Which A1 twin is outperforming?

This journey began with the simple question Will David beat Goliath?

This journey began with the simple question Will David beat Goliath?

Value.able Graduate Scott T resolved to take up a fight with conventional investing, by tracking the performance of a typical and published ‘institutional-style’ portfolio against a portfolio of companies that receive my highest Montgomery Quality Ratings.

By 30 June 2011 the A1 portfolio was up 1.8 per cent compared to the XJO, which was down 2.9 per cent. As for the conventional ‘institutional’ portfolio, the bankers were down 6.2 per cent.

Over to Scott T for his third quarter update…

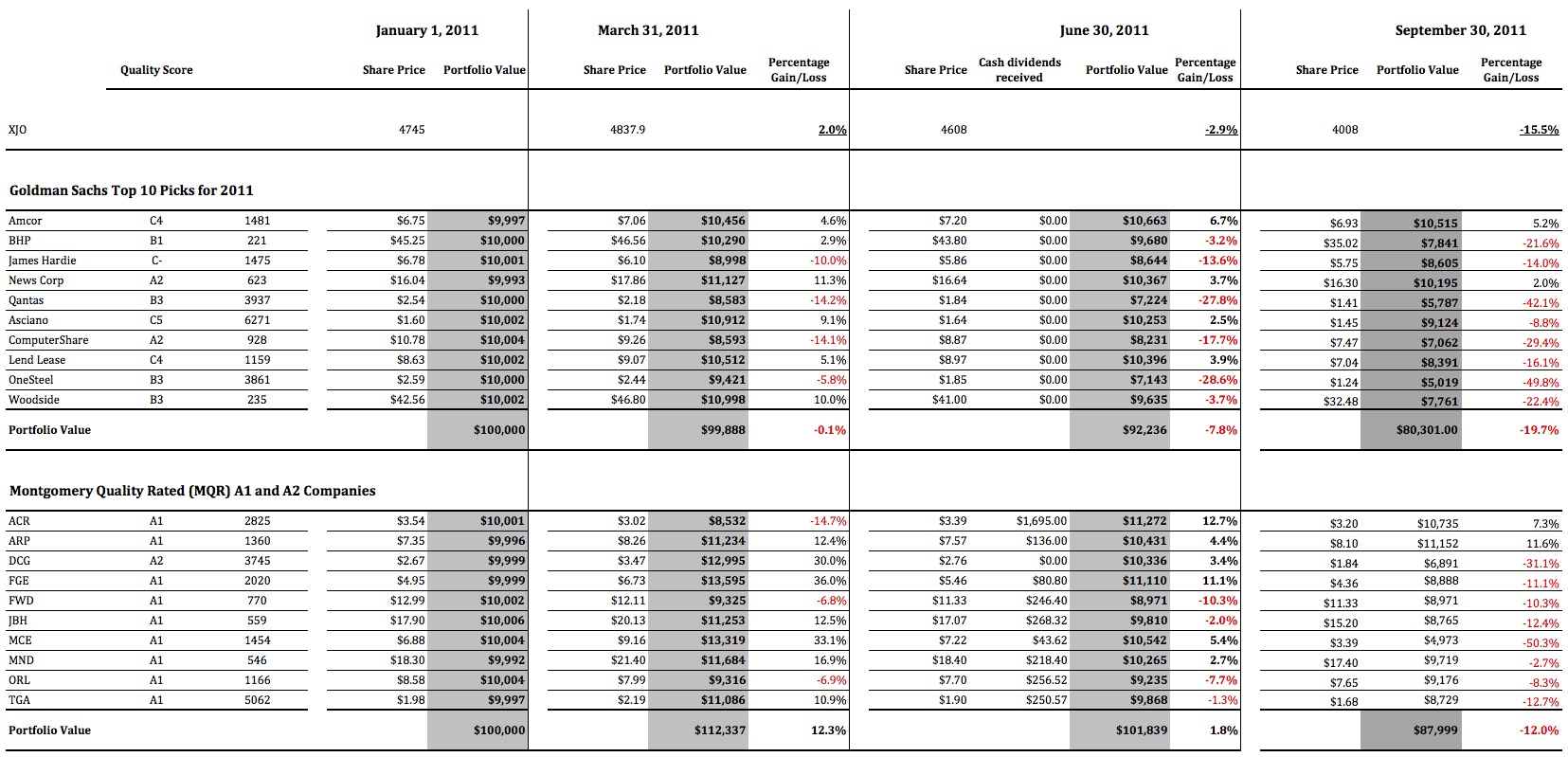

“For new readers to Roger Montgomery’s Insights Blog, welcome. Here at Roger’s blog we are conducting a 12-month exercise measuring the performance of a basket of 10 stocks recommended by Goldman Sachs, against a basket of 10 A1 or A2 businesses that were selling for as big a discount to Intrinsic Value as we could find.

“Nine months have now passed since our twin brothers each invested their $100 000 inheritance, and it has been a very turbulent time in the market.

“Our Queensland regional accountant has had his head down at the office for the entire quarter. The end of the financial year had come and gone and hundreds of clients where sending in their tax documentation, calling with questions and chasing their refunds. Time flew by in the office, and he hardly had time to try to attract new clients, let alone watch the daily gyrations of the global equities markets. By the end of September when he was finally able to take a breath and look at the performance of his portfolio.

“He was surprised at how poorly his portfolio of A1 and A2 companies, acquired at prices less than they were worth, had faired. But he quickly realised the overall market had done even worse. Loosing 12 per cent, or $12 000, YTD was bad. But it could have been worse, much worse.

“His twin brother was in a world of pain. The federal department he worked for felt like it was under attack. The mood in the department was that the media seemed hell bent on criticising everything the government did. No initiative was well received and every announcement was instantly compared to last months failure. To top it all off, every night he would check his portfolio, to see how much more of his inheritance had vanished. The red negative number on his spreadsheet just seemed to steadily increase. With little information to go on, and a feeling of helplessness washing over him, he thought seriously about visiting his financial advisors, desperately seeking reassurance, and perhaps changing the mix of the stocks held. He resounded, “Buying what they advised would be good for 2012”.

“As per the first half of the year, dividends will be picked up in the fourth quarter, when shares have finished going ex-dividend and the dividends have actually been received.

“In summary for the nine months to 30 September 2011:

The XJO is DOWN 15.5 per cent

The Goldman Sachs Portfoliois DOWN 19.7 per cent

The A1 and A2 Portfolio is DOWN 12.0 per cent

The A1 and A2 Portfolio has achieved an OUTPERFORMANCE of 3.5 per cent over the XJO and 7.7 per cent over the Goldman Sachs portfolio.

“Here are the portfolios in detail, including cash dividends received in the first half (click the image to enlarge)

“We will visit the brothers again at the end of December for a final wrap up of their first year, and discuss their strategies for 2012

“All the Best

Scott T”

Thank you Scott.

How is your A1 portfolio performing?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 6 October 2011.

Scott

Welldone,thanks .In the Dec wrap up can you use scaffold to show the relative

IV’s at each stage of the exercise.

Might be interesting

Yes Roger, when people get theor super statements this month, they will not be happy

If this is a long term comparison, then I do not think changes should be allowed in either portfolios even on a yearly basis. A true comparison should be over many years, with minimal tinkering. If this is tinkered with every year then this becomes an exercise in short termism. I also agree that the comparison should be the all ords accumulation index, not the XJO.

Share Indices Accumulation Series

I used to find this on the AFR site

But i don,t seem to be able find it now

I just buy the Financial Review

I do this once a month to review my SMSF balances

On Sept 30

XJO Accumulation index has fallen by12.5%

XAO Accumulation by 13.5%

It is quite misleading to to add the dividends & then compare to an index which does not include the dividends

If i am right the accumulation index assumes you have reinvested the dividends.?? If so this is also misleading

With these in mind: don’t include dividends in the share price

but have another column for dividends received; preferably grossed up to include the value of franking credits

Use XJO for Goldmans & XAO for MQR stocks

If you only want one index take XAO

Please let us have your input

Someone my like to redo the table this way???

Macca

Roger, this somewhat triumphalist blog post appears to go against everything you advocate in your book. What relevance is there in the outperformance of an index or some other fund manager(s) over a nine month period? In your book you advocate ignoring the short term gyrations of the stock market. Isn’t it all about investing in good businesses that perform well over the long term? What happened to the oft quoted Benjamin Graham’s “In the short run the market is a voting machine, in the long run it’s a weighing machine.”. Or is it that you regard nine months as long term? This post is even more embarrassing given the level of outperformance being trumpeted and the fact that it has been “achieved” in an extremely volatile market where such percentages can swing one way or other in the course of a day or even an hour!

Hi Mike,

We will be tracking this for a very long time, but we have to make a start. So, by definition, there will be a period of short termism. In our own investing we remain true to label and are staying the course. This is an exercise started by Scott and one I am watching with interest for a very long time. Scott updates us each quarter. And aside from all of that, we don’t need to take ourselves too seriously in every post. A little bit of fun at the our own expense or that of a big institution (depending on the “day” or “hour”) is ok – a bit like Buffett’s “tax-return off” challenge this week to Rupert Murdoch.

To Roger and All others

I have managed my SMSF since 1988 – In the early days I asked advice from the professionals re- investments and I can confirm no one gets it right – you just get a degree of success. In 2005 I had to access my super and a part disability pension however the well known financial business that that I entrusted my SMSF to in 3 yrs

lost me half of my funds value. I won after 12months of sacking them but I was still 40% out of pocket. For the last 3 years due to necessity I have again managed my own fund and achieved a 25% return on my investments year on year. Starting this financial year I am very concerned about the next few years and have reduced my stock holdings by 50% It is in my opinion a short term high risk play.

Hi Roger,

The ROE for acr is 125%. How do I use the ‘ multiplier selector ‘ tabled 11.2 on page 184 ? It only goes up to 60%.

Thanks

George

Hi George,

There’s have been many questions like yours here at the blog. For the benefit of all readers, its worth going through the answers again, so I will open it up to the community to explain. Anyone?

I’ll give it a shot. I think abnormally high ROE can be attributed to a company taking on more debt, which then reduces the “net equity” component of the ROE equation and therefore inflating the result.

In the case of ACR, it received a lump sum royalty payment which temporarily spiked the ROE in 2011. The royalty payment is not expected again in 2011/2012 and therefore NPAT will probably be significantly lower in 2012, the large ROE is not justified in the future.

So I think the table cuts off at 60% because it is extremely rare for a company to maintain that kind of ROE, and if you get a value higher than that, it is probably just a temporary inflation and you should stick to lower ROE expectations for your valuations.

Hi George,

Sometime ago this bothered me as well, basically I now look at it this way. Return on equity of this proportion is not sustainable over time, therefore I am happy to use 60% as the max amount, This will also give you a little bit more margin is safety. Works for me anyway, hope this helps

By the way Roger love the name of new service, it can have so many hidden meanings. Support, levels can be modified, safe, easy to use, mobile, easy to build and alter, helps people to reach higher and higher, all whilst providing a stable platform, hats off to the person who thought of the name

Regards

Robert

Thanks for the encouragement. I thought so too.

Hi George/Roger

Most of the grads must be watching the Bathurst 1000 so i will try to help

A 125% ROE is unsustainable so really you have to use history as a guide or use one of the higher ROE tables in the book.

Like choosing the RR and the MOS [when buying] there has to be some assumptions made to get a company value

The main thing is to chose extraordinary business growing at a fair clip in the future

I hope this helps

Thank you Tony.

Hi George. When looking at the ROE of ACR, consider that the main contributing factor to that income was a one-off (second) milestone payment from Lily of $87 million dollars. Although Acrux are due to receive further milestone payments and royalties from Lily, they are not expecting a similar payment (of that magnitude) from Lily in this FY. When considering what ROE figure to use when formulating a valuation Acrux, consider Acrux’s own future earnings guidance for this FY and the next.

Hope that helps.

John C.

Hi George,

The really simiple answer to your question is that a ROE of 125% is not sustainable in the long term. I don’t know the company from a bar of soap, their ROE history doesn’t give much of an indication either so i don’t know if this would be the case or not with ACR.

Usually when a company consistently earns a high ROE they attract competitors who will cause the companys return on equity to drop.

Rogers tables stop at 60% as anything above that is difficult and unlikely to be sustained.

My understanding of the value.able formula is that it is forward looking and by using a high ROE you are in one part saying that the ROE will be stay around 125% for a period of time. I think this is unlikely. Read up in value.able about implied growth rates and learn more about them.

Your mission is to do some research into ACR’s industry and determine what an acceptable growth rate is and work out any future value based on that.

Thanks Roger, Darren, Rob, Tony, John and , Andrew for helping me with my querie.

It’s great to be in contact with clever minds

Was this compared against the S&P/ASX200 accumulation index? Else it distorts the results of outperformance if both portfolios include dividends, but not the index in which it is being compared with. My assumption here is that the total return and not the capital growth/loss is what is important here.

Hi Scott and Roger

No one likes a smartarse, but truthfully, my $100,000 in bank hybrids has grown to $107,000 in the same 9 months. So, to the results quoted here, you should add in opportunity cost, no? I have owned 5 of the A1/A2’s in the list, but sold them all in high spots, being always prepared to buy in again. I based my sell decisions on the relevant sections of Value.able, just going a little early with the likes of FGE and ORL. I’ll probably be excommunicated for this but honestly,this is no market for buy and hold, not even in the short term,not in my book. I hope this all looks better by December, but if it were my portfolio I wouldn’t be sleeping soundly in the meantime.And as for Goldmans…Amcor? Qantas? Onesteel? Let’s not be cruel boys and girls..

Hi David,

I have always thought the easier decision is getting out. The much more challenging one for you is getting back in.

Hi Roger,

I’ve recently been researching what exactly determines the discount rate and while finding some answers, I have many more questions. In Value.able, you mention that the discount rate is determined by the ‘real rate of return’ (3.2%), historical inflation (3-5%) and the equity risk premium (around 4%). This leads to a static discount rate that does not change in different economic conditions. However, later on, you also mention that rising interest rates increase the discount rate and vice-versa. Where do interest rates come into this calculation?

From what I’ve gathered, Buffett has disclosed that he uses long term US bonds as his discount rate as they are risk free. He also adds something which I presume is a compensation for risk. But to my knowledge, Buffett has never mentioned inflation in his discount rates. Is this because the risk free rate already includes inflation?

At the moment, my theory on the discount rate is that investing in a business must give you at least the risk free rate, it must compensate you for the added risk in the business and it must adjust for the loss of purchasing power, ie. inflation. I believe that current figures should be used as when deciding where to allocate your capital, you must look at your alternative options at that very moment. For instance, right now the risk free rate is lower than usual so it would make sense to invest your money in stocks. My discount rate means the risk free rate and the inflation rate will change over time, which is different from the static discount rate advocated in Value.able. In summary:

Discount rate = Risk free rate in Australia (say 10 year government bonds) + Current inflation rate + Equity risk premium

Right now this would translate to:

4.2% + 3.6% + Equity risk premium

= 7.8% + Equity risk premium

With these inputs, if interest rates rise, inflation should fall and bond yields should rise, generally balancing each other out. One issue is that in an environment of very high inflation rates, the resulting higher discount rate may make stocks appear expensive and force you to hold cash or bonds. However, cash or bonds are a pretty undesirable place to park your money in this situation. This dilemma is why I ask whether inflation is already priced into government bonds. If you take out inflation from the above equation, you end up with a pretty low discount rate unless you adopt a high equity risk premium. Another issue is allowing the risk free rate to be determined by the market, which is often driven to extremes by fear and greed.

One more thing, it is regularly mentioned that when determining the intrinsic value, after tax earnings should be used. Each individual investor would come up with a different after tax risk free rate and after tax return on equity. However, when determining the value of a business, the market does not care what your own tax situation is, rather it reflects the majority of people. So why is it necessary to adjust the discount rate and ROE for your personal after tax earnings? Shouldn’t you be making an estimate as to what the tax rate of everyone else is? Sorry if much of this sounds confusing as I’m pretty confused myself.

Anyway, I’d like to say a big thank you to people like Scott T and Roger who take time out of their busy lives to share some of their wisdom and talents. It is greatly appreciated.

Thanks,

Chris

Hi Chris,

I will return and answer your questions in more detail later. For now, it’s important to understand that those discount rate inputs represent very long run averages. In the short run, they’re not static at all.

I will try to jot down my 2c worth:

“This leads to a static discount rate that does not change in different economic conditions.”

None of the variables comprising the equation are static, so this measure shall never ne static in the real sense. Yes, you may offsetting influences in the interim, but that does not mean that the state of flux is absent.

“For instance, right now the risk free rate is lower than usual so it would make sense to invest your money in stocks.”

When I ponder over this line of thinking, one must realize that risk free rates and equity risk premiums aren’t totally independent of each other. A depressed and volatile markets like today are usually charachtarized by low risk free rates and rising equity premiums (some might like to view this as contraction/ expansion in PE multiples)

Another pitfall of which an investor should be aware of is the fallacy in long-term averages, which I think RM accurately captured in his comment. And convergence back to these averages may trace a path that is not smooth or in line with our expectations. So if one is anticipating mean-reversion to be a charachter of the market movements going forward, say equity risk premiums to decline, they may take longer than expected or even get worse before they get better (an opportunity for a value investor).

As for tax related aspects, in big scheme of things a few basis point deviation and a MOS concept, will not be THE detrimental factor when it comes to long term returns. Go to any of these so called “independent expert”, valuation reports and they will find a way to express an adjusted after tax cost of return. Buffet’s adage of “being approximately right than being absolutely wrong” comes to mind. Hell, to a novice like me, an ideology of “after tax cost of equity” is essentially saying that what excess marginal return do you expect from a business, just resting on the notion that you will be required to pay some portion of your ‘expected returns’ in tax if those returns eventuate. Too much uncertainty at buying stage exists to deduce a mechanical explanation for a contingent event that shall occur upon selling.

As for myself, being a Value.able follower, what matters is risks inherent in the actual business that should take a front seat in determining the discount rate one should use, and not some ‘forecasted’ inflation or equity risk premium.

Cheers

Thanks Roger and Vinny,

I generally agree with what both of you have pointed out, that the Value.able discount rate will vary depending on what time period you select and historical averages can be deceptive. Also my question on after tax returns was just out of curiosity, whether or not you adjust for tax is probably insignificant if you follow the mantra of ‘approximately right’.

While I also agree that the underlying business is very important in deciding risk, I believe other aspects of the discount rate should not be ignored. In 1982, 10 year Australian government bond yields reached 16.4%. Using the discount rates in Value.able of 10-14% is clearly inadequate as you would be way over-valuing stocks. In this situation, the concept of ‘approximately right’ goes completely out of the window, your intrinsic values would be a mile off. So my question remains, what exactly determines the discount rate?

Im starting to think that while inflation will have an impact on your future dollars, there’s nothing you can do about it. What you should be worrying about is where best to put your money right now, whether that be cash, bonds, stocks etc. Therefore, the discount rate should simply be used to compare different investment options and decide which is currently the best one.

“one must realize that risk free rates and equity risk premiums aren’t totally independent of each other.” I’m not quite sure I understand this part, what is your definition of the equity risk premium? In my opinion, equity risk premiums should not be determined by the market, they should be an independent assessment as to the risks involved when investing in something. I know that Roger has spent many hours finding a way to calculate the equity risk premium without human input. Buffett varies in what he says, on occasions, he says that you can’t compensate for risk by using a high discount rate, while on others he says that there are degrees of certainty that influence his discount rate. For myself, the equity risk premium inevitably subjective and I am still learning how to better account for risk. But that’s something for another day.

Thanks,

Chris

Interest rates are a vital input and like gravity they effect the value of every asset, not just shares. You can for example say I will have a minimum rate of say 10% even if rates are much lower but if rates exceed x I will raise my minimum in lockstep with rates – all other factors remaining equal. This is not what we do at the company but it’s one possibility to think about. Many have attempted to quantify the required return eg CAPM but the science doesn’t produce any better long term returns than simply asking for, say 15%. Subjectivity with consistency is perhaps best.

I look at it this way: Risk Free Rate + Long term Inflation + equity risk premium.

My equity risk premium depends on the business and how comfortable I am with its continued and steady earnings power (most companies it is 4%, 2% for the best companies like WOW and the Banks) and 6% for new companies/anything commodities related (FGE, MCE, BHP etc).

In the last few years this has resulted in about 10% for banks, wow, 12% for most other companies and 14% for anything commodity related or a new company without too much history (bhp, rio, fge, mce etc)

Thanks for the input Roger, I saw you mention this possibility in Value.able and it sounds reasonable. Personally, I would prefer to simply use the risk free rate/interest rate even when it is low but just keep in mind this will likely go up and therefore demand a larger margin of safety. I also think there’s something to be said for over-conservatism, if your discount rate is too high, you can miss out on many gains – an opportunity cost. Expanding on my thought last time about the discount rate, I ask the question, what is value? How do you define it? I would say that value is relative to everything else. In our world, value is generally determined by interest rates, so to determine the value of a business you would at least need to compare it to the interest rate. And thanks for sharing your thoughts Parag, maybe you explain how you arrived at this discount rate, I’d be interested to know.

Chris,

I was just alluding to the fact that a ‘flight to safety’ pointing to depressed expectations of economic growth/ inflation expectations, usually manifests itself in risk-averse equity markets. Althout the decline in your benchmark real interest rates should provide some positive offset in supporting valuations, empirically investors have voted with extreme pessisism in such periods. ERP’s are likely to rise in such a period and exert negative influence on valuations. Or put simply in broker speak “More than decline in earnings, the overriding force in declining markets is the contraction in multiples”.

Cheers,

This is a great post, Scott. It is interesting that, even though the mining services companies have taken a real hammering over the past 6 months, the A1 portfolio continues to outperform both the index and the Goldman Sachs portfolio. Of course, it is long term performance that is important but I’m confident that a well researched portfolio of financially sound stocks purchased when they represent good value will produce a superior return.

“The A1 and A2 Portfolio has achieved an OUTPERFORMANCE of 3.5 per cent over the XJO and 7.7 per cent over the Goldman Sachs portfolio.”

Don’t forget to include dividends on the ASX 200 benchmark – XJO is exclusive of dividends and the index is around 3.5-4% yield.

Use ASX 200 Accumulation index to ensure dividends are captured on the XJO index benchmark you using or if you don’t have the data (you need to subscribe to the S&P dataset as its not public) use “SPDR S&P/ASX 200 Fund” ETF and track the distributions.

Kisses,LL

Scott – interesting table but I’m not sure your conclusion doesn’t have a bit of curve fitting to get the good result. From March to June the GS’s out performed the A’s by 4.4%. The A’s fell 10.5% to the GS’s 6.1%. A quick calculation shows that at close today they have fallen line ball – the GS’s by 14.0% and the A’s by 14.5%. On that basis over 6 months the A’s are behind mainly due to the “hammering” that FGE DCG and MCE have taken – the latter has to turn a 169% increase to get back to March levels – nothing in the GS’s has that level of “issues”. I think the point here is that you are looking at price not value – the market is driving prices (read US and Europe) and the opportunity to value invest is significant however the broader market (read inferior stocks) will perform over the shorter horizon as well as any A’s if not better – the dreaded large “blue chips” get held up by the institutions. I find it interesting that I read on the blog about buying cheap – now is as cheap as it gets – until it gets cheaper. The trick here is to be able to get out of the value stocks as they fall and back in when they are cheap, not ride the bronco because as you can see the quality doesn’t protect you – it will get you great returns one day but going down its not gurantee. As RM keeps saying, he’s not in the market in a big way but in cash – why is that? Surely there are many many great buys at significant discounts which should be bought. The reason he’s out I suspect is because the market isn’t right – how you determine that is a “technical indicator” and the decision is therefore not based solely on the intrinsic value of the share itself. I think that there’s a piece to the RM strategy that he;s keeping to himself (and rightly so) and thats the buy entry – I don’t believe its solely based on the share price.

If you held blue chips TLS, FGL and WES, you would have better returns this year than the index, the A’s & the GS portfolio.

Hi Michael,

As with most observations one swallow does not a summer make. Interesting you think that a foreign company buying fosters for a price it’s shareholders think is too much and arguably to prevent a takeover of itself, makes it blue chip. I don’t think it’s economic performance would justify that badge. Telstra hasn’t grown its profits one dollar in ten years. Blue chip? Dont take your queue from prices. But good point nevertheless.

Can’t speak for Roger, but i think the market is still expensive so i would be sitting on mainly cash as well.

Hi Scott T,

Love this post,

Is it just me or is there a problem?

When I click I just get updates up to june.

Again good stuff and take care

Apologies Ash and thanks for alerting us. Technical error with the file upload. The table now displays Scott’s results to 30 September 2011. Roger’s team.