Darth Veda

Veda Group Limited (VED) is one of the more successful IPO’s we have participated in recently. Listing in early December 2013 at $1.25 the stock went on to subsequently double in price hitting a high of $2.55 just a few months later.

Adding to this success was the exceptional 2014 full year results that came in ahead of the prospectus guidance, producing one of the best reports over the August reporting season.

Revenue increased 13.3 per cent (including a $2.4 million joint venture profit) and the scalability of the business under the current negative reporting framework resulted in EBITDA increasing 22.8 per cent, and finally earnings increased 41.5 per cent over the 2013 result. An impressive set of numbers:

So why then did we sell our entire holding at $2.40?

So why then did we sell our entire holding at $2.40?

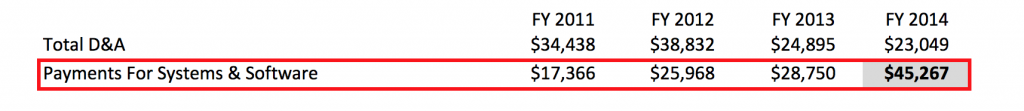

Upon further review, we noted that adding to the businesses operational leverage in 2014 was lower Depreciation and Amortisation (D&A) expenses. We noted the comments that some older assets came to the end of their useful depreciation life in this period; the benefit of this to earnings under the EBITDA line can be seen clearly here highlighted in black:

This piqued our interest and we spent a considerable amount of time reviewing Veda’s historical accounts (FY11-FY13), which they provided on listing. The outcome of our research was that we noted this was an abnormal development.

This piqued our interest and we spent a considerable amount of time reviewing Veda’s historical accounts (FY11-FY13), which they provided on listing. The outcome of our research was that we noted this was an abnormal development.

Historically, amortisation of Systems & Software spend has been running at approximately 71 per cent of those costs capitalised in any year. 2014 saw this number fall to just 40.9 per cent.

The impact of lowering accounting D&A expenses is that a bumper result can be produced and the earnings leverage serves to get the market all-abuzz. Which is an outcome you may wish to engineer should one potentially wish to exit a large holding.

This therefore appeared to be a ‘managed’ outcome and one in which caused us to naturally ask the question, why would anyone want to sell?

In the case of private equity (PE) funds, the old argument goes that PE firms have an investment lifecycle of five years and hence this is just natural turnover. Plausible perhaps, but we consider another argument being that the earnings leverage just reported by Veda is unsustainable as they move to the CCR (comprehensive reporting) Framework.

In the businesses outlook statement, management noted “The anticipated revenue trajectory should see Operating EBITDA in FY2015 achieve at least low double digit growth over FY2014’s pro forma EBITDA of $129.0 million, even though operating expenditure (excluding data costs) is expected to grow faster than has historically been the case. A factor driving this increase is Veda’s decision to increase staff to support the next stage of revenue growth (including CCR), and the implementation of a new equity incentive scheme to support alignment of the interests of staff and shareholders.”

A few key points to note on this comment, at least low double digit EBITDA guidance is very healthy guidance to give at the start of FY15 and shows the strength/recurring revenue nature of the business.

Also, historical earnings leverage would have many analysts and investors assuming that that earnings could grow at a multiple of this top-line EBITDA growth which is where we notice an issue which management have addressed.

Turning our attention onto the businesses statement of cash flows and note 17 of the annual report, Intangibles, it’s clear that Veda’s software development expenses for example have already increased markedly as they ramp up investing to support the move to CCR.

The Statement of Cash flows shows spend on ‘other’ which largely includes payments for Systems & Software, has jumped by 80.7 per cent over 2013.

Broken down further, we note that the actual increase in software development spend is over 60 per cent over the prior corresponding period.

Broken down further, we note that the actual increase in software development spend is over 60 per cent over the prior corresponding period.

This is the highest level of investment the business has made since 2011 and management are suggesting that these are set to increase further in FY15 as spending on moving to the CCR framework creates a cost ‘bubble’. Yet despite this, D&A expenses in 2014 decreased?

This is the highest level of investment the business has made since 2011 and management are suggesting that these are set to increase further in FY15 as spending on moving to the CCR framework creates a cost ‘bubble’. Yet despite this, D&A expenses in 2014 decreased?

Because Veda’s accounting policies allow these expenses to be ‘capitalised’ on the balance sheet and amortised over their estimated useful life, the impact of this is that they are not yet fully reflected in D&A through the P&L. The capitalisation can be seen for example via ‘additions’ to intangible assets as we show below:

From here we can make a few assumptions when modelling the likely impact in the years ahead in terms of Veda’s future financial results.

From here we can make a few assumptions when modelling the likely impact in the years ahead in terms of Veda’s future financial results.

Firstly, what we know is that guidance is for low double digit EBITDA growth. We can assume that EBITDA grows at approximately 15 per cent in 2015 (slightly ahead of Veda’s EBITDA guidance given their success this year) but then tracks lower over 2016/2017 in terms of growth (the law of large numbers).

Secondly, we also assume that D&A in the next three years will normalise at approximately 70 per cent as per actual levels pre-IPO. This will see D&A rise materially from the 2014 financial year and we think this may catch a few investors off-guard. We estimate that D&A will need to increase by a compound annual growth rate of approximately 20 per cent over the next three years (almost 25 per cent in FY15) to normalise itself – the impact of this on Veda’s earnings leverage is profound.

Versus the growth reported in earnings reported in 2014 of approximately 42 per cent, we forecast that an almost immediate slow-down in FY15, FY16 and FY17 will occur in terms of earnings growth.

Hence, unlike the 2014 financial period, we will not see the same operating leverage in the next three years until these D&A expenses normalise and this is what we believe they are alluding to when they set the scene for this year (2015)“The anticipated revenue trajectory should see Operating EBITDA in FY2015 achieve at least low double digit growth over FY2014’s pro forma EBITDA of $129.0 million, even though operating expenditure (excluding data costs) is expected to grow faster than has historically been the case.”

Hence, unlike the 2014 financial period, we will not see the same operating leverage in the next three years until these D&A expenses normalise and this is what we believe they are alluding to when they set the scene for this year (2015)“The anticipated revenue trajectory should see Operating EBITDA in FY2015 achieve at least low double digit growth over FY2014’s pro forma EBITDA of $129.0 million, even though operating expenditure (excluding data costs) is expected to grow faster than has historically been the case.”

Based on these assumptions, on current shares on issue, we estimate that EPS will rise from 8c FY14 to 11-12c in FY17 putting VED: 30x historical and +22x FY17 earnings. This is a lofty valuation and one that we find hard to justify. To put this into perspective, when we participated in the float, we initially paid 16x FY15 Earnings one year forward.

We estimate that the business needs to do approximately 25 per cent earnings compound annual growth rate to justify a price of $2.30-$2.40 (current market) which as their cost base grows to support CCR, is looking unlikely.

This analysis leads us to expect a forecasted earnings growth slowdown and a rich valuation. We saw the hype around the stock as an opportunity to exit what has been a wonderful investment.

Veda however remains an amazing business, is the clear market leader, and has high levels of recurring revenues and bright prospects – all of which are highly attractive business economics – the only thing currently missing is a rational price base.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hayden

:

Dear Russell,

Any thoughts on the recent report from Veda? Good results on the face of things. However, the market didn’t like it!!

look forward good and bad reports.

Cheers,

Hayden

Russell Muldoon

:

Hi Hayden,

We sold VED (as you might know, over 12 months ago at $2.40) – our view is still as it was then.

Veda is a high quality business, but we believe private equity sold it well / right before the uplift in costs / expenses / cash flow drain required to become compliant with the comprehensive reporting framework.

As such and as I wrote here; http://rogermontgomery.com/darth-veda-2/

We anticipated a large uplift in costs through the Profit and Loss accounts which would crimp operational leverage / earnings growth.

Hence, we couldn’t justify the businesses valuation (and still can’t)

I suspect this might be the reason its now falling.

Phil Crossan

:

ANZ have $2.533B of capitalised software on the balance sheet which is higher than any of the other big 4 banks and is the largest as a proportion of the total shareholder’s equity. NAB has $2.126B and is the second highest. NAB wrote down $297M from those assets for the FY 2014 year.

Andrew Legget

:

Very interesting post Russell and good sleuthing by yourself and the team.

The result does seem like an outlier from the data you have shown us. I have recently learned some measures to help spot the existence of earnings management and quantifying the quality of earnings and one thing that i have seen is that it usually will filter out and revert back to the “normal” scenario rather quickly.

Some might say it is cynical but i believe it is always good, and believe there is enough evidence out there to back it up, for investors to always question the figures that are being reported to see what is really going on.

Paul Purnell

:

Great insight

Sounds like a major software overhaul is required for the new negative reporting regime. Whilst this is crucial for Veda to undertake I have never been a fan of capitalising software given the majority of IT projects fail to deliver the benefits that were projected.

Also worth pointing out that the one year increase may not be the end of it given large IT developments can run for years and then ongoing IT costs typically increase to keep the system operational.

Still Veda should get massive benefits from negative reporting so likely will get the payback down the track if they do it right.

Appreciate the insight

zoran arnautovic

:

Hi Russell,

Few weeks ago David Buckland said on YMYC that VEDA is a great buy.

Now it turns out that is not so.

I don’t know why this happened but am convinced with your figures.

Cheers

Roger Montgomery

:

Hi Zoran,

There is also a possibility it wasn’t just a few weeks ago.

zoran arnautovic

:

You could very well be right Roger. David is as good as gold.

My mistake.

steven lock

:

Was the “further PEP sell down” announcement the flag for this review or was it part of your process.

Would someone please explain the following;

The remainder of the PEP Funds interest in Veda will be escrowed until the day following release of the H1 FY15 reults, subject to customary carve-outs set out in the Block Trade Agreement.

and the implications.

Russell Muldoon

:

One of the core lessons learnt early in investing is to let your quality companies run and avoid the disasters. The only way to do this is to do a deep dive into all of the companies we hold and consistently question / stress test our logic.

danblaze420

:

How do we know that the jump in system and software expense in the year is not just a once off relating to the shift to CCR? If it is a once off wouldn’t it make sense to amortise the cost over a longer period?

I would be interested to see what the company has to say about it before liquidating my holding.

Russell Muldoon

:

Yes, its a cost bubble, which we have stated – but a bubble non the less and costs are likely to be ongoing to support a business and data costs tackling both negative and comprehensive reporting frameworks.The person best placed to answer your questions, as it was for us, is the CFO for VED.

Greg McLennan

:

Nice sleuthing, Russell. Would this sort of ‘managed outcome’ behaviour make you wary of investing in this company should the price fall to a lower level?

Russell Muldoon

:

Financial engineering (accrual accounting) is something all investors should be aware of, should be educated about and used to their advantage in the long run.

Steve Leahy

:

‘Financial Engineering’ sounds like a good topic for a weekend whitepaper Russell.

Roger Montgomery

:

Will put it on the list for future consideration. There’s enough material for an entire book! Thanks for the suggestion, if the topic interests you have a read of the Book entitled Pigs at The Trough.