Small cap series – Senetas Corporation Limited

Last week we discussed Integrated Research Limited (ASX: IRI), a small cap stock with a pleasing track record of performance. Several readers mentioned they would like to hear our comments on Senetas Corporation Limited (ASX: SEN).

Senetas designs high speed encryption and data management solutions for a range of governments and corporates around the world. Firms of this nature can be attractive if their financials benefit from operating leverage over time, which to date appears to be occurring in Senetas.

The chart below shows if we strip out half yearly earnings over the last few years we note the following positive trend. Not bad. Note that we’ve used the lower of the $5.7-$6.0M FY15 profit before tax guidance announced today.

We’ve also elected to use net profit before tax in order to strip out past tax benefits.

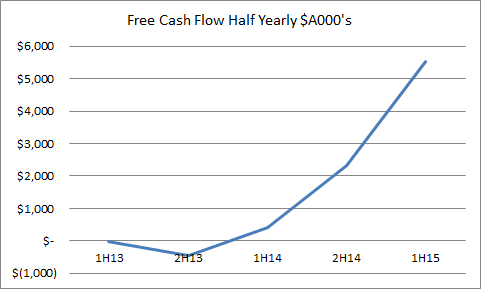

On a cash basis (net operating cash flows minus net investing cash flows), we notice a similar trend.

On an annualised basis, these kinds of earnings on an equity base of circa $10m-$15m is worthy of further investigation.

The market for these products whilst small (circa $180m worldwide) is expected to grow as a rapidly over the coming years. Data security is becoming increasingly important to large organisations as noted by several high-profile leaks noted over the past few years.

This is not a recommendation to buy SEN, please do your own research and consult a licensed financial adviser where appropriate.

The Montgomery Fund and The Montgomery [Private] Fund do not hold a position in Senetas Corporation Limited (ASX: SEN).

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Darren Stephens

:

Thanks Scott for taking the time to respond to us on this (appreciated). Always interesting to see the approach Montgomery take to evaluate companies