Has 2010 been a good year for Value.able investing?

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.

Does the Value.able approach to investing, as advocated some of the world’s leading investors, have merit?

First Edition Graduates may not be surprised by the results posted below. The higher quality businesses, those scoring A1 and A2 Montgomery Quality Ratings (MQRs), and those at larger discounts to intrinsic value have, in aggregate, beaten the index. Some have trounced it. And with the exception of QR National, the companies that were labeled as poor quality (C4 and C5 MQRs) and overpriced, have under-performed. Some of the maturing higher quality companies (think JB Hi-Fi) have indeed performed.

The following tables present some of the blog posts and the stocks that I have listed, mentioned or discussed in them. I have consistently suggested investigating an approach that seeks the highest quality businesses and prices that offer the biggest discounts to value.

Whilst the results are short-term (therefore nothing should be taken from them), they are nevertheless encouraging. The approach advocated in Value.able is worth investigating.

Many Value.able Graduates have suggested I start a newsletter or a stock market advice service. Thank you for the encouragement. I do enjoy the cross pollination of ideas and look forward to 2011 attracting even more investors to the patient and rational approach shared here at my blog.

Here are the tables (DO YOUR HOMEWORK AND RESEARCH. ENSURE YOU ARE COMPREHENSIVELY INFORMED. SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE).

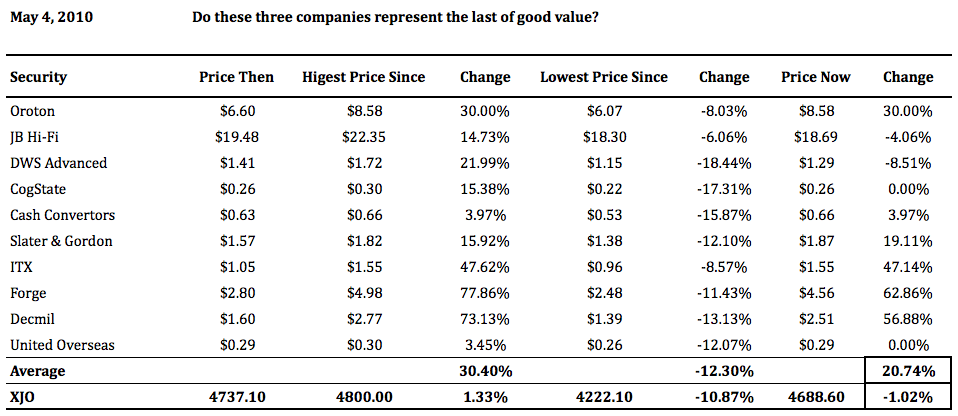

Do these three companies represent the last of good value? Oroton, JB Hi-Fi, DWS, Cogstate, Cash Converters, Slater & Gordon, ITX, Forge, Decmil and United Overseas

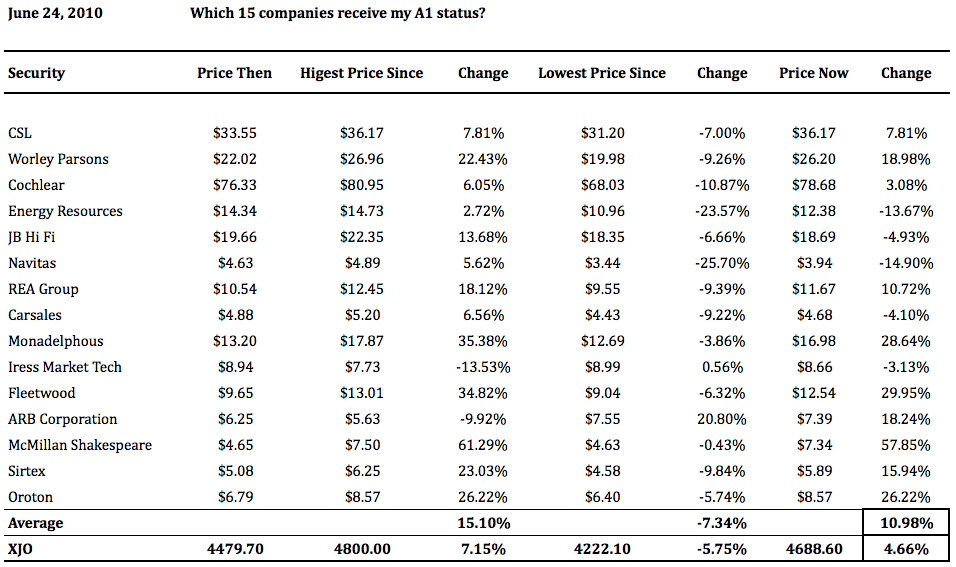

Which 15 companies receive my A1 status? CSL, Worley Parsons, Cochlear, Energy Resources, JB Hi-Fi, Navitas, REA Group, Carsales, Mondaelphous, Iress, Fleetwood, ARB, McMillian Shakesphere, Sirtex, Oroton.

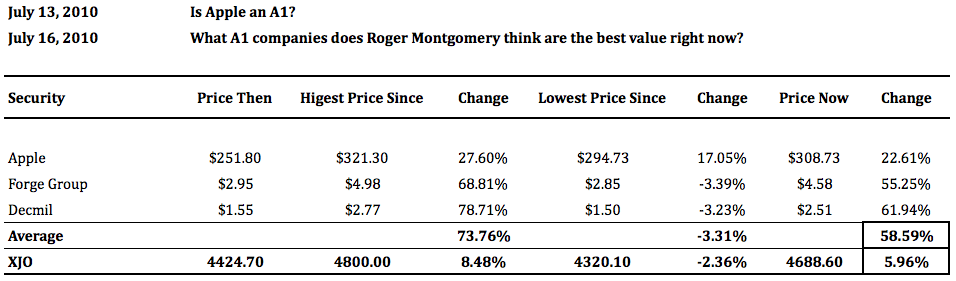

Is Apple an A1? What A1 companies does Roger Montgomery think are the best value right now? Apple, Forge and Decmil.

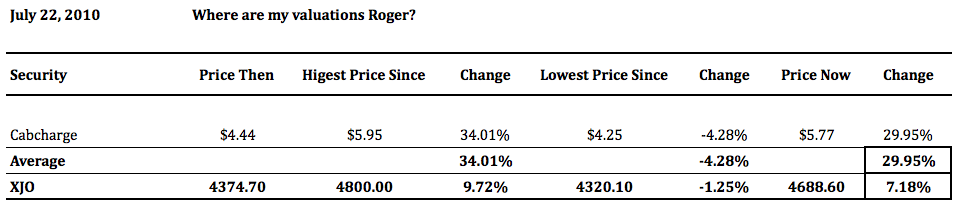

Where are my valuations Roger? Cabcharge.

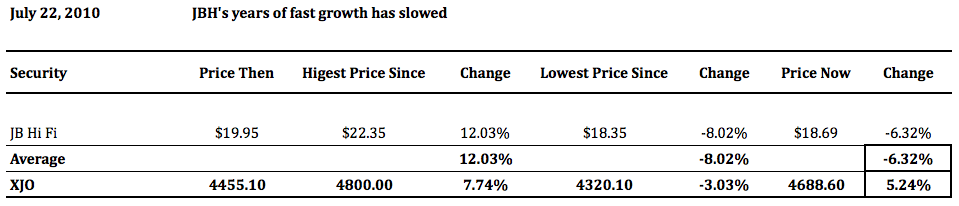

JBH’s years of fast growth has slowed.

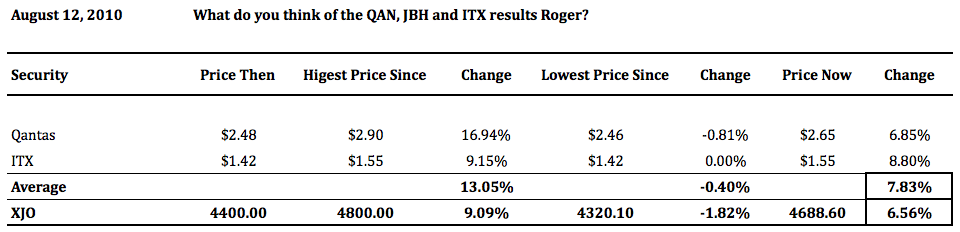

What do you think of the QAN, JBH and ITX results Roger? Qantas and ITX

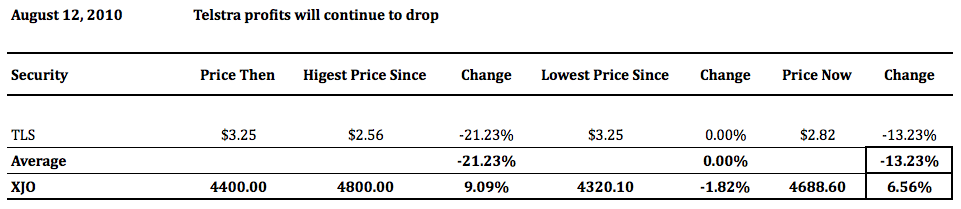

Telstra profits will continue to drop

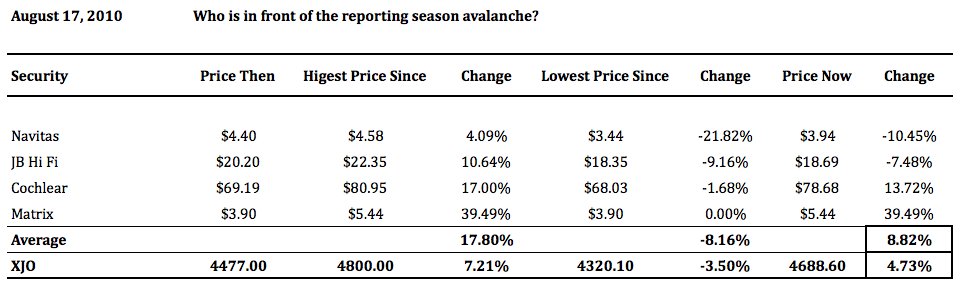

Who is in front of the reporting season avalanche? Navitas, JB Hi-Fi, Cochlear and Matrix.

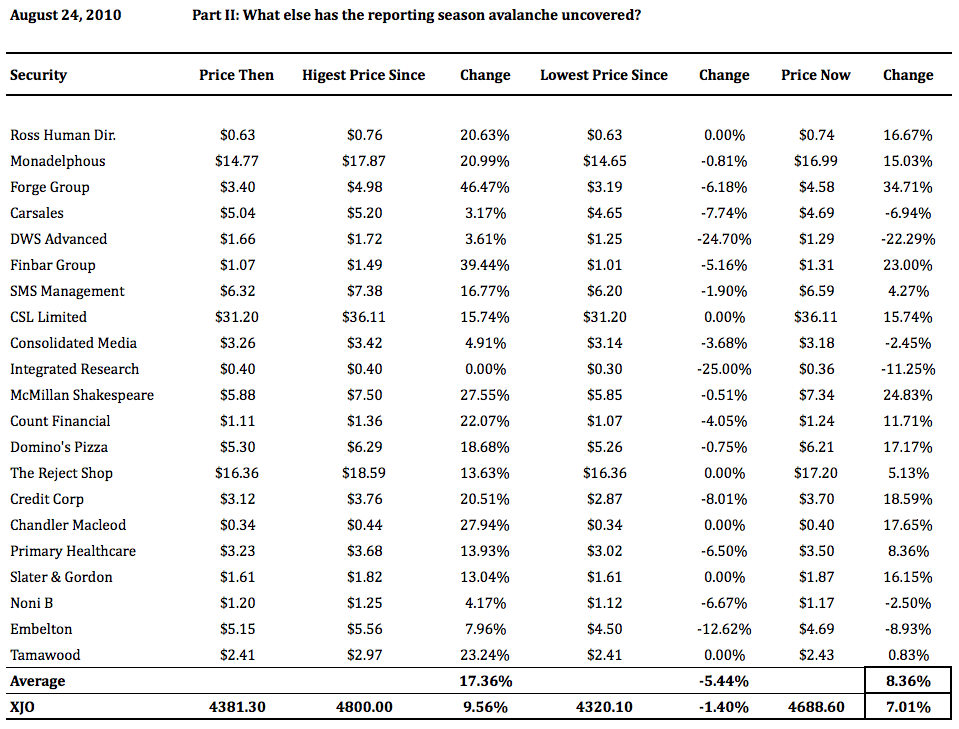

Part II: What else has the reporting season avalanche uncovered? Ross Human Directions, Monadelphous, Forge, Carsales, DWS, Finbar, SMS Management, CSL, Consolidated Media, Integrated Research, McMillian Shakesphere, Count Financial, Domino’s Pizza, The Reject Shop, Credit Corp, Chandler Macleod, Primary Healthcare, Slater & Gordon, Noni B, Embelton and Tamawood.

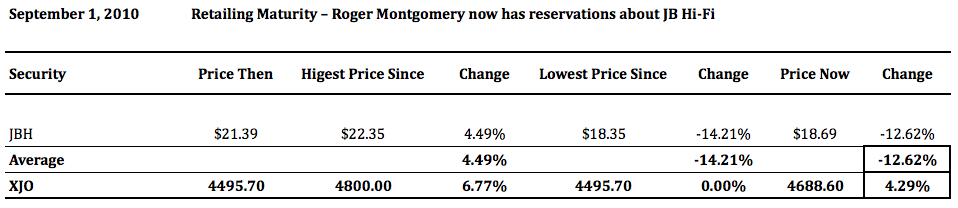

Retailing Maturity – Roger Montgomery now has reservations about JB Hi-Fi.

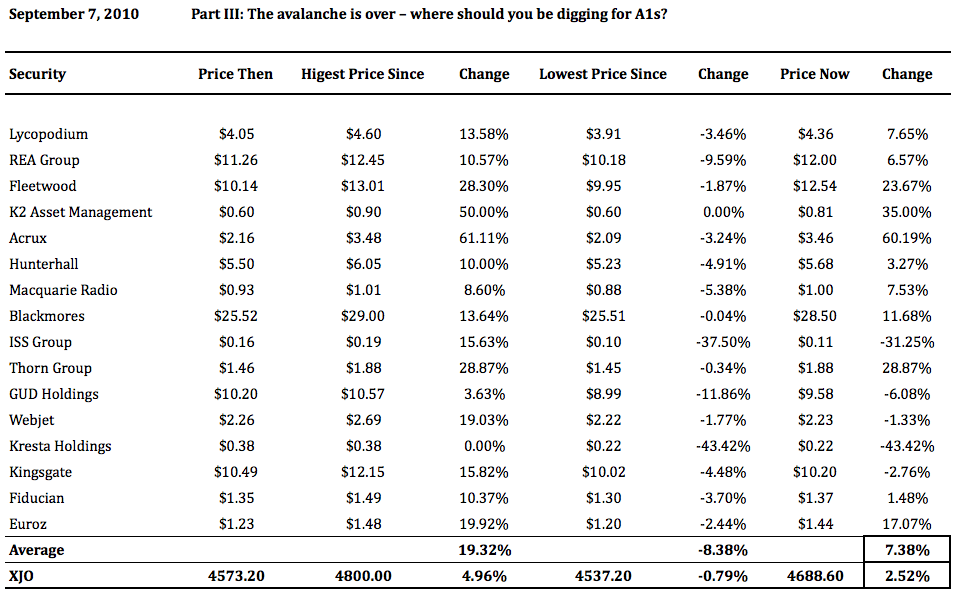

Part III: The avalanche is over – where should you be digging for A1s? Lycopodium, REA Group, Fleetwood, K2 Asset Management, Acrux, Hunterhall, Macquarie Radio, Blackmores, ISS Group, Thorn Group, GUD Holdings, Webjet, Kresta Holdings, Kingsgate, Fiducian and Euroz.

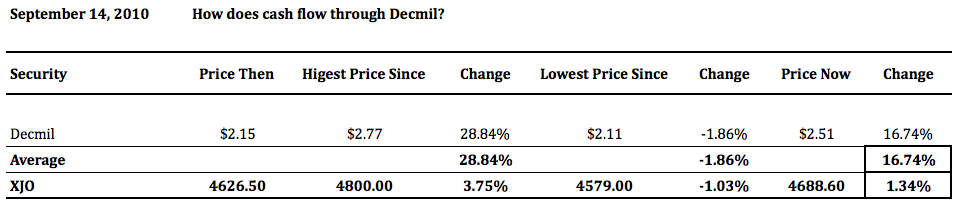

How does cash flow through Decmil?

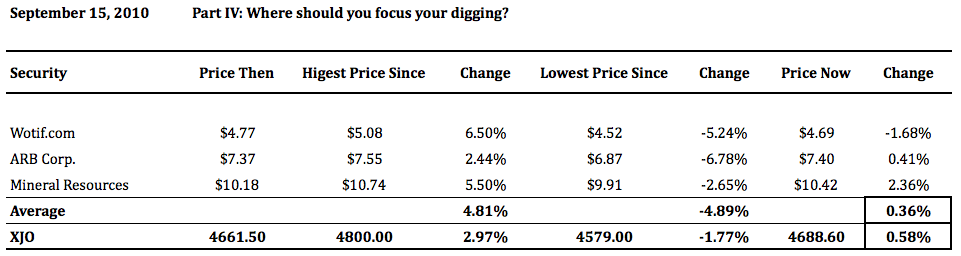

Part IV: Where should you focus your digging?

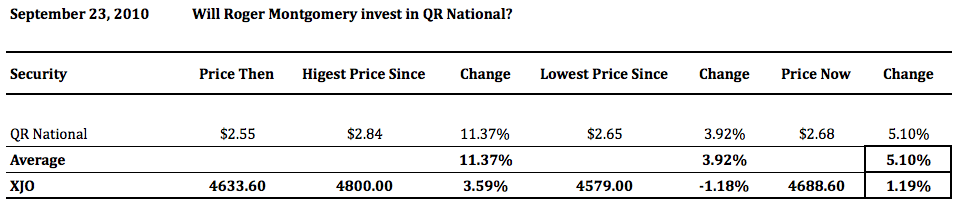

Will Roger Montgomery invest in QR National?

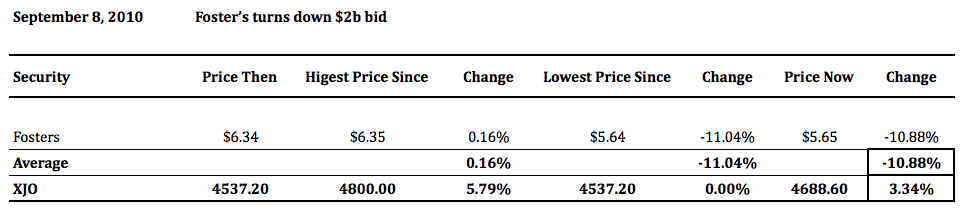

I thought the performance of Fosters after the wine bid was knocked back was interesting, but only another year or two will confirm whether the opportunity to add value was passed up. Some higher quality businesses also underperformed the market, thanks in part to deteriorating short-term prospects rather than deteriorating quality.

Remember to look for bright long-term prospects. Of course, in the short-term prospects will swing around – that is business, but longer-term prospects of businesses with true sustainable competitive advantages tend to win out.

Keep an eye on the blog before Christmas as I will be posting a couple of very handy lists (and possibly some homework) before the annual Montgomery Family Christmas break.

Posted by Roger Montgomery, 7 December 2010.

Thanks Roger, I just finished reading value.able, except for appendix A of course!! Looking forward to a fresh approach to investing in 2011. Happy Xmas

David

Delighted to hear it David. Happy Christmas to you and thanks for your well wishes.

MCE seems to be a popular new stock and Roger has rated it highly. However, I am not sure how to calculate its IV as there is little history to go on. What ROE or payback ratio would we assign to it? What do ValueAble practioners think its Intrinsic Value is?

Hi Gordon,

the company has existed since 1982 so if you look at the filings from around the date of listing you will find some pro-forma accounts there.

Hello Roger,

Just wondering what your views are on the latest announcemnets from DWS.My view is the market has over reacted to the announcement and represents a buying opportunity.What are your views on DWS.All the best to you and your family for christmas and the new year.

Hi Michael,

Have a look at the recent posts. There have been quite a few comments about DWS following those posts.

Thanks for posting Roger.

Will be very interesting to see the positions of these after a year or so – I’m sure they will look as healthy as some of the results above.

Re: Xmas homework, the more you give us, the longer break you can have before returning in the new year with the answers :-)

Merry Xmas and thanks for all the knowledge sharing this year!

MarkH

Thanks Mark H,

I will keep that in mind!

HI Roger

All the best to yourself and family for a well deserved Xmas break, Thank you for sharing you time and expertise so freely with us and patiently answering our questions.

Have a great break, Bruce

Thanks Bruce. Happy Christmas to you and yours.

HI Roger

Instead of speculating about MQRs A1/C5,bloggers should try to develope their own system, there are many hints on how to do this in various books,web pages etc.

One should keep in mind though that different sectors will have different ratios, also A past trend is a fact a future trend is an assumption.

A few examples.

High Gross Profits +?%

The lower the company General expenses the better, Under ?% may be considered exceptional

R&D as a percentage of GP.

Depreciation as a 5 of GP.

If there is a lot of cash and securities on hand and little or no debt, check previous Balance sheets (was it a 1 of event that created the cash.

Company interest payments less than ?% of operating income.

Ratio of Net Profit to Total Revenue.

Is Inventory and Net Earnings on a corresponding rise.

Increases in Goodwill (why)

There are many more pieces of information that you can add to this list, award points to how they perform, and you have your own ratings.

Merry Christmas and Warmest Wishes Roger and all blogers,

the past 12 months has been the greatest education experience of my life. Thank You All

Ratio of Net Profit to Total Revenue

Hi Roger,

Have a safe and Merry holiday season. This is a fantastic post that helps to summarise all those companies we have been discussing over the past 12 months. The launch of your book has been an inspiration to so many people and has helped many of us have the courage to keep investing in the market. One of the great aspects of your teachings is that you are not just feeding us tips. As they say: “Feed a man a fish and he will not be hungry; but teach the man to fish and he will never be hungry”. Not only that but we can now teach our fishing skills to others. Again many thanks for all of your insights and your desire to share your knowledge with others.

Best wishes and a happy festive season to all,

David V

P.S – I own MCE, FGE and ORL and am very happy that your information helped me to maket hose decisions …… which I made with financial advice of course.

Thanks David V. Happy Christmas to you too.

Hi Roger,

What is your opinion on the recent drop in DWS share price?

Hi Leo,

Have a look around here on the blog. In comments attached to recent posts, DWS has been discussed.

Roger’

Just wanted to add my thanks and appreciation to you for the generous manner in which you share your wealth of knowledge, experise and information on your blog and elsewhere.

Wishing you and yours everything of the very best over the festive season and in the new year.

Peter

Thank you Peter,

I aprpeciate the thought. See you next year if not before.

Hi Roger

Just purchased a copy of your book for Christmas and am eagerly awaiting it to arrive under the tree. Just a comment, I was looking at your post which explains where you get your data from for the book. I noticed in COMSEC that you look at a number of places for various bits and pieces…. yet you can get it all in one place under the company “Wrap Sheet” which COMSEC produces. After going to the “Research” link for a company, there is a link I think from memory called “Company Info”. From there you can download or display the Wrap Sheet which has it all in one page. I find this handy.

Great Tip Paul Thank you. Oh, Santa just swung by and picked up a heap of books destined for the globe!

What a great year,,,,Thank you for the book and education.

A very merry xmas to you and your family Roger

Gavin 2

Thank you Gavin 2.

Hi Roger,

Am curious about your overall investment strategy. You seem to go for stocks that are excellent growth prospects (ie growing sales/ revenue/ margin and therefore profit).

A few comments:

Do you have an overall tally of how you went for the year- it see,s that your intrinsic valuations made at the start of the year seem to have done better than your more recent valuations? How much do you diversify (obviously as I tend to concentrate my investments on the better value, I imagine you do as well)?

Do you factor in macro conditions and sentiment into your valuations (I suspect sentiment should not make a difference to the long-term profitability of your portfolio)?

I personally use a different valuation model to yours (the multipliers you use make no sense on a fundamental level to me- ) and try to use market timing(thereby factoring in sentiment) to limit the opportunity cost in terms of other shares that might perform well.

Finally, how do you rate the following three companies:

– MyNetFone (MNF)

– HGL (HNG)

– Flexigroup (FXL)

I think they are substantially undervalued at present.

Thanks

Hi Mal,

The reason its seemed to work with the earlier valuations and less so more recently is quite simple, and it had nothing to do with the technqiue. Quite simply, a rising tide lifted all boats. In the short term share prices can do all sorts of things unrelated to the underlying company. Longer term however, I believe, I will beat the market with a portfolio of extraordinary businesses purchased at rational prices.

An excellent presentation Roger, congratulations on your results although again I was most impressed with your honesty and integrity when you said,

“Whilst the results are short-term (therefore nothing should be taken from them), they are nevertheless encouraging”

The true test of whether these are indeed great companies worthy of their lofty MQR’s will be decided over the next 5-10 years, time being the best friend of the great company.

“Remember to look for bright long-term prospects. Of course, in the short-term prospects will swing around – that is business, but longer-term prospects of businesses with true sustainable competitive advantages tend to win out.”

This definitely applies to JBH & Noni B stores…but what about QBE and DJS ?? Neither are A1 but both have been over looked by many investors, in favor of more popular resource stocks DCG, MCE, FGE & MIN. It would appear that having a diverse group of A1’s has become the new vogue at the expense of wonderful businesses that rate B1. I feel that many of Rogers A4,A5 and B1 will surprise the market next year will strong profit growth and be positively revalued as was the case with WBC this year.

Having said that, I am starting to feel that the stock market is beginning to move in a more logical manner where stocks are judged on their individual merits and not merely sold off on P.I.G.S debt fears or off the back of panicked U.S sellers. This does not mean that there will not be further falls in 2011, but I am becoming more confident that we may witnessed the bottom of this bear market and that within the next six months we may even see the next bull market take shape.

Merry Christmas everyone!

I own shares in DJS and am quite happy to increase my holding in them if the right price comes up once i am ready to jump back into the market. I believe they have a huge moat and have survived the high profile court case quite well with very little damage.

Plus girls will want expensive shoes and clothes and when they do, they will more than likely go to DJ’s instead of Myer as they have the better link to the fashion world as they are the up-market luxury dept store where as Myer is the middle of the road.

Hi Andrew,

I have secretly harboured doubts aboyt department store’s relevance in the years ahead. Its worth exploring as a subject next year.

I would defintiley like to hear yout thoughts Roger, so looking forward to it if you decide to put it up as a discussion topic on the blog.

In a way i kind of agree, i expect the future of retailing to look a lot different with online stores gaining more and more market share. However i expect this to be more of a factor with a JB Hi Fi. It will impact on DJ’s non fashion related products but when it comes to high-end, luxury, high fashion clothes i don’t think tangible stores will be overtaken for a few reasons.

1-people will want to make sure the clothing/accessorie fits and looks good before purchasing an expensive clothing product. Fashion purchases is very much an emotional purchasing decision and a main element of that is seeing it on you in the changing room.

2-Shopping for clothes is still very much a day out rather than a chore for the type of customers DJ’s is aimed at and there for they are not too fussed about the convenience factor and shopping online with friends does not have the same appeal.

I think there is and still will be a moat around DJ’s due to their product range and identity and they will be well placed to take advantage of any future change in the landscape.

I expect boutique stores (apart from the major luxury fashion brands) to become irrelevant well before anything harms the fashion department stores (although Myer is already bodering on irrelevent in my opinion due to their product range)

I see major problems for a JB Hi-Fi though and dept stores that sell similar type of products. They will be the first dept stores to feel the hit and i expect store roll outs by these companies to slowly wind down and instead having money invested to online stores. But as is the nature of online businesses, barriers to entry are low and in the market for music, dvd’s and games etc i expect these companies to struggle against iTunes.

I hear you Andrew. Interesting perspective.

Hi Roger,

You’re not the only one who is questioning the future relevance of department stores. Ahmed Fahour of Australia Post is apparently betting the farm on the growth of internet shopping. Due to decreasing mail volumes, Australia Post is shedding staff, drastically.. Leaning up, with the aim of being the no1 parcel delivery service in Australia. My guess is, they are watching the trends, and acting accordingly. Of course, If they do become more efficient etc, then with their infrastructure, they are a real threat to the likes of Toll.

And, Merry Christmas Roger, thanks for the leg up.

Very nice analysis Roger.Keep the good job up.Merry xmas to you and your family.

Roger,

Thanks for sharing your experience and making this blog so fantastic.

Merry xmas, Matt

Roger,

Well done and thanks for the stimulating insights.

Have a safe and happy Christmas and and an equally successful and prosperous New Year.

Regards

Lloyd

excellent blog post roger well done

Great to see you share your knowledge and insights with everyone and take the time to help.

Thanks roger merry christmas.

Thanks Nik. Happy Christmas to you too.

Hi Roger,

I bought Forge and Finbar after researching them following your highlighting of them. Good stuff.

Roger,

I note that FRI have announced a $45.6M placement today. That makes a big dent in their IV by my calculations. I assume it would also “breach” their A1 status ?

Regards, Ken

Could do Ken,

Will review on my return. On another matter you are going have to live with coming up with some solutions yourself. Beyond a certain point on every journey – the point that most people stop – the track narrows to a single-track. This track is so narrow that it does not allow two to walk side by side. Given I have stated I won’t be carrying you at this point, that single-track must be walked by you alone. I don’t obfuscate about the fact that I am giving a leg-up, not a hand out.

It sure does Ken. Question now is whether the capital can be employed in a manner that translates into a material positive impact on NPAT and within a reasonable timeframe. To my way of thinking, this would need to translate into a 50% year year increase in 2011 which leads me to think that the benefits of this raising, assuming there are any, are only likely to manifest in 2012 and beyond.

The fact that they opted for an equity raising as opposed to project specific debt financing given the intended use of the funds is also interesting.

Peter