Will your portfolio repeat its 2011 performance?

If you are new to my stock market Insights blog, welcome. And to the Value.able community, thank you for your many comments and encouraging words. It gives me great encouragement and motivates me to hear how your investing and returns have improved as a result of reading Value.able and the collection of comments posted by Graduates here at my blog. Thank you also for spreading the word and purchasing additional copies for family and friends.

If you are new to my stock market Insights blog, welcome. And to the Value.able community, thank you for your many comments and encouraging words. It gives me great encouragement and motivates me to hear how your investing and returns have improved as a result of reading Value.able and the collection of comments posted by Graduates here at my blog. Thank you also for spreading the word and purchasing additional copies for family and friends.

Taking a look back over the stocks we discussed last year, it appears the Value.able approach to investing in the highest quality businesses, with a true margin of safety, has been doing quite well.

In addition to the blog, I also wrote about many of the stocks that achieve an A1 Montgomery Quality Rating (MQG) in my Value.able stocks for Money magazine over the last six months of 2010.

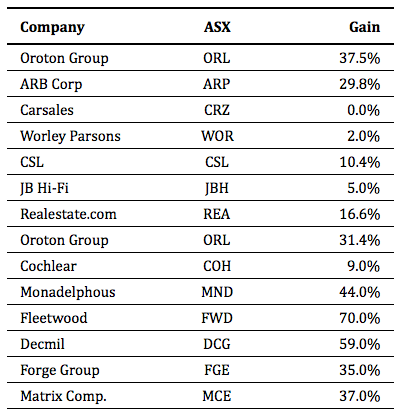

The stocks are listed in the table below. The column titled ‘Gain’ demonstrates you can do well without exposing yourself to lots of risk – for example the risk that is inherent in speculative stocks.

The returns exclude the dividends received, which would obviously boost results materially. The correct comparison therefore is the All Ords price index rather than the All Ordinaries Accumulation Index. Since 30 June 2010 the All Ordinaries has risen 12%. That is a stark contrast to many of the returns produced by the high quality businesses listed above.

The returns stand even higher above the Index when the selection is ranked by those that I regarded as offering the greatest margin of safety at the time the stock was mentioned: Oroton (up 37.5%), ARB Corporation (up 29.8%), JB Hi-Fi (bought and then sold the next month (up 5%), Monadelphous, Forge, Decmil and Matrix (up 44%, up 59%, up 35%, and up 37% respectively). The average, six month, price-only return of these businesses is 34.8%. And some of these A1 businesses, a margin of safety still exists.

If you are new to value investing you will, when searching around, find many commentators, portfolio managers and investors who may disparage value investing generally. They may question the method of calculating intrinsic value or even dismiss the valuations produced, but quite seriously, the proof is in the eating. And the returns offered have been nothing short of mouth watering.

But six months is NOT enough to hang your hat on, as Tony and Adam recently pointed out on my Facebook page. So if you have been an investor in any of these companies, following a conversation with your adviser of course, remember that the change in price over a year or two shouldn’t excite or concern you. It’s the change ahead in the Value.able intrinsic value of the company that matters.

If you haven’t already purchased your copy of Value.able, I commend it to you. It will change the way you think about investing in the stock market for the better, and as the many independent comments elsewhere here on the blog can attest, it may also materially improve your results. Value.able is available exclusively at www.rogermontgomery.com

Posted Roger Montgomery, author and fund manager, 2 February 2011.

Sean Ezra

:

Hello roger,

I’ve been following you on youtube for a while,,

I think I am almost ready to purchase your book, but before I

do that I would like to have one more information if you don’t mind providing. that is, what would be your past 10yr performance record? I’d greatly appreciate it.

thanks

Roger Montgomery

:

Hi Sean, It is public, you can look it up and work it out. And you need this for a $49 book purchase? Really?

Ash Little

:

Hi Sean,

Just buy it…………………………………………………

It will change your life for the better.

Sean Ezra

:

Hello Roger,

I really appreciate you’re quick reply,

is not about spending $49 bucks,, i really don’t care about the money at all..

I do have great respect for what you do, and I’ve been your biggest fan for a while now and I thing you’re one of the brightest guy I have seen in the buffettlike investment community.

I also run a small investment partnership my self, and just wanted to

do a final check to see whether your strategies matches your results (because I think there’s one little valuing factor you’re missing, I say this with all my respect).. thats all..

no mean to disparage your wonderful contribution and generosity..

Thank you and have a great day..

P.S. Thanks for your concern Ash Little, I really appreciate it

Roger Montgomery

:

Thanks Sean,

I am reasonably confident I am aware of the factors that are ‘missing’. I am also happy to exclude them. They are alluded to in Value.able. No valuation formula is perfect however some independent research that has recently been conducted here in Sydney at one of the Uni’s using the Value.able approach suggests the approach is worth pursuing. It really is not our job to convince everyone to follow it. Its ok either way.

Joab Soh

:

Hi Roger

Any chance you can point us to independent research?

Would be an interested in their findings.

Ash Lillte

:

Hi Sean,

Don’t mean to be obtuse but it is hard to find out the “valuing factor you’re missing” if you have not read the book.

Approximately right that is the important thing in my view

Sean Ezra

:

Hello Ash,

I eat, sleep, and read annual reports,, thats all I do..

its been for about 7yrs since I quit my job as a broke stalker..

Over the course of my career, I have read countless books about investing, and I have leared that most of the authors have gone rich by selling books, and not by investing..(this is not a criticism to roger,, I really think his is brilliant and he’s been a fund manager for years)..

For all investors seeking counsel though, results speaks louder than words.. in my view..

By the way,, I love that skyrocketing picture up there roger! looks like something I own..

Thanks

Roger Montgomery

:

Hi Sean,

…and yet I haven’t met an author who has made any money from books.

Ash Lillte

:

Hi Sean,

Have you purchased Value.able yet??

Roger Montgomery

:

A quick point Sean,

A quick scan of my library reveals at least half a dozen books written by very successful and very wealthy fund managers and investors. I expect Jim Roger’s (retired from the Quantum Fund at 37 and a billionaire) books weren’t about the money. Some of us actually are passionate about teacher others what we know and genuinely wish to help. I think you will find a growing band of investors here at the blog who have profited handsomely from the companies suggested to research. Finally, I have edited your post. If you wish to disparage others, you should find another forum to do it. All the best in your investing.

Roger Montgomery

:

Hi Again Sean,

Once again, let your fingers do the walking, you will find the results.

Roger Montgomery

:

Hi again Sean,

You can look it up. If you have found the blog, and posted to it, your Google skills should be adequate enough. All the best.

Kerishd

:

Glancing at the MCE 1H2011 report today (18/2/2011). A few things concern me.

1. NPAT 19,251k (looking good)

but then…

2. Cash Flow From Operating Activities -6,201k (NEGATIVE!) with payments to suppliers exceeding receipts from customers by about $4m

3. So maybe all that NPAT got delayed and MCE didn’t receive the cash just yet. Maybe it is in their accounts receivable and they will receive it later. But their Trade and Other Receivables are down $3m. Only Current Financial Assets are up approx $10m. Non-Current Financial Assets up $2.7m. Inventories up $1m.

So where have all the MCE NPAT gone?

Roger Montgomery

:

Hi Kerishd,

This is a really good time for investors to consider the cash flow calculation that I mention in the Value.able and following th calculation back out the spending on PP&E…

”MCE has reported a strong accrual profit but operating cash flow is negative by -6.2m. This is due to a reversal of an approximately $30m deposit which was received in FY10. Think of the deposit like a deferred revenue item – cash is received prior to revenue being booked in the P&L. So the revenue was booked in the current period but the cash had been received in the previous period. This can be seen under current liabilities; ‘Progress Claims and deposits’. My understanding is that this came about as a customer was willing to pay a substantial deposit to move up the order book as Malaga was running at full capacity last year and the customer wanted to ensure their order would be filled in a timely fashion.” Thanks Chris. It will be good to confirm the frequency of the treatment and its impact on reputation (what do other customers in the queue think – or are monopolistic behaviours tolerated, indicating MCE is a price maker) during the conference call next week.

jeff browne

:

Does any one have any clues on SWL? They announced on Feb 17 that a QLD Gov. increased the scope of a Brisbane project they are involved in significantly…..and the share price dropped 5%!

Any logical explanation would be appreciated

jb

Raj Singh

:

I’m surprised CCP has not made a mention two profit upgrades, 18-20% ROE..I think its significantly undervalued? DWS is another one.

Am I missing something?

Roger Montgomery

:

Hi Raj,

CCP has been mentioned here previously. It is an A1 and has been at a discount to IV for some time.

Peter Ralph

:

A small company Zicom (ZGL) that reports in S$ appears to meet Roger’s criteria… it has been consistently profitable and NPAT for the six months will be up over 100% to S8m…….ROE is approx 24%…..Cash S$25m against debt of S$18m for a net cash position of S$7m and a company that likes to pump profits back into the business rather than distribute them as dividends (dividend yield is only 2%)……the two things I don’t like are its size (capped at less than $100m) and the weakness in its share price……it hit a 3 year high on Friday but is still on a PE of only 6.4 in respect of 2010/11 earnings.

Michael Leslie

:

This is really exciting. Not only did we get a great book from Roger Montgomery but we also got a blog which is sensible with participants who want to be genuine about assisting each other. I asked about FRI and received excellent comment and assistance. Thank you.

Having spent most of my working life in Industrial Relations and HR I was impressed by the approach taken by FRI (only 10 employees). I was also impressed by the fact that they claim that 6% of sales are from previous customers. They must have some competitive advantage in that fact. they also happen to have a very good website.

Thanks bloggers. This is so impressive.

Roger Montgomery

:

Thanks for the feedback Michael, on behalf of everyone who contributes.

kent Bermingham

:

Roger, have read the book late lst year, invested in 7 companies and overall doing quite well. Have encouraged 3 friends to buy the book so we can setup an investment think tank.

Just writing to say thankyou.

Roger Montgomery

:

Thanks for letting me know Kent. I appreciate the encouragement. Well done and all the best.

John M

:

Hi Kent,

I did the same last year, and I found that the output of the group is greater than the sum of its parts, and it keeps my enthusiasm high as well as a bonus.

Dave v

:

Based on JBH half year results I’ve calculated the following for 2011.

Half year NPAT of 87.9 and full year guidance 134 (range 134 – 139) which means 2nd half NPAT @ 46.

Dividend payout of 52.4M (48 cps) in first half of year and estimated 28M (~25cps) in 2nd half based on 60% payout ratio policy.

Equity as at half year is 352.8 which could fall slightly in 2nd half given higher dividend payment now 52.4M vs 2nd half NPAT of 46-51M. For calculation I’ve used final equity of 350M.

Ending shares estiamted at 110M

This provides an ROE of 41.7%. I’ve used 40% and an RR of 10% to give an IV of $23.06

Ashley Little

:

Not disagreeing too much with that Dave.

How good will are return be if we can buy it for below$15

Sin G

:

Just done my calcs Dave, a little late I know. I have an IV of $23.16 for 2011.

Janet

:

Hi all,

Thank you you all for sharing your thoughts, knowledge and experience – learning lots! I have bought and read Roger’s book (need to reread it a many more times). I would like to do my first estimate of IV for a company but I am not sure where’s the best website to get the figures from to do the calculations. Does it matter where you get the figures from? Sorry for such a basic question – but I have looked at financial statements on Comsec and the terminology didn’t appear to totally much what was required – or do you go to the company’s website and use financial statements there? Any tips much appreciated.

Roger Montgomery

:

The Value.able community and I prepared this earlier Janet – http://rogermontgomery.com/where-to-find-the-source-data-for-value-able-valuations/

Ann

:

Prefer it to repeat 2006/2007 performance!!

Matt R

:

Thanks Joab and Andrew

Andrew, when you mention a “huge” margin of safety, what does this mean for you – 20%? 30%? 40%?

would you mind sharing your thoughts?

Thanks once again

Matt

Andrew

:

I think very rarely would i need to bother about the huge MOS in regards to the 2011 forecast as i am tralking about 50-60% maybe even more which usually also results in a big margin of safety below my 2010 IV as few companies IV change by that much year to year.

As the 2010 IV is based on data from the annual report i believe this to be more accurate than the forecast and the one i give preference to using.

As forecasts are basically guesses and are based partly on other peoples geusses I just want that extra cushion as i am not Charlie Munger and my guesses are not as good as others.

Wayne G

:

Hi Ray,

I am assuming that the ROE of around 26% will continue for the next 2 years.

06 – 42%

07 – 48%

08 – 42%

09 – 15%

10 – 25%

History is only a guide I guess.

Wayne

Lloyd

:

09 – 15% looks like a better long run average. Unless of course you believe that the command and control economy is infallible! Are you feeling lucky?

Wayne G

:

Hi all

Just looking for your views on BHP

I have the IV at $52.28 in 2011 and %61.57 in 2012 with a + cash flow of $6,801,193,919. My calculations give it a Margin of Safety of 11% 2011 abd 24% 2012.

Used a 10%RR

This seems like an attractive position with the positive news around at the moment.

Regards Wayne

Ray H

:

Hi Wayne,

It is important to remember that the IV calculations assume that the ROE and Payout Ratio that you are using will continue indefinitely.

Is this realistic in the case of BHP?

Ashley Little

:

Hi Ray and Wayne,

Eventually size matters and unless the commodity boom continues indefinately they need some really big purchases at big discounts(As WB and RM say they need elephants) to mantain this ROE.

Considering what has happened with RIO and potash the Elephant hunting has not beed good.

Just my view as I am old enough to remember when commodities were not so popular.

John Mooney

:

I concur Ashley, every asset class has its own rhythm. Sometimes it beats a little bit faster than other times. Commodites are doing a quickstep right now, getting chased by the bulls. Like you said it is imperitive to look back to see what is going to happen in the future. Commodities will do their quickstep for a period of time, but as sure as the morning follows night some time in the future they will start to do their slower bear waltz. Keep an eye out for the telltale signs and you will benefit immensely.

Roger Montgomery

:

What are the tell tale signs? In all seriousness, I have been long oil for some time (all those US dollars had to go somewhere) and I can see the (destabilising) toppling of several dictatorships (revolution is like a domino) including Algeria, Libya, Morocco and Jordan, as a result of a very serious global food crisis. As one fund manager recently noted (I think it was Bill Gross at PIMCO) “We’re running out of everything”. I am very interested in this subject, because it will impact, through operating leverage, many of the companies I have been invested in and discussing here on the blog for some time.

Ashley Little

:

Hi Roger,

Very true but oil and gold have different metrics,

Just my view

Roger Montgomery

:

Thats great Ashley, A different view is entirely what we need to find opportunities, and its great for the blog too.

John M

:

Hi Roger. Good to hear from you.

Think bubble characteristics for telltale signs. Japanese asset pricing bubble. Dotcom bubble. US housing bubble. Funny how WB wouldn’t have a bar of the Tech stocks and everyone thought he was crazy at the time. Fundamentals don’t support the prices being traded. What is the intrinsic value of a tulip bulb versus the price being asked. Mr Market can be a crazy some times. WB and RM don’t believe in the Efficient market theory. Supply and demand. Ad infinitum.

I am guessing you know infinitely more on this topic than I. I regularly watch/read/listen to experts in each of the asset classes as to what stage of the cycle each one is in. You happen to be the premier expert on the Australian stock market. You are the Doyen of company analysis in Australia. When intelligent people like Peter Switzer and Alan Kohler ask you for your views, me thinks you already have all the brains and tools you need, and I know you have the energy and drive because I have seen you in action many times. I give you many thanks and praise.

Jim Rogers (I started following him after you referred to him talking about Rubber last year I think) believes we have been in a commodities bull market for about a decade now and he thinks that it will last for a good while yet, albeit a bit of a rollercoaster ride. A famous Jim Rogerism is that if a commodity is at an all time high, he doesn’t buy at that level – his example a little while ago was gold. Jim didn’t seem to have any trouble picking the beginning of this current commodities bull market when nobody was interested in commodities (be greedy when others are fearful – or not interested). I think this is the main reason that he (and WB) is a Billionaire. He is an independent thinker. He does his homework, sees what other people don’t see and then acts on it – and then a massive transfer of wealth occurs. (By the way, this transfer of wealth is happening to many Value.able investors as we speak).

I have started reading Jim Roger’s book called ‘Hot Commodities’. I will do a book report for you when I have finished reading it if you like (you may have already read it). I have also bought Jim Roger’s book ‘A bull in China’ which also turned up in the mail this week. I am going to read that one next.

Jim Rogers thinks that there is a coastal real estate bubble in China but doesn’t think it will derail the commodity bull market – maybe add a few speed humps.

Jim Chanos thinks that the real estate bubble is more serious and he is short on China (once again you introduced the other Jim to me as well).

http://www.businessinsider.com/jim-chanos-short-china-fixed-asset-investment-2011-2

Chanos: China Bubble Ready to Burst Youtube video:

http://www.youtube.com/watch?v=POGX8_UDhh4

When two experts don’t come up with the exact same answers I guess you have to improvise. Lucky I was taught how to identify great companies, how to value companies and how to be patient and wait until I can buy them at a significant discount to ensure a large margin of safety. Also having an exit strategy is very handy because even WB has now admitted that he wouldn’t hold stocks indefinitely.

I totally agree on oil, have been studying the Petrodollar theme and the Peak oil idea for a little while. I am also very interested on the critical difference between money and fiat currency and fractional reserve banking, and the critical balancing act of inflation/deflation and the knock on affects to the world economy.

What would happen if Oil was no longer sold in US$. They would have to export enough goods to get foreign currency to purchase oil. I don’t think the US would like it if a major oil producer decided to change the fiat currency used to purchase oil – instead of US dollars for example Euro’s might be the fiat currency for purchasing oil at the demand of said oil producing country. What happens when China overtakes USA as the largest oil consumer (not too far away) in the world, who would get the highest grade and cheapest crude oil – I wonder. Geopolitical tensions ….

The supply of food, oil and commodities in general are going to be an ongoing challenge with all the developing nations’ ever-increasing demand on a finite resource. Even though price and quantity are driving forces here, there are always going to be myriad other unforseen determinants which we cannot always factor in.

In this case we have a Property bubble forming in China which could throw a big spanner in the supply and demand clockwork of the financial universe. I have done a range of jobs in my life. At first I was a Jack of all trades, then I studied hard and become a Master of None. Now I am currently basing my doctoral thesis on making a special pair of glasses that render the wearer immune to the hypnotic effect of the investing pendulum. For some reason the market, at some point in its regular enough cycle, throws all common sense out the window and conveniently forgets history and recurring market cycles and just totally goes Looney tunes. How much did that tulip bulb cost. What about your example of the Tech stock (I can’t remember its name) that reported that it didn’t conduct business and didn’t have any plans to in the future. What would someone be willing to pay for something that is worth nothing?

When I start to hear that this time it is different, that any asset class (commodities included) can rise forever I guess I know it is time to get out of that asset class, because that will be the first sign of an international financial pandemic.

What if the China bubble theory eventuated and burst?

If I know you at all, you will find the silver lining in the storm cloud and hit the mother lode of all mother lodes (that ‘eating rice with silver chopsticks’ Jim Rogerism is always on my mind – I can’t get commodities out of my head lol).

Alan’s latest Eureka article refers to Wesley LeGrand, a boutique funds manager in Adelaide. He mentions that he is quote, branching into geopolitical analysis and you really need to be a master of all things global in the financial and economic system to navigate your troubles through the way ahead’

.

I have had the same idea for a little while now. I have been devouring anything that I can read/watch/hear about commodities and economics and I would love more than anything to have Jim Rogers ability to read the geopolitical tensions of the world and profit from them. I am only at the beginning of this journey. If I am in Sydney in the future (probably not for a while) I would love to catch up for a coffee (sorry another commodity) and have a chat about this topic. Jim Rogers has a commodity fund (and there are several other funds that emulate it) created out of the lack of a credible fund at a time when he wanted to invest for the long term – he was doing his world tour and wouldn’t of had the time to manage his investments so he started up this fund. His fund results speak for themself.

Maybe keeping an eye on what the master Jim is doing would be prudent. The same technique has worked for me watching you (master Roger) investing in stocks.

By the way, you’ve got me hooked on this subject due to your many references during the year. : )

Sometimes I spend more time researching this subject than looking at stocks in general, so I have had to make a schedule to ensure I spend enough time keeping track of stocks. Due to my abovementioned addiction, I tend to regularly break the schedule.

Must go now, need sleep. Have to get up early. I hope this all makes sense as it is fairly late and I am havng trouble keeping my eyelids open. (Sorry I broke the 1400 word mark but I can’t stop thinking about this subject either).

Roger Montgomery

:

Having read all of Jim Rogers books I recommend them highly. And having a friend at Kynikos is certainly something you should aim for too. Just keep in mind, Chanos is long indices and shorts individual securities but each short position is very small.

David V

:

John M,

Thank you for your contribution. I and many others will appreciate your contribution!

Kind regards

John M

:

According to Jim Roger’s website he has an upcoming speech in Sydney. I would love to go to that. Details are below:

Thursday, April 7, 2011

Sydney, Australia

Roger Montgomery

:

I have chatted with Jim on the phone several times and seen him speak. It is worth the effort. My long term positions in commodities are a direct result of a solid understanding of his approach. Without knowing the people behind the visit however, I cannot promote them. Please google Jim Rogers/Sydney if you are interested.

John M

:

More commodity news today as it relates to stocks – with a Jim Rogers context:

http://www.theaustralian.com.au/business/wealth/show-them-your-mettle-commodities-will-offer-rich-rewards-for-courageous-investors/story-e6frgac6-1226000454700

Steve I

:

Oil is an interesting topic. Growing demand and limited supply. However it causes a reduction in its own demand as it the price appreciates too much. Either way, high oil prices are here to stay.

Steve I

:

I have 2011 at $47.86 and 2012 at $52.53 with a 14% RR.

Analysts forecasts seem to assume roughly a 70% combined growth in earnings over the next two years.

Not much of a margin of safety for me given that it is currently trading at $46.70 – especially if there are any jitters out of China in the next couple of years.

Would have been a good buy in 2009, however there are two many ‘if’s’ for me at the moment.

Matt R

:

Hi Roger or others

Would anyone care to comment on this?

Which IV should we use in order to judge whether there is MOS in a current purchase?

the current IV, next year’s, the year after’s? (ie 2011, 2012, 2013?)

ie if we calculate that a company’s sp is currently at its IV, but that next year’s IV compared to the current sp is calculated to provide a MOS, should one use next years IV, or the current IV?

naturally, i’ll take advice etc, but would like some other thoughts if that is possible

regards

matt

Joab Soh

:

Hi Matt,

Let me have a go at it… I prioritise them.

(I may have got this from one of the Roger’s appearances on TV): First prize is Share Price (SP) is trading below current IV. Second prize is IV is rising in the future (i.e SP is trading below future IV). So you should always aim for first prize. That said, if you believe that future IV will rise significantly, than second prize is good too.

After learning it the hard way, I always remind myself that patience is an important aspect of value investing.

Andrew

:

I usually go for the lowest. If the 2010 IV is the lowest as future years is rising then i will want to buy below the 2010 price however if the company is truly great i would consider buying it at well below the 2011 forecast price but the margin of safety must be huge and bigger than the one i would require for a company trading at below their 2010 price as that was based on real data and not forecasts.

If the IV is declining, well i wouldn’t bother about which price to use as i wouldn’t invest in it, but for the case of the example i would want to buy it at below my 2012 forecast or the lowestIV price.

Roger Gibson

:

Roger,

Do you have a rating on Count Financial (COU)? It trades at around IV depending upon the RR you use and has an exceptional record of ROE above 40% for ten years. It seems to be a very well run financial services business.

Roger Gibson

Ashley Little

:

Hi Roger,

Fairly sure it’s an A2

Nic Arena

:

Yeah A2 this year and an A2 last year

Roger Gibson

:

Thanks guys.

I’ll have to work on putting together a comprehensive list of past MQR’s unless there is one around somewhere?

Joab Soh

:

All,

I started re-visiting the list of A1s from the previous reporting season and ISS pop out.

It’s still trading at significant discount to its intrinsic value. FY10 was the turnaround year which resulted from it improved from C4 to A1 per MQR.

Seems like there’s concern over FX impact on their US$ revenue. That said, it seems like the company has went through a major restructure to their management team which now focuses on driving sales and cutting cost.

It also ‘claims’ that ISS has competitive advantage being established for 15 years and has a team developing software.

Tick all the other boxes on low debt, high ROE, positive cash flow.

Any thoughts on ISS would be much appreciated.

Thanks

Ashley Little

:

Hi Joab,

I looked at this a little while ago but something turned me off.

Can’t remember what though?

I will have another look at let you know

Ashley Little

:

Hi Joab,

It was the really bad first quarter trading announced on 26 October.

Revenue down 37% and a loss for that period.

This was a function of the fear over the mining tax.

This would probably have turned around since then but we really don’t know as the company is so small and has no coverage that I know of.

The directors must have thought they are cheap as they have announced a share buy back. That said it looks like they have only spent 40K.

Be interesting to see the half yearly accounts which are due to come out on 23 February

Joab Soh

:

Hi Ashley,

Thanks for that. There is a recent announcement that stating that it has won several key projects which the combined value is greater than $2m. This is part of the reason why it’s back on my radar.

The other consideration is that this is a company that service the resource section (in particular oil & gas). As such, it’s an alternative to investing directly in producers which I tend to avoid.

I do agree that we may get a clearer picture after half year accounts.

Ashley Little

:

Yep Joab,

I Agree

Roger Gibson

:

Joab,

For me it would be far too small. Many of these companies that trade below IV are small, but how low do you go? With a market cap of $21m only a few thousand shares are traded each day on average with most of the significant trades, at values of $1m to $2m happening once or twice a year. How do you manage such an investment?

Not for me.

Roger

Joab Soh

:

Hi Roger,

Thanks for your thoughts. I do agree that it is small and more importantly, the lack of volume traded directly result in increase volatility in share price.

That said, liquidity is only one aspect of my investment decision. It has stopped me from investing previously which I regretted. Of course, hindsight doesn’t prove anything.

From a longer term perspective, I still believe that identifying good quality business and buying it with significant margin of safety will minimise the investment risk, even for such small companies.

I will also admit that I can’t find anything cheap at the moment, so my alternative is to go even “smaller”.

Andrew

:

Another alternative Joab, is to not go searching at all. Sit on the cash and let the cash build up through interest etc. When the opportunity does come you will be able to take advantage of it even more.

At some point an opportunity will present itself.

Brian Aitken

:

Hi Roger, your Blog encouraged me to see how my Valueable portfolio is tracking. I finished reading your book in mid September & started looking around & valuing your A1 & A2 shares. I have now purchased shares in 9 of these companies & have been very pleased with the results of each, except DWS which was my first purchase & which I bought at near their IV (I was eager , but lesson learned to buy shares at significant discounts to their IV. They’re only down about 10% now). Well I’ve just checked the results of this Valueable portfolio (including DWS & the portfolio overall has increased by 23% & that’s in 4 months, but some of those shares I only purchased a week or two ago. I see the all ord’s has only moved up about 5% during the same time. To say I’m thrilled is an understatement! What’s exciting is that many of these shares are still way short of their IV. I’m looking forward to this reporting season to see if there are any more bargains to be had, or shares I should take profits on. My best investment by far was the purchase of your book, which has paid for itself many many hundreds of times over already. I’m looking forward to attending your workshop with my daughter in Perth during March. Thanks again for your sharing & teaching.

Brian

Kent Bermingham

:

Brian where do you get a list of the A! and A2 shares etc?

Duncan

:

Hi Roger

your workshops, are you coming anywhere near the sunshine coast?

Dunc

Greg Mc

:

G’day Kent,

If you look at the right hand side of the page you’ll see the categories for Roger’s posts. A1 is one of them. If you hit that, then right down the bottom click on ‘older entries’ and you’ll find lists of A1s and A2s from the last reporting season. Bear in mind that these are now 6 months old and things may have changed for some of them, but a wealth of good companies to investigate nonetheless. Just make sure that you incorporate all the info that has come to light since then.

All the best,

Greg

Kent Bermingham

:

I have some QBE and bought them at a discount to their IV, in light of the catastrophe in QLD surely the long term outlook is excellent with premiums having to rise substantially.

Is it time to lock in more or get out of a very vulnerable industry?

Ashley Little

:

Hi Kent,

My View,

Great business,

We will always need insurance no matter what happens and the best of the best will do well overtime.

Just a bit expensive for me at the moment

Kent Bermingham

:

Once again thankyou Ashley your comments are well regarded

Ian

:

Hi Kent,

I also have some QBE, have held them for quite a long time and even with the recent share price decline have made a good return on them.

Someone did write a good summary on QBE under the 12 shares of Christmas post on this blog if you might find it helpful.

Even though it is not at a discount to IV I was also considering adding to my holding.

MLK

:

Hi everyone

I currently hold FGE and just wanted to check my calculations. I am using a RR of 14% and am getting a 2010 valuation of $7.33 and 2011 IV of $7.94.

For 2011, I have ignored Comsec’s forecast and use an estimate of a 40% increase based on their previous announcement.

2011

Current Shares on Issue 78,759,014

Beginning Equity (Last year’s ending) 48,782,590

Ending or current Equity 93,375,523

Net Profit After Tax 29,450,235

Dividends Paid 3,418,888

Current Earnings Per Share (EPS) 0.374

Current Dividends Per Shares (DPS) 0.043

Payout Ratio 11.61%

Ending or Current Equity / Current Shares (EQPS) 1.19

Return on Equity (Using Starting Equity) 60.37%

Return on Equity (Using Average Equity) 41.43%

Select ROE 40.00%

Company Intrinsic Value $7.33

2011

Current Shares on Issue (Assuming No Buy Back/Split) 78,759,014

Forecast Beginning Equity (Last year’s ending) 93,375,523

Forecast Ending or current Equity 129,092,721

Forecast Net Profit After Tax 41,230,329

Forecast Dividends Paid 5,513,131

Forecast Earnings Per Share (EPS) 0.523

Forecast Dividends Per Shares (DPS) 0.070

Forecast Payout Ratio 13.37%

Forecast Ending or Current Equity / Current Shares (EQPS) 1.64

Calculated Return on Equity (Using Starting Equity) 44.16%

Calculated Return on Equity (Using Average Equity) 37.07%

Select ROE 35.00%

Future Intrinsic Value $7.94

I hope someone can provide some insight on a few things that I might have missed or not considered or I could compare my valuations against yours. Thanks all.

Graeme

:

My 2011 IV for Forge is $6.71 using ROE 32.5% RR 12% and payout ratio 17.4% (from Etrade)

My 2012 IV is $9.59

G

Roger Montgomery

:

Greame,

When you look at your ROE estimate and your payout ratio estimate, they can be used to produce an implied growth rate for earnings (see Value.able). Ask yourself if that estimate is reasonable?

RobertD

:

My IV for Forge @ 12% RR is ~9.82 for FY10, and ~10.93 based on latest H1 results and forecasts.

Jonesy

:

A more conservative valuation;

Equity per share: $1.19

ROE: 30% (if you use average equity over the past 2 years, you will get a ROE of 41.49%, but equity has almost doubled in the last year, therefore I am using NPAT/Ending Equity and get a ROE of 31.58% and rounded this down to 30%)

Required return rate: 13%

Payout ratio: 12%

Intrinsic value: $5.04

I do earn FGE shares but picked them up at the end of 2009 at a big discount to IV. I currently would love to own some more of this company but I don’t think there’s a margin of safety at the mo.

David Sinclair

:

Hi All,

I am currently looking at IT services companies like DWS, SMS, and Oakton. The financials look good for some of these companies, but there doesn’t seem to be one that stands out as clearly better than the rest and I can’t see any competitive advantages other than reputation and established relationships with customers (which are not particularly strong and durable advantages). Is this a reasonable assessment, or are there things that I have missed?

Thanks,

David S.

Michael P

:

David

Have a look at DTL and SMX (SMS) historical.

I have current IV at $11.49 and $6.36 respectively (not factoring recent change to forecast for DTL).

Relationship with their partners (Microsoft, hardware/software vendors) is also important to consider., and can be gleaned from reading annual reports/industry news.

cheers,

Michael

David E

:

Hi All,

I’m wondering if the blog can give me some pointers, or places to look for information, on how to interpret pre-tax profit forecasts as NPAT. Is it possible to calculate an NPAT figure from pre-tax guidance with enough certainty? Please forgive the naevity of my question!

David E

:

I mean pre tax earnings forecasts (ie EBITA) or profit forecasts (before tax). Thanks!

Ashley Little

:

Hi David,

This is not an easy exercise but have a look at historical data and you should be able to make reasonable assumptions from there

Mal

:

Hi Roger,

I have purchased and read your book, and I can’t work out the rational basis for using the earnings multiplier tables.

How can I plug in a number as a growth factor to calculate a stock’s intrinsic value? Also, how is this superior to a forward PE ration.

I use a far more conservative valuation method, but some shares still shape up nicely. By far my favourite is mynetfone (MNF) a voip provider who became profitable last year. They seem to do well in the small business sector, are growing rapidly and are quite impressively keeping their costs down. By my calculations they will be generating a fair amount of free cash flow this financial year, and it will be interesting to see how they utilise this to facilitate long-term high returns on equity. What would you value this at?

Roger Montgomery

:

Hi Mal,

You could be onto something there. A couple of quick questions as it’s not presently and A class or even B-class company; what do you think is its competitive advantage? Do they enjoy the network effect? Whats the asset Do you think, people will prefer the product/service they offer over a rival? Why? Do you think customers would be willing to pay more or is deflation a feature of the industry? The space they are in has very low barriers to entry and, as a result, intense competition. I see the deal they have signed with Panasonic and looked at the product line-up of Panasonic but I can’t help but wonder if there is anything resembling a monopoly here? Of course that is just one competitive advantage. They may indeed win the race but why do customers prefer them over the bigger rivals and those with much deeper pockets?

Regarding value, Its a very small equity base excluding carry fwd losses ($4 million contributed) and 52 million shares on issue (equity per share of 7 cents) earning a return on equity currently of 50% (excluding carry fwd losses). Lets suppose they retain all of those earnings – equity rises to $6 million (11 cents per share) and they conservatively earn $3 million profit next year (50% ROE again), they then might be worth conservatively 35 cents. They’re at 27 cents at the moment. Is that a wide enough margin of safety? I just don’t know how sustainable that high rate of return is. If you can show me why it will be sustained…

Mal

:

I agree with you that it isn’t quite an A-class company. It’s competitive advantage is certainly it’s service, and their growth is really in the small-medium sized business sector (and not in retail phone lines for general homeowners). I think the barriers to entry are actually quite high. Most people are probably aware just how difficult and annoying it is to change phone companies for a single line (it is not dissimilar to changing banks), this becomes significantly more complex when it comes to multiple lines. It can also be reasonably complex to set up in the first instance. MNF seems to be operating via word-of-mouth and really delivering quality service. Pennytel definitely competes in the space, and for homeowners I don’t think there is a great deal of difference. From what I’ve read and heard, MNF’s lines are better quality and their service is exceptional, and as a result people pay the higher premium for their service. This is all conjecture, but I think the proof is in the fact that they have managed to significantly grow their market share over several years, with a minimal advertising budget and without really increasing their costs (the business seems scaleable). ***disclaimer- I have no special personal insight into their operations***

I think the greatest risk is really one of technological development (although in general, people are rapidly moving from fixed line services to data and internet based services currently). Also, it will be interesting to see how they actually utilise the significant free cash flow that they develop this year into sustainable organic growth.

Roger Montgomery

:

Thanks Mal, What you are saying is that they benefit from high switching costs to the customer. Thats the possible competitive advantage. The trick then is to sign up as many customers, as quickly as possible. I am in the process of moving offices so I will try them out first hand.

Peter

:

Had a look, and my conclusion is company is deeply handicapped by lack of size and consequence lack of marketing clout in order to entrench its advantage quickly. Its advantage is in the SME sector at a time when the major carriers do not support IP telephony (which has cheaper costs attached and better functionality).

Also worried about related party transactions as the company purchases bandwidth from a private company owned by the majority shareholders and directors.

This is high risk high return.

John M

:

I forgot to ask you Roger, what is the signifigance of the picture at the start of this blog? Is it a silver money tree? Or am I imagining things?

Ashley Little

:

LOL John,

You just love your commodities

Hope they go well for you.

John M

:

I think the heat has got to me. The Silver Money tree picture is now a rocket. Is that a subtle hint. I wonder. LOL.

Funny you should mention that Ashley. A book just arrived in the mail today – Jim Rogers’ “Hot Commodities”. Am looking forward to reading it.

Ashley Little

:

LOL John,

It will be a good read,

I like Jim Roger very much,

Happy reading

Duncan

:

John

what’s the book say on Gold and RSG? i only have one commodity stock and that MIN. it’s rising nicely.

Dunc

John M

:

Hi Dunc,

Will read the book next week. If you Google or YouTube Jim Rogers you will find lots of info on him.

I can’t give advice in this blog.

A recurring theme of Jim Rogers and other Commentators/Investors is the awareness of the cyclical nature of all asset classes. Jim thinks Gold is close to an all time high (it has come back a little since then) so he doesn’t like to buy into something when it is at that level. Jim thinks that one should not disregard any asset class, but take advantage of market cycles of all asset classes – especially if one asset class is intrinsically cheap versus another asset class that is intrinsically expensive. Self-made Billionaire investor Jim Rogers studied history extensively and is a multiple Guinness Book of records record holder for his world travels. He has studied investment cycles throughout the ages and has intimate knowledge of what is happening in the world. I like Roger’s and Rogers’ style.

John M

:

I forgot to mention that another topic worthy of study is the formation of asset bubbles. Jim Chanos focuses on profiting from overpriced assets in the form of a hedge fund – Kynikos (greek for cynic).

Using this information in the Value.able context, the easiest way to beat the return of the Long Index funds is to eliminate the C – grade stocks and by default you should be ahead. So by identifying terrible and overpriced companies (or other asset classes) is the first step in the Value.able journey that leads to financial freedom.

Lloyd

:

As Buffet said : “Rule No.1 is never lose money. Rule No.2 is never forget rule number one.”

So avoid the C category MQR like they have the plague (which is true – the default plague)!

Joab Soh

:

Hi John,

Hope you don’t mind me adding to the list. I have reading about Niall Ferguson recently. His book the ‘Ascent of Money’ provides a good read in the history of money. The start of loans, government bonds, insurance, stuff.

There’s a common theme around the the rise of China, and US being in trouble.

There’s an ABC program, which Niall has presented in July last year in Australia. If anyone is interested, just search “Niall Ferguson: Empires on the Edge of Chaos”

John M

:

I am always open to new ideas and welcome all of your comments.

I watched the ‘Ascent of Money’ when it first came out. I think it was a brilliant doco and I learnt a lot from it.

Thanks for your input. I will definitely look up ‘Empires on the edge of chaos’.

I assimilate (forgive the Star Trek reference) the best ideas of the best authors that I read. Now that I have Roger’s valuable framework(or context) I have a way of assessing and implementing these ideas.

One such borrowed idea high on my list is the concept of Moore’s Law which refers to the rate of technological and social change in the modern world being close to exponential (pretty much doubling every couple of years). What that translates to is that we all need to constantly keep up to date with new knowledge because what we learn at school is only the starting point. The modern world is changing so quickly if you don’t regularly sponge and digest new information there is a good chance we will be left behind.

While commodities are on the table, I would like to do something that normally is not allowed on this blog, but I think Roger might make an exception in this case. I would like to make a recommendation and advise everyone to invest in what I believe is the most precious commodity in existence. I believe that it is greatly in demand at the moment, and historically and relatively the supply of this commodity is dwindling to its long term nadir.

Is everybody ready for my recommendation. It is TIME. My recommendation is to do a TIME budget and invest in some time management techniques. I recently watched a brilliant lecture on Youtube by a now deceased Professor Randy Pausch. I you have a spare hour or so, watching this video could possibly change your life. The link is:

http://www.youtube.com/watch?v=oTugjssqOT0

Duncan

:

Folks

all good stuff. i’ll get on to it.

Dunc

John M

:

Have you done your homework?

Thank you for this exercise. I agree with you Roger, doing the homework and reviewing the results helps immensely. I did all the homework pretty much straight away after you posted it, although I didn’t post my results (very naughty graduate I am, I will have to give you an apple to make up for it). Very painful looking at C-grade companies but very important to be able to spot them in order to prevent buying them.

Homework Results

Challenge1 Task 1: Correct

Challenge1 Task2: Oops, I only used the Non Current Liability borrowings (forgot to incorporate Current Liability Borrowings). I spent quite a while going through several YouTube videos on the cashflow of ABC learning (you happen to appear in many of them Roger) as a background to this question and learnt heaps.

Challenge1 Task3: I used the calculated ROE returns (whereas you used ROE of 0)so some of these came out with a very small (as opposed to your 0) intrinsic value. Probably moot as we obviously steer clear of MQR “C” class companies. I didn’t know whether to round down to 0 or round up to 5% so I used the actual calculated ROE. From now on I will use 0 for these sub- 0 ROE’s.

Challenge 2: CAGR is a brilliant formula. I have since used it for some other applications so thanks for this time saver. Lol, to think I have been doing this long hand all along.

For AAC I used 2005AR, TCL I used 2000AR and PGA I used 2004AR.

For ELD ‘03 I found that I come up with a different number for the Number of shares. I had 652 million shares (you had 65.2 million shares)? Did I get the decimal point wrong?

For GNS ‘03 I had total number of shares 82.6 million Page 73 of AR (you had 355.6million)?

For TPI ’05 I had total number of shares 200million Page 84 of 2005AR (you had 254 million)?

For AIO ’08 I had total number of shares 657million Page 88 of 2005AR (you had 820 million)?

I am getting the correct equity figures but my ‘number of shares’ are incorrect. I didn’t have a problem with calculating the IV for The Reject Shop. I have had a shocker here with these C-grade companies.

For the historical change in Price for the companies that I calculated using the same years, I came up with similar amounts using the CAGR formula that you provided.

Hoping I have came close to a pass in the homework otherwise I will have to repeat the class.

Luke

:

Hi Roger,

I hold a few of these A1 companies and I expect them to perform well in 2011. I have been hanging out for your Valueline article in the Eureka Report for the last few weeks. Are you still writing for Alan?

Cheers,

Luke

Roger Montgomery

:

Hi Luke,

Alan and I are very good friends and yes I will be writing again.

fred

:

Hi Duncan, regarding Resolute Mining Limited………nah……….see ya………..check with ashley

Duncan

:

Thanks for the reply Fred

The potential growth of the mines they have is big and relatively low cost compared to it’s rivals. As the usa economy continues to decline are more people going to head to gold? i understand the real value of a useless piece of metal but scared people love to hug it.

look forward to any ideas

thanks again

Dunc

Ashley Little

:

Hi Dunc,

Since 1914 the average inflation adjusted gold price is $672us so it has got a bit ahead of itself ATM.

Because this is the average I know with great certainty that in inflation adjusted terms gold will go lower than this figure. I just have no idea when.

It was less than 10 years ago that the price was in the $200us

These types of businesses are very difficult because you really don’t know the reserve, you don’t know how much it will cost to get it out of the ground, you have no clue what price you will sell it for when you get it out of the ground and you don’t know who you will sell it to.

As someone much smarter than me said “A Gold Mine is a hole in the ground with a liar on top.”

The company may do really well but it is speculating.

The valu.able grads like one foot hurdles.

This one is far too high for me

Hope this helps

Steve I

:

Sorry Ashley, have to disagree.

Its not really the inflation that counts. Plus, it depends on which inflation figure you use.

What counts is the value of gold compared to the value of paper (fiat) currency. For example, the purchasing power of the British pound has fallen 235 times in the last 100 years.

Using an inflation comparison for a gold valuation is overly simplistic. What happens when the currency you are comparing it to is worth nothing?

Gold is money and a store of value. It always has been. Therefore it should be the exact opposite to speculating.

Duncan

:

Steve and Ashley

Thank you very much i wish i have your abilities.

Dunc

Simon Anthony

:

JBH certainly underperformed compared to its retail peers ARP & ORL. Not all A1’s are equal. Be careful when investing in retail stocks this year, its going to get worse before it gets better.

Ashley Little

:

Hi Simon,

You may be right but you are speculating.

Great Businesses at big discounts will always work over time no matter where the economy goes.

As someone much much smarter than me said.”If you wait for the robins, spring will be over”

Simon Anthony

:

No speculation here friend :) That is why I said “Be careful when investing in retail THIS year”. Of course if you start waiting for robins in October your in for a very long wait for spring indeed! In a contracting market if you hold your nerve greater margins of safety are realized. Rogers note “Stock is now down 11% since then” is proof that (our) such warnings (speculation) about retail future prospects may in fact be sage advice indeed.

Your comments Ashley are very welcome on this blog and I for one wouldn’t want you to change anything about your posts.

P.S Thinking and praying for all the people in FNQ. Cheers.

Ashley Little

:

Yes agreed Simon,

Some of the videos I am seeing of FNQ look terrible.

What type of storm is it if it is still a cyclone when it gets to Mt Isa.

Lucky it did not hit a major centre but that is no consolation for the people suffering.

My thought are with all that have problems in FNQ

Roger Montgomery

:

Do note my column in Eureka and in Money Magazine with warnings about future prospects. STock is now down 11% since then. But as Ashley points out, long run it is the value that matters and the price merely creates the opportunity.

john

:

Hi All,

I have a value of $40.11 on COH … That seems low am i doing something wrong?

Thanks.

Ashley Little

:

Hi John.

I have higher but nowhere near the current price.

Post you inputs and we will help you

john

:

Hi Ashley i was using RR at 10% for COH because not sure what to use…should i change that?

Thanks

Ashley Little

:

No John RR 10% is the absolute lowest you should go.

This is one of the few companies you should use it on

What are you other inputs/?

That may be where the issue is

john

:

Hi Ashley,

eps $7.82

payout ratio 73%

roe 35%

Thanks

Ashley Little

:

Hi John,

I have forecast ROE of 40% and forecast POR of 69%.

I am using the analyst forecasts.

Slight difference in EPS as well but not much.

This will raise your IV a little but still well below current price

Andrew

:

Hi John,

You are in the right ballpark. I got $48.08 on a 10%RR.

I have a lower payout ratio at 69.02% and i also have a slightly different EQPS of $7.75 and a higher ROE.

My total ROE was 39% so i think using 35 might be a bit low although its better to be too low than too high.

If i use 35% ROE i get $41.62 however if i use the same inputs as you i get the exact same IV that you get so you are not doing anything wrong, well done.

Also when you take into account the idea of a big margin of safety than the difference between ours and yours doesn’t mean all that much.

Either way, i have it as trading at about a 61% premium so i think we will be waiting a while before we can jump into this fantastic company.

john

:

Hi Ashley what do you do if a company your interested in does not pay a dividend as far as payout ratio goes?

Thanks.

Andrew

:

Hi John,

Not Ashley, but i will take a shot at this too being the nosy sod i am.

If a company does not pay a dividend than the payout ratio will be 0% and the growth or retained amount would be 100%.

In some business cases this is exactly what you would like to see. As those that can retain earnings and compound them at a high ROE is better than them paying it out to us.

john

:

Hi Andrew ,

Take ARP as an example, payout ratio is 100% does that mean multiply my income figure by 0 and my growth figure by 100% ?

Thanks so much in advance.

Ashley Little

:

Hi John,

The Special dividend will explain this.

Go to the annual report or use analyst forecasts.

Hope this helps

Ken G

:

You should only do the one calculation which is the retained 100% of earnings as it is reinvesting its earnings Table 11.2

Regards

Ashley Little

:

Hi John,

Andrew and Ken are correct to an extent.

It is very very difficult to compound 100% of earnings forever at High ROE but this is what the tables assume.

If the company is currently paying a low or nil dividends which is not sustainable (And all bar Berkshire are in this boat) I will look forward to when the POR will rise and see what will happen to future valuations. This takes a fair bit of practise but you will get it in time. When doing this I totally ignore what the analyst say on this. eg FGE according to analyst data have nil dividend growth for the next few years……..Not going to happen

As you are fairly new here John go have a look at the blog below about forecasting value. I think you will get alot out of it

http://rogermontgomery.com/how-do-value-able-graduates-calculate-forecast-valuations-2/

Hope this helps

john

:

Hi Ashley,

Thanks so much.

Ashley i have looked at a few stocks but cant find many with a big discount on intrinsic value, could you point me in the direction of a stock you think is good value. I will then attempt the calculation on the stock purely for practise.

thanks again.

Ashley Little

:

Hi John,

I was just emailing a friend about this a few days ago.

The conclusion we came to is that most high quality businesses are fully priced and that this year may be tough year for our type of investing.

I know it is difficult with the news skills that you have learned but the key is patience.

Opportunities will present themselves, they always have in the past and they will in the future.

All that said I still don’t think MCE is ridiculously expensive and MLD with the recent upgrade might be OK, But I am currently not a buyer at the moment.

Sav

:

Hi John.

The problem with COH is not that it isn’t a great business. It is.

The problem is that everybody knows it is great. And because it is so big it is on the radar of all the insto’s and fundies. It is one of the VERY few companies I would even consider putting the rock bottom RR of 10% on. And depressingly, little bad news seems to come out of it. Every day I wake up hoping to hear in the press that bionic implants have been linked to cancer (only to be discredited later on) and watch the share price plummet. Fat chance.

COH is way overpriced at the moment. And if you look back over the last 4 or 5 years the SP has only dipped below it’s IV a few times. And even then only briefly.

COH is like CSL. A great company, but sadly, overpriced.

So no, your valuations aren’t completely stupid. My own valuation of its IV at the moment is around $65, rising to mid $80’s in 2012.

Patience is the key here. Something that is truly “value.able” and something, unfortunately, I sorely lack.

john

:

Hi Ashley and Sav,

Appreciate all your comments and will take it all onboard.

Thanks again.

ken fraser

:

Roger, Thanks for stopping my blogg on CSV and CTD my inputs were clearly wrong. I will be more carefull in future. Thanks, Ken.

Roger Montgomery

:

I didin’t stop your post. Indeed, I haven’t seen it. If you would like to repost some other version or even the original, feel free.

Scott T

:

To those new to this blog, and casual visitors, welcome. After looking around and reading the many posts, you may have come to the conclusion that this bloke just wants to sell you a book.

Nothing could be further from the truth (well, he does want you to buy his book) but what he is really on about is changing the way you view investing and the stock market in general. I have read the book cover to cover 4 times now, and in 2010 my investment performance was the best it has been for 10 years. It is not for what Roger suggests is a buy (indeed the book contains no buy tips), but rather gives you the tools to reassess your existing portfolio, and critically analyse future investments.

Many of us have stocks in our portfolio that have done nothing for years, (I sure did) and we often think “It’ll come good, It’ll turn around, there’s hidden value in this one” Well it wont and there isn’t. What I was lacking was the clear direction as to how to unemotionally look at these businesses and and decide to move on, because I wanted more than those poor businesses could deliver.

Roger Montgomery’s book gives you the tools to carefully and, I believe, accurately value a business, whilst pointing out the tell tale signs of a business in decline, over laden with debt, or suffering from Warren Buffets “Institutional Imperative”

I simply suggest, join in the blog conversations, ask questions, read the book and be a better investor, here’s to a great 2011.

All the best

Scott T

Ashley Little

:

Great Post Scott T

Matthew R

:

Great post Scott T

I continue to be amazed by the time people spend writing insights here (and giving them away for free!) – I think that says a lot about how much more value they attribute to the book compared to what it cost them

MTL

:

Hi,

I’ve just started my first job in the finance profession and will finish uni in the near future (majoring in accounting). While being new to the market, I quite enjoy reading up and learning new things from day to day. My boss referred me to Roger’s works and hence I have been reading up and exploring the site. I was wondering if you think ‘Value.able” would be above my head, or just the thing to get a newcomer started.

Regards,

MTL

Roger Montgomery

:

Hi MTL,

I don’t usually respond to posts without a name. Please use your name in your next post and welcome to the blog! I think the community of Value.able graduates are the people to ask that question. Have a look at some of the posts from other readers and remember the ideas of the snowball and compound interest.

Pat Fitzgerald

:

HI MTL

Value.able is very easy to understand and I would recommend it to all newcomers to the sharmarket, in fact I think everyone should read it before they make their first investment, if possible.

Roger Montgomery

:

Thanks for advocating my book Pat. I am delighted it has helped so many investors.

fred

:

Thats fantastic Andrew on Finbar group.

Graeme M

:

They all certainly did well, I am looking forward to some opportunities similar to these in the coming year.

One company I have been looking at is Silver Chef (SIV). They providing restaurant equipment finance and catering equipment finance through the unique Rent-Try-Buy. I have them trading at a slight premium to the IV. Was wondering other thought of the business.

I am also interested what others people’s IV are Decmil. I have 2011 IV = $3.05 and 2012 IV = $3.56 there for being current safety margin of 14%.

Thanks G

Peter M (Mully)

:

Hi Graeme,

My research into this company ceased rather quickly after reviewing their debt/equity ratio, cash flows and capital raisings outlined in their 2010 annual report. In short, it doesn’t pass my investment grade filters at this point in time.

Hope this helps

Mully

Matt

:

Hi,

For DCG a quick balance sheet derived cash-flow of about $25M. I can see they have $5.7M in debt, $52M cash with total equity of $89M. Issued capital went from $73.5M to $78M.

Which all seems fairly good to me, they also received an A2 from Roger in December http://rogermontgomery.com/who-made-the-value-able-grade/.

Maybe I’ve missed something or other events has transpired?

Nic Arena

:

Hi Graeme,

I liked Decmil at $1.70ish when annual report came out but not now. There is no MOS for me. But my IV for next year is $3.09 and $3.70 for 2012, so very close to yours. Nic

Graeme

:

Thanks for your replies, when I first looked into SIV they looked quite promising, but delving deeper I was coming to similar conclusions as well, but is is always nice to get feed back from others to confirm you are on the right track :)

G

Duncan

:

Hi Folks

i’m sick of making all these easy returns with MND,MCE, FGE etc so i’ve had a wee look at resolute mining RSG, GOLD. The charts look good to me, bollinger bands, Relative strength and money flow index. The current fundaments aren’t great at the moment but eps for 2012+ has a huge leap at current gold prices iv increases nicely. if the gold price goes to 1900 as some say, HAPPY DAZE.

anyone else had a look at the stock?

Thanks Dunc

Ashley Little

:

Hi Dunc,

I have not looked at the stock but you might want to reread Valu.able

Hope this helps

Roger Montgomery

:

Hi Dunc,

I hope you get well soon.

Lloyd

:

“I hope you get well soon.”….brilliantly dry one liner that says it all … LOL!

Wing Leung

:

Hi Roger,

Can I “like” your comment? :)

Also happy Chinese New Year!

Cheers,

Wing

Duncan

:

Sorry Folks

the chartist kak was my bit of fun on a day i was made redundant. ( time on my hands!!) Roger you have some very good people on the forum!!!!! i must thank you as the 50% hit rate chartists get (if lucky) has turned to a short term 90% hit rate that i’m sure will turn to 100% in time.I’m losing on DWS as i didn’t follow the margin or safty rule effectively

i am tempted by RSG though!?

Thanks

Dunc

Tom Charles

:

Love your work Roger!

Manny

:

I think most of us have made money on at least one of these a1s. I have on 5 of them. I am holding macca and avoiding Mac d. Thanks Roger.

Roger Gibson

:

I like your style. Unfortunately I computerised my calculation of IV onto a database and failed to anticipate the extent of “division by zero” that these companies generate. The program responded in a language rarely seen by financial advisers? Still, I believe that the market will do well over the next year, and as everybody says – ‘any fool can make money on a rising market’. Good luck.

Roger

Matt R

:

Hi Roger

Firstly, thanks for the fantastic book. I was on the way to learning how to trade when I listened to one of your podcasts from the ASX site. Strangely, share trading no longer seems appealing…

on another note, should we always use the average equity from the last 1-2 years when calculating IV, or can one use the starting equity from the current FY

eg when calculating IV for JBH for 2011, should one use EQ for 2010 FY (293.2m), or the average of 2009 + 2010 EQ (229 + 293/2= 261m?

Thanks for your time.

Matt

Ashley Little

:

Hi Matt,

Most of the valu.able grads average ROE but I don’t.

The answer is to be consistent over time.

My RR would be higher than the others on here but that is a function of my tax rate and using beginning equity for roe.

All that said if new equity is raised I will weight it.

Not everyone here agrees with this view

Hope this helps

Roger Montgomery

:

I am not uncomfortable with this approach. Remember: Margin of safety!

Andrew

:

Alot of people have suttle differences. I personally always use the average method as it hink it gives a pretty good overall view of the companies performance. It may not be the best way but as Ashley says, i want to be consistent and that is the method i have been using. It’s also pretty easy to calculate.

And as roger says, the ROE will be in the ball park, the key is to have a big if not huge margin of safety which will help reduce the impact of any difference between the companies true and our estimated value.

If you value JBH at $21 then you want to buy the share at somewhere around $17-18 if not lower. Thats where the money is made.

Ray H

:

Hi Matt,

Just a quick one – if you are trying to calculate IV for JBH for 2011 by the average equity method, you should be using the average equity for 2010/11, not 2009/10. If you want to use starting equity only, use the equity number in the 2010 FY report.

David Sinclair

:

I have just discovered that Morningstar give ASX listed companies an ‘Economic Moat’ rating which can be none (for most companies), narrow (a competitive advantage exists, but is not strong), or wide (a strong competitive advantage).

Does anyone know how reliable Morningstar’s assessment is? Are its ratings good enough to use as a starting point for further research?

Thanks,

David S.

Roger Montgomery

:

I would also be interested to hear whether they report their rating in the bi-annual Shareholder Compendium.

Peter M (Mully)

:

Hi Roger,

I’m afraid not….at least not in the 30th Edition 2010

Mully

AT

:

Two entries for ORL with different GAINS :-)

Roger Montgomery

:

That’s because it was discussed in Money in two separate issues.

Lloyd

:

AT,

So you had two chances to make good money on this one!

Don’t say Roger isn’t generous!

But as noted ” …. six months is NOT enough to hang your hat on”. Nevertheless, its an impressive start from the budding Warren Buffet of Australia.

By way of comparison this is what he’s shooting to match, or exceed, in the immediate five years … the first five years of performance as documented in the Berkshire Hathaway annual report:

% Change % Change

BRK S&P 500 % Outperformance

1965 23.8 10.0 13.8

1966 20.3 (11.7) 32.0

1967 11.0 30.9 (19.9)

1968 19.0 11.0 8.0

1969 16.2 (8.4) 24.6

So take notice, if Roger can outperform the benchmark ASX index by an average 11.7% per annum over the next five years then we’re all on the road to nirvana, provided he continues in his generous sharing of ideas!

Regards

Lloyd

Ashley Little

:

Hi LLoyd,

Great Stuff,

Roger has taught us well.

I don’t think you need any tips from Roger anymore.

I think it was you who discovered ITX and Roger in no way gave you SWL.

You are on you way to nirvana without Roger’s Help.

Michael Leslie

:

I think Worley Parsons is WOR rather than WPL..

Thank you for such a great book.

I am wondering about FRI. What do others think about this business?

Andrew

:

Hi Michael,

Just had a bit of a look at FRI. Can’t say i am a fan and heres why. Basically it revolves around it being a property developer and the things that go hand in hand with being a property developer.

FRI being a property developer, its hard to see a sustainable competitive advantage that exists in my opinion.

I also have it with a large amount of debt which is another hallmark of the property developer.

It also looks as if though they have raised a lot of capital which was spent on repaying debt, i prefer companies that don’t need to raise capital to pay off their debt and can do it through the natural cashflow of the company. Another red light for me is that in 2009 it didn’t even generate positive cash through its operations.

The ROE seems fine at 25% but all of the above means i would not be in any hurry to get on board the company even at a big discount to IV. Am quite happy to be corrected on any of the above and interested to see what others think.

Michael Leslie

:

Gee, thanks Andrew. I have read the book a couple of times but I am very much a novice. I think I will need to watch what other graduates do (as well as trying to get the concepts under my belt) before jumping in too far.

Again, thank you.

Andrew

:

Don’t worry Michael, i learn something from here every day and it is a great resource for anyone so feel free to try things here in public and someone will be able to help you, we are all quite a welcoming lot and most of us love talking about this stuff more than what is probably healthy.

As Walt Disney said “The best way to get started is to quit talking and begin doing”.

You have started doing so you have made the first step, the rest will come along with practice and experience (both your own and learning from others).

Someone will always be able to give you their opinion here and help you so if you are having trouble with any element of the value.able process from identifying companies to checking IV’s or anything else just throw it on the blog and there will be someone able to help you. There are a lot of generous people on here you will no doubt learn.

Plus it all starts a discussion and that is what this blog is all about.

Also, read over some previous blogs if you have the time, so many companies, industries, ideas and theories have been covered they could form an investment book themselves.

I should also say welcome aboard Michael, look forward to hearing from you in the future.

Peter M (Mully)

:

Hi Andrew,

Whilst FRI carry a reasonable amount of debt, their current gearing levels are not too inconsistent with the construction sector as a whole given the capital intensive nature of the construction business.

Looking at their 2010 financials, FRI raised approximately $20.5 in equity and retired approximately $71.3m of debt in 2010, For the most part, this debt was extinguished by operating cash flow – not by the capital raising.

FRI’s most recent capital raising is being used to accelerate their Karratha development plans by bringing forward stage 2 of the project – not to directly retire debt.

FRI appear to have a pretty good track record for maintaining a robust project pipeline supported by a well developed pre-sales strategy aimed at extinguishing debt on completion of each project.

From a competive advantage perspective, FRI have a terrific brand and reputation in WA in addition to an expanding footprint in that geography.

Whilst recognising that the volatility and risks associated with the construction industry is not everyone’s cup of tea, FRI ticks most of my quality rating boxes for a business within that sector and appears to be trading at a reasonable discount to its IV.

Just my $0.02c worth and most certainly not a recommendation to anyone invest in FRI.

Mully

Disclosure: I own shares in FRI.

Andrew

:

Hi Peter,

I agree, their gearing levels are pretty consistent with the construction industry, I did initially calculate the gearing ratio incorrectly (not sure how) and got 65%. I have redone it and get around 32%. Which is not as bad as first thought.

As for the competitive advantage, i have no knowledge of the WA property market and that could well be the case. it’s not impossible for a property company to have a form of competitive advantage (Trump does it quite well through its designs and branding).