Why sky-high property prices are here to stay – for now

When it comes to explaining our booming property market, one thing stands out: access to cheap loans. So I’m sure many property owners would have breathed a sigh of relief this week when the Reserve Bank of Australia confirmed the historically low overnight cash rate of 0.1 per cent would remain unchanged.

The lack of movement should not come as a surprise. The RBA’s Governor Philip Lowe has, on multiple occasions, enunciated a patient approach to any changes to monetary policy. Indeed, on March 1, he employed the ‘patient’ word again, noting in his statement:

“While inflation has picked up, it is too early to conclude that it is sustainably within the target range. There are uncertainties about how persistent the pick-up in inflation will be given recent developments in global energy markets and ongoing supply-side problems. At the same time, wages growth remains modest and it is likely to be some time yet before growth in labour costs is at a rate consistent with inflation being sustainably at target. The Board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.”

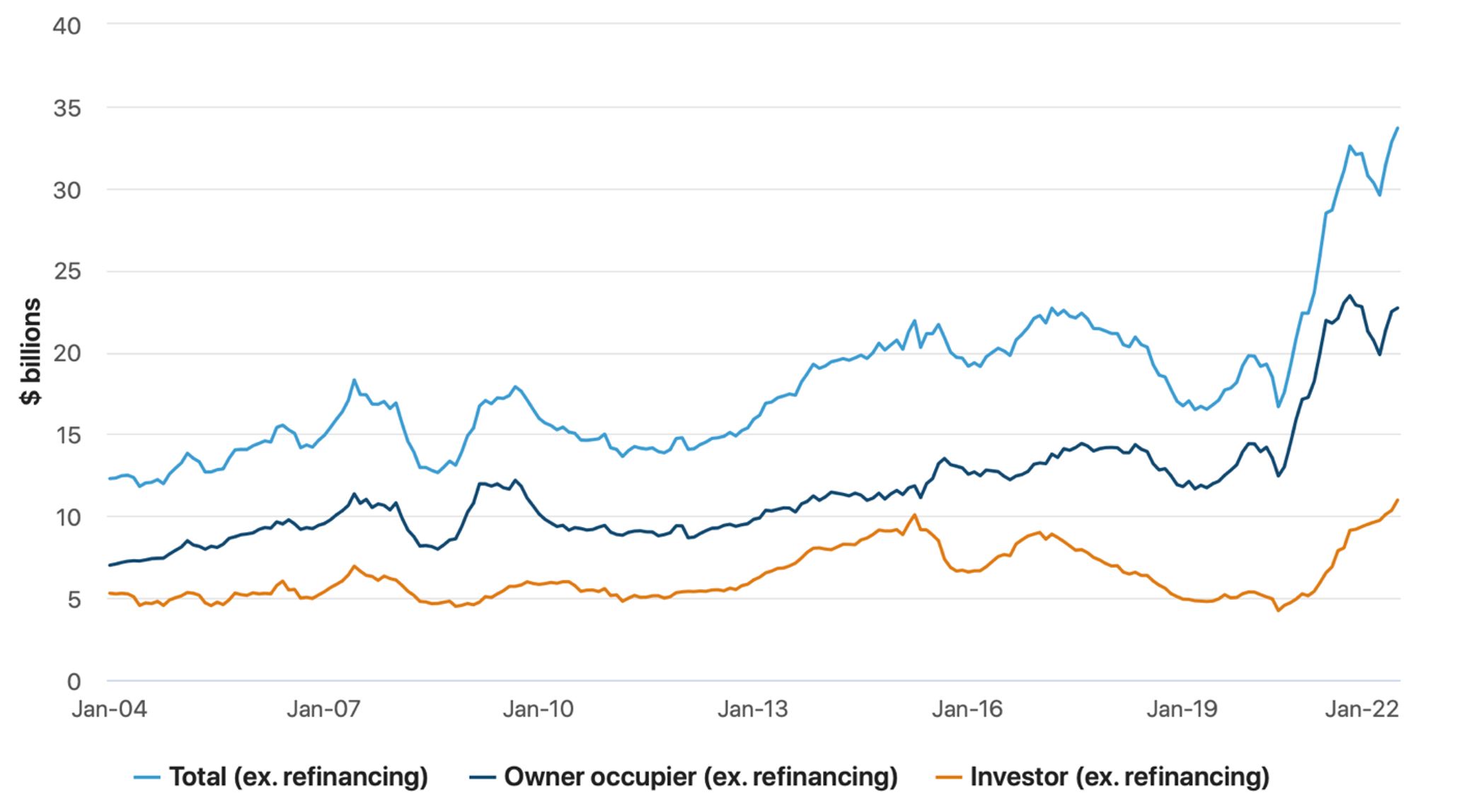

It seems many property buyers aren’t concerned. In January 2022, home loan activity touched another record high. The Australian Bureau of Statistics (ABS) noted $33.7 billion of mortgages were written in January, up 2.6 per cent on December and up 18.2 per cent on January 2021. For context, $32.8 billion of mortgages were written in December, up 4.4 per cent on November 2021 and up 26.5 per cent higher than December 2020. In other words, the pace of growth slowed slightly.

Figure 1. New Loan commitments, total housing (seasonally adjusted), values, Australia

Owner-occupiers took out $22.69 billion of mortgages in January ‘22, which was up one per cent on December and 18.2 per cent higher than the amount written in January 2021. Investors loans of 10.97 billion were written in January and were up 6.1 per cent on the $10.3 billion written in December. New investor loans written were up 67.8 per cent for the year to January 31, 2022.

For a pictorial explanation of what’s fuelling booming property prices, look no further than Figure 1. As we have always reminded investors, access to credit is the single most important driver of short-and medium-term property prices.

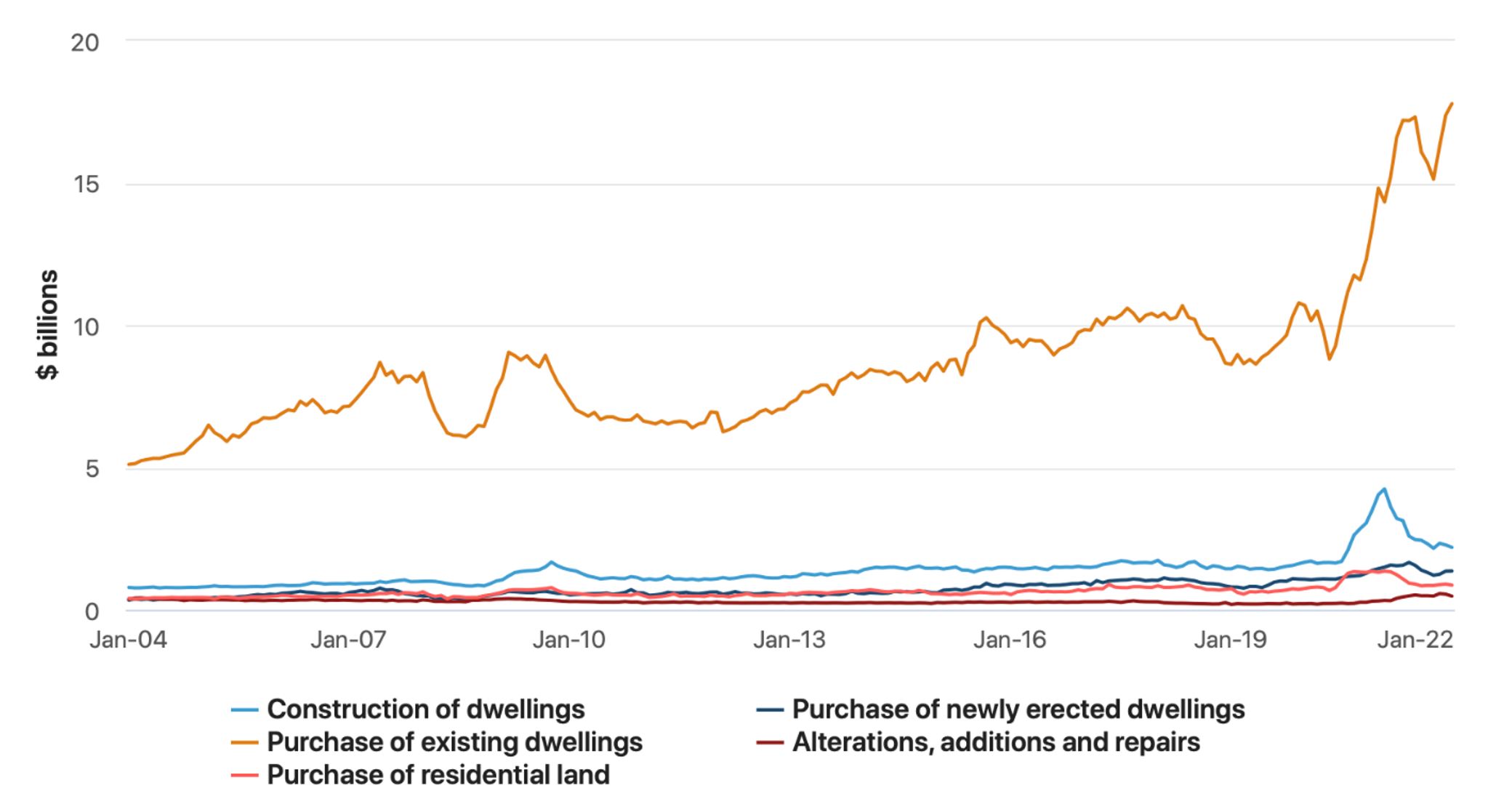

The relatively low supply of established dwellings available for sale, has also, since 2020, made an important contribution to prices. Figure 2. reveals mortgage borrowers have had a particular fascination with, and preference for, established ‘existing’ dwellings, over constructing a new house.

Figure 2. New loan commitments by purpose

Perhaps the rising cost of construction, as well as delays thanks to the shortage of materials and supply chain disruption, has had something to with it.

Residential construction costs in 2021 accelerated at their fastest annual rate since 2005. According CoreLogic’s Cordell Construction Cost Index (CCCI) home building costs rose 7.3 per cent in calendar 2021. Interestingly, the pace of price increases might be slowing (with important implications for inflation rates and the RBA’s monetary policy). While residential construction costs rose 3.8 per cent in the September quarter, they slowed to a 1.1 per cent increase in the December quarter.

Several prominent and respected property forecasters are predicting property price declines in 2023, or if the RBA raises rates by 100 basis points. And there’s no doubt the pace of increase in mortgages since early 2020, and described in Figures 1. and 2., looks like the ‘Highway to the Danger Zone’ fondly sung about by Kenny Loggins, in the original Top Gun movie.

But with the health of, and confidence in, Australia’s financial system heavily reliant on a massive book of home loans, the Government, the RBA, APRA and the banks would be loath to do anything that upsets the apple cart. That’s not to say property prices can’t fall – they fell meaningfully between 2015 and 2019 – but all stops would be pulled, I believe, to limit the falls.

And it is worth remembering it is the marginal buyer and seller, this weekend, that determines property prices for everyone else. At the moment of course, it’s all relatively smooth sailing.