Medibank Warms Up For The Big Dances in 2016

On 2 July 2015, Medibank Private (ASX:MPL) announced that it will end its contract with Calvary Health Care from the end of August. This followed a number of press articles discussing the issue being released in prior weeks.

Medibank is refusing to pay for any patient readmissions within 28 days of a procedure, except in the case of chronic heart failure, chronic obstructive pulmonary disease, cancer and palliative care.

Medibank believes that a large proportion of readmission claims within this period are for preventable complications, and as such, there is no incentive for hospital operators to act to reduce the incidence of these preventable outcomes if they know they will be paid for follow up treatment.

Medibank also claims that the rate increase asked for by Calvary was unsustainable.

Calvary argues that having to take on the operating risk of complications means it might have to turn some high risk patients away.

Talks have broken down and Medibank has informed policyholders that it will only cover the required minimum 85% of the average cost of services provided by Calvary to policyholders from 31 August. Negotiations are now going to mediation on 21 July.

Calvary has 11 hospitals (2 in the ACT, 1 in Wagga, 4 in SA and 4 in TAS) and high market shares in its local regions.

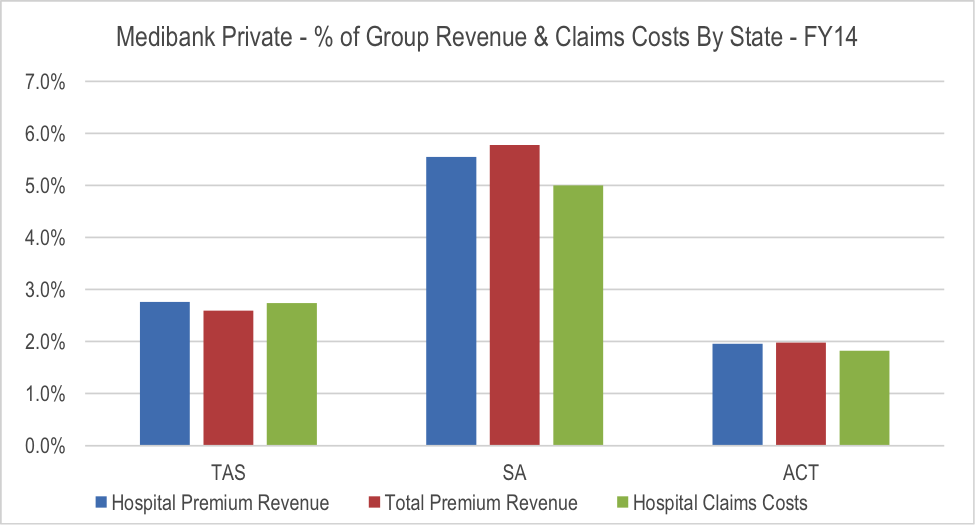

While the cancellation of the contract will have an impact on policyholders that live within the catchment areas of Calvary’s hospitals, it is not overly significant in the context of the overall operations and policyholder base of Medibank. The table below shows the proportion of Medibank’s hospital and total premium revenue came from TAS, SA and ACT in FY14, along with the proportion of its hospital claims costs. Calvary would only make up a proportion of these figures.

From Medibank’s perspective, the reaction from policyholders will present an interesting insight regarding what would potentially happen if it is forced to drop a major operator if it can’t negotiate better contract terms.

One of the core focuses for the market is whether Medibank will be able to lift its margins by slowing claims cost growth. More recently, the imperative for Medibank to slow claims costs inflation has been boosted by an acceleration in policyholders trading down to lower cost products as a result of the rapid rate of growth in premiums in recent years. The high rate of premium growth has been driven by high rates of claims growth.

We view the Calvary negotiations as a key test case for the negotiating power of Medibank over the hospital operators ahead of the main game next year when the Healthscope (February 2016) and Ramsey (August 2016) contracts expire.

Medibank’s success or failure, and more importantly the impact on policyholder retention through this period and potentially after the contract expires, will be a big signal as to whether Medibank has sufficient leverage to win some concessions in negotiations next year.

While any fallout from a potential cancelling of the contract with Calvary itself is minor for Medibank in isolation, it has significant read through implications for the outlook to reduce claims inflation from FY17.

The Montgomery funds own shares in Medibank.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Stuart Jackson

:

Actually, under the portability provisions, health insurance must be provided on pre existing conditions as long as the person has been continuously insured since the condition occurred. The new insurer will not pay for claims on services undertaken prior to the commencement of the policy, but would have to pay any new claims incurred after.

Peter Evans

:

Thanks for the article Stuart – i’d be interested to hear your thoughts on MPL’s recent divestments form its complementary service unit to TLS and SHL. Neither of which seem to have been picked up by analysts.

Are they just too immaterial?

Stuart Jackson

:

Hi Peter, both of these businesses were pretty small, and while they did provide some insight into primary care, they were not earnings their cost of capital. Following the strategic review, MPL decided to divest the businesses. It’s an interesting move given discussions around the potential benefits of health insurers driving improved health care outcomes on a proactive basis. However, in the context of the broader company, the impact is immaterial.

Gaveen Jayarajan

:

Also depends on how different specialists respond. The re-admission criteria may work against certain specialties. A specialist may choose not to take on people with MPL as their insurer. So it’s not the hospital picking and choosing patients, it’s the specialists who have admitting rights to the hospital.

Carlos Cobelas

:

I take your points Stuart, but from what I read in the news, Medibank are stating that ” For example, if a cancer patient contracts an infection while under going chemotherapy, Medibank will not reimburse the hospital for additional care. It also won’t pay for bleeding or hemorrhaging of patients who have blood clot disorders”

What this means is that private hospitals will be incentivised to cherry pick their patients and decline services to those sicker or more complex patients that are at higher risk of developing complications as a natural course of their illness or due to inherent risks of surgery or treatments for severe illness. Having major surgery ,or chemotherapy for cancer, is not a walk in the park and it is totally unrealistic and unreasonable of Medibank to demand a zero complication rate ! Thus it is the patients who will suffer from this decision and will have to fall back on the already severely overburdened public health system. The lawyers will also do well out of this as there will be lots more litigation around anything less than pure unrealistic perfection. Very very bad. Won’t be buying Medibank shares again out of principle, nor be a customer of theirs.

Peter Silbert

:

The above is one approach for private health funds (PHFs)- but usually would carry with it an incentive at the first admission. The lack of that suggests to me that it is part of the negotiation game rather than the end game.

It does however highlight the need for PHFs to be more proactive about controlling admissions and costs incurred.

The US equivalent of the PHFs do it very proactively by stopping “soft”admissions in the private sector, and avoiding prolonged admissions that may not always be entirely medical. A Diagnosis Related Group (DRG) approach already does this by saying that procedure X carries with it funding for Y days in hospital. If a hospital is inefficient and the admission is Y + 2 days – then they do not get funded for the other 2 days (a financial disincentive), and if more efficient with discharge programmes and they can get the admission done in Y – 1 day, then they have a financial benefit.

When PHFs start adding to the above efficiencies by stopping admissions for procedures, assessments and interventions that can be performed as an outpatient procedure, and through other cost saving methods then as the Montgomery group have been saying, there is a lot of fat that can be trimmed from health care costs and redirected to the Medibank shareholders !

Greg SALWAY

:

“””Medibank is refusing to pay for any patient readmissions within 28 days of a procedure, except in the case of chronic heart failure, chronic obstructive pulmonary disease, cancer and palliative care.”””

We’ll see how many policyholders they lose with this aggressive stance. If the sums add up and they force these “high risk clients” elsewhere, the bottom line will improve. Good for investors, but the big question is do you want to be a patient in this scenario? And what happens to the unlucky punter who gets a clot, or some other routine complication?”

Yavuz Atasoy

:

Do you see any potential for litigation firms (IFM, Slater and Gordon, etc…) resulting from this?

Stuart Jackson

:

Hi Yavuz, given policy portability and the community rating system, as long as Medibank makes its policyholders aware of any changes in enough time for them to change providers if they choose, there shouldn’t be any legal issues for the company. I would note that according to the media reports, Medibank intends to honour claims that commence prior to the expiry of the contract, as well as providing some other provisions. But the onus should be on the policyholder to understand any changes and make their own decision as to whether they want to change insurance companies. It should also be noted that other insurers have tightened provisions for readmission claims as well. In terms of policyholders not being covered for some post procedure complications, if they are indeed avoidable, this would shift the consumers focus back onto the responsibilities of the hospital operator. As such, there could arguably be more activity on that side.

John E

:

Nice to see Medibank starting to flex their muscle. There’s no way people can keep copping premium rises of up to 10%/yr.

Bupa also needs to take a similar approach. It is a delicate situation though trying to get the balance right and still have optimal care.

Carlos Cobelas

:

refusing to pay for any readmissions within 28 days of a procedure is really UNFAIR, as many complications occur due to bad luck and inherent risks involved in surgery and the chronic ongoing nature of many medical problems.

They are basically saying any complications are avoidable and therefore “negligence” . SIGH !

they will lose a lot of customers and make lots of enemies if they persist with that approach. I have already sold my shares at profit and will not buy them again. Medibank are being very unreasonable.

Stuart Jackson

:

This is a difficult issue with credible arguments on both sides. Rigid rules are not appropriate in all cases. However, at the same time if an operator is paid to fix their mistakes, there is no incentive to prevent them in the first place. Ultimately, its not the health insurance provider that pays for this, its the consumer through higher premiums. What is likely to occur is that hospitals will take on greater proportion of the exposure to operational risk in having to fund more follow up care. However, to offset this, they will receive more for the initial procedure. This will incentivise the hospital provider to minimise complications and follow up. Medibank wants to shift the system from a fee-for-service system where hospital service providers can be incentivised to grow the number of services they provide to fill capacity irrespective of need (and to be clear I am not suggesting they do this), to one where health insurance providers pay an operator a bundled fee for overall care including an amount for potential follow ups. This is the sort of agreement that Bupa has recently signed with Healthscope. This should allow good hospital operators to benefit while eliminating waste from the system. Of course even this system has issues if it means that patients are turned away if the hospital provider believes that there is a heightened risk of excess costs from complications. As I said, its not a simple issue with a one size fits all fix.

Greg McLennan

:

Interesting. Based on what we see in our practice, I think that policy holders who have a readmission and are directly financially affected by the changes will crack it and change their insurer instantly. There is minimal customer loyalty to a health insurer, it comes down to price and what you get. Those who do not have to go to hospital and thus will probably be unaware of the change will stay as they are.

Given that the type of patient that is having these early readmissions are likely to have a number of co-morbidities and therefore more costly to insure, Medibank probably won’t lose sleep over them changing insurers – in fact it could conceivably end up being beneficial for them.

Chris

:

“I think that policy holders who have a readmission and are directly financially affected by the changes will crack it and change their insurer instantly”.

And do you really think that another insurer is just going to “pick up the tab” for something that happens “after the fact” ? That’s a bit like having a car accident but your existing insurer doesn’t pay it, then you go and get insurance with someone else and expect them to pay. Doesn’t work, because they won’t.

You have to do it before it happens. It’s called a pre-existing condition and you also have wait times that you have to serve. No one will insure against it.