We’re all in this together

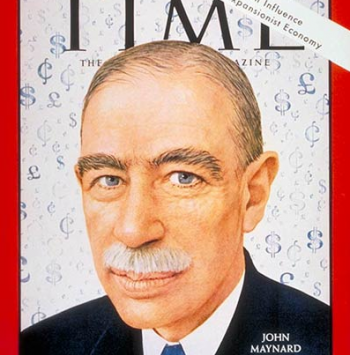

For the historically minded reader you will note that this title was a famous quote attributed to John Maynard Keynes, the grandfather of Keynesian economics. The quote is said to have been made by Keynes as he commented on the harsh post-war conditions placed on Germany at Versailles in 1919. In short, one condition required that Germany repay the Allies for the cost of the war.

Keynes thought that the treaty at Versailles was counterproductive in that Germany couldn’t possibly pay these reparations given the sheer scale of the payments and Germany’s shambled post-war economy.

He was right; Germany was reduced to printing money to pay its debts and normal government obligations. The economy soon spiraled into hyperinflation and only began to recover later in the 30’s.

Luckily the Allies learned from their mistake and post Second World War Germany had an easier time of recovery. I qualify “easier” in that the recovery was hard; price controls severely restricted economic growth and general business activity for a period.

However, on a relative basis they were better off not being straddled with unbearable debt. To boot, the Allies provided loans of which large parts ended up being forgiven. Once all was said and done, the country grew once again to become a European superpower and spur growth in the region.

Today we have a similar situation where Germany and other European nations have granted loans to Greece to bail them out of years of fiscal irresponsibility. The burden of so much debt has forced government spending to be cut aggressively. The Greek government can’t simply print Euro’s to fill the gap given it is part of the European Union, this is something only the European Central Bank can do. As such, their only avenues of capital are the emergency loans, reduced spending or asset sales (the latter of which leads to lower revenues in future periods).

The impact appears to have led to an economic contraction with disastrous results. The country now has an unemployment rate of 26 per cent – worse than peak unemployment rates in the Great Depression of the 20’s/30’s. Youth unemployment is even worse at approximately 50 per cent.

It’s of little wonder that the Greeks have elected the Tsipras government who claims they’ll reject the debt repayment commitments as agreed in prior periods in an effort to revitalize the economy.

A slow death of the Greek economy does appear to be to anyone’s benefit, however a revival surely is. A stronger economy that produces more tax dollars must surely be able to better handle debt repayments than an economy spiralling into long-term depreciation.

Would going easy on Greece raise issues of moral hazard? Of course, one wonders if the time for fiscal conservatism is before a crisis rather than during.

Going hard on Greece could easily lead to a crisis worse than we already have, in contrast, the clemency side of the field appears much greener.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

The funny thing is Roger, that 100 million Deutschmark note is worth more than the bonds that they defaulted on in 1931!

Now that IS funny!

Scott I would just like to point out that in 1917 a revolutionary government came to power in Germany and historically these governments have been unable to borrow and printing is the only option such as the United States where the continental currency hyperinflated after the revolutionary war. After the hyperinflation Germany instilled confidence in thier new currency by backing it with real estate. Germany struggled on untill they defaulted on their debt during the 1931 soveriegn debt crises. The debt crises and subsequent defaults occurred when France and England insisted that a monetary union between Germany and Austria not go ahead and insisted that they stick to the terms of the treaty of Versailles. France called in all their deposits in the Creditanstaltz in Austria and set off the contagion. Now we have Greece playing the role of Austria and Germany playing the role of France. The script is exactly the same just with different actors. It appears that governments are totally incapable of learning from their mistakes. Greece will have no option in the end but to leave the Euro and return to the Drachma where they can devalue their currency and return controll to themselves. This will help the economy and it will then start the crack in the Euro as other countries see the benefit of leaving the Euro. Unfortunately any talk of the Greece economy recovering and servicing their debt is just fantasy. So we need to prepare ourselves for a repeat of 1931 because these politicians are making the exact same mistakes.

So Aaron, there’s no point in hanging on to my 100 million Deutschmark note (printed on one side only to save on ink and help the money be printed faster during the subsequent hyper inflation)!

I made this same comparison when discussing the Greek/European situation with my partner on the weekend. She seemed surprised when I said that I thought the best course of action (both morally and financially) would be if Greece’s lenders were to forgive some or all of Greece’s obligations – as had happened to Germany in the past. Unfortunately this looks increasingly unlikely and a fear default and ‘Grexit’ is looking less and less avoidable.

I think forgiveness is easier when the borrower is not recalcitrant.

Very true, though you could accuse both sides of playing hardball in this situation. I’m curious now to look further into the forgiveness of German debt to see how the situations compare.

Thanks Patrick

It’s important to realize that Germany only made it’s final war debt payment on 30 Sept 2010, some 70m Euros. Some 90 yrs after the Versailles Treaty! Because of mounting interest and some post WWII years of non payment some of the debt was postponed in 1953 to a time when the country would be reunified. At the time this was considered to be a very long way off. However, all debts no matter how unfair were paid. Greece take note.

I don’t imagine such a long term approach from modern Greece.

Very interesting. I wasn’t aware of this. This is the danger of relying on 2nd hand information rather than doing research yourself (a lesson all which is very valuable in investing).