lose money.

Of course, any selling must be conducted with a certain amount of trepidation, particularly when capital gains tax consequences are considered. But not selling simply because of tax consequences is unwise.

We pay tax on our capital gains because we make a gain. Yes, its difficult handing over part of our investment success to the Tax Man for seemingly no contribution, but without success our bank balance would remain stagnant forever.

When then should you sell? In Value.able I advocate five reasons. For now I would like to share with you a possible reason. Based on any of the other reasons I may be selling Matrix so make sure you understand this is a review based on one of five reasons.

Eventually share prices catch up to value. In some cases it can take ten years, but in the case of Matrix, it has taken far less time for the share price to approach intrinsic value.

One signal to sell any share is when the share prices rise well above intrinsic value.

There are no hard and fast rules around this. And don’t believe you can come up with a winning approach with a simple ‘sell when 20% above intrinsic value’ approach either.

What you MUST do is look at the future prospects. In particular, is the intrinsic value rising? I believe it is for Matrix (and I am not the only fund manager who does – you could ask my mate Chris too).

Here’s some of his observations: Risks associated with the timing of getting Matrix’s facility at Henderson up and running are mitigated by keeping Malaga open. And Malaga is producing more units now than it was only a few months ago. Matrix could also produce more units from Henderson than they have suggested (the plant is commissioned to produce 60 units per day) and I believe the cost savings will flow through much sooner than they say. Recall the company has indicated Henderson could save circa $13 million in labour, rent and transport costs (see below analyst comment). Excess build costs are now largely spent and if the company can ramp up to 70 units a day, HY12 revenue could double.

Why do I believe this? Because a recent site visit for analysts suggested it. As one analyst told me: “Production of macrospheres has started from Henderson with 7 of the 22 tumblers in operation. This is a good example of the labour savings to come as it’s now a largely automated process – there were only 3 people working v >20 on this process at Malaga.”

(Post Script: My own visit to WA at the weekend revealed a company capable of producing just over 100 units per day – Henderson + Malaga) Moreover, the sad events unfolding in Japan will force a rethink on Nuclear. If nuclear energy – recently hailed as a green solution to global warming – reverts to being a relic of an old world order, demand for oil will increase. Oil prices will rise. Deep sea drilling will be on everyone’s radar even more so.

And the risks? Well, one is pricing pressure from competitors. This is something that needs to be discussed with management, but preferably with customers!

Some Value.able Graduates may be reluctant to place too much emphasis on future valuations. Indeed I insist on a discount to current valuations. If it is your view that future valuations should be ignored, then you should sell.

Personally I believe one of my most important contributions to the principles of value investing is the idea of future valuations. Nobody was talking about them at the time I started mentioning 2011 and 2012 Value.able valuations and rates of growth. They are important because we want to buy businesses with bright prospects. And a company whose intrinsic value is rising “at a good clip” demonstrates those bright prospects.

If you have more faith and conviction that the business will be more valuable in one, two and three years time, you may be willing to hold on. On the basis of this ONE reason I am currently not rushing to sell Matrix (of course I may sell based on any of the other four reasons), however notwithstanding a change to our view (or one of the other four criteria for selling being met) I do hope for much lower prices (buy shares like you buy groceries…)

I cannot, and will not, tell you to sell or buy Matrix and I might ‘cease coverage’ at any time. As I have said many times here, do not use my comments to buy or sell shares. Do your own research and seek and take personal professional advice.

What I do want to encourage you to do is delve deeply into the company’s history, its management, their capabilities, recent announcements and any other valuable information you can acquire.

And in the spirit demonstrated by so many Value.able Graduates, feel free to share your findings here and build the value for all investors.

When the market values a company much more highly than its performance would warrant, it is time to reconsider your investment. Looking into the prospects for a business and its intrinsic value can help making premature decisions. Premature selling can have a very costly impact on portfolio performance not only because the share price may continue rising for a long time, but also because finding another cheap A1 to replace the one you have sold, is so difficult. At all times remember that my view could change tomorrow and I may not have time to report back here so do your own research and form your own opinions. Also keep in mind that we do not bet the farm on any one stock so even if MCE were to lose money for us (and we will get a few wrong) we won’t lose a lot.

Posted by Roger Montgomery, author and fund manager, 18 March 2011.

by Roger Montgomery Posted in Companies, Energy / Resources, Investing Education, Value.able.

Investor type 2: the tester of patience, the value investor

Roger Montgomery

March 17, 2011

Marcus Padley, stockbroker and author of sharemarket newsletter Marcus Today, investigated “Value investing” as a potentially a potentially adoptable self-managed super trustee identity. Marcus wrote “At its worst, it is a great filter for identifying bad stocks. At its best, it is a disciplined structure for share assessment that works. If you can do it, it knocks the socks off any other. For those that want to pursue it, let me plug Roger Montgomery’s book Value.able. It’ll get you started without having to read boring old textbooks.It’s on Montgomery’s website – www.rogermontgomery.com“. Read Marcus’ article.

by Roger Montgomery Posted in In the Press, Media Room.

- READ

- 24 Comments

- save this article

- 24

- POSTED IN In the Press, Media Room.