Why I think tech and small caps could rally this year

With inflation finally coming down, it looks like the U.S. Fed Reserve could soon stop lifting interest rates and start cutting, possibly as early as this year. That’s great news for equity markets, which tend to rally when rates are lower. And it’s particularly good news for technology stocks and small caps.

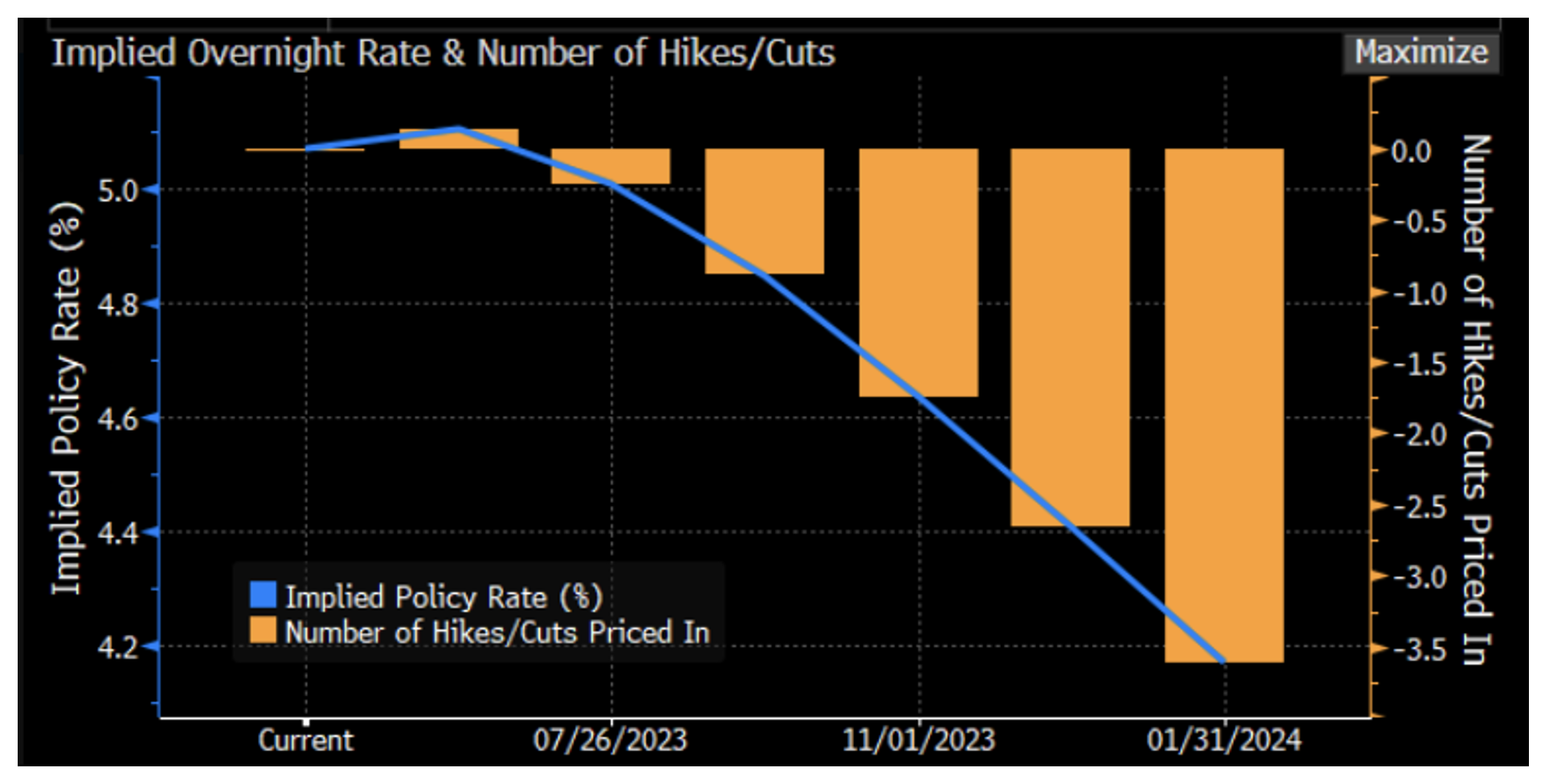

U.S. interest rate markets currently reflect investor expectations for a rate cut by the Federal Reserve before the end of the year, and more than three rate cuts by the end of January 2024. That’s just seven months away! Clearly, the market is rather bearish about the prospects for the American economy, but earnings season doesn’t appear to lend any credence to predictions of an economic collapse.

With earnings season now well underway, only a third of companies have yet to report. Of the two-thirds that have reported, earnings growth has come in at negative three per cent year-on-year, according to JP Morgan. The result, thus far, is significantly better than the negative nine to twelve per cent hitherto anticipated, and suggests some reappraisal of rate expectations might be necessary.

Last week we saw the U.S. indices rally after a stronger than expected jobs report. In the not too distant past, news of strong jobs would be met negatively amid expectations of consequent rate hikes. Now, it seems, equity investors are enthused by strong jobs that a recession is less likely.

Last Wednesday, Federal Reserve Chairman, Jerome Powell, reminded those investors expecting early rate cuts that the labour market remains robust if not hot. He also submitted the prediction that there will not be a recession in calendar 2023. Judging from the current reported results from corporate America, it certainly seems the Fed Chair is right.

The Bloomberg chart in Figure 1. reveals current consensus rate expectations and confirms the noted expectations of at least three cuts before the end of January next year.

The magnitude of the divergence between Powell’s comments and the market’s expectations is unusual.

Figure 1. U.S. Rate cut expectations

Source: Bloomberg

So, what needs to happen for the market to be right? While anything is possible (another pandemic perhaps?), it seems the requirements will be difficult to achieve before the end of January 2024.

For example, inflation would need to fall to the Fed’s target of circa two per cent relatively quickly. That’s not out of the realms of possibility as the annualised rate of U.S. CPI over the past six months is just 3.6 per cent.

Incidentally, we have frequently reminded investors that deflation is very good for innovative growth stocks. The fall to 3.6 per cent annualised consumer price index (CPI) is very positive for equities and explains the 20 per cent jump in the Nasdaq since January 1st, this year.

But the path from 3.6 per cent to two per cent is not guaranteed. The strong jobs market and strong earnings from corporate U.S. suggest there will be bumps and delays to the Fed reaching its target.

And presumably, even if the Fed’s target of two per cent inflation is achieved, it won’t immediately start cutting rates unless that CPI print is associated with weakness in the economy, in corporate profits and consequently, the jobs market.

So, the next question might be, could the labour market weaken from here? Layoff data has now risen to its highest level in two years. (From 2019 onwards we began warning investors that when the spigot of Private Equity and Venture Capital money dried up, layoffs would be seen in the “profitless prosperity” sub-sector of the tech industry – the sub-sector NYU Professor Scott Galloway referred to in 2019 as suffering from “Consensual Hallucination”. See here and here.

So, can the labour market weaken quickly enough to justify multiple rate-cut expectations by January 2024? While the media is now breathlessly reporting the not-so-widely-anticipated layoffs in profitless technology businesses, there would have to be a much broader and more dramatic increase in unemployment to produce the necessary weakness that would validate significant rate cuts.

The final question then, can the U.S. tip into a deep recession this year if the jobless rate doesn’t accelerate quickly and inflation doesn’t drop to said target of two per cent?

First, it is worth keeping in mind that some experts believe that current two per cent real rates are not as “restrictive” as the Fed chairman has asserted. If they are accommodative, then the economy might just side-step a recession altogether.

The tumult in the banking sector may be a precursor to some credit tightening, and perhaps that is the source of economic weakness, but there are lags associated with such transmission mechanisms, not least because regulators will do everything in their power to avoid it. And let’s not forget that the inverted yield curve means long bond rates are accommodative and therefore supportive of investment.

If the market’s investors have the rate cut scenario wrong, it could mean their predictions of a recession are also wrong. In the event, investors conclude the economy is growing and disinflation remains in place, equities will continue to rally and potentially strongly. Further gains in the Nasdaq and perhaps even small companies would not surprise remembering, since the 1970s, the combination of disinflation and economic growth has been very good for innovative and growth stocks.