What has probing the reporting season avalanche revealed?

With reporting season in full swing, I would like to share my insights into whose Quality Score has improved, and whose has deteriorated. Remember, none of this represents recommendations. It is intended to be educational only. You must seek and take personal professional advice before acting or transacting in any security.

To date, 232 companies have reported their annual results. I am sure you can understand why we feel snowed under. With almost 2,000 companies listed on the ASX, the avalanche still has a way to roll.

We have updated all of our models for each of the 164 companies that we are interested in. As you know, we rank all listed companies from A1 down to C5. The inputs for those rankings always come from the company themselves. I would hate to think how bipolar they would be if we allowed our emotions and personal preferences to infect those ratings (or be swayed by analyst forecasts)!

Rather than arbitrary and subjective assessments, we download some 50-70 Profit and Loss, Balance Sheet and Cash Flow data fields from each annual report to populate five templates. All of these templates employ industry specific metrics to calculate the Quality Scores. This allows us to rank every ASX-listed business from A1 – C5. Its our objective way to sort the wheat from the chaff.

For Value.able Graduates not familiar with our scoring system, company’s that achieve an A1 Score are those we believe to be the best businesses, and the safest. C5s are the poorest performers and carry the highest risk of a possible catastrophic event.

A1 does not mean nothing bad will ever befall a company. A1 simply means to us that it has the lowest probability of something permanently catastrophic. Further, ‘lowest probability’ doesn’t mean ‘never’. A hundred-to-one horse can still win races, even though the probability is low. Similarly, an A1 business can experience a permanently fatal event. In aggregate however, we expect a portfolio of A1 businesses to outperform, over a long period of time, a portfolio of companies with lesser scores.

With that in mind, we are of course most interested in the A1s and – on a declining scale – A2, B1 and B2 businesses.

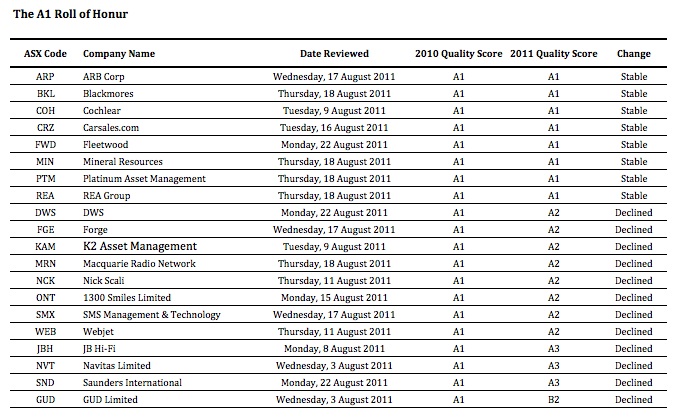

So, who has managed to retain their A1 status this reporting season? And which businesses have achieved the coveted A1 status? If you hold shares in any of the companies whose scores have declined (based of course on their reported results), please read on.

Of the companies that have reported so far, last year 20 of them were A1s, 28 were A2s, one was a B1 and 13 scored B2. That’s an encouraging proportion, although we tend to discover each reporting season that the better quality businesses and the better performing businesses are generally keen to get their results out into the public domain early.

Its towards the end of every reporting season where the quality of the businesses really drops off. This is always something to watch out for – companies trying to hide amongst the many hundreds reporting at the end of the season. It’s always a good idea to turn up to a big fancy dress party late, if you aren’t in fancy dress.

This year we have seen the number of existing A1s fall to nine from 20, A2s from 28 to 24, B1s rise from one to two and B2s fall from 13 to six.

The first table shows all twenty 2009/2010 A1 companies that have reported to date. You’ll see a number of very familiar names in here, including ARB Corp (ARP), Blackmores (BKL), Cochlear (COH), Carsales.com (CRZ), Fleetwood (FWD), Mineral Resources (MIN), Platinum Asset Management (PTM), REA Group (REA), DWS (DWS), Forge (FGE), K2 Asset Management (KAM), Macquarie Radio Network (MRN), Nick Scali (NCK), 1300 Smiles Limited (ONT), SMS Management & Technology (SMX), Webjet (WEB), JB Hi-Fi (JBH), Navitas Limited (NVT), Saunders International (SND) and GUD Limited (GUD). Nine have maintained their A1 rating this year.

Now, before you go jumping up and down, a drop from A1 to A2 is like downgrading from Rolls Royce to Bently. When we talk about A2s, its not a drop from RR Phantom to a Ford Cortina, not that there’s anything wrong with the old Cortina (if you are too young to know what I am talking about Google it!).

The only big rating decline is GUD Holdings, which made a large acquisition (Dexion) during the year. Indeed, a common theme amongst the higher quality and cashed up businesses this reporting season has been the deployment of that cash towards, for example, acquisition or buybacks (think JB Hi-Fi).

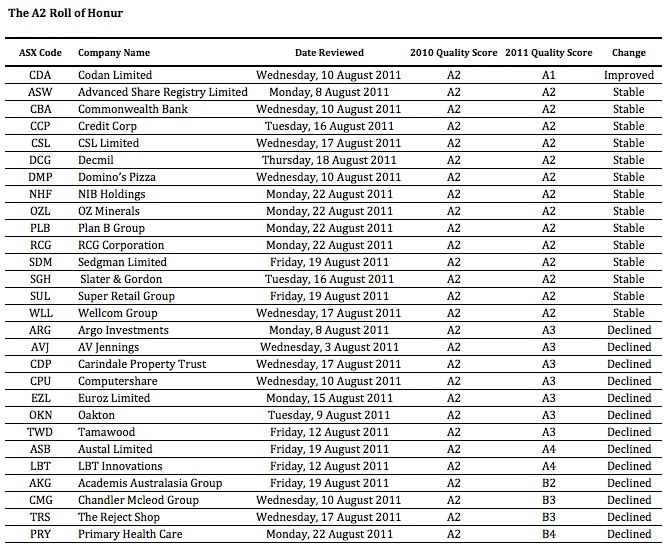

Moving onto the 2009/2010 A2 honour roll: Codan Limited (CDN), Advanced Share Registry Limited (ASW), Commonwealth Bank (CBA), Credit Corp (CCP), CSL Limited (CSL), Decmil (DCG), Domino’s Pizza (DMP), NIB Holdings (NHF), OZ Minerals (OZL), Plan B Group (PLB), RCG Corporation (RCG), Sedgman Limited (SDM), Slater & Gordon (SGH), Super Retail Group (SUL), Wellcom Group (WLL), Argo Investments (ARG), AV Jennings (AVJ), Carindale Property Trust (CDP), Computershare (CPU), Euroz Limited (EZL), Oakton (OKN), Tamawood (TWD), Austal Limited (ASB), LBT Innovations (LBT), Academis Australasia Group (AKG), Chandler Mcleod Group (CMG), The Reject Shop (TRS) and Primary Health Care (PRY).

The businesses that make up this list showed slightly more stability. The biggest fall in quality this year was Primary Healthcare (PRY),which is still struggling to digest the large purchases it made a few years ago. The Reject Shop (TRS) also declined, to B3. TRS is still investment grade and we would lean towards believing this is a short-term decline, given the floods in QLD that caused the complete shutdown of their new distribution center and the massive disruptions subsequently caused. As the company said, you can’t sell what you haven’t got!

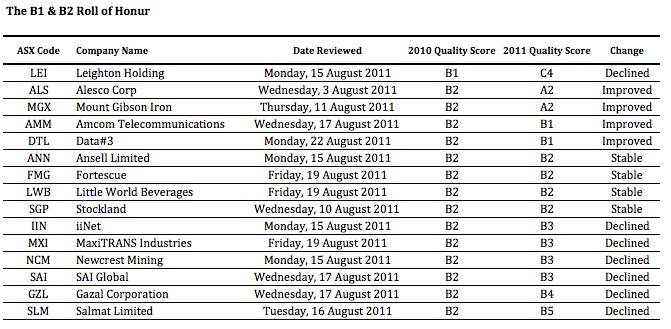

Finally, B1 and B2 companies: Leighton Holdings (LEI), Alesco Corp (ALS), Mount Gibson Iron (MGX), Amcom Telecommunications (AMM), Data#3 (DTL), Ansell Limited (ANN), Fortescue (FMG), Little World Beverages (LWB), Stockland (SGP), iiNet (IIN), MaxiTRANS Industries (MXI), Newcrest Mining (NCM), SAI Global (SAI), Gazal Corporation (GZL) and Salmat (SLM).

About half the companies in the B1/B2 list retained or improved their ratings from last year. Mind you, half also saw their rating decline!

The clear fall from grace is Leighton Holdings, whose problems have been well documented in the media and via company presentations.But once again, like The Reject Shop, this could be a temporary situation. If the forecast $650m profit comes through, I expect LEI’s quality score will improve. What the dip will do, however, is remain a permanent reminder that Leighton is a cyclical business. Getting the quote right on a job is important, even more a massive enterprise like Leightons.

Are you surprised by any of the changes? We certainly were!

Sticking to quality is vitally important. That’s what my team and I do here at Montgomery Inc, and its what our amazing next-generation A1 service is all about. Value.able Graduates – your invitation is pending.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Remember, you must do your own research and remember to seek and take personal professional advice.

We look forward to reading your insights and will provide another reporting season update soon.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 24 August 2011.

Is Vocus communications still an A1 stock

Hi Russell,

It’s been a B2 two years running. On March 9 this year I wrote in Eureka “My Montgomery Quality Rating for this company is B2. ”

You may also be interested in watching and reading these:

http://www.youtube.com/watch?v=kprUfGJa6X8

http://rogermontgomery.com/wp-content/uploads/2011/04/Roger-Montgomery-writes-about-Vocus-Communications-in-his-Value.able-stocks-column-for-Money-Magazine.-April-2011.pdf

If you’re looking to buy VOC, now could be the time… Down 9% today to $1.36. More than 50% decline in price over 4 to 5 months. Is Mr Market being irrational as usual? I hope so!

What are your Views on MYG

and VMS and AXT please?

thanks

Who Likes FRI?

A WA company well worth looking at is Finbar (FRI) They mainly develop apartments in East Perth & close in suburbs.By far their largest (100% owned) development is in Karratha the commercial centre for the Pilbara, The project is by far the largest & most prestigious (9 Floors) in town, Apartments can sell for $1M

Stage 1 is valued at $90m now 50% sold. Early next year construction will start on Stage 2 valued at $140m

If mining or LNG developments stall no doubt FRI will struggle otherwise it should make good profits,

East Perth is an excellent area for development of apartments. I have walked to the Mint in this area which is between the WACA & the City centre.

I have a significant investment in FRI which i am happy to hold

Regards Macca

Macca,

I like Finbar also.

I did research on this company a few months ago and bought into them.

As with a few companies with the recent crash, Finbar was one i wish I had some lazy cash to put into it.

80cents SP was pretty good. When you consider the P/E ratio of it and assuming the dividend was going to stay the same or get better (given their history thats a likely case also)

You wouldnt need any capital growth and its already as good if not better than a bank.

Hi Roger,

In regards to COH, I valued the IV at 45.55, surely I have made a mistake.

I calculated the EPS as 503.3/56.7 = 8.88 with ROE 34.9% and Payout ratio = 73%

Are all these figures wrong?

Hi Ian,

I don’t know about yr figures, but the result looks very close to right if I remember correctly.

I remember Roger’s being somewhere in the high 40’s and many participants on this blog, including me, have shared your surprise.

Does this mean the share price will come down or will COH’s IV gradually creep up to the price? I don’t know but I would not feel comfortable buying it at present, even at the bottom of its current range.

Also, could anyone please tell me why Perilya (PEM) has been trading round 60 cents for most of this year when its IV is over $4? Is it to do with its unusual ownership register?

Thanks.

Hi Ian, Andrew,

For COH i have 2011 at around $56.00 rising to $58 next year. You will find many comments here about COH and people wishing that something drastic will happen to make its share price plummet 50-60% so we can buy. it is a great company, unfortunatley everyone else thinks so as well.

As for what the share price will do, no-one here will be able to tell you that, maybe speak to your local crystal ball reader. I am thinking that in the long term for this company it might be more the IV reaching the price than the price coming down to IV. But thats just my thought.

I think it is still extremley expensive and a smuch as iw ould love to, i am not seeing myself as an owner of this company any time soon.

I’m ecstatic that just a week after this comment Andrew (which completely aligned with my own thoughts) the impossible came from left field

Any time soon may have come sooner than you (and I) could have thought.

I know you have said many times you are not investing in the share market because you have your own personal goals. But would COH on sale tempt you? I imagine you are brewing some thoughts.

I’m waiting to talk to some colleagues who put these in to get their thoughts on whether this will affect their decision making. I will report back.

Looking forward to it Matthew.

Yes

Thanks Matt

Hi Andrew,

Whilst i have some time thought i would have alook at PEM for you as well. Once again, i can’t tell you why a stock is at a particular level nor can i tell where it will go but i think a lot of people are not as optimistic as you are about this company.

I had a quick look out of curiosity due to the big difference you mention in regards to IV and current price, it is not a company or industry I personally would invest in so feel free to make of this as you will.

The below is worked out based on the 2010 Annual Report released earlier this year.

I have a value on a 14% Required Return of around $0.24 and i feel that might be a bit optimistic personally.

I was drawn to the fact that they recevied a $47 million tax benefit which boosted net profit from 20 mill to around 70 mill and ROE from 14% to 50-odd%. Looking at its past its earnings have fluctuated so seeing a consistent path is hard so i worked my valuation out based on a worse case scenario of a loss ($0.00 IV) and as high as a 17.5% ROE ($0.47 IV) so there is a lot of room in between where the true value could be, so even though i said $0.26 really you could throw a dart anywhere between $0 and $0.47 which is quite a vast amount of relative values.

Net Debt is around 66% of total equity and has negative working capital. Around 63% of total debt sits in current liabilities so could possibly need to be repaid in the next 12 months from the date the 2010 Annual Report was released.

26% of assets is made of of “exploration, development and evaluation expenditure” which i think should not necessarily fall into the asset column (it is mentioned in value.able in the cash-flow chapter, can’t remember what Roger says about it off the top of my head but might want to check it out) another 32% for property plant and equipment so is reasonably capital intensive. Has negative company cashflow as well.

I would not be surprised if this company were to fall into the C (perhaps if i was to guess in a very uninformed manner C3) class of Rogers quality scoring as i can see the potential need for a capital raising or such some time soon.

Seek and take your own advice before acting in any way, I am by now way an expert at this industry and avoid it like the plague usually but had some time on my hands so thought i would have a look. I could be so far wrong here so do some research.

Hi Andrew,

Debt, mine life and management track record have to be considered hear.

Personally I would not buy it at any price

Hi Andrew and Ash,

thanks for yr input. I wrote a much longer and detailed response and clever me somehow erased it! However…I have never bought Perilya but its’ price in relation to apparent holdings and output has intrigued me.

BTW, I have heard it said repeatedly on YMYC that Matrix is going to have

ANOTHER capital raising. Is that true? I thought that sounded a bit grim in the light of recent difficulties; on the other hand those very difficulties kind of make it believable. Can anyone enlighten me re this?

Thanks again.

Have you noticed that in the last month Australia has developed an inverted yield curve??

IYC occurs when the 90 day bill rate is higher than the 10 year bond rate. IYC is very rare and last occurred in Australia in the depths of the GFC.

What to make of it? Am I spending too much time looking at tea leaves? Or is there something to this signal?

Historically in the US an IYC has been a relaible 2 year warning signal of impending recession.

My guess is that the RBA has got itself into a thorough muddle with cash rates and will have to reduce the cash rate by 50 basis points very soon.

A lower cash rate should be good for some sectors. Which sectors?

Hi Martin,

Yes inverted yield curves have an uncanny ability of picking a recession around the world. Will it happen……..I don’t know but I will certainly avoid our Banks…..In a Recession losses will happen and the much talked about dividend will be nonexsistant.

When and if this happens pin you ears back and buy as many as you can.

To answer your question at the end, I would think it would be easier to name the sectors that will do worse…. but here goes:

I’m no economist, or accountant for that matter, but discretionary and non-discretionary retail should do better in a low interest rate environment. Favour might be greater toward the discretionary end, but both should benefit. ie ORL, JBH, NCK, WOW, TRS

Businesses requiring large amounts of capital expenditure will find it harder if inflation gets a foot hold. ie QRN, QAN, FMG (and any predominantly Australian based miners really, however note: this may be offset by the following paragraph)

A weakening Australian dollar will help any industry that sources locally and sells overseas: think COH, CSL, or any industry that benefits when people stay at home, ie WTF

Sadly, lower interest payments won’t help many companies because they will probably find the difference competed away in a tighter margin (with some exceptions of course). Later on they may find themselves in trouble when interest rates rise again.

A lower interest rate should stimulate the economy and markets. That is good for the Banks, the Mortgage Lenders/Arrangers, the Fund Managers, the Share Registries, the Trains, Trucks and Couriers and by default all assets except cash. May even be good for the dear old Australia Post (and it may be floated).

Oh yes, and it is also good for the heavily indebted middle aged homeowner Frank and Jane, but makes little difference to the young credit card junkie named Aerikkah (pronounced Erica). Anyone looking to buy a house may also find it harder as prices rise.

I’m interested in furthering this discussion. I learn as much, maybe more when I stop to think, as when I stop to read.

What are other’s suggestions?

I am a little confused why Value.able graduates have not jumped on Cedar Woods (CWP) yet? Last time Roger looked at it before reporting season he gave it a rating of A3 (not present in these lists) and an intrinsic value that was over 100% of its current price, confirming something I already believed. I have not seen a stock yet on this forum with such a discrepancy between valuation and price. Since then it has reported per expectations and guidance has increased earnings expectations for the next two years (growing 27%), but the company has a habit of beating its own guidance.

The numbers are fairly reliable as some of their projects stretch to almost the end of the decade and the slight declines in residential property values do not seem to be affecting its greenfield developments as I learned when buying a block recently – they’re so popular that you have to be at the front of a que and pay them a $1000 deposit to just sit down with them to discuss the possibility of buying whatever is left within the first few hours of a land release. Earnings are rising because the blocks they are selling now are half the size they were initially intending to sell at double the price – people are so desperate now for land that back yards are becoming a luxury in new developments (whether 20km or 100km from the CBD). There are no hidden skeletons, debt is not significant and most importantly its an easy business to understand. Being Perth based, they are one of the few developers who have been granted access to cheap vacant land to develop in the Kimberly by the WA government, where rents are currently over $1000 per week, so I’m keenly watching this space. Management is very stable and they hold a high proportion of the shares so they do not do stupid stuff to shoot themselves in the foot like entering into dilutive capital raisings during the GFC or ill conceived takeovers and they recently dismissed a takeover approach significantly above the current price (i.e. they see more value in their own stock).

This is one of a hand full of stocks left on the exchange that have demonstrated the capability to post a fairly smooth 650% increase in earnings over the last decade, as it looks like the government has forced the wheels to fall off another great performer – Cash Converters. Its actually outperformed some of the forum favourite A1 and A2’s over the decade like ARP. Apologies if I appear over zealous, but I feel that when I’ve mentioned this stock once or twice before its failed to generate much meaningful conversation and some people were a bit dismissive because it was not an “A1”. Remember that Roger liked Zicom and Codan who were A4 and B2 in 2010 – investment grade and at a good discount to IV recently. Codan is now A1. I’d really appreciate some informed opinions on CWP if there are others out there who have taken a look at it post reporting. P.S. Very excited by the new system Roger is developing for Value.able grads – I’m a fairly young investor, so hope its within my budget.

Hi David,

Perhaps investors aren’t as bullish about property as the company is. But you are right, it has been an A3 since 2007, with the exception of 2009, when it fell to an A4 and profit more than halved.

Having said that they are forecasting a 2012 NPAT (finally a company talking about NPAT instead of EBITDA) of $34 million (another record) from their recently reported $28 million for 2011. Based on $34 million for 2012, intrinsic value is over $5.00. The company said to one paper “This result confirms the strength and diversity of our property portfolio, and importantly, the success of our business strategy to offer residential housing across a range of price points in Western Australia and Melbourne.”

“The company maintains modest gearing, with a net debt-to-equity ratio of 43 per cent as at 30 June 2011, comfortably within our stated 20-75 per cent target range.

“Our financial position remains strong, with a $110 million corporate facility in place until August 2013, drawn down to only $60.5 million at year end.”

The company also has $130 million in presales already in place for projects completing this financial year.

Hi Roger

Help required with IV Mine is near $10 Much further north than $5

I have CWP with Equity at $2.10 for YE11

Forecasts for next year EPS 54c Div 25C ROE 25.76

Using RR of 10% I get a IV of $9.89

(Table 11.1 100% payout = 2.58) (Table 11.2 =5.499)

Given these figures am i near the mark

Regards Macca

Hi Macca, it could simply be the RR is too generous. Also, do you think that the rate of earnings growth will be around 11 or 12 per cent annually? That’s what you are implying with your ROE and POR combination.

Thanks Roger

I’m expecting about 15% growth in EPS last year it was 58%

This years prediction for 2012 20%

They also claim $130m Presales which underpins their profit estimate of $34m for this year (last year $28M)

On their guidance in April their land bank (July1 10)is estimated at $6 per share. I guess this means after development, Just how accurate it is difficult to assess,

On the negative side Gearing has increased from 36% to 43%

Net operating cash flow Y10 $17.8m Y11 ($17.8M) It should be noted that $56m was spent on new land purchases

The company also stated that inquiries & sales have slowed, Clearance rates have fallen as well price growth is flat

I am happy to hold shares in CWP but are unlikely to increase my holding

Regards Macca

Hi David – thanks for the insight. Looked at CWP. Wary of property (used to own GPT & Stockland years ago), but CWP looks pretty solid. I’m from WA (now in SA), and my family still live in WA, and CWP is certainly developing in the right places (geographically). I note that Roger hasn’t found anything too negative about them either. Gearing is my main concern. A downturn in property prices, especially in Victoria, is another.

However, on balance, for me, I think at current prices, they’re worth the risk. I bought at $3.77 yesterday and more at $3.74 today. I’m not in a hurry and I don’t care if I don’t get the full 7000 that I’m after. If people are prepared to drop their sell price down to those levels from $4.00 and above, I’ll happily mop up those shares.

I truly appreciate the time people spend to share their ideas and insights on this blog, and although I wouldn’t touch many of the companies discussed, there are plenty of undervalued gems that do suit my own criteria. My own favourite right now (and a past favourite of RM’s) is ZGL. I can’t go past them for value.

I ended up with 12,000 CWP bought between $3.73 and $3.77 over two weeks. CWP closed friday at $3.73. May well drop to $3.50 or lower today. The highest substantial bid (pre-open) is 22,500 @ $3.50. Still looks like good value to me. Apart from the potential upside of the share price due to IV, there’s a current %6+ fully franked dividend yield, and it goes ex-div 10th October for their 12 cent final div. payable Oct 31. May get a little bit of a share price run up to their ex-div-date, but thinly traded stock, so it could go either way. Will almost certainly see a substantial drop (at least 12 cents) when they go ex-dividend, based on recent experiences with small caps in a bear market environment. So Watch the price on Monday October 10th (ex-div-day), if you’re looking to buy even cheaper.

Monday 10th October: CWP went ex-div, but didn’t trade all day. Highest bid at close was 3.45. Lowest sell price was $3.60 (for the last few hours of trading), but nobody was interested… They were 5,500 available for $3.60, so that would have been a 15 cent drop (or 4%) on the previous days close of $3.75, had anybody bought any of those shares (that were available at $3.60). I was tempted… but I’ve probably bought enough already…

Hi Peter,

Bought the book after having funds decimated in the 09-10 years looking for

some guidance. I did get a lot from the book and have re-adjusted our portfolio with the inclusion of many in your Eureka portfolio.

However I noticed ZGL has disappeared from your portfolio and from what I gleaned from their Reprt to shareholders they appear to be going OK. I have trolled through the Eureka report archives and have not found any information as why you have sold/removed them. Have you discovered something that has changed your opinion on them?

Regards

gary

Yes. It was discussed here and there’s a mention of why with a graphic to explain in tonight’s report.

A couple of surprises in the changes – CDA upgrade the biggest given its revenue, underlying profit and operating cash-flow all declined significantly on the prior year. FGE result was good, and has a strong balance sheet, but its rating declined.

One aspect of the results this year is that many results look solid at first glance, but when you get into the detail they are not as good as they appear – examples MTU, VOC & MCE.

ARP & FWD put in impressive performances. ARP needs a rating all on it’s own.

Mr. Market seemed to agree with you yesterday about MTU Michael. I’ve printed off their various reports and have a bit of reading to do. Certainly looks good on the surface. I already own some MTU, but I may buy more if they get much cheaper. Like I said, I’ve got a bit of reading to do.

Hey Guys, I have not updated my IV but slowing growth is a concern,

At least management gave guidance which is better than most in the current reporting season

Hi Ash,

I purchased MTU recently and am happy to hold on. Its priced as if it will grow slowly, and they may be conservative in their estimates due to current economic conditions. The economic conditions will be temporary. As you say, at least they put out guidance.

Interesting to note that company cash flow has been negative in four out of the past 6 years with negative balance sheet and free cash flow in FY11.

Their debt to equity ratio also increased in FY11 as did the value of their intangible assets. Whilst recognising that the company is in a growth phase, growth has been funded by increasing debt and, to a lesser extent, a capital raising in 2010.

That said, ROE circa 32% is still very respectable and not artificially inflated by worrying debt levels.

Whilst I quite like the business and the sector, I think I’ll just keep this one on my watchlist for the time being.

Hello Roger,

In your book you refer to two methods of calculating cash flow: 1) Company cash flow and 2) the balance sheet method (on page 152 of your first edition).

Do you have an opinion on which is more useful or more accurate? Or or are they just different methods and the investor can safely rely on the figures from each?

I’d appreciate your or anybody else’s reply.

Great forum by the way.

Edward

We use both to help us understand where the cash has gone and is going.

Hi Roger,

I have been analysing the Vocus result and trying to calculate cash flow using the balance sheet method. It is complicated by the fact that they hold the IRU as an intangible asset in the non-current assets, but also assign the accelerated payments for the IRU as borrowings in both the current and non-current liabilities.

For the purpose of calculating the balance sheet method of cash flow, would you discount these entries?

Either way, Vocus appears to have burnt some serious cash with recent acquisitions. The tangible assets and returns of the acquired businesses seem to be sound, however, so they could well prove Value.Able in the future.

The big question for me is ultimately competition. The NBN and Pacific Fibre could both be significant for VOC.

Would appreciate any comments you might have.

Hi Ray,

Yes it is more complex however, as I have noted before, current numbers are largely irrelevant. The company will raise more money to roll up/consolidate the industry and it will then be bought by someone just as PIPE was. I would not be surprised if the board has already identified to whom they will be sold.

Roger, can you give us your best guess? (re: who will buy them)

cheers.

G’day Roger,

I thought the Vocus results were ok, but Mr Market seems to be not to fussed, although I do notice that the selling is on quite small volumes.

Cheers.

There is actually 3, the third is free cash flow which is the one i am trying to come to terms with also.

The balance sheet method has helped me a great deal over the reporting period. Not even necessarily needing to calculate it but i can eye ball it and come to an idea as to whether the company had a good cash profit and is worth looking further into.

It helped flag to me that a 1.5 mill increase in cash at bank was due to a 3.5 mill capital raising for a small company that turned up in my filters because it had a decent result last year (both profits and cash profits and had little debt) however made a loss this year in both cash and accounting profits. It allowed me to see when judged by previous years that it is not the type of company that is stable enough for my portfolio despite it trading at a good margin of safety to what it was worth on the 2010 IV.

If FCF is needed, we can put up a blog post on that.

I would be very interested in a blog on analysing cash flow. From an accounting perspective (Ash!), and from a finance perspective (as the two disciplines don’t always see eye to eye).

My biggest interest would be to read comments on estimating future cash flows (not simply: the reinvestment rate x ROC) but assessing the risk of that estimated future cash flow, the quality/volatility. From the finance discipline can we employee a risk model such as Expected Short Fall to come up with a probability analysis? Or from the accounting side can we apply accounting ratios to perform a quality test? (Fundamental betas maybe). Ash what accounting methodology best serves forecasting and valuation?

Can we really leave it up to the asset pricing model to account for the risk of this uncertainty or can we improve our estimation techniques and along the way develop a better understanding of the business..

It would appear that within DCF models estimation of future cash flows is where we may find ourselves grasping at thin air, hot air or BigAir, pardon the punt.

Pursuing a more ‘accurate’ guess?

I would like to read a post on FCF and DCF. After my own research I have found trying to obtain any “scientific” accuracy in the calculations a waste of time – I would be interested in the views of Roger and other posters. Time is better spent working out the business – what is the product? Is this product going to be required in a few years time? What needs to happen for revenues to increase? Are operating margins steady or improving? What has the historic return on incremental capital been? Does the management own shares? Is the company approaching maturity? and so on. A quick calculation of the free cash flow using historical data to obtain a reasonable approximation of FCF, then work out a conservative growth rate appropriate to the business, after that using some DCF calculation cheats you have the value of the company – this takes all of 5 minutes. If you need to get more detailed in the math there is no margin of safety. I have fallen into this trap too many times and recommend splitting the valuation process into two – spend 5 minutes calcuating the economic value of the business and then spend hours/days/weeks calculating your confidence in the business to realise the future cash flows.

Cheers

Edward

Hi Edward, thank you for your feedback. I’ am currently doing my honours in finance and searching for a dissertation topic that fits within the DCF process, though I very much agree with you that the process is more about the journey than the destination (IV). I had the idea about estimation techniques of future CF from an NYU prof and thought that sounds interesting.. But I’ am starting to side with your experiences and question whether this is the most effective topic to improve my ability to analyse companies. The last few days I have been looking at studies that estimate company insolvency risk (more from an accounting perspective) I guess these kind of studies would be more akin to Rogers quality ratings or the Lincoln indicators accounting ratios. And more importantly would be a better way for me to understand the company and to discern how confident I’ am in its ability to realise future cash flows.

Edward thank you again, if you or any other bloger would like to suggest what you believe would make an interesting study, one that is within the DCF process I would be interested to hear.

yes, or a more systematic approach to that guess?

I do not recall seeing TGA mentioned – perhaps the material was written prior to TGA publishing its annual report.

I am not surprised to see SGH keep its A2 rating. SGH’s two acquisitions complicates the calculation of the firms intrinsic capacity to generate EPS, and the “normalised” EPS figures are better than the reported figures, and hence other metrics like year-on-year comparisons and ROE are better too.

In my view, SGH’s normalised diluted EPS is higher than the 18.3 cents that the report states, although to be fair, the report uses the word “diluted”, not “normalised “diluted”.

The report adds back the $1.4 million one-time acquisition costs of Keddies and Trilby Misso, whereas to normalise the level of profitability as at 30 June 2011, I extrapolate to 12 months Keddies six months’ contribution of $11 million revenue, and Trilby Misso’s eleven months’ contribution of $32 million, using an EBITpercentage of 26.2% to convert revenue to earnings, and then multiplying by .7 to get after-tax earnings. This, divided by 149.2 million shares gives an extra 3 cents EPS. The spreadsheet calculation to arrive at the extra 3 cents is:

((((11000000*2)+(32000000/11))*0.262)*0.7)/149200000.

Consequently, in my opinion the normalised diluted EPS is 18.3 cents plus 3 cents, or 21.3 cents. If you multiply this by a PER of your choosing you would get something like the following SPs:

10 x 21.3 cents = $2.130

11 x 21.3 cents = $2.343

12 x 21.3 cents = $2.556

I have accepted the report’s normalised growth of 12.3%, so if one wanted to use 2011/12 figures, increase the 21.3 cents by 12.3%, or 12% if you like whole numbers.

The normalised ROE is, following my logic 21.3 cents divided by the $1.31 equity per share (shareholders’ equity, $195.4 million divided by 149.2 million shares), which is a respectable ROE of 16.26%. What multiple of $1.31 should be used to arrive at an intrinsic value of SGH’s SP would vary from person to person. It could be something like the multipliers mooted below, or higher (SGH pays dividends about 30% of its EPS). I do not have my copy of VALUE.ABLE at hand, so I cannot develop the model a la Montgomery:

$1.31 x 1.6 = $2.10

$1.31 x 1.7 = $2.23

$1.31 x 1.8 = $2.36

$1.31 x 1.9 = $2.49

The Morningstar EPS for 2011 is 18.3 cents, but the next two years are mooted to be 23.7 cents and 26.7 cents, which looks like the Morningstar folk have factored in the contributions of the two acquisitions, and uplifted the numbers by a growth factor of about 12%. As an aside, the so-called Aspect Earnings Model is .37, which suggests the SP of SGH is undervalued by whoever calculated that metric.

Anyhow, all these calculations do not determine the SP, so let us see what the market thinks of SGH in coming months. I bought 18,000 at $1.68 in October 2010, so I am not unhappy with that, but like Oliver Twist, I want MORE.

SGH’s business should be immune from the things that impact many firms – things like currency rates, interest rates, CO2 taxes, and the price of sprats in Grong Grong. The depredations of the legal profession will always be with us, so if one cannot beat them, join them.

What IV do readers of this forum attach to SGH? I am in WA, and my copy of VALUE.ABLE is in SA, and hence I do not have access to the uplift factor that would apply to a share that pays 30% dividend.

Hi Michael, for everyone else thinking about extrapolation, before doubling six month contributions just ask first whether there is any seasonality.

Macca here

Hi Michael my heads spinning with your entry

Im’n looking at SGH using a required return of 10%

Current equity $1.31 – ROE 14% – 30% Payout – PE 11.30 MOS 7%

The ave of 5 analysts for next year is

EPS 23.6c up 5.3c DIv 7c same payout% as this year

A PE 11 would give us a price of $2.60- MOS 45%

Giving a capital profit of $0.526 c plus 10cDiv (inc Frk Crds)

The annualised return of 26% looks pretty good

My take

I have taken a more conservative view

The company has never increased the EPS by more than 2c

I’ll take 2.5cincrease + 6c div Also gearing has gone up from 4% to 22%

Keeping PE at 11 – payout at 30%

WE have Cap profit of$0.218 & div $0.86 MOs of 33%

Returning 12.5%

I might consider buying if 1st half looks good

I have many shares on a Mos of 50% returning over 25%

about 15 years ago I worked for a stockbroking firm. All was going well for management until one Friday afternoon when 1/4 of the dealing team walked out and with it half the company’s revenue and > 100% of its profits (they left me behind!)

Businesses like SGH and ONT remind me of this and Buffett’s experience when he owed a stake in Salomon Bros (and ended up running it for a time).

The great man’s take was “you don’t want to own a business who’s goodwill goes up and down the lift every day”

Much of the goodwill of slater and gordon, IMHO are its lawyers and 1300 smiles, it’s dentists

On reflection I was sorry that I did not mention some of the negatives that pertain to SGH, and one was the possibility of a bunch of lawyers walking off with a large chunk of the business. This type of risk is one of the reasons why I have not invested in some investment-related firms with stellar ROEs – a few people could walk off with the cream of the firms assets – knowledge residing between their ears, and relationships with the customers.

The same thing could happen to a hamburger mongery or lollywater maker, but when these businesses are large, like McDonalds or Coca Coala, they are able to build a moat to protect themselves – their size allows them to leverage advertising, and create brand awareness. SGH has some 1125 staff (unsure what % are lawyers) in over 50 locations, so it is unlikely that break-away lawyers will cause them the kind of grief that could happen to PTM if a few high-profile investment staff orchestrate a palace revolution.

SGH’s gearing went up to fund the acquisition of Keddies, so because it is not high, and the debt incurred for a solid reason, that does not bother me. SGH is a bit like QBE in that acquisitions are a normal part of its business, and SGH seems to handle them well. Smacking the ill-famed Keddies into line should not be a problem.

Because I have 18000 SGH, I look at it more from the hold-or-sell perspective, rather than a buy one. At $2.40 I might sell to retire some debt – that is if another one of my holdings does not emerge as a better selling candidate. Where does MOS fit in when deciding to exit a stock? To my way of thinking, the IV should be the value before applying a MOS, and after applying the MOS, the value obtained is the buy price. How would the MOS vary from stock to stock, from time to time (bear or bull market) and from situation to situation (buying, selling or holding)?

On the non-numeric side of things, the UK does not allow an SGH-style law firm to operate, and hence none exist. If UK regulation changes now in the offing come to land, then SGH will jump in with a firm business plan; and, hopefully, clean up. I hope SGH retains enough earnings to be able to do this without raising capital.

What I like about SGH is that it is not in a boom-or-bust style of business, and hence it could perhaps tolerate a less conservative IV formula, which raises the point of how one should handle risk in the Montgomery-style valuation formula. If one handles risk via the RR, then each stock should have a different RR (the risk-free RR, or RFRR, multiplied by a risk factor). If one is sitting on cash at 5%, then it is difficult to justify consistently using an RR of 15% to calculate IVs, irrespective of the stock’s risk profile. If one then multiplies by a MOS factor, and call the resulting number an IV, then one stretches the semantics of the words “intrinsic value”. The result of all this is that different terms like RR and IV may not have a consistent meaning in this forum, which reminds me of the tower of Babel.

Hi Michael,

my take on Buffet’s writings is that the RR is your figure of the minimum return which you need from any investment to make it better than the theoretical risk free return, the closest thing to which has been US T Bonds. It shouldn’t vary from company to company or between alternative investments.

The varying risk should be allowed for in your MOS, which should (obviously) be higher for riskier propositions. BUT if you follow a reasonable set of selection criteria (eg those in Value.Able or Buffetology or similar value investing texts), you should be reducing a lot of the risk anyway and, additionally, the range of risk in your subset of companies – ie they will all have some risk but a lot of those risks will be common to all or groups of them eg a depression, changes in regulation, China collapsing and so forth.

Hey Chris,

I like that approach. The difference between using a constant Required Return and varying the MOS versus a variable Required Return and constant MOS …is it perhaps minimal?

I like the idea of a fairly constant RR like 10% on an investor-by-investor basis. Investors sitting on buckets of cash earning 6% could use 10%. Even if one is sitting on cash earning 6%, one may be happy to use 10% in return for the luxury of having the liquidity to act when bargains come our way.

Accommodating the risk in the MOS is fine for investing, but what about selling a stock? The words “intrinsic value” occasion the dissonance in my mind. If I reckon that X is worth $Y, and I decide that I would buy at $,75Y, and sell at $1.2Y, then what is the IV? To me, $Y should be called my IV, $.75Y should be called my “buy price”, and $1.25 should be called my “selling price”.

My issue is a question of semantics, not understanding. What wording should we apply to the hypothetical $Y, $.75Y and $1.25Y values?

Perhaps ‘Target Price’?

Hi Roger et al

Been following the blog and comments with interest for a while now – I’ve been a fan of the valuation method since getting a copy of ‘intelligent investor’ when I was 19. Interested to know people’s perspective on portfolio mix at the moment. I liquidated what equities I had left several weeks ago and have been 100% cash (at 6.5%) as I’m simply not happy with the general market volatility and overall trend (viz:bear) at the moment. I’m normally very happy to continue to own a company long term, without reference to the share price, provided I’m happy with fundamentals – but I am erring on the side of capital preservation, for the immediate term (especially with cash RR at 6.5%). If I lose 20% of my capital the day after investing, that is still a concern for me at present – even with a decent MOS and good fundamentals, the reality is that it may take 3 years to reclaim it. A question of balancing risk preferences, I guess. Any other thoughts?

I have been following Roger for several years now and have been a regular viewer of your money your call. Rogers valuable method has certainly improved my understanding of careful stock selection and thanks to Roger, I have done quite well since the GFC. The recent share price fall of MCE and the response by the odd annoyed blogger reminds me of the importance of applying discipline and rules to ones investments and not getting carried away with a single investment philosophy or a particular broker or advisor. I have watched well known brokers and chartists on YMYC recommend ERA at $24 and leighton at $34 etc etc.

As a medico I would never expect a patient to do enough research to be able to become knowledgable enough to make a major decision about their health. Countless years of study and experience are required. The same thing applies with analyzing company reports etc. I rely on experts ( pleural!) to analyze company reports etc to help me make an informed decision.

Some general rules that I have learnt to obey

* if a share price is heading south there is nearly always a reason. Holding on in blind faith is dangerous and often leads to disappointment when announcements are made which validates the previous decline. The smart money always gets out in time

* don’t fall in love or get addicted to a share. I think this has clearly occurred with MCE.

* always have some sort of stop loss. Preserve capital and you will sleep better at night.

I know all the above is fairly obvious but reading many of the recent blogs makes me appreciate the importance of adhering to certain basic rules when it comes to share investing. Preserve capital !

Thanks Rob,

There is an entire chapter devoted to cash flow that everyone should embrace. The half yearly report revealed enough concerns for us to hold off building any substantial position. And Robs point about searching for a reason for declines – inverting the problem – is a very good one.

If you were to invert this problem you wouldn’t be searching for the reason for the decline you’d be searching for the reason why it isn’t going up!

Inverting and inversion would be right-way-upping!

all businesses are cyclical.. its whether you have the conviction to stomach the volatility and average down during trying times. That being said, im refering to businesses like those within consumer discretionary.. i’d never ever extend myself to miners purely because they are hinging on thematics.. and once they’re gone.. its goneskis for them.

I hear MCE will be tendering on floatation devices for this (!!!)

“PayPal founder Peter Thiel funding a plan to build new societies in international waters…”

Read more: http://www.news.com.au/technology/sci-tech/paypal-founder-peter-thiel-funding-a-plan-to-build-new-societies-in-international-waters/story-fn5fsgyc-1226122738294#ixzz1W7SHBMWL

http://www.news.com.au/technology/sci-tech/paypal-founder-peter-thiel-funding-a-plan-to-build-new-societies-in-international-waters/story-fn5fsgyc-1226122738294

CCV reminds me of MMS during the Henry tax review process

Anyone want to run a book on government policy decisions !

Hi Brad – I like your comment on government policy and its negative effect on various businesses. I just watched the 31st August Lateline Business story on EZCorp pulling out of the CCV deal, including the Peter Cumins interview. It sounds like CCV could come out of this particular government policy decision a LOT worse off than MMS has (from the tax review).

CCV have dropped by around 30% in the past week or so, and I’d be expecting a bit more of that today, once the market opens, since their MD, Peter Cumins, has now said that the Australian government (or at least Bill Shorten, the minister) are hell-bent on wiping out the short-term lending (or “micro-lending”) market in Australia, or words to that effect.

BTW, MMS has had a reasonable rally after their results release I notice, and their share price is up by around 26% over the past month (including the results rally).

CCV, however, is a whole different story…

I wrote a column about ccv a few weeks ago warning about this. Will put up a link for you.

Hi John C

Re MCE, if they announce an order do you think the stock will rise $2 or $4?

“you gotta know when to hold ’em, know when to fold ’em, know when to walk away, know when to run..”

Don Schlitz (and sung by the great Kenny Rogers)

Hi Brad – I haven’t bought any MCE, and I have no idea how the stock price will react to any order announcements. Guess that would have a lot to do with the value of the order. My concern with MCE wasn’t so much the falling stock price (that could present a good buying opportunity), but the fall in IV due to no (or few) new work orders. MCE seemed to be grabbing good market share off established companies in the same space as themselves (up until this last report that is). Now other companies appear to be taking market share back.

Valuations are only as good as the inputs you use in the calculations, and I’m a little surprised by how quickly MCE have dropped away in their order book. It’s a real turnaround for a company that only 6 months ago (seemingly) could do no wrong.

I like the song, “The Gambler”, and I actually do think that investing new money into MCE right now without confirmation that their order book and sales are back on track would be a BIG gamble. Not a bet I’d want to make. I honestly wouldn’t touch MCE now even if they announced a HUGE sale, or three. If their sales can dry up so quickly once, it could easily happen again, and next time – for how long? Where is the clear and compelling competitive advantage?

I saw Shane Jacobson (who plays the character “Kenny” in the mocumentary film of the same name) sing Kenny Rogers’ “The Gambler” during the closing credits of a “Spicks and Specks” repeat on foxtel two nights ago – great song!

noted, there’s 2000 stocks out there, MCE is just one of them

Quick note to Brad – John C here (space between the John and the C) – I just found a post about MCE by JohnC dated 25th August. Different guy (no space). Not sure which one of us you were referring to in your August 26th post (at 6:35 pm). Just thought I’d mention that there are two of us, with probably very different opinions on MCE…

most of my comments are probably directed to myself !

BTW, I don’t have a problem owning a growth stock like CCP or MCE and seeing the share price declining c.50%. The way I see it, that’s the game I’m in, but I can tell you a lot of poeple cannot handle it.

Despite what is taught at university, price volatility is not risk in the stock market, unless of course you’re gambling (sorry – trading) cfd’s or the like. Short term price movements are a random walk, or moreover thats the theory we subscribe to.

Hence the Kenny Rogers references….

What is interesting is a lot of people who I have been pitching for business to lately are coming up with objections like, “things are too uncertain, I’ll wait until the market settles down etc….”

Hence my Buffett comments from his forbes article August 1979 “You pay a very high price in the stockmarket for a cheery consensus”

In any case, this is a very interesting business. Also this is a great blog with some very though provoking comments and keeps my mind active. – I hope I can continue to contribute in some small way.

Hi brad, and the name of the song is …. “the gambler” !

The title doesn’t sit too well with value investing but it is still catchy.

Islands in the stream with Dolly has gotta be my favorite !

What that has to go with shares I’m not quite sure, but it’s a classic

I would be interested in what people think of Navitas (NVT). It’s prospective earnings has recently reduced quite a bit (which was fairly obvious was going to happen given the high dollar and reduction in foreign students). Which now means it is significantly overpriced on a basic valuation (earning 20.3c/share payout 100%+).

In particular on what basis does the forecast expect earnings increase without any earnings retained. Is that why the price is so high, people expect earnings to keep increasing for a long time without any need to invest. How would you actually calculate that?

‘Understanding the business’ seems to have become some kind of mantra here lately. It’s beginning to feel like a cover-all for short-term problems, as in ‘you made a paper loss on MCE? Oh well, you didn’t understand the business.’

Speaking simply as a retail small-time investor, whose retirement nevertheless depends on these investments, I’d like to know what ‘Understanding the business’ means. It seems to mean almost anything between ‘know in a sentence or two what the company does’ to ‘be knowledgeable about all those internal company-political matters which people normally don’t understand because they don’t have access to’ to ‘have a clear grasp of the balance sheet’ to know the company’s products, plans, hopes’, ‘know its place in the larger business context’, and so and and so forth.

Being someone who spends most of his time not looking after my investments, but on working in my profession, as I must, could someone be more specific about what one should understand and what is enough and how much is enough?

Understanding how cash flows through the business, understanding the competitive environment, are fantastic starting points.

Hi Rod,

I agree with what Roger says.

For me, “understanding the business” means understanding the competitive landscape of the company, the factors that will have positive and negative affects on earnings, what are its competitive advantages, what are the requirements for capital in this business, who are its target customers, what are the risks to this company, is it a growing, mature company etc etc

I also, will have a bit of a think of what the future may hold for it. Basically i just want to create as clear of a picture as to what this business is and what threats are there to it.

I will perform a SWOT anaylsis on companys as well as taking a look at the landscape from a Micheal Porters view (5 forces, generic strategies and value chain).

I am a bit of a visual thinker so i use an image of castle to come up with an overall picture and fit it into my various categories of investments which i judge on strength and stability. The castle that has the biggest moat (compeitive advantages), highest and strongest walls (brand strength) and biggest army (financial strength) is considered to me to be the highest quality investment.

My aim is to find companys that have large armys but because it is almost impossible to get inside the castle to battle them, they are not needed and the army can instead focus on ensuring its citezans are getting more prosporous.

Hey guys,

Just interested on peoples’ views on CCV in light on the credit cap reform. The legislation aims to protect consumer by placing caps on the amount of fees and charges on small loans (under $2000). CCV’s average loan amount is $325 so this is likely to effect them. As i understand it they would have to drop the charges from a maximum of 48% to a maximum of 24%, although the rate of interest on the average loan is 35%. They would also have to drop their establishment fees from $300 to 10% of the loan amount (a maximum of $200). Given the significant amount of revenue generated from financing activities, these changes seem to make it likely that CCV will have to downgrade their guidance numbers.

Conversely i wonder if these change may force some smaller lenders out, thus increasing CCV competitive advantage and market share as the biggest lender in this field.

Very interested in peoples thought, although the legislation is obviously not finalised

Roger,

I would appreciate your opinion re the recent announcement by CCV re government regulation. This was the piece of information that you had been looking for in being able to solidly value this company. Does this planned regulation knock CCV down the rung from a MCR A business. The market certainly is behaving as such.

Es

HI Roger

Does Dragon Mining still have a rating of A1?

cheers

darrin

Hi everyone,

Hopefulyl Roger or one of our learned accountants can help me understand a couple of things. Might also be a nice little distraction from MCE.

Question number one:

Is inventory on the balance sheet calculated on the price it cost them to purchase from the supplier or at the retail price that they will sell that bit of inventory to their customer?

Is it ok by accounting standrards for both or do they change as to whether they are finished goods or raw materials?

Just interested in this as i look at a lot of retail companys and if it is the retail price than this could be a problem as the longer it sits in inventory the more likely they will need to put that item on sale and there for receive less profit on that item.

Question number two:

I will use the example of Wotif. Wotif receive money from us when we book a hotel but don’t hand it over to that hotel until teh day ro so of the actual booking. Meanwghile it sits in WTF’s bank account generating interest.

I know that cash is not booked as revenue until the sale has been completed. In the meantime it will be listed on the cashflow statement and balance sheet as cash,payables and revenue received in advance etc.

My question is when will WTF book the money as revenue? Is it the day the booking was made and received the full amount from us or the day they send the money for that room to the hotel?

One goal i have set myself this reporting period is to exercise my financial analysis muscles and get better at deconstructing the financial reports to see the whole picture.

Also one more, in a previous year in regards to JBH Roger, you said something along the lines of the suppliers are funding the inventory. Is this worked out by comparing the total or average accounts payable to inventory?

Sorry for the beginners question, just been doing some research and have learned a far bit and want to see if i am on the right track.

There’s too much here to answer not to give it it’s own post so for now, read the first set of notes – the accounting policy notes often just before or after the main three financial statements. More often note 1.1,1.2 etc…

Hi Andrew,

Inventory is recorded at cost, regardless of whether it is finished goods or raw materials. If it can’t be sold above cost, it should be written down to the amount it can be sold for.

For WTF, on page 48 of their financial statements you will see that the revenue is recognized when the customer commences their hotel stay. The amount that is to be paid to the hotel is not recorded as revenue, but is included as a cash inflow.

Thanks Michael, you have confirmed my suspicions good to see I am on the right track.

Wheres silverlake?

The haven’t reported yet will

I think the issue here is the quality of companies you pick. Pick companies with commodity type businesses and unpredictable earnings or patchy earnings and this system of valuation will not work. You will just get people getting burnt even if you buy at significant MOS.

However, there may also be problems even if you buy stocks with better earnings predictability. Take ORL for example. There is a very strong chance when one looks at its trading even in generally up markets that the earnings is going to miss analyst expectations. So, at present you have an IV for this company, but the day after earnings there could be a substantial fall in this IV. Now, if you are a long term believer in the story, this may be a buying opportunity. However buy now and you take a gamble, it could go either way. However, I would suggest that ORL is a better business than MCE, hence I would be more confident to buy this stock on a share price fall.

I personally do not hold ORL or MCE and am confident I will be able to buy ORL at a substantially lower share price.

Hi Es,

Comes back to understanding the business…and then you can most certainly use the approach.

While I agree with Roger completely that we all need to take a deep breath and focus more on the quality of the business just as much as the MQR and IV, there is an argument that not all A1s are created equal. Some, in my humble opinion have more operating leverage than others and are therefore more susceptible to earnings shocks (or fall in orders). This is something that many of us have been reminded of recently. For example one would expect that ARP and COH to have lower operating leverage than MIN. Understanding this and the impact economic cycles on the company being reviewed can provide an additional overlay of safety for our share portfolios.

Hey Vishal,

This a great topic for a post. Would you like to write it?

Hi Roger,

I will have a go at it.

Regards,

Vishal

Great Vishal.

Hi Roger,

MIO’s result caught my eye today, it was a strong result with upbeat comments for FY12 outlook, currently doing more research on but I am getting IV of $1.95, RR12% ROE17.5% for FY12.

Any thoughts, how does it score with your MQR.

Regards

PK

Hi Paul.

I get an IV of $2.00 but find the data from Westpac confusing. How does a company increase its profit by $20 million, have a payout ratio of 30% and end up with less equity in the business as a result of this? I guess I am an accounting novice. Interesting to note the massive volume yesterday and then strong spike in price today.

Regards

John

hi roger,

i noticed you didnt have ORL in your lists ? is there a reason or are you just waiting for the report before adding it?

The list doesn’t include all of them yet.

Does anybody know when ORL are reporting? I was thinking maybe mid-September, but they’re “announcement” list seems pretty scarse. They don’t seem to have a lot to say to the market between their 6-monthly reports – but then you’ve probably got Sally on speed-dial haven’t you Roger? What’s this I hear about them losing the rights to market Polo Ralph Lauren?

I wonder if they’d be better off without Polo?

Hi John C.

ORL use a financial year ending on 31 July, rather than the usual 30 June, which means they don’t report their results until the end of September.

David S.

Thanks David. Thanks too to Roger for your comment about Polo. Intriguing… I do own some ORL and am more than happy to hold the stock while Sally Macdonald is at the helm. Looking forward to finding out more about their future direction with or without Polo.

A good reason is that ORL reports in a month so there’s nothing to update them with.

ORL haven’t reported yet. As Roger said in his post this is only for some of the companys which have reported.

Another good report from Ideas International (half yearly report). I own shares and I will continue to hold while this great little company continues to produce pleasing results.

I have been keeping an eye on them too. They have announced a dividend which was interesting, i only have them doing this before in 2002. They have been generating a fair bit of cash by my calcualtions in the last couple of years so probably not at all unexpected.

I saw that they announced that they have had around 100 companys trialling a new product, it would be interesting to know what type of hit rate they expect in converting these trials to subscriptions.

I am not surprised that GUD fell to B2 following their acquisition of Dexion. Sooo many CEOs seem to assume that they can always do better out of a takeover, little realising the destruction of shareholder value because: business integration is more complex (Fosters), Cannibalising GR8 brands drives away customers (Westpac closing down BoM after paying hugely for its intangibles), etc.. Wonder what happened to Westpac (WBC) ? A2 maybe in a similar way to CBA.

Thanks but MCE is one of the most talked about companies on your blog and that does not appear on any of the three tables above… ??

Hey Manny,

Because I had already written about it and mentioned it is an A2.

Hi All,

Although on a personal level, I have certainly purchased higher quality companies since buying Rogers book, I must say of late, I have started to become concerned that although value investing calls for buying high quality companies and holding them for a long time i.e. Buffett’s approach, Roger’s quality scores change very quickly (and I think a change of quality within 1-2 years is fast) e.g. MMS, MCE, AGO, JBH, TRS, NVT, SND, PRY, SND, LEI.

I do not currently own any of these stocks and I don’t mean to suggest that Roger owns all of any of these but the value.able method has highlighted all of the above as high quality companies (only 12-18 months ago) and they have all changed now.

I’m not sure that Buffett has changed his mind about his purchases as rapidly (at least not in the public domain).

Value.able would have looked very good in the 2000s during the bull market (law of averages would say that most methods look good in a bull market as long as a simple diversification policy is followed). The real test of value.able will be in a bear market. Value.able seems very good at identifying a quality company in the present but doesn’t seem any better than tossing a coin in identifying a quality company that is likely to remain high quality for long periods of time……and isn’t THAT what differentiates Buffett from the rest?

Somewhat jaded..

Hi Adnan,

Thats why we have quality ratings going back more than ten years for all companies and as far back as they have been listed when less than ten. What it tells us is who is stable as well. Very very value.able!

Like Roger says, its about stability and you can work this out by doing your own research and looking at past performance.

It appears that some people are waiting for Rogers MQR for one period to base their investing decisions on and not looking at it themselves to see if the high MQR is a once off or a sign of a quality company. Others seem to be having a case of schadenfreude even if it is not exaclty a case of MQR’s failing, just changing when the circumstances change, if they have changed at all.

My forecasts and research had shown up that a lot of the companys (high quality companys) were going to have an average year this year so i am not too concerened. The writing was on the wall for most. I have weeded out those that appeared ot be quality but were very volatile in the quality stakes so i think i have a good core group of 26 companys that i can look at in the future as my A1-2’s.

The nature of the Australian landscape is that our companys will likely be more volatile than our american giants (Coca Cola etc) as the population is far smaller and centralised to specific areas which brings saturation around earlier.

Adrian, you as well as many others on this forum, seem to fail to understand how valu.able differs from buffetology. Sure, whilst the initial identification of good businesses follows a similar approach to Buffet (consistant sales growth, sound management, good ROE, profit margins greater than 10-15%, pricing power etc) estimating a stock price and when to make the decision to buy the company does not. Roger and Buffet are very different. So please, do your homework. Read buffetology, and understand why you can’t necessarily compare all of RM’s approachs with Buffet. Particularly on small caps within the commodity based and tiny economy that Australia really is….may I suggest you get as many books about buffetology as you can and read them before you think you can apply his thinking to everything valu.able does and every stock on ourmarket….cheers and don’t lose faith!

Would also be interested in hearing what Buffet thought of Buffetology when he was asked!?!?

Hi Andrew. So, it’s all about stability, but expect volatility, and avoid it? Surely you can’t see everything coming?

You can’t see everything coming, there are some quality companys which are more volatile than others in terms of results, i choose to ignore a lot of the companys that are. The rear view mirror can be good in predicting as such.

Also when i say volatile i do not mean share prices. I actually want a stable high quality company to have volatility as i wouldn’t be able to buy otherwise.

Hi Andrew. Noted. There’s results volatility (the bad sort), and there’s share price volatility (the good sort). I just think that a little results volatility (not too often, mind) can lead to some share price volatility, which is what we want in this game. Your point, though, is that you choose to avoid those that have a history of results volatility. Fair enough.

A drop in MQR for a business may be a sign that it is volatile and unreliable, or that it is no longer a good business, or it may just be a temporary problem that will soon be overcome. The example that comes most easily to mind is WBC and CBA. They were both A1/2 before the GFC, fell to A4/5 when they reported their GFC-affected results, then regained their A1/2 ratings the following year. Regardless of whether you think those two business are good investments, they are a good example of temporary difficulties, and it was fairly obvious that the difficulties were over well before they reported the improved results that returned them to their former A1/2 ratings.

The best time to buy a good business is often when it hits temporary difficulties and the market overreacts. Of course, a business that is consistently and reliably good but also cheap is an even better buy, but those don’t come around too often. More opportunities will open up if you are prepared to consider businesses in temporary difficulties. If you rule out any company with a low rating in the current year regardless of its past and its likely future, you may either miss out altogether, because the only time it is cheap is at the height of the difficulties, or find yourself paying a higher price because you wait for proof that the difficulties are over (in the form of a return to an A1/2 rating) before you buy.

I would suggest that you take a long-term view and ask whether the MQR downgrade is likely to be temporary or permanent, and the same for an upgrade. Don’t buy on one good result if it is unlikely to be repeated. and start looking for buying opportunities if you are confident that poor results are temporary.

Excellent advice David. I tend to think that GUD might prove to be an example of what you are saying (my opinion only).

They’ve dropped from an A1 to a B2, after a large acquisition (Dexion) which incurred $12.3 million in costs (acquisition, integration and restructuring costs), and that has obviously affected their NPAT negatively (down 14%). Their underlying EPS is also down slightly. However, their underlying NPAT is up 6% to a record of $49 million. More importantly, their history suggests that their track record of extracting value out of their various acquisitions over the years is excellent. They still might buy Breville, if they get the chance (even though their Sunbeam sales were down a little this year, along with many other consumer discretionary brands). After all, Metcash got the Franklins deal up, despite the ACCC. GUD’s Water Products division also seriously underperformed this past year, but that’s only one division in one year (of very wet weather). Their debt has increased to 40% debt to equity ratio, principally due to the Dexion acquisition, but the benefits of the FY11 restructuring projects are expected to become evident in FY12 and FY13.

So it gets back to what you are saying David. I am I confident that this poor result is temporary? Well, it’s not a terrible result, but it does say that the business has been less profitable in FY11 than in FY10, and it has more debt. GUD is already my 2nd largest holding (after FWD), but if the price drops low enough, I’d buy more, because I am confident that better years are ahead.

I agree that temporary difficulties or one year of poor results (and even general share price volatility) can present buying opportunities that otherwise might not occur.

Roger, check out DGX.

Hi,

Just ran the numbers from Westpac through my spreadsheet and got an IV of $0.57 on a ROR of 13.3%. I think there are better options out there.

Regards

John

Hi Bloggers.

Hi Roger,

Thank you for your latest A1 list.

Reading your article I see your team and you are working hard to stay on top of data collection and processing. On one hand I feel sorry for you guys to go through all that enormous amount of data every time there is reporting season. But on the other I guess you are not along, every one has to do more or less same.

And that brings me to the article I’ve seen somewhere in investment papers while ago. I think it was published before the GFC (?), I can’t remember to be honest. In that article they were talking about introduction of standard data input during reporting season in USA, at company level rather then at managed fund (investment company) level. In parallel to printed annual report there will be data entry report released by the company in form of spreadsheet, I think. And each data field will be indexed, meaning tagged. As far as I understand it would be similar to spread sheet (?) and each data entry would be allocated to a particular data field. So say if it is a “Profit” or “Debt” it will go into those designated fields of Profit or Debt, and so on.

But then GFC came along and all those wonderful ideas of uniform accounting, reporting and data entry were forgotten.

Would any of you know or heard anything about it? If it is still the case. And if yes would you know where to look it up (perhaps internet link) please?

Thank you.

Regards

Hi Sergey,

I have already proposed it to several participants. There appears to be a very real reluctance to adopt it but perhaps I am not speaking to the right folks.

Hey Roger (and team). Before I read your book I had bought some

shares in Iluka Resources (ILU). Since reading Value.Able I have done some calcs and come up with an intrinsic value for Iluka (of which I was quite alarmed!). Was wondering whether you could do just a 5 minute ‘back of the envelope’ review and let me know what you calculate Iluka’s current intrinsic value to be, so that I know whether I am on the right track and following the procedure correctly. I used a required return of 12%.

Thanks. Jordan

Hi Jordan,

Can do. WIll try to include it in a post reporting season list.

Hi Jordan. I’m looking forward to that! – I bought ILU yesterday on their results. I like their debt reduction (actual, rather than just planned) while increasing dividends – and their profit increases are massive. Their ROE has become much more respectable too. It was pretty pitiful last year I thought. What a change from 12 months ago! Their current IV must have risen considerably with Thursday’s report Jordan! I’m looking a bit further ahead I guess. I think their current CEO is a very smart guy who chose to slow down production during the GFC and make some massive investments to allow increased production now as prices are rising. Controlling most of the supply side of the equation is a big competitive advantage.

He’s not afraid of shaking up the market to reposition the company and create better future returns. If it wasn’t for their Area C Iron Ore royalty income stream, I doubt that ILU’s bankers would have gone for the massive capex during the GFC while they were reducing production at the same time.

In a recent interview with Alan Kohler, he made it clear that in his mind that asset (the BHP Area C royalty rights) isn’t about to be spun off (or otherwise sold) either. He likes having it there for the lean times. Although still resource based, it’s a form of diversification of income, and requires no maintenance or ongoing costs whatsoever. The gift that keeps on giving (as long as the iron ore lasts).

Being such a HUGE global mineral sands player now, and having the demand exceed supply enough to keep driving up prices by so much, I think that ILU’s future is very bright indeed. Would like to hear if anyone else has thoughts on Iluka. Looking forward to Roger’s valuation.

Hey graduates,

I am trying to value ACR for 2012.

I understand that this years big profit of $57m was a once off due to the royalty payment from Eli Lilly.

I am using NPAT for 2012 of $33m based on analyst forecasts (EPS = $0.201).

The main issue is the payout ratio. The analyst forecast in my trading account has basically a 100% POR for 2012.

Yet I read in the full year report that the next dividend announcement will not be until Aug 2012 which means there will be no dividends in this financial year.

Because of this I have just put in a 50% POR to get a 2012 IV of $4.33 (RR = 12%, ROE = 72%, Beginning Equity = $45.7m).