Telcos, revamped

In the last decade or so, Australian mobile phone services have risen from 8 million to 30.2 million. Internet penetration has risen from 30 per cent to 89 per cent of households. And, despite unique anti-syphoning legislation, which ensures free-to-air TV gets to broadcast the big sporting events; Pay TV has increased to 30 per cent household penetration (despite being stuck there since 2008), from virtually nothing in 1995.

Following this, consider that by 2018 (if we’re lucky) Fibre to the Household (FttH) will make our present broadband look like the dial-up systems of yester-year, and will create all sorts of opportunities and products to be used and sold. The future growth looks as bright for the Telco sector as it is has previously for digital media, applications, video content hosting, storage… the list goes on.

In fast-changing industries, working out who will benefit and who will dominate year-to-year, or even in 10 years’ time is extremely difficult. So too is working out where to best place your hard-earned investment dollars, and get the best bang for your buck.

Telstra Corporation Limited (ASX: TLS) is of course Australia’s largest telecommunication business, and one of the most recognised businesses on the ASX. Not only for its long-term consistent track record of stable profitability, but also because it’s rated as one of the best income producing businesses. A question worth asking at this juncture is whether or not Telstra will be able to take advantage of continued sector growth, and retain is darling market status in the years ahead.

This is of course an opinion that differs depending on whom you ask, but as we can show below, Telstra (in its current form) has not been able to convert its strong market share, and leverage this growth into improving economic and above-average share price performance recently. On this basis, we question if it will in the future.

Whilst we don’t argue that Telstra is still the sector’s stalwart and is extremely popular as a blue chip company, we do argue that historically, it’s been preferred to avoid investment in the business and instead, own a number of the second tier smaller telco offerings.

A simple comparison is all that’s needed to see that Telstra just doesn’t stack up against the other incredibly attractive opportunities on offer in the sector.

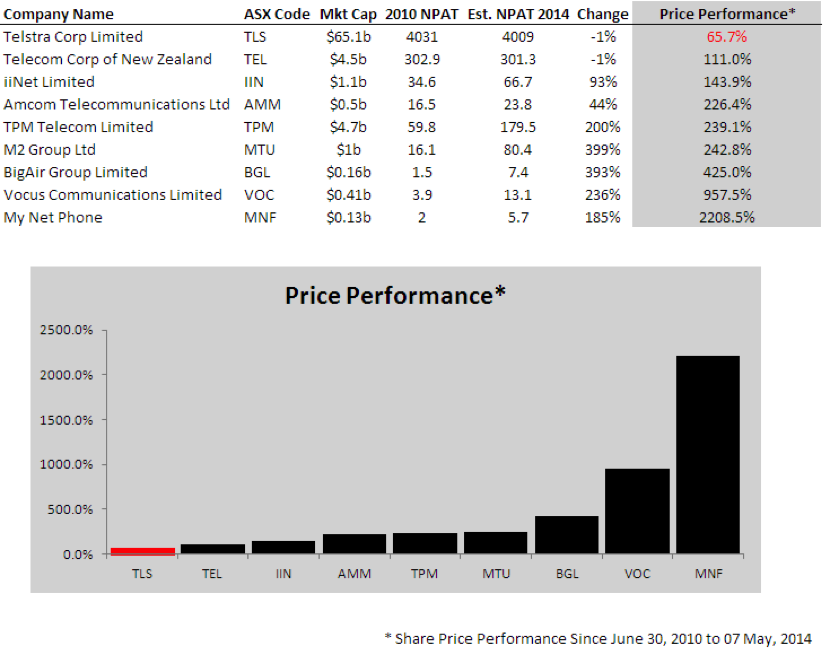

As they say, a picture tells a thousand words and several much smaller telco stocks have had stellar gains in the past few years. This is despite the rapid growth in new technology and Telstra’s dominant market share, meaning it should have been a participant. Its profits, however, are no higher today than they were In 2010 (actually, even those of 10 years ago), and while its share price has risen recently to +65.7 per cent, this is clearly not in the same league as other quality businesses.

We believe there is a strong correlation over the long term between a business’ economic performance and its share price performance. You might therefore be interested to see that our comparison of the growth in NPAT and the price performance (excluding dividends) of a number of listed Australian telco companies since 30 June 2010 to now, which shows that TLS has failed to keep pace with all others, and on both metrics.

Demand for internet connectivity (what we refer to as “the internet of everything”) and mobile telephony is booming, and smaller players are eating into the market share of the incumbent. For this reason, Telstra ranks poorly on pretty much everything from absolute growth to market share growth to underlying profit and share price growth. Gains, however, have been especially strong for the smaller end of town, as each company continues to consolidate a highly fragmented industry. It remains here where we think the opportunities in the future will continue to present themselves for those willing to do the work.

Montgomery Investment Management fully expect that investors who continue to look beyond the large-caps and acquire higher quality smaller telco stocks should benefit from The influences in the sector that have already rewarded investors.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

David Szeto

:

Hi Rus

The BigAir group share price has been hammered by the recent announcement from Telstra regarding the re-rollout of the national WiFi network.

Just want to know your opinion on what are your thoughts and the impact might be on BigAir?

Thanks

David

Russell Muldoon

:

Hi David,

A few things worth noting on this, and why it’s not worth taking your queues from price action –

You are right, the sharp drop in BGL’s share price followed Telstra’s announcement that it’s going to roll out a national WiFi network to take the pressure off its own wireless capacity.

WiFi earnings make up less than 25 per cent of profits for BGL and the universities that BGL joint ventures with share in the revenue, so it is not in their interests to use Telstra WiFi.

Also, Telstra’s ‘public’ WiFi network is not the same as BGL’s ‘private’ network.

As such, even Jason has commented on this, while it may affect their planned move into WiFi in shopping malls/public places, the announcement has no impact on their existing business.

Hope that helps.

Russ