Why the market’s bullish sentiment could turn on a dime

Global stock markets have catapulted in anticipation of a sharp economic recovery. The trouble is, no one knows how soon, or how strong, the recovery will be. My concern is that negative data could easily swing market sentiment from optimism back to pessimism.

With stock markets globally clearly enamoured with the idea of a quick and easy V-shaped recovery, it is worth continually and carefully challenging the reasonableness of that assumption.

The sharp two million increase in US jobs, which saw the US S&P500 index register a positive return for the calendar year was one datapoint that supported the V-Shapers’ argument.

But as the team under Ray Dalio at Bridgewater Associates noted, employment data is perhaps the least precise thanks to both participation rate changes and the new trend to multiple jobs each with fewer hours.

The US economy contracted by about a sixth in April and it also bottomed that month. And while the data in May will show recoveries in business and consumer sentiment (as it has done here in Australia – remember Australia is ahead of the US COVID-19 experience) it is likely that wallets will remain zipped up thanks to job insecurity and the very high level of government support upon which consumers know reliance cannot be guaranteed.

There is also the massive issue of US corporate debt. While the US Fed has just stated that rates will remain at zero until at least 2022, and while the Fed is buying corporate and junk bonds, these policies – amid huge debt – could take a long time to stimulate animal spirits among consumers and businesses.

Tighter balance sheets inevitably render companies and governments more cautious about spending, they defer hiring and capital expenditure. Consequently, we still believe in the premise that the recovery in economic activity and corporate profits will be slow and halting rather than quick and easy.

So, the stock market has recovered in anticipation of the economy recovering, but the economy will take a while to catch up. You can see this in Figure 1.

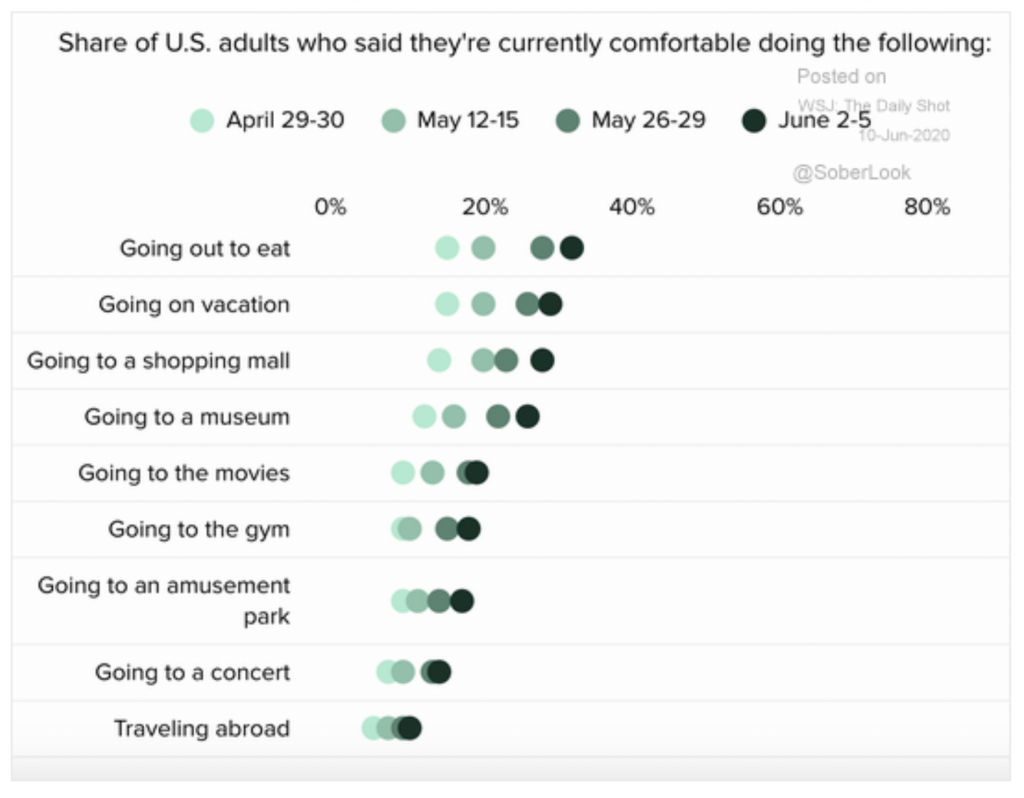

Figure 1. The stock market’s patience will probably be tested

Figure 1. reveals that about 35 per cent of US adults are now comfortable going out to eat, which is a significant improvement on the 18 per cent who felt comfortable in late April. But despite the recovering numbers we are a long way off 100 per cent of adults wanting to be restaurant diners.

So, again we see there is a recovery underway but returning to 100 per cent strength is a long way off. As I have noted in several recent webinars for our clients, the boxer has risen from the canvas, after being knocked out, but he is a long way off being at full strength and ready to go another round.

That however is what the stock market is betting on.

The consequence of the stock market’s enthusiasm however is NOT an imminent crash. The consequence is that a very high bar for earnings has been set by the market. If a company meets the market’s expectations for that company’s earnings, all will be well. If however the company misses expectations, a serious retracement will be likely.

We were very fortunate to be able to put cash to work during the sell-off in March. Our Montgomery Small Companies Fund, for example, went from about 40 per cent cash during the worst of the COVID-19 sell-off to about 10 per cent cash near what turned out to be the lows. Consequently, the Montgomery Small Companies Fund has been one of the top small cap fund performers and generated an 11.74 per cent return in May alone.

But I am starting to wonder whether accumulating several years of normal returns in just two months means we must start to be much more discerning.

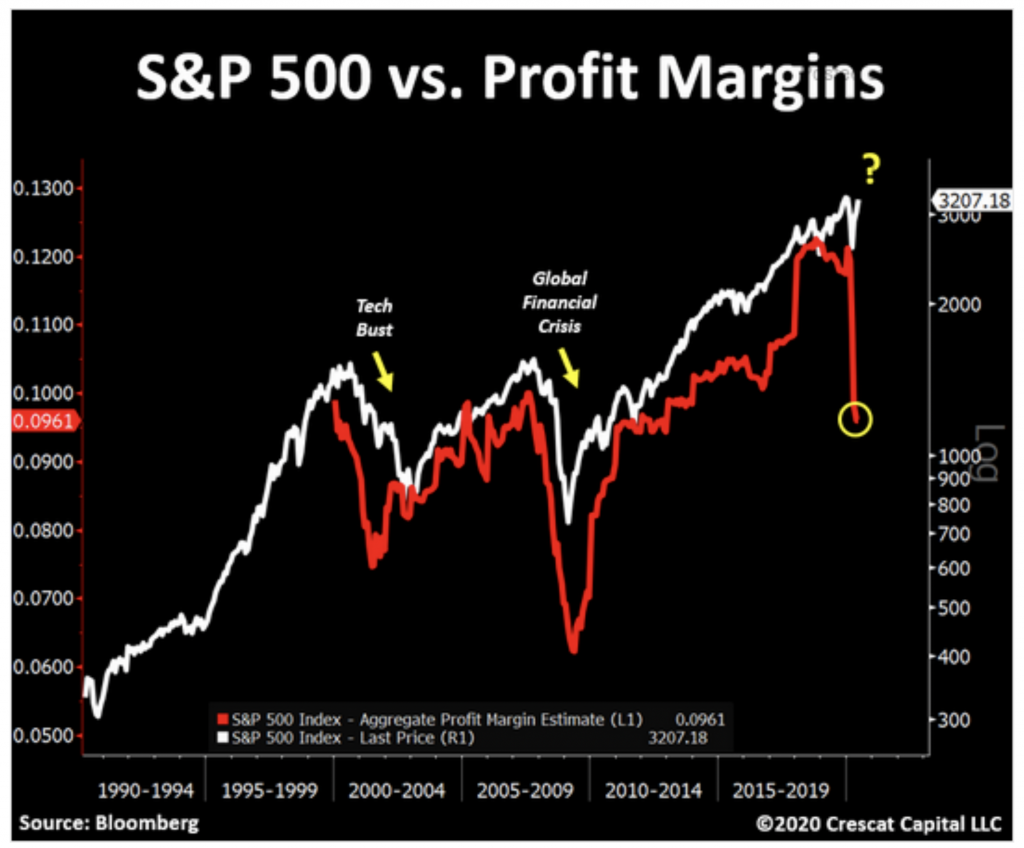

Figure 2. is also worth considering

Figure 2. Will this time be different?

Figure 2. shows a sharp drop in S&P500 company profit margins. Unlike previous profit margin cycles, the most recent decline is of course due to the hard stop placed on the economy due to the Coronavirus outbreak. It will certainly be an interesting six months as we observe whether fear about a protracted recession overwhelms optimism that the economic contraction will eventually end.

Hello Roger,

Which type of corporate bonds is the Fed likely to start buying? Are these ‘systemically important’ companies?

So a typical highly indebted company gets to borrow at almost 0% interest, which lowers its WACC and hey presto, the entity declares a profit and share price goes up. Is this how its intended to work?

How likely is it that the RBA will do similarly in Australia?

Thanks for your insights Roger. Your articles are always a pleasure to read.

Regards,

Amit

Hey Amit, The issue is that the Fed’s actions won’t help the company generate revenue or bring new customers. The Fed’s buying activity only has the effect of maintaining low interest rates for companies that would otherwise already be bankrupt.

And of course, all of this bond buying support must be funded by the printing of money, something markets are also currently cheering.

But think about this, what is the money being used for? If the money – being printed without limit, under the auspices of Modern Monetary Theory – was helping to finance military or economic domination, which in the current geopolitical environment is probably wise, it would make sense. Instead, however the printed money is merely being used to buy the bonds of, and support low interest rates for, rubbish, Triple C-rated, junk companies.

Nothing is being created except the appearances. Nothing is being built, growth isn’t being generated. All that is happening is rubbish is being allowed to continue rotting and investors are being attracted to speculate on that rubbish.

Witness the recent speculative fervor in the US-based car rental company Hertz. Hertz declared bankruptcy on May 22, this year. The shares subsequently rallied 1500-odd per cent, which prompted the company to seek US Federal Court approval to raise a billion US dollars. The company’s lawyers disclosed to investors that the shares would probably be worthless.

Pricing is being affected by a higher level of those treating the market like sportsbet.

https://www.abc.net.au/news/2020-06-12/first-time-share-investors-take-a-punt-on-coronavirus-recovery/12344008