Where to for Avita Medical?

One company that recently caught our attention, that I believe is worth monitoring, is Avita Medical (ASX:AVH). AVH owns the patents and produces a medical device called RECELL, which produces a “suspension” of spray-on skin cells using a small sample of the patient’s own skin to help treat burn patients and skin defects.

The sample contains the cells necessary to regenerate the outer layer of skin and is applied at point-of-care (at the hospital – an important distinction versus competitors). The primary purpose of RECELL initially will be to treat patients with acute and severe burns.

The device was invented by Australian of the Year Dr Fiona Wood and has been used to treat victims of the Bali bombings in 2002.

The company has been listed since 2002 but has suffered numerous setbacks to commercialisation– including delays to clinical trials required for regulatory approval – while racking up losses and raising capital along the way.

A major turning point appears to have occurred in 2015, where AVH was able to secure significant funding from the US Biomedical Advanced Research and Development Authority (BARDA) to help fund development efforts to secure Pre-Market approval for RECELL by the Food and Drugs Administration (FDA) in the US. In September 2018, the company received FDA approval for use of RECELL to treat patients with acute and severe burns for patients over 18, paving the way to commence commercial activities in the largest burns market.

To understand the benefits of the RECELL device, it is important to look at the clinical trial results. The current standard of care for severe burn patients is based on skin grafting techniques; the RECELL device significantly reduces the donor skin requirement with no compromising impacts on efficacy. For larger burn areas, the skin requirement is reduced in combination with traditional grafting, where surgeons have used “spray-on” skin between gaps on wider areas for successful surgical outcomes.

RECELL trials have demonstrated improved patient outcomes including shorter length of stay, reduced pain and improved cosmetic outcomes (less scarring), while hospitals have benefited from lower treatment costs and improved productivity.

In April-2019, RECELL was showcased in numerous presentations at the major ABA Burns Conference in the US, which featured analysis on significant cost-saving outcomes for AVH’s target patient market (i.e. patients with a total burns surface area more than 10 per cent). The increased awareness of the product should help drive adoption in a market that is relatively concentrated (134 burn centres, 300 burn surgeons) over the next few years.

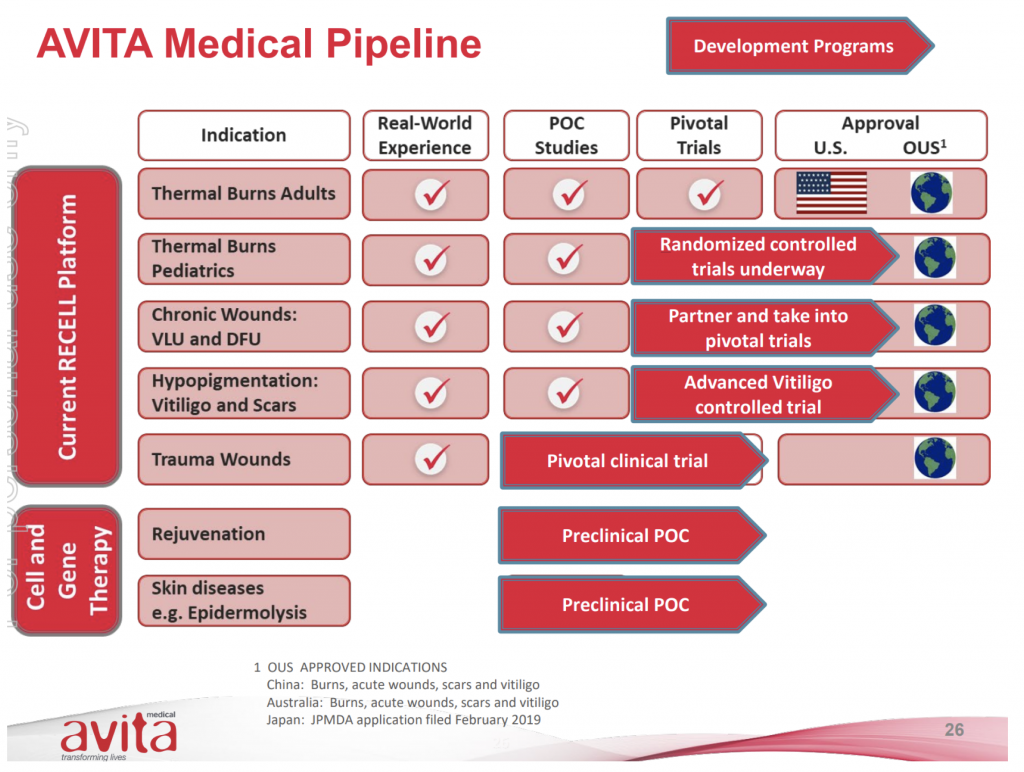

While AVH’s initial target burns market appears to be somewhat limited in terms of the Total Addressable Market (AVH estimates of ~US$200 million based on Burn Centre in-patients in the US), there appears to be additional opportunities for application of the RECELL technology. There are various stages of trials and development including:

- Approval for use for Paediatrics – where trials have commenced in late 2018. AVH has already used the device on paediatrics in previous trials for compassionate use

- Chronic wounds – including venous leg and diabetic foot ulcers

- Hypopigmentation – vitiligo and scars

- Trauma wounds

There is also the opportunity to partner with other companies to penetrate new geographies (as evidenced by its recent deal with COSMOTEC in Japan).

Avita Medical Company pipeline

Source: Company presentations

Given sales roll-out is at a very early stage, one major risk for AVH is execution and wide-spread adoption. Despite 26 of 134 Burn Centres already having placed orders for RECELL, adoption of new medical devices takes time, including training of staff and evaluation of the product by a hospital’s Value Analysis Committee. This impacts the trajectory of sales revenue and path to profitability.

There is also significant time and money investment involved with clinical trials and regulatory processes (as well as risk on approvals) – albeit for burns indications for paediatrics appears somewhat mitigated by BARDA’s funding of trials and pre-existing approvals for adults.

The Montgomery Funds own shares in Avita Medical. This article was prepared 06 May with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Avita Medical you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Andrew Forbes

:

Does the team still have a view on Avita Medical?

Joseph Kim

:

Hi Andrew,

We’ve written about Avita Medical a few times since our initial write-up – with the most recent post based on their JunQ 2021 sales update.

https://rogermontgomery.com/some-encouraging-updates-from-avita-medical/

https://rogermontgomery.com/avita-medical-a-small-cap-with-big-potential/

https://rogermontgomery.com/is-there-more-upside-potential-for-avita-medical/

There are potentially some very interesting developments for the company over the next 6-12 months which could have a significant impact to the longer-term thesis including a decision on US Medicare reimbursement for outpatients. This is laid out in their most recent presentation in upcoming catalysts.

Thanks

F.

:

Hi, quick questions:

Do you have any specific insights as to when Avita Stock will move to the NASDAQ? I only info I could find was 2019.

Do you have a rough estimate when/if Avita could get FDA approval for their pediatric thermal burns trials and their vitiligo trials?

Personally, I think Avita will eventually have a meteoric rise over the next 3-5 years, like EXACT Sciences Corp. (EXAS) which is currently @ 101.29 today. I have friends that think Avita will end up getting purchased much sooner though by a big company (@ around $15-$25 range). What are your thoughts? Will Avita get purchased quick, or will it get the chance to grow into a big company?

Joseph Kim

:

Hi F,

Thanks for your comments.

I don’t have any specific insights as to when Avita will list on the NASDAQ, but I personally don’t see a NASDAQ listing as a specific catalyst for this stock.

re: FDA approval for pediatric, the company expects a trial + approval timeline of ~2 years, but I suspect we will see a significant increase in compassionate use for pediatrics. I expect Vitiligo indications will follow a similar, if not slightly longer time frame.

My view is that corporate interest and activity is certainly a possiblity, but this is not central to an investment thesis on this stock.

william-garbett

:

Has the ruler been run on Clinuvel?

Similar position, but with more cash & more cash coming in.

I recently gave it a look, but discounted it on valuation grounds.

Joseph Kim

:

Hi William,

While I am not in a position to comment in detail on Clinuvel I understand it is at a different stage of the regulatory process.

John

:

I have no idea about this company but I would be cautious unless you understand the science and technology. Short seller Marc Cohodes demonstrates quite well why people need to be careful of biotech sector.