The 3 red lines that could bring iron ore prices back to earth

Chinese property construction accounts for close to 30 per cent of world seaborn iron ore demand, and is probably the most important demand driver impacting the iron ore price. But with Chinese regulators trying to crimp the sector, population growth turning negative, and urbanization peaking, I think today’s lofty iron ore price will prove to be short-lived.

One of the factors that we follow to try to assess the risk/reward equation of investing in iron ore producers is the health of the Chinese property development sector. You might ask, why is Chinese property development important for the Iron Ore price?

To explain that, let’s go through some charts with data from Bloomberg.

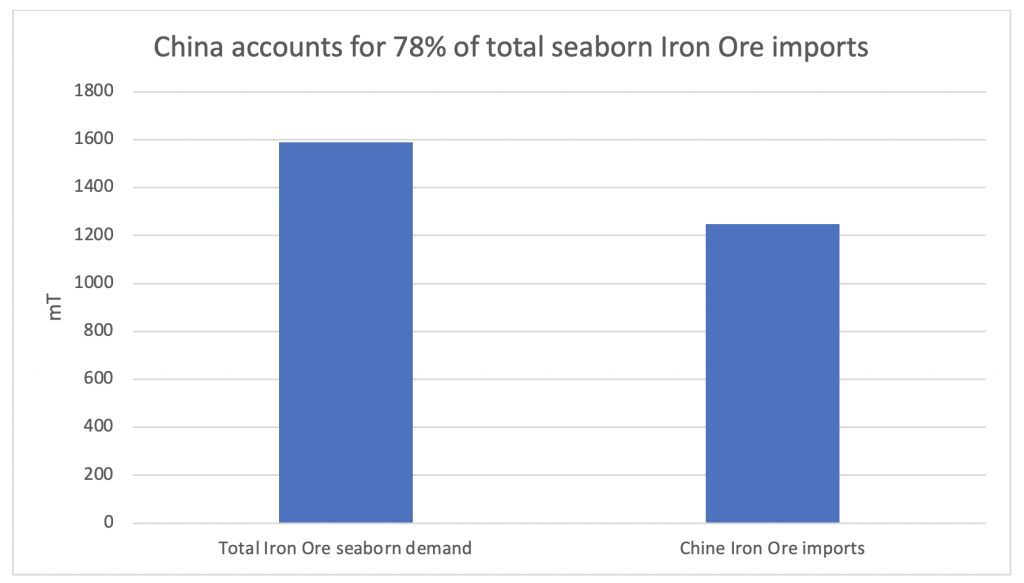

Firstly, as people probably know, China is the major driver of iron ore demand, accounting for 78 per cent of worldwide seaborn iron ore imports:

Source: Bloomberg

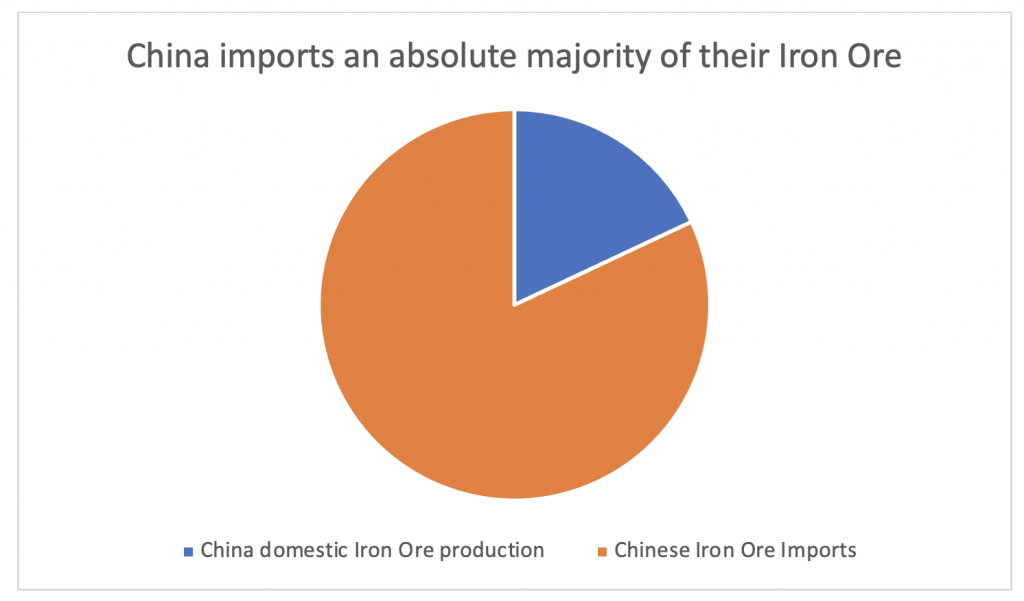

Secondly, Chinese domestic iron ore production (18 per cent) is small compared to imports (82 per cent) so demand changes in China will mostly translate into changes in import volumes:

Source: Bloomberg

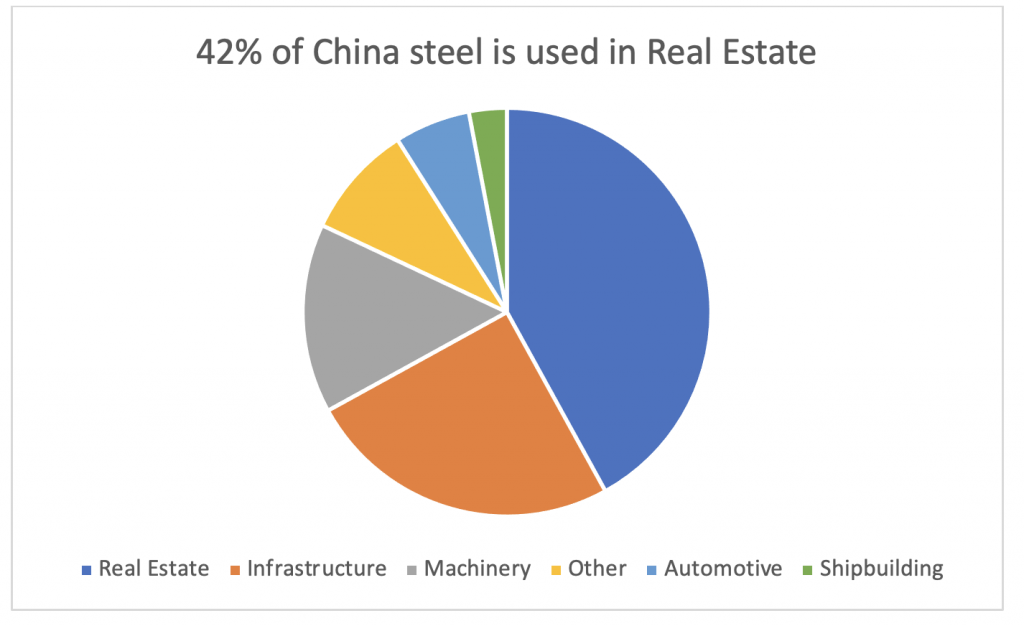

Thirdly, Real Estate construction is by far the largest demand driver for Chinese steel demand accounting for 42 per cent of total Chinese steel demand:

Source: Bloomberg

About 26 per cent (= 78 per cent * 82 per cent * 42 per cent) of the world’s seaborn iron ore demand is therefore directly dependent on Chinese property construction activity (or even more as domestic iron ore is probably more likely to be stable rather than ramp up and down for domestic political reasons) and it is hence clear that Chinese property construction is probably the most important demand driver impacting the iron ore supply/demand balance.

So, let’s now see what we can say about the health of the Chinese property developers!

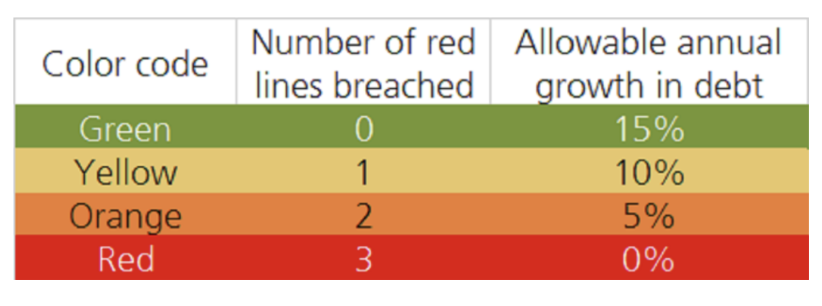

We should first note that since mid-2020, Chinese regulators have been trying to lower leverage in the property development sector by regulating how quickly developers can grow their total debt through the introduction of “Three Red Lines” which are:

- Liability-to-asset ratio (excluding advance receipts) of less than 70 per cent

- Net gearing ratio of less than 100 per cent

- Cash-to-short-term debt ratio of more than 1x

If companies do not fulfill one or more of these criteria, they have limits imposed on them in how quickly they can add debt as per this table:

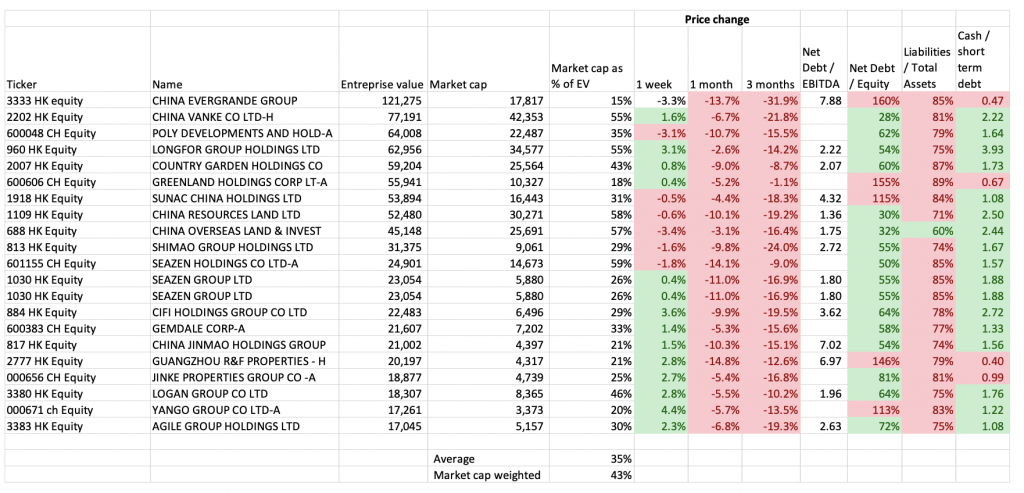

If we now look at this list that shows the major property developers in China, we can point out some interesting things:

- Debt accounts for a large portion of the enterprise value of the sector. On a straight average the market cap is 35 per cent of enterprise value and 43 per cent if we market cap weight the average.

- Share prices have in general been very weak over the last 3 months and are down on average 16 per cent vs. a Hong Kong index that is flat and a Shanghai index that is up around 5 per cent.

- Some of the companies have very substantial gearing ratios with net debt to equity ratios well above 100 per cent and net debt to EBITDA over 7x.

- Credit ratings are generally sub investment grade with some exceptions.

- Only one company in the top 20 developers meets all “Three red lines” in the regulations and most miss on at least 2 points with some missing all 3 criteria (last 3 columns in table above)

- This means that the sector as a whole is severely limited in its ability to take on more debt and the Chinese regulators have also been expanding the number of developers that are covered by this policy and now virtually all developers are covered.

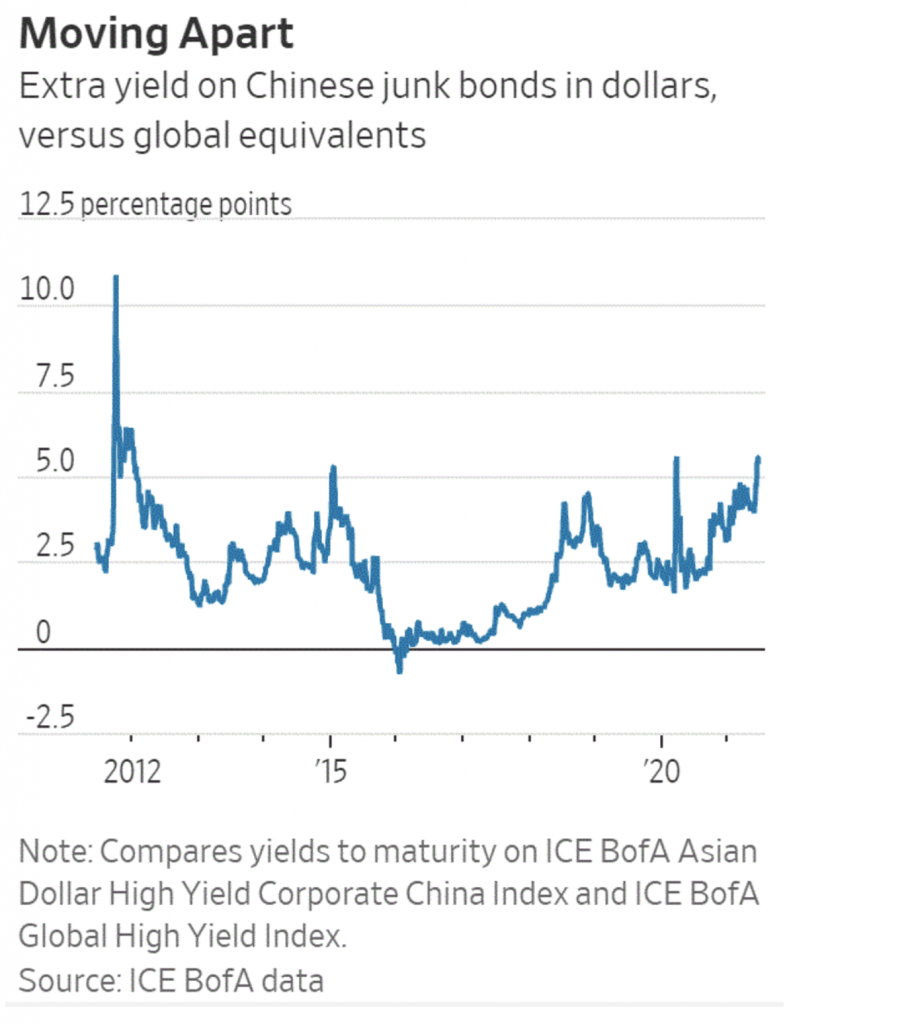

We can also see that the cost of accessing new debt looks challenging with the Chinese Junk bond index trading at a significant discount to international markets (highest delta in yield since 2015). Junk bonds in China are generally issued by property developers so this shows how expensive new debt is for them.

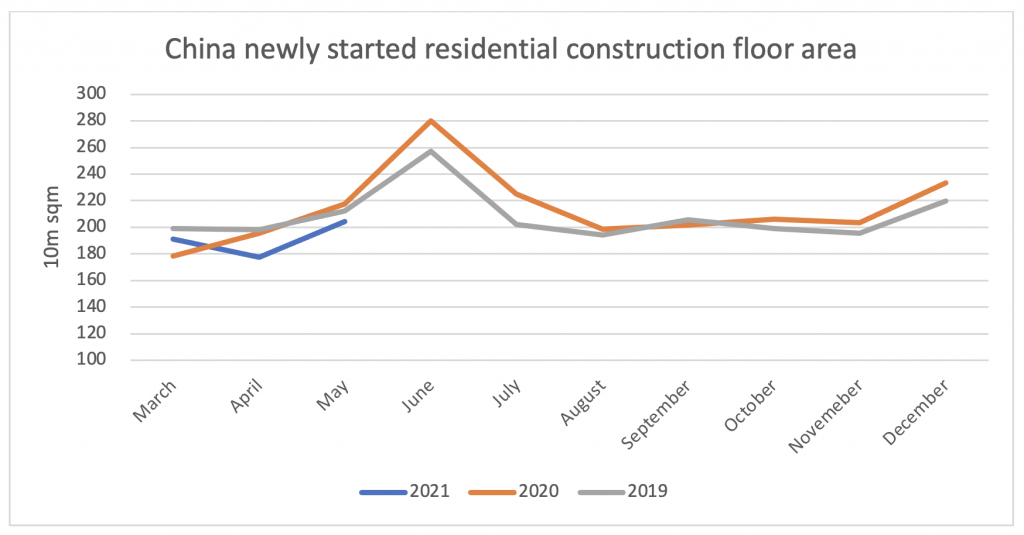

As a result, it is clear that Chinese property developers are slowing down their construction activities which we can see from this chart that shows Bloomberg data on new residential construction starts where we can see that we are currently running below both 2019 and 2020 levels by about 5 per cent:

Source: Bloomberg

This raises a couple of questions:

- Given that it is increased government regulations that has triggered a downturn in the growth rates, what would happen if the government decided to again unshackle the property developers? Given the increase in funding costs, it is clear that the market has perceived the risk with lending to property developers increase significantly and with the Chinese government seeming to have stepped back from the concept of “too big to fail” in the property sector, I very much struggle to see investors being willing to step up again and lower the cost of funding. (Goldman Sachs has a good video on it here).

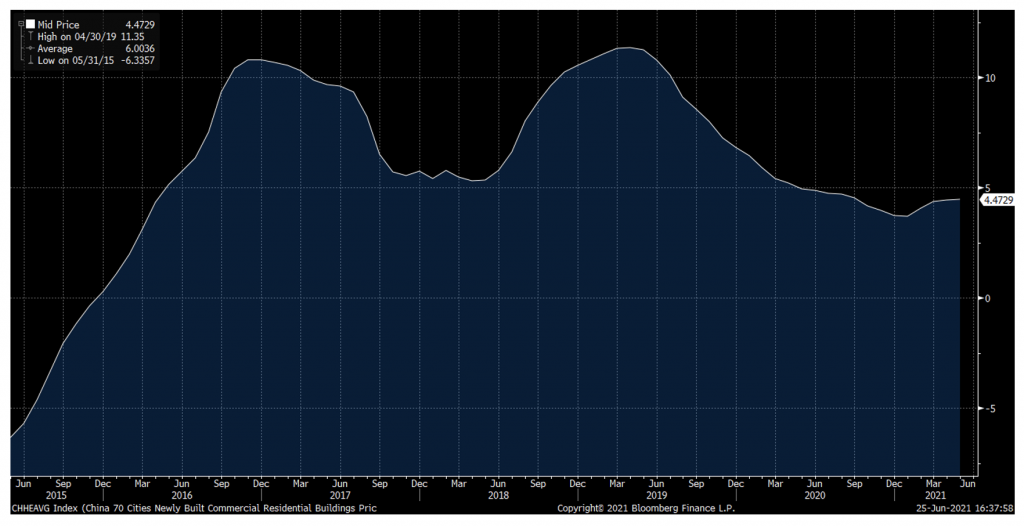

- It also raises the question: could there be a sudden crash for the sector given that so big a portion of the total enterprise value is made up by debt similar to what we saw in 2007 in connection with the GFC or in March 2020 when COVID-19 first emerged? At the end of the day, property developers need to be able to sell their developments for good prices to be able to repay their debt and if we were to see a fall in real estate prices, this would be very worrying and could definitely trigger a similar crisis for the sector. So far, we have only seen a significant slowdown in price growth but we are still seeing about 5 per cent YoY increases which is down from over 10 per cent per year a couple of years ago (chart from Bloomberg shows price growth YoY in percentage for newly built developments).

Source: Bloomberg

My high level outlook for the property development sector in China can therefore be summarized as follows:

- China has recently turned negative in population growth rate and this was well publicized and with the long standing one child policy only just recently changed, it will take a long time for this to turn around meaning that there will not be an underlying population growth supporting the demand for property.

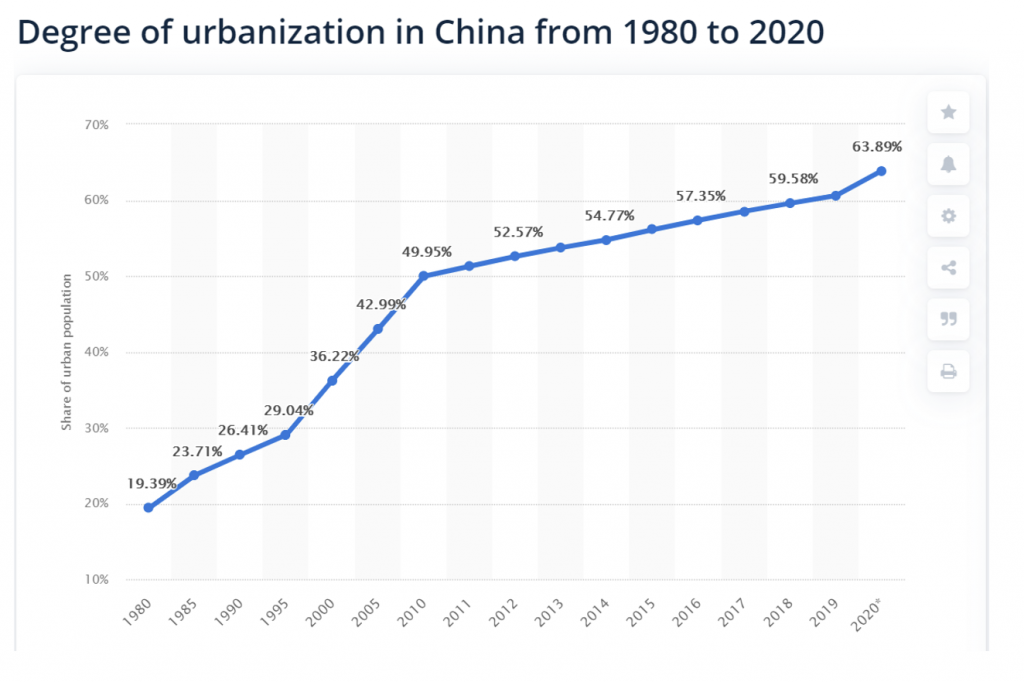

- The Chinese urbanization rate has reached well over 60 per cent. It can of course go higher still but at least the majority of the move to the cities from the countryside is over. With many industries with large parts of their supply chain in China likely to consider relocating at least part of manufacturing outside given the increasing geopolitical tensions between China and the western world, one of the main drivers of urbanization is likely to be less in the future than in the past.

- The Chinese government wants to encourage investments into higher tech sectors and less into property speculation and it seems like they have taken their hands off the sector at least to some extent.

- The cost of debt has increased a lot for the developers, and they are limited in the amount of additional debt they can add despite the global availability of cheap debt funding and it seems like the cost of equity has also increased significantly for the sector recently.

- There is a massive amount of inventory in the Chinese property sector already with figures of 65 million empty apartments being quoted and the stories of “ghost cities” being plentiful.

With a sector that accounts for close to 30 per cent of the total seaborn iron ore demand looking this shaky and with iron ore prices at all time highs, we are very hesitant to consider investing into the sector.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

A 10-15% fall in property prices would probably make every developer on that list insolvent.

And the scary thing is that Chinese housing prices bear no relationship to fundamental value.

Chinese apartments are not freehold – but leased for 70 years. Furthermore, the construction quality is so bad that the economic life of many buildings will be 20-40 years. You don’t need a DCF model to see it’s uneconomic to rent an apartment at 2.5% in a building will struggle to stand 40 years.

There is strong evidence suggesting that China’s population has already begun shrinking (despite what their Census says). It wouldn’t surprise me if we see Japanese style corrections in many chinese cities (up to 90% declines). I don’t see how the Chinese government could stop such a correction – no matter what they try debt, demographics and dodgy construction will eventually catch up with them.

Hi Ricky,

You are probably right in that a 10-15% fall would make at least the clear majority insolvent and yes, the majority of the buildings are not up to what most people would consider acceptable standard!