What really propelled the Aussie market in 2019?

Over the past 12 months, the soaring Australian share market has made most local investors feel pretty smart. However, for most part, it was falling interest rates, rather than rising company earnings, that kept the rally going. The question now is: how much longer can this bull market go?

January is generally a very quiet time in the Australian share market with majority of investors and company employees taking time off enjoying summer holidays and with an absolute majority of companies in blackout preparing their first half results announcement and presentation generally scheduled for February. This is therefore a good time to look back and reflect over the last year. My colleagues have already done that in a number of blog posts (here and here for example) but I thought I would take the opportunity to look at what drove the performance in 2019 by breaking it down into dividends received, earnings development for companies and changes in valuation.

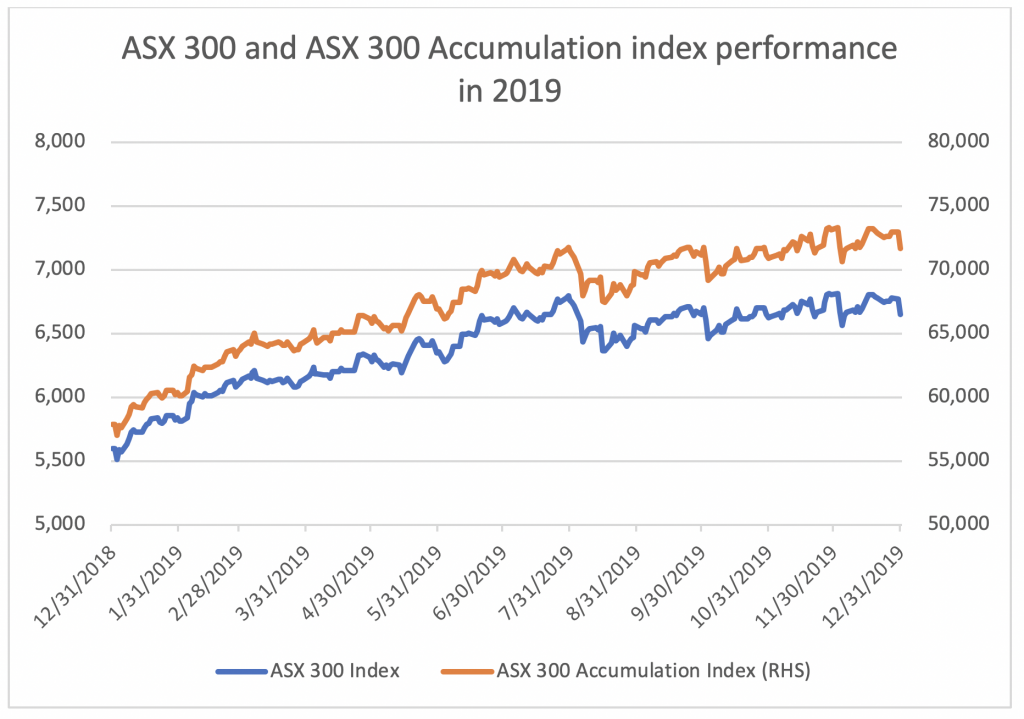

Let’s start by looking at what the actual performance of the Australian share market was in 2019:

- The ASX 300 index, which is the most well-known index in Australia, increased by 18.8 per cent in 2019.

- The ASX 300 Accumulation index, which also includes the dividends received (and assumed re-invested), which we consider a more meaningful index, was up 23.8 per cent.

- The difference between these indices was 5.0 per cent, which is the return that was achieved from dividends during the year.

Source: Bloomberg

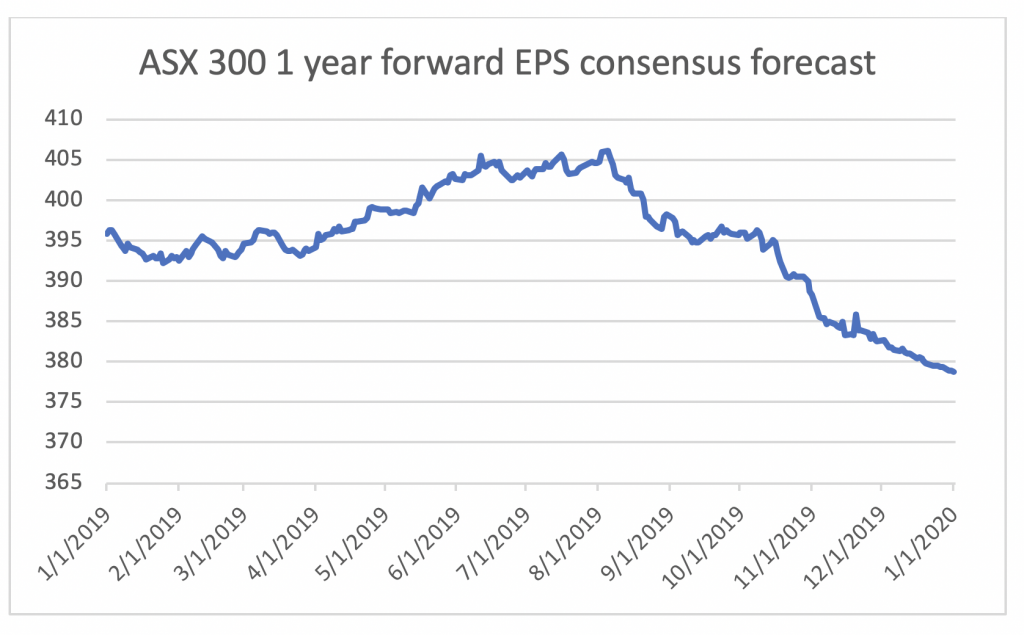

If we move on to looking at what happened to earnings for the companies that make up the index, we get the following chart, which shows at each point in time what the blended 12 month forward earnings forecasts are for the aggregate of the companies that make up the index:

Source: Bloomberg

From this chart we can see that the year started out reasonably well for companies and we saw the aggregate earnings forecast increase by 2.6 per cent from the start of the year to the peak in early August. The outlook statements presented in connection with the annual results were though generally worse than expected and we started to see quite a steep drop in earnings forecasts in aggregate, and the year ended with aggregate 12 months forward looking earnings forecasts that were 4.3 per cent below where we started the year.

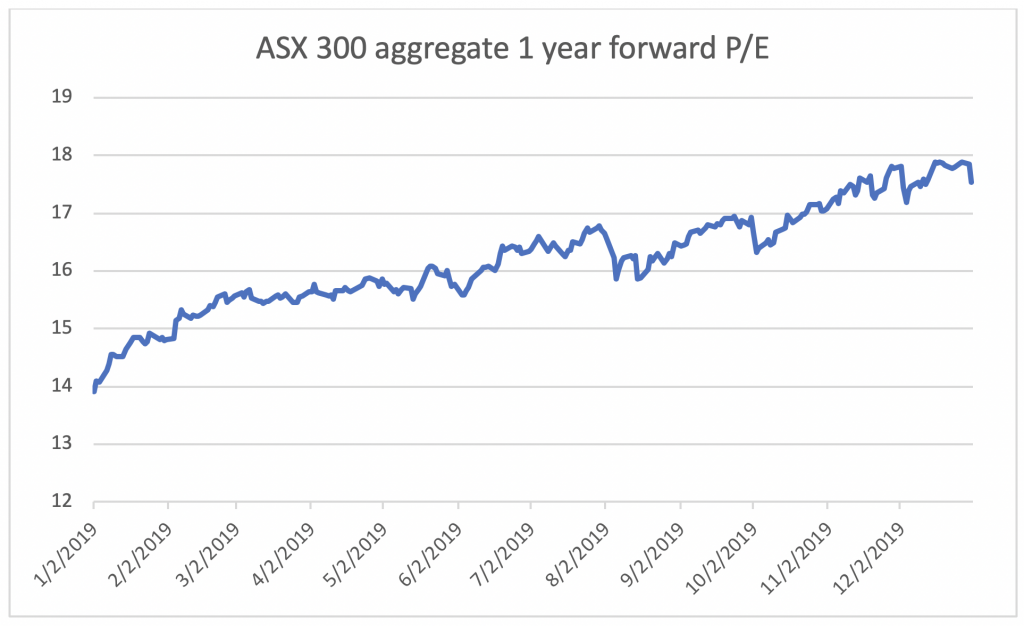

There are many different ways to measure valuation but the most common one is Price to Earnings ratio or P/E.

As we have established, share prices did really well in 2019 while underlying earnings forecasts declined so it should hence not come as a surprise that the aggregate P/E for the market increased quite significantly. Indeed, the aggregate P/E increased by approximately 23 per cent to 17.5x as we can see in this chart:

Source: Bloomberg

So, to summarise, the 23.8 per cent total return of the ASX300 Accumulation index can be broken down into:

- 5 per cent return from dividends received (and assumed reinvested)

- Negative 4.3 per cent aggregate earnings revisions

- 23 per cent P/E multiple expansion

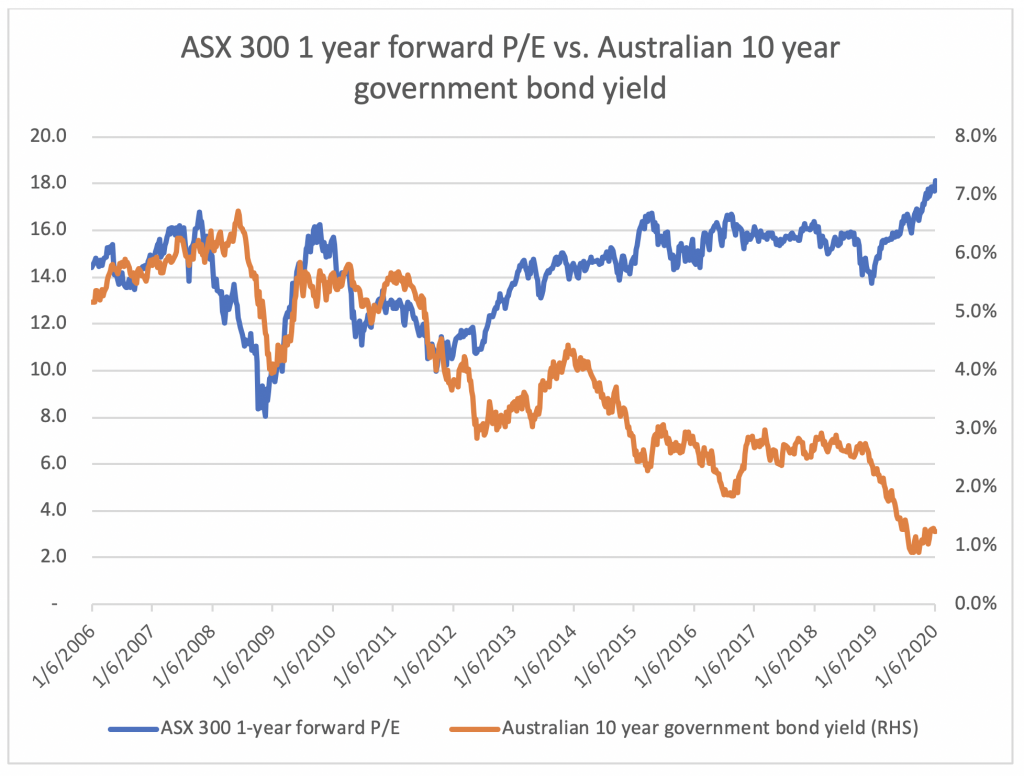

Looking at what caused this multiple expansion, it is quite instructive to look at this chart which shows the 1-year forward P/E of ASX 300 compared to the 10 year Australian bond yield:

Source: Bloomberg

We can see that during the last few years there is a very clear negative correlation between interest rates and P/E multiples and the effect is especially pronounced during 2019. It is also interesting to see that if we go back to the GFC, the relationship was inversed so that P/E multiples and interest tended to move together rather than in opposite directions.

We can also see that we very recently have started to see interest rates (at least longer dated interest rates) go up again but we have not seen any adverse reaction to share prices, which I find interesting.

Predicting where interest rates will go is very hard. Consensus seems to be that we are in a “lower for longer” scenario, which should be supportive of share prices, but given that interest rates are already very very low, it is hard to see them falling much from here (we have indeed started to see some European countries start to raise interest rates) so at least I would not expect the same kind of multiple expansion to continue.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

“From what I have experienced, the mistrust of stocks and trust in property is quite deeply ingrained in a large portion of the population and it is hard to see a significant portion of this group abandoning this position.”

Andres you are correct that this cultural narrative (The Australian Dream) is engrained in Australian culture however the newer neoliberal version (‘The Australian Delusion’ – owning a portfolio of properties) is less ingrained and Australians will become shift their beliefs when it affects their hip pocket. If equities bubble along nicely and housing stagnates ( a relative state) then property investors have a nice alternative- equities have the bonus of being substantially more liquid and now they don’t have to worry about so much about maintenance and inability to get renters, the place being trashed and so on.

The type of people who have jumped on the property bubble are not going to be conservative types – who mistrust everything – they will be more willing to jump ship if it looks more plush even though they have no idea where it is going.

Andreas this is quite interesting, if interest rates remain low and equities continue to surge do you think it is likely that investors will start reallocating money from the property bubble (creating a negative feedback loop which deflates this bubble ) to the equity market ( a positive feedback loop which will last until it becomes unsustainable?).

Hi John,

Very hard to say but what I think is clear is that low interest rates propels all asset prices. One could hope that over time Australian investors would over time move from investing in unproductive assets like residential property to investing in productive assets which includes providing capital for companies that are reinvesting as the current level of property prices in Australia is a clear impediment to the Australian economy’s long term potential in my mind (although a rapid correction from the current state would indeed be very painful short term!).

Without a crystal ball, it is impossible to tell where interest levels will go, but I very much struggle to see that central banks will try to lift rates significantly any time soon. We should though remember that interest rates is basically the clearing price for debt and as any other market is governed by both supply (i.e. how much and for what price central banks and banks are offering to lend at) and demand (i.e. how much people and companies wants to borrow). I think supply is likely to continue to be very strong (i.e. central banks being accommodating) but demand is more of an unknown and can be impacted to a lot of different factors including black-swan type events like war or a repeat of SARS etc. and there is not much central bankers can do about that.

To answer your question though, I think there is quite a sharp delineation between investors in Australian property market that sees investing in shares as an alternative. From what I have experienced, the mistrust of stocks and trust in property is quite deeply ingrained in a large portion of the population and it is hard to see a significant portion of this group abandoning this position.