The case of Telstra

While the market does its best at trying to distract and dissuade, we ignore its bipolar short-term nature and treat near-run market fluctuations as random. Instead, we think about (and focus on) uncovering companies that can substantially grow their worth – which moves much more slowly – over the long term.

If I were to tell you about a company with a long-term average return on equity of 30 per cent or more, a company with great brand awareness that’s known as the market leader in an industry brimming with recurring revenue, could I persuade you to buy its shares?

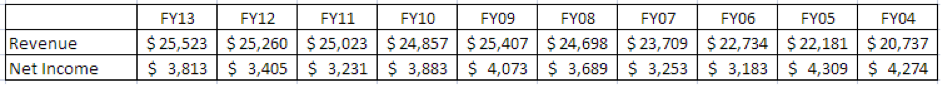

The company I have in mind is Telstra (ASX: TLS); a company that we at The Montgomery Fund have commented on previously. I think it’s clear that we are not investors in TLS due to what we perceive as an entrenched mediocrity in earnings growth. Table 1 below aims to explain this further (all figures are in millions).

Table 1

Notice that net income in FY13 rose over $400 million to $3.8 billion from $3.4 billion in FY12. That’s great, although looking back to FY04, net income was just under $4.3 billion. Overall then, growth has been negative (factor in inflation and it’s worse). This isn’t through a lack of customer growth however; you will note revenue has grown impressively by almost $5 billion.

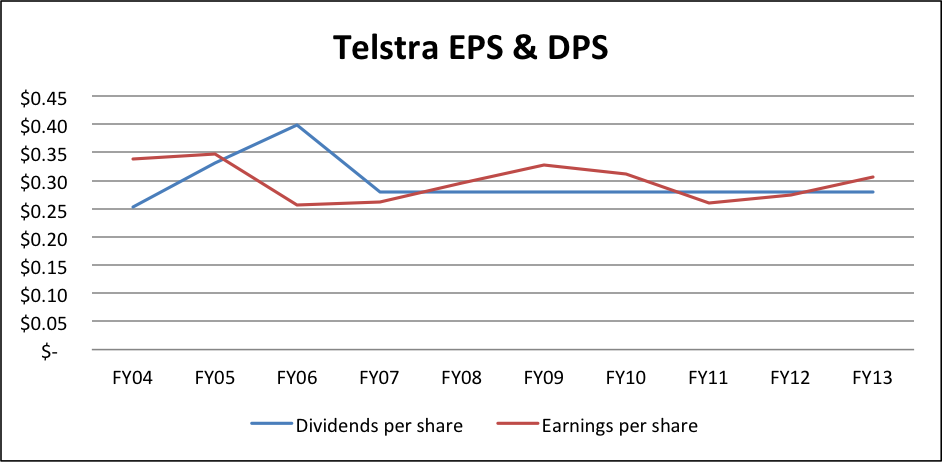

As above, Telstra is known as a dividend stock where it pays out almost all of its earnings to investors and this relationship is evident in the Figure 1, below.

Figure 1

Profitability growth has been stagnant. The buoyant share price however suggests some participants believe that this could change in the future. Could it?

There are two fundamental ways for a company to achieve profit growth:

1) Increase returns (profitability) from existing assets

2) Deploy retained profits into new assets that can generate additional returns

In regards to the first, opinions will vary – however, the telecoms industry is extremely competitive with many competent operators. Consumer penetration is high and thus for TLS to grow its customer base, it must do so by converting competitors’ customers, which is difficult when the products are largely homogenous and the price usually the main determinant. Having said that, it does appear Telstra is picking up many of the mobile customers Vodafone is losing.

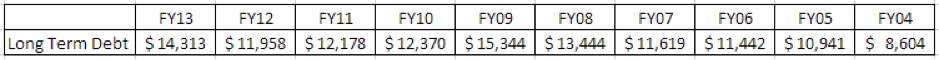

In regards to the second, investment theory would suggest that rational firms only deploy capital into projects that can earn an acceptable return. Given TLS is paying out most (or all) of its earnings as dividends, it would suggest that they have not found projects of sufficient scale or profit potential, or they are happy to fund expansion via debt (which incurs interest charges, can be restrictive and has to be paid back someday).

If you decided to fund expansion via debt and you owned TLS, would you be happy borrowing money today for equal or less earnings in the future? Table 2 reveals TLS long-term debts are increasing.

Table 2

Given Telstra’s size, the lack of large expansion opportunities isn’t unexpected. For a firm with low growth prospects (or no growth) we would need a very large discount to our estimate of its value to be sure of an adequate long-term return from dividends. Prices will fluctuate over time (perhaps wildly) but long-run prices are determined by intrinsic value and intrinsic value is not increasing.

Naturally, we are only interested in firms in which the ability to increase earnings at a good clip (and likewise intrinsic values) is evident.

To be sure, we aren’t calling an end to Telstra’s popularity any time soon – we hope all investors do well. But as for the funds we steward on behalf of our investors, we have found a significant number of preferable opportunities.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Andrew Legget

:

I don’t think it is inconceivable to see rival customers moving towards Telstra. I was inches away from doing just that, decided to give Vodafone one last chance who then proved to me i probably should have made the switch. Whether this migration to Telstra will be large enough to move the needle in anyway for the companies performance is another matter. Setting things up or resolving issues regarding our bigpond account is a lot easier than trying to do anything with vodafone.

Telstra sounds like a bit of a trap for me, it on a brand level sounds liek a company that should be performing really well as everyone in Australia knows it, it has the biggest network etc. However, and i think they are at least trying and recognise this issue, land lines are dying so future growth will have to be found through internet related services and this is a much more competitive field than they are used to with phone services.

The more i look at them, the more i am happy to leave it for the yield seekers where dividends trumps company performance. There maybe few bigger names in Australia than Telstra but there are plenty better companies to invest in.

Brendan

:

I agree with Dylan. Dealt with that particular caller really well.

Alexander Pinnock

:

Excellent article Roger, thank you. I see Telstra as a revolutionary company trying to follow in the footsteps of Google etc. Their recently renovated head office in Sydney generated great media interest and with regards to increasing their customer base continued sponsorship of sporting events and advertising of their 4G network is very appealing to Gen Y. Telstra undoubtedly has the best mobile infrastructure in Australia and are finally offering retail products at a price only just higher than their competition. I see massive potential in terms of innovation, employee benefits and hopefully this will result in an increase in revenue over time.

Dylan Taggert

:

Great read. I love you way you guys at Montgomery break the complex into the simplistic. Also to Tim, I thought the way you handled and respond to the callers comments regarding Telstra on last weeks your money your call was delt with very professionally. Well done.

Tim Kelley

:

Thanks Dylan. Much appreciated.

zoran arnautovic

:

Agree with you Dylan. YMYC was a good one last week, especially TLS question.

Tim is not just a pretty face ha ha

Cheers